When a person talks about investing their funds, the most obvious choices for investments are shares and bonds. Now it is common knowledge that shares are riskier than bonds and they cater to diverse groups of investors. Therefore, for effective decision-making, it is essential to know the correct meaning and important features of shares and bonds and make suitable investment decisions. Given here is a brief discussion of the same and the key differences between shares and bonds. Read More: What are the differences between equity markets and debt markets?

When a person talks about investing their funds, the most obvious choices for investments are shares and bonds. Now it is common knowledge that shares are riskier than bonds and they cater to diverse groups of investors. Therefore, for effective decision-making, it is essential to know the correct meaning and important features of shares and bonds and make suitable investment decisions. Given here is a brief discussion of the same and the key differences between shares and bonds. Read More: What are the differences between equity markets and debt markets?

In simple words, shares are the portion of equity held by the shareholders which also represents the ownership of the company. These shares can be in the nature of common shares, preference shares, convertible or non-convertible shares, etc. The key features of shares are mentioned below.

In simple words, shares are the portion of equity held by the shareholders which also represents the ownership of the company. These shares can be in the nature of common shares, preference shares, convertible or non-convertible shares, etc. The key features of shares are mentioned below.

Bonds are financial instruments that represent a form of debt. When you invest in a bond, you are essentially lending money to the issuer, which can be a government, municipality, or corporation. There are various types of bonds available in India, including government bonds (issued by the central or state governments), corporate bonds (issued by companies), municipal bonds (issued by local government bodies), and debentures (long-term bonds issued by corporations). The purpose of issuing bonds is to raise capital for various purposes, such as infrastructure development, expansion projects, or financing government expenditures. When you invest in bonds, you become a creditor of the issuer. In return for lending your money, the issuer promises to make regular interest payments at a fixed rate, known as the coupon rate. Bonds have a specified maturity date when the issuer repays the principal amount. Bonds provide a predictable income stream, making them appealing to investors seeking stable income. Some of the key features of bonds are highlighted below.

Bonds are financial instruments that represent a form of debt. When you invest in a bond, you are essentially lending money to the issuer, which can be a government, municipality, or corporation. There are various types of bonds available in India, including government bonds (issued by the central or state governments), corporate bonds (issued by companies), municipal bonds (issued by local government bodies), and debentures (long-term bonds issued by corporations). The purpose of issuing bonds is to raise capital for various purposes, such as infrastructure development, expansion projects, or financing government expenditures. When you invest in bonds, you become a creditor of the issuer. In return for lending your money, the issuer promises to make regular interest payments at a fixed rate, known as the coupon rate. Bonds have a specified maturity date when the issuer repays the principal amount. Bonds provide a predictable income stream, making them appealing to investors seeking stable income. Some of the key features of bonds are highlighted below.

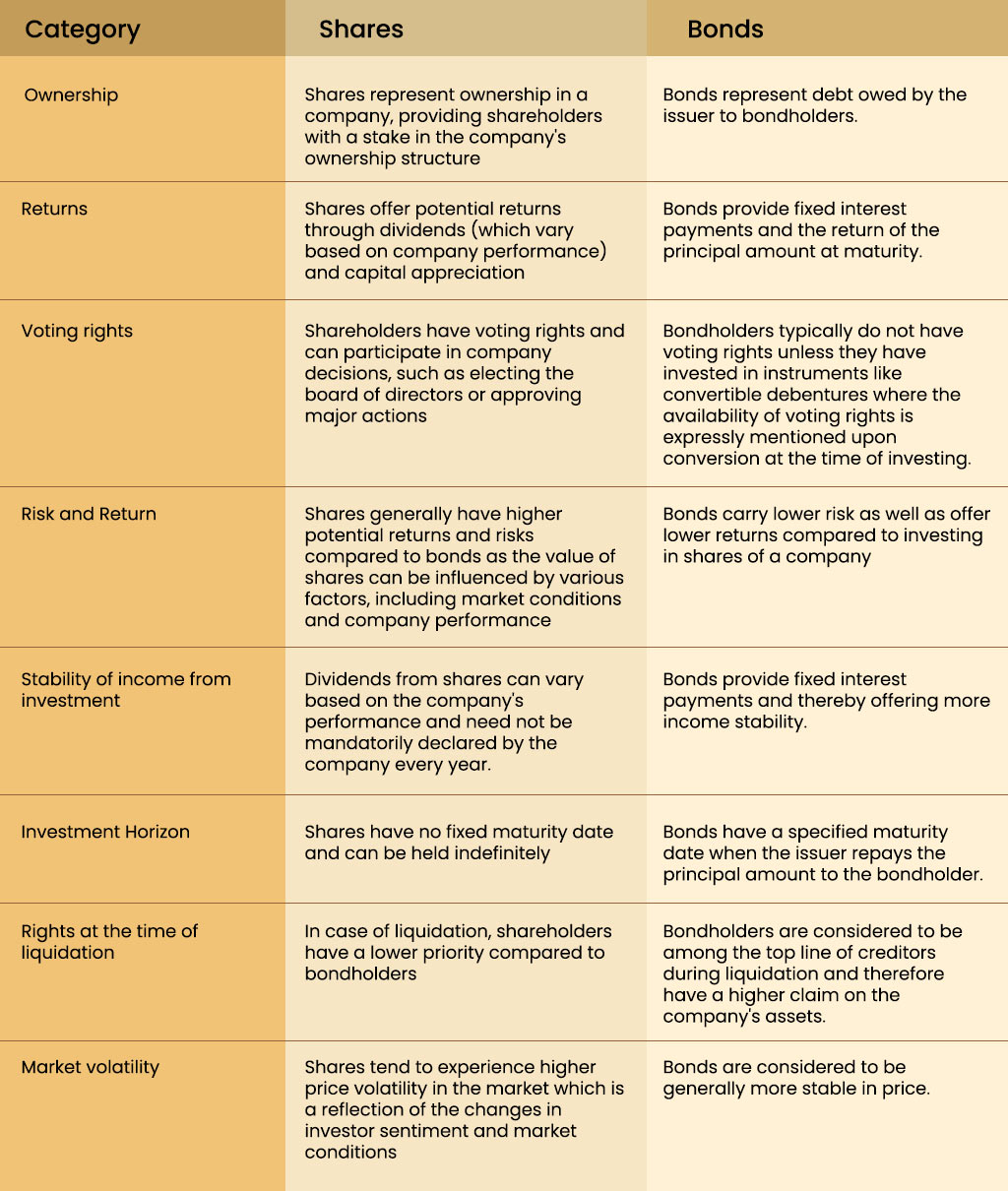

Now that we know the basic meaning and features of shares and bonds, let us now focus on the key differences between the two.

Shares and bonds are like two opposite ends of the investment spectrum and they are both equally crucial for a balanced investment portfolio. The mix of shares and bonds in the portfolio can be influenced by factors like risk perception, returns expectations, investment goals, and investment horizon. We hope this blog was able to provide you an in-depth understanding of shares and bonds and thereby aid in shaping your investment portfolio. Let us know if there are other common terms in the stock markets where you need a detailed understanding and we will take it up in our coming blogs. Till then Happy Reading!

Investing inshares listed on stock exchanges has become an integral part of many...

The term stock is the starting point to invest or trade instock markets. While m...

In our previous article, we saw the importance of working capital in keeping the...