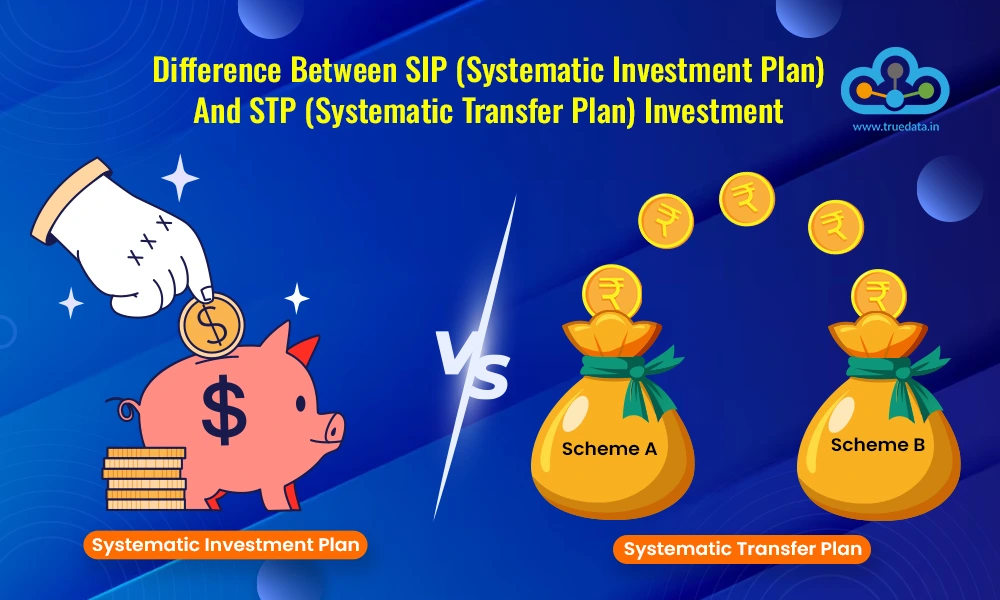

Mr. Warren Buffet has a very famous quote: 'If you don't find a way to make money while you sleep, you will work until you die.' While financial awareness has come late to Indian society, it is fast gaining traction among the youth so we do not repeat the mistakes of our past generation. To this end, SIPs and STPs are important pillars of mutual fund investment which is a staple in financial planning. While SIPs and their importance are widely talked about, STPs are more of a hidden treasure. Explore this blog to learn all about the SIPs and STPs in detail and how they can be used to make your investments grow.

