The world of investments has been constantly evolving. Gone are the days of relying only on traditional investments to increase wealth. Investors now have access to dynamic investment strategies and options that can boost wealth creation and also diversify their investment portfolio. AIFs are one such strategic investment option that is gaining huge popularity in India. Here is all you need to know about AIFs and the benefits of investing in them.

AIFs are Alternate Investment Funds that are privately pooled investment funds that collect money from diverse classes of investors. These funds invest the pooled funds in a wide range of assets beyond the traditional assets like stocks, bonds, mutual funds, gold, etc. These funds are governed by SEBI regulations under the SEBI (Alternative Investment Funds) Regulations, 2012 and cater to investors like NRIs, HNIs, UHNIs, institutional investors, venture capital funds, hedge funds, etc. AIFs can provide potentially higher returns than mutual funds but also come with a higher minimum investment amount along with higher risks. This makes them more popular among the more sophisticated investors seeking portfolio diversification and exposure to diverse assets.

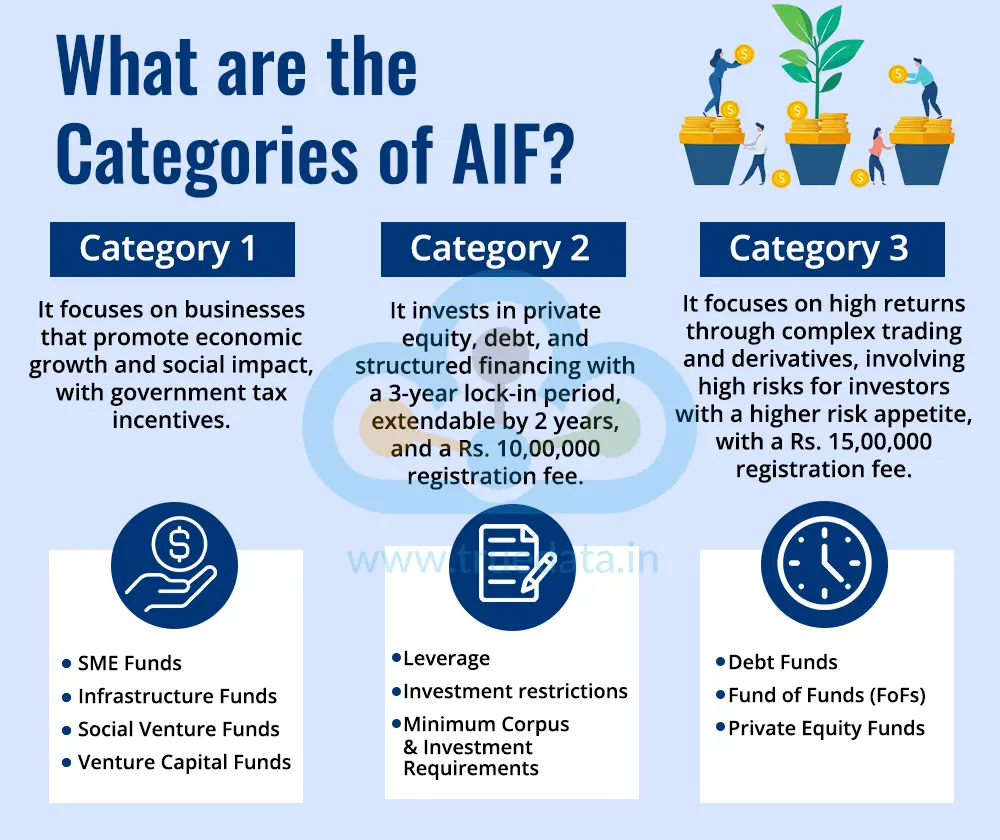

AIFs are classified into three categories as per SEBI rules based on the purpose of investment, investment strategy, and risk of investment. These categories and the funds registered under these categories are explained below.

Category I AIFs focus on investments that promote economic growth and have a positive social impact. These funds invest in businesses that are innovative, socially beneficial, or contribute to economic development. The government often encourages investments in this category by providing tax incentives or concessions.