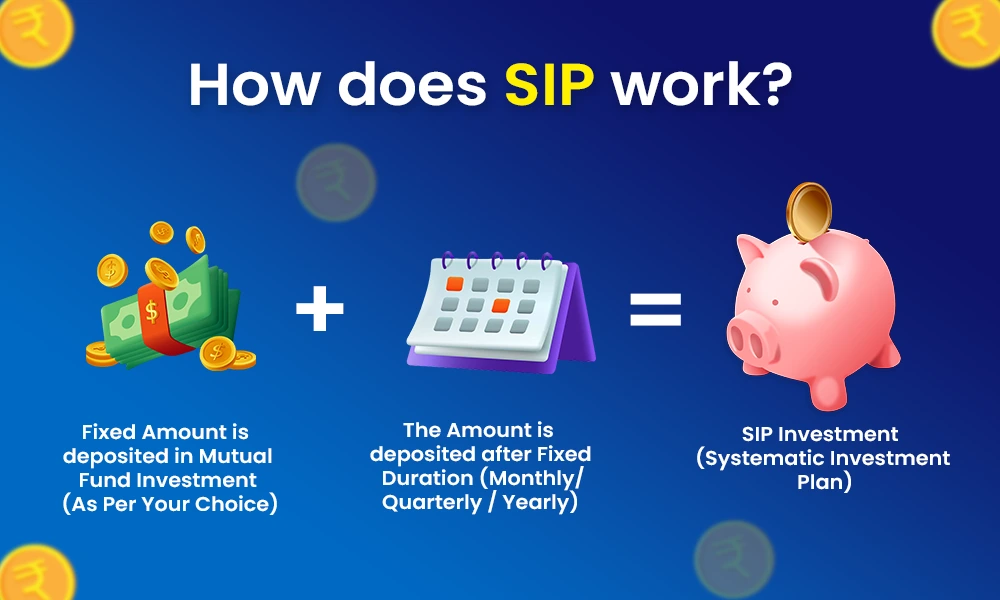

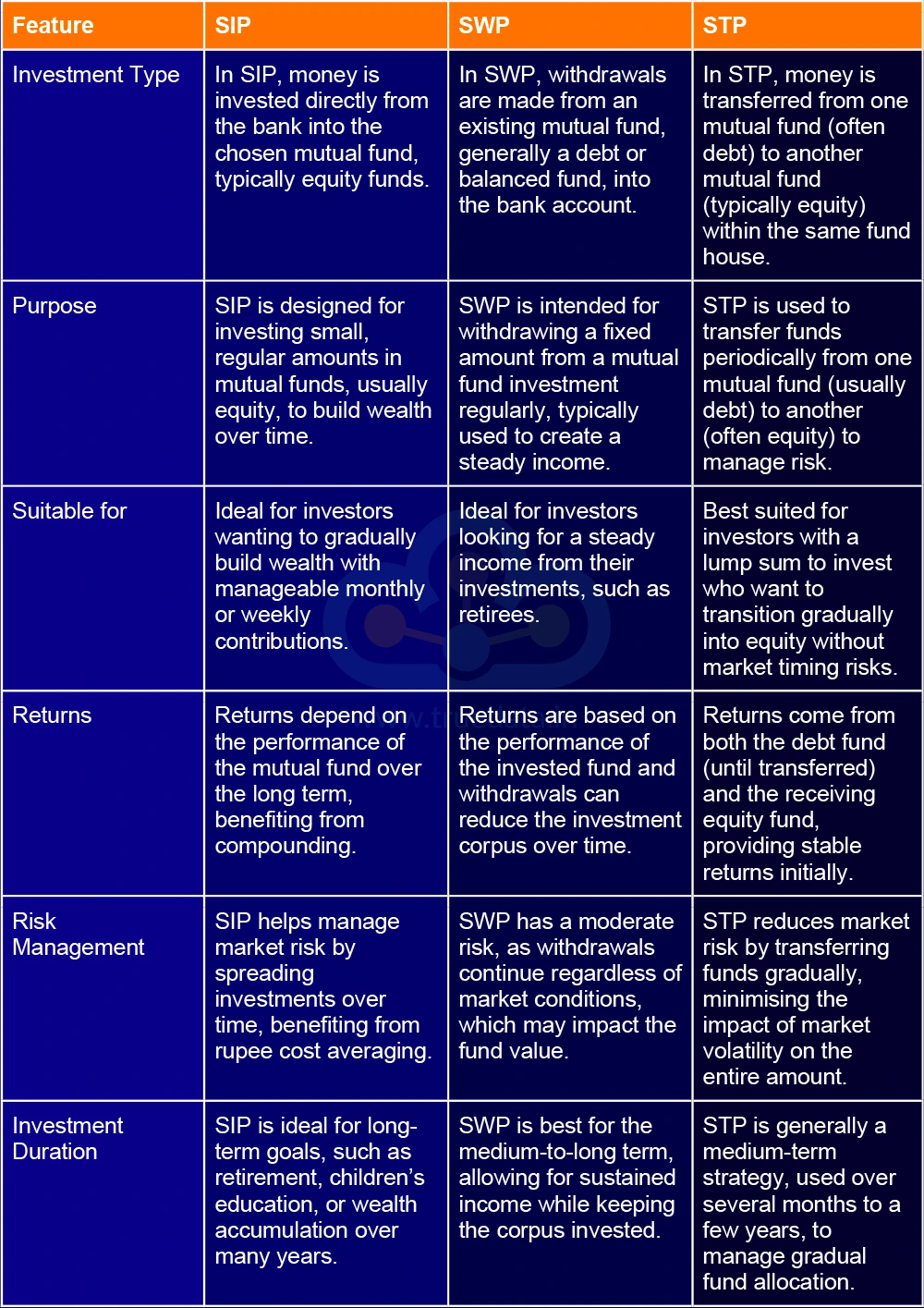

A Systematic Investment Plan (SIP) is a method of investing in mutual funds that allows investors to invest small, fixed amounts of money regularly, typically every month. Think of it as a disciplined way to build wealth over time. Instead of making a large, one-time investment, SIPs let investors spread their investment across months or years, making it more manageable.