Types of Funds Under Category I AIFs

Venture Capital Funds (VCFs) - These funds invest in early-stage startups and small businesses with high growth potential to provide crucial financial support. Since startups carry higher risks, these funds focus on companies with innovative business models or technologies. Investors in these funds receive equity shares in return for their capital. These funds are close-ended funds with a lock-in period of 3 years which can be extended to a further 2 years with the approval of investors. These funds can be listed on stock exchanges too provided the minimum lot size for trading is Rs. 1,00,00,000. SEBI guidelines also restrict these funds from investing more than 25% of their total capital in a single company to proctor the investor’s interests. VCFs are allowed to invest in different subcategories of Category I AIFs, however, they cannot invest in Fund of Funds (FoFs).

Angel Funds - Angel Funds is a sub-category of VCFs where funds are pooled from angel investors to back early-age startups. An angel investor is an individual with atleast Rs. 2,00,00,000 in net tangible assets (excluding the main residence). Another step for eligibility is the requirement for experience as a serial entrepreneur or at least 10 years of professional experience in a senior management role. The purpose of these funds is to provide capital for new or innovative businesses that may not yet qualify for funding from traditional venture capital funds or banks.

SME Funds - SME (Small and Medium Enterprises) Funds invest in small and medium-sized businesses, whether they are listed on stock exchanges or privately owned. These funds provide capital through equity investments to help SMEs grow and expand. Investors must commit a minimum investment of Rs. 1,00,00,000. SME funds also have a minimum lock-in period of 3 years, with the possibility of an additional 2-year extension if needed.

Social Venture Funds - These funds invest in businesses that create a positive social impact, such as companies working in renewable energy, healthcare, education, or financial inclusion. These funds too require a minimum investment of Rs. 1,00,00,000 which must remain locked-in for a minimum of 3 years and extendable for 2 years if required. An important SEBI rule for these funds requires a minimum of 75% of the total assets to be invested in companies that contribute to social development.

Infrastructure Funds - Infrastructure Funds invest in businesses involved in large-scale infrastructure projects, such as roads, bridges, power plants, and public utilities. The Indian government offers several incentives to encourage investments in these funds. Similar to other Category I AIFs, they have a minimum lock-in period of 3 years, extendable for 2 additional years. These funds cannot invest more than 25% of their total capital in a single company. Infrastructure funds can also be listed on stock exchanges, but they require a minimum tradeable lot of Rs. 1,00,00,000. Additionally, investors can liquidate their investment within 1 year after the fund’s tenure ends, and each investment scheme can have a maximum of 1,000 investors.

Category I AIFs are considered relatively lower risk compared to other AIF categories, as they are aligned with government priorities and economic growth. The registration fee to be paid by Category I AIFs as per SEBI guidelines is Rs. 5,00,000.

Category II AIFs are more like residual funds that do not fall under Category I or Category III AIFs as per SEBI. These funds can include funds that do not get direct government incentives but also do not engage in speculative trading. These funds invest in companies through private equity (PE), debt instruments, and other structured financing options and come with a lock-in period of 3 years that can be extendable for another 2 years if required. The registration fee to be paid by Category II AIFs as per SEBI guidelines is Rs. 10,00,000.

The typical characteristics of funds under this category are,

Leverage - SEBI guidelines prohibit these funds from borrowing money or taking leverage except for meeting daily operational expenses.

Minimum Corpus & Investment Requirements -

Each scheme must have a minimum corpus of Rs. 20,00,00,000.

Employees or directors must invest a minimum of Rs. 25,00,000.

Investors must contribute a minimum of Rs. 1,00,00,000.

Investment restrictions -

Can invest only in unlisted companies or units of other AIFs.

Cannot invest in Fund of Funds (FoFs).

Can subscribe to the unsubscribed portion of an IPO (Initial Public Offering) after an agreement with the merchant banker.

Allowed to engage in hedging strategies to manage risks.

Exempt from insider trading regulations (only for investments in SME exchanges), provided the investment is held for at least one year.

The different types of funds available under this category include,

Private Equity Funds - These funds invest in established businesses that require capital for expansion, restructuring, or acquisitions. Unlike venture capital funds, private equity funds invest in companies with a proven track record making them relatively less riskier as compared to venture capital funds.

Debt Funds - These funds invest in debt securities of companies that need funds but may not get loans from traditional banks making them a more approachable fund resource for such companies. These funds offer high-interest returns but come with higher credit risk.

Fund of Funds (FoFs) - These funds do not invest directly in companies but instead invest in other AIFs thereby spreading the risk of investment across multiple funds and increasing the diversification benefits.

Category III AIFs focus on generating high returns through complex trading strategies and investment in listed and unlisted derivatives. These funds often involve high risks and are meant for investors with a higher risk appetite. The registration fee to be paid by Category III AIFs as per SEBI guidelines is Rs. 15,00,000.

Some of the funds included in this category include,

Hedge Funds - Hedge funds pool money from institutional and accredited investors to invest in domestic and international markets. These funds follow fewer regulations compared to other investment funds, allowing them to use aggressive strategies such as leverage, short-selling, and derivatives trading to maximise returns. Fund managers charge a 2% asset management fee and also take 20% of the profits as a performance fee. Due to their high-risk, high-reward nature, hedge funds are best suited for investors with a strong risk appetite.

Private Investment in Public Equity Funds (PIPE) - PIPE funds involve privately managed pools of capital that invest in publicly traded companies by purchasing their shares at a discounted price. These funds are particularly beneficial for small and medium-sized businesses, as they provide quick and easy funding with less paperwork compared to a traditional secondary share issue. Although companies receive less capital due to the discounted share price, the faster funding process makes PIPE investments an attractive option for businesses in need of capital.

AIFs are an aggressive investment option that can help investors diversify their investment portfolio and include strategic assets that can add long-term value to their wealth creation. SEBI guidelines have highlighted clear guidelines for investment in AIFs. These guidelines and eligible investors for AIFs are mentioned below.

Eligible Investors - Resident Indians, NRIs, and foreign nationals can invest in AIFs.

Minimum Investment Requirement -

General investors must invest at least Rs. 1,00,00,000.

Directors, employees, and fund managers can invest a minimum of Rs. 25,00,000.

Lock-in Period - AIF investments come with a minimum lock-in period of 3 years.

Investor Limit per Scheme - Each AIF scheme can have a maximum of 1,000 investors, except for Angel Funds, which can have up to 49 investors.

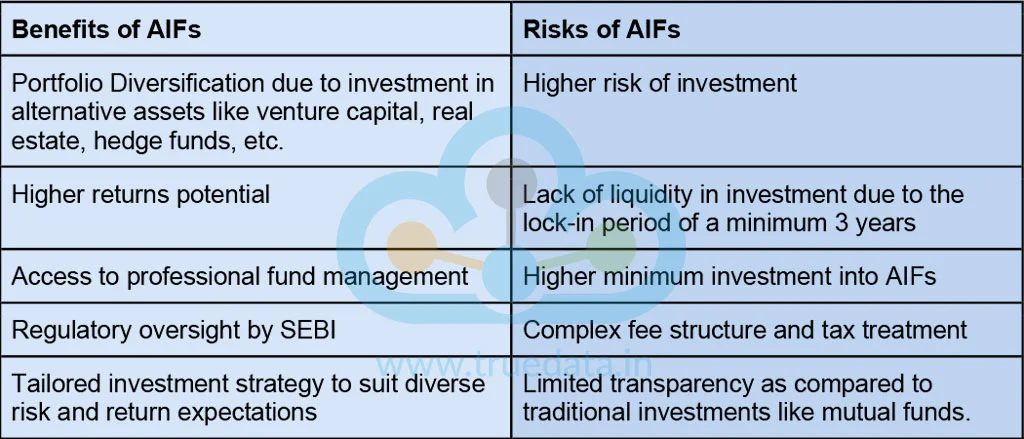

Investment in AIFs should be after a thorough analysis of the risks and benefits of investing in this option. Here is a brief analysis of the same.