Here is a simplified explanation of how SIPs work.

Investors choose a mutual fund and decide how much they want to invest each month. Then, the amount is automatically deducted from their bank account. With each instalment, investors buy units of the mutual fund based on its current price, known as the Net Asset Value (NAV). Over time, this approach benefits them through ‘rupee cost averaging’ which means they can buy more units when prices are low and fewer when they are high thereby reducing the overall cost of investment. SIPs also help investors benefit from compounding, where the returns generated on their investments earn returns themselves. Overall, SIPs are an ideal way for investors to start investing in mutual funds without needing a large sum upfront, and they encourage regular saving and investing towards meeting long-term financial goals.

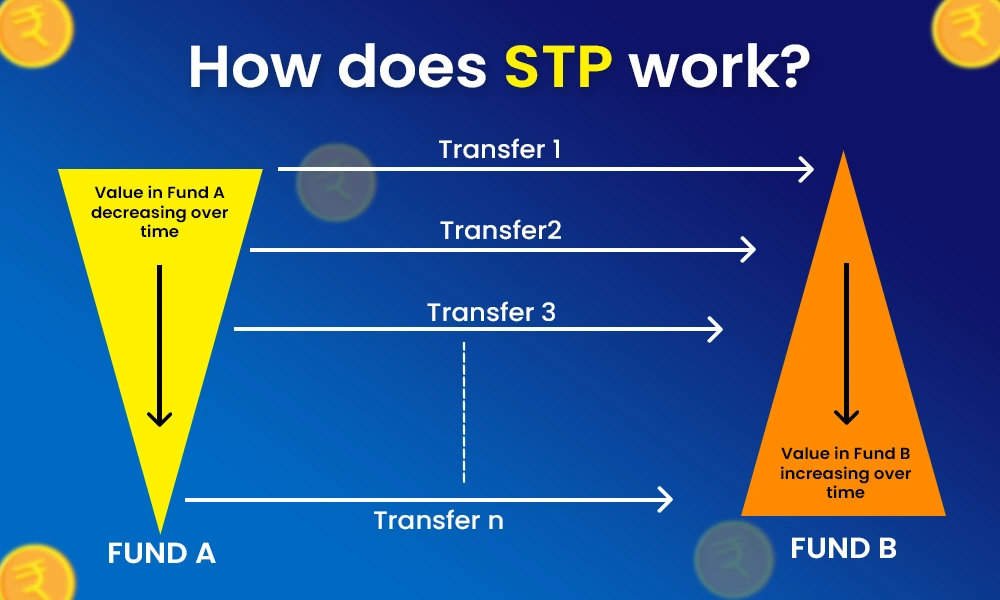

A Systematic Transfer Plan (STP) is a tool that lets investors move their money gradually from one mutual fund to another. It is primarily used by investors who look for change from one fund to another depending on their investment strategy, market opportunities and growth potential of the overall portfolio. STPs allow investors to have a gradual shift from one fund to another over a period of time while ensuring they minimise the risk and maximise the benefits of one fund over the other. Typically, investors use an STP to move their lumpsum corpus from a debt scheme to an equity fund.

Here is a detailed explanation of how STPs work.