Taxation of AIFs in India is as per the provisions of the Income Tax Act, 1961 and SEBI guidelines. The tax structure of AIFs in India is explained below.

Category I and Category II AIFs are granted a ‘pass-through’ status under Section 115UB of the Income Tax Act. This means that any income (excluding business income) earned by the fund is not taxed at the fund level but is instead taxed directly in the hands of the investors.

Income Types - Investors are taxed on their share of the AIF's income based on the nature of the income,

Capital Gains - Taxed according to the holding period and type of capital asset.

Interest Income - Taxed as per the applicable slab rates for the investor.

Dividend Income - Taxed as per prevailing tax rates.

Business Income - If the AIF earns business income, it is taxed at the maximum marginal rate at the fund level. Distributions of such income to investors are exempt from further taxation.

Withholding Tax - The AIF is required to withhold tax on distributions (other than business income) to investors in the following manner,

Resident Investors - 10% withholding tax.

Non-Resident Investors - Tax is withheld at rates applicable as per the relevant tax treaties or the Income Tax Act, whichever is beneficial.

The tax treatment for Category III AIFs for the funds and the investors investing in these funds is explained below.

Tax Treatment at the Fund Level - Category III AIFs do not enjoy pass-through status. The fund is taxed on its entire income, including capital gains and business income, at the applicable rates.

Tax Treatment in the Hands of Investors - Income distributed to investors from the AIF is generally exempt from further taxation, as the income has already been taxed at the fund level.

AIFs are relatively new to the Indian market and investing in AIFs requires adhering to a systematic approach as explained below.

Check Eligibility Criteria - Investors must meet specific eligibility requirements set by SEBI, including being a high-net-worth individual (HNI), non-resident Indian (NRI), or an institutional investor. The minimum investment amount is typically Rs. 1,00,00,000 for most AIFs and Rs. 10,00,000 for Angel Funds.

Choose the Right AIF - AIFs are categorised into Category I, II, and III, each focusing on different asset classes like venture capital, private equity, infrastructure, and hedge funds. Investors should evaluate the risk profile, strategy, and past performance of the AIF before committing.

Understand the Investment Strategy - AIFs invest in unlisted securities, startups, or alternative assets, which are high-risk, high-reward investments. Investors should understand the fund’s investment strategy, goals, and expected returns.

Complete the KYC Process - As per SEBI regulations, investors need to complete their Know Your Customer (KYC) formalities, including submitting identity proofs, address proofs, and financial documents to the fund manager or distributor.

Dematerialisation - SEBI has mandated that AIF investments be held in dematerialised form from October 1, 2024. This ensures better transparency and ease of management.

Sign Investment Agreement - Once the AIF is selected, the next step is to sign the investment agreement with the fund, outlining the terms and conditions of the investment, including the lock-in period (typically 3 years) and fee structure.

Monitor the Investments - After investing, it is important to regularly monitor the fund's performance and stay updated with reports and updates from the fund manager, as AIFs are typically close-ended funds with limited liquidity.

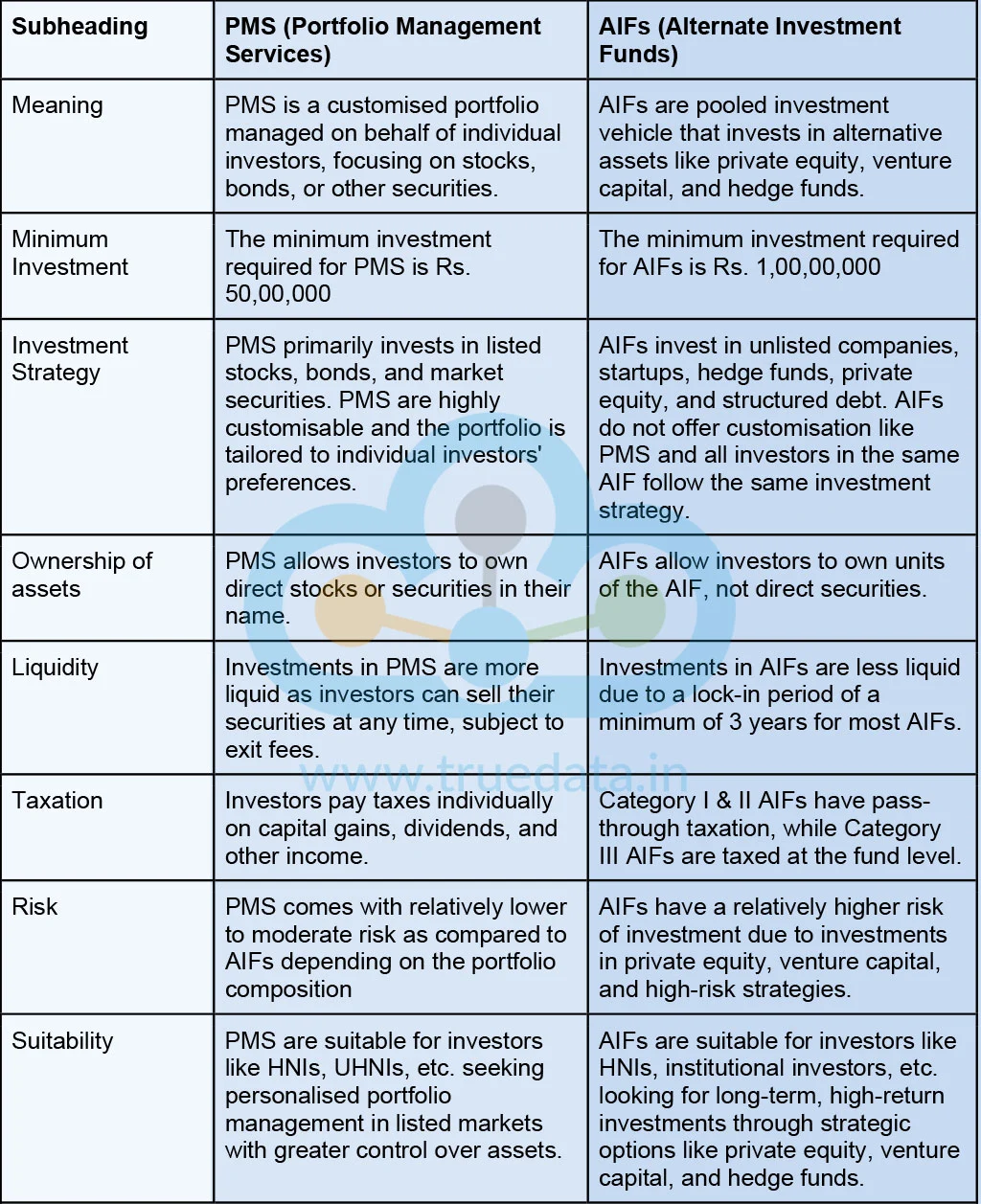

PMS and AIFs are the newage investment options catering to investors with higher investible corpus and seeking aggressive investment strategies. However, there are a few key differences between them that make them distinct. These differences are highlighted hereunder.

Alternative Investment Funds (AIFs) offer diversified, high-return investment opportunities for High-Net-Worth Individuals (HNIs) and Institutional Investors. They offer more diverse investment options than traditional ones like stocks, bonds, and mutual funds. AIFs allow easier and more structured access to private equity, venture capital, hedge funds, infrastructure projects, and other alternative assets for investors seeking dynamic, higher-return investment options. However, they come with higher risks, higher costs, and longer lock-in periods, making them suitable only for niche investors.

We have talked about the basics of AIFs in this article and how they are offering new avenues for investments to India’s increasing HNI investors. What do you think of this investment option? Let us know your thoughts or if you need more information on this topic and we will address it.

Till then Happy Reading!

Read More: SEBI’s Revolutionary Ideas to Protect Loss-Making Retail Traders

Mr. Warren Buffet has a very famous quote: 'If you don't find a way to make mone...

A famous quote by legendary investor Mr. Warren Buffet: 'Someone's sitting in th...

The year 2025 has started with huge volatility in the Indian stock markets and t...