In an STP, an investor with a saved corpus, say Rs. 10,00,000, can place this amount in a safer fund like a debt fund to earn steady returns. Since markets may be volatile, instead of investing in equity funds immediately, the investor can set up an STP to gradually transfer a fixed amount (e.g., monthly) from the debt fund to an equity fund. This way they can earn a higher interest from the debt mutual fund (typically more than a bank account) and small amounts are shifted regularly to the equity fund thereby taking advantage of long-term growth while managing risk. However, STP transfers can only occur between funds within the same fund house. For example, an investor could transfer between two HDFC Mutual Fund schemes but not between one HDFC fund and one ICICI fund.

The benefits of SIP and STP are explained in detail hereunder.

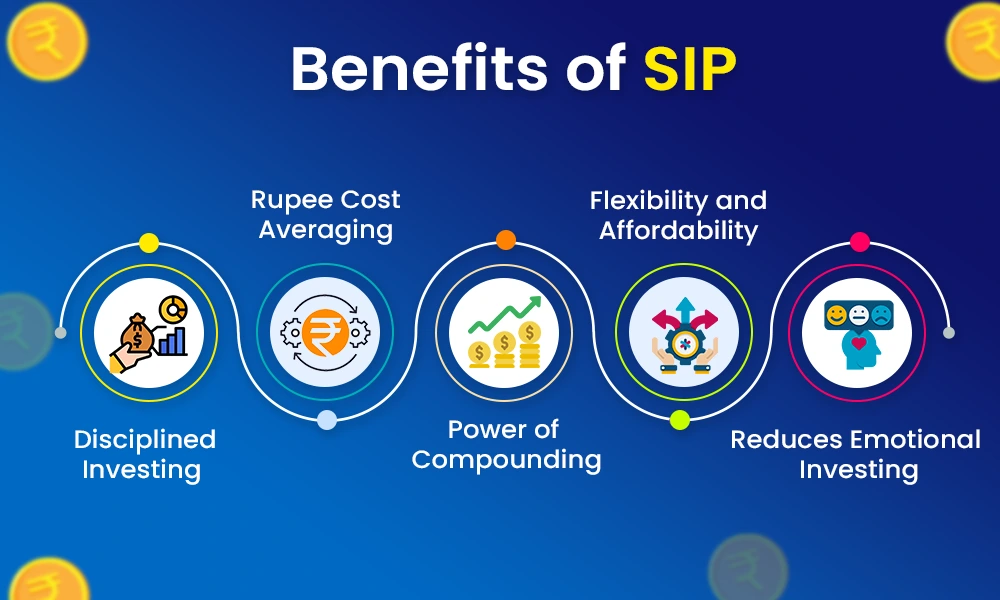

SIPs have become the preferred mode of investment for millions of investors, especially in India, given the multiple benefits they offer. There is a detailed account of the various benefits offered under SIPs,

SIP encourages disciplined investing by allowing you to invest a fixed amount regularly, often monthly or quarterly. This approach builds a habit of saving and investing, ensuring that investors allocate a portion of their income towards investments without the stress of timing the market. Over time, disciplined SIP contributions can accumulate into a substantial corpus, helping investors achieve long-term financial goals.

SIPs allow investors to buy more units when prices are low and fewer units when prices are high due to rupee cost averaging. This averages out the net purchase cost over time, reducing the impact of market volatility. As a result, investors can benefit from both market ups and downs without trying to predict them, making SIP a suitable option for new investors or those cautious about market timing.

Compounding plays a vital role in SIPs, as investors earn returns not just on their initial investment but also on the returns it generates. By investing regularly over a long period, even small contributions can grow significantly, as compounding helps accelerate wealth growth. Starting SIPs early is the best way to maximise this benefit, making it a powerful tool for long-term wealth creation.

SIPs are flexible as investors can start with a minimal amount (as low as Rs. 500) and adjust the contribution amount according to their financial situation. This affordability makes SIP accessible to everyone, from students to salaried employees. Additionally, SIPs offer the flexibility to pause, increase, or decrease the contribution without major procedural hurdles.

Since SIPs follow a fixed, regular schedule, they help reduce emotional biases in investment decisions. By automating the investment process, SIPs allow investors to avoid impulsive decisions driven by market swings, promoting a steady approach to building wealth. This reduces the temptation to ‘time’ the market, which often leads to costly mistakes for investors.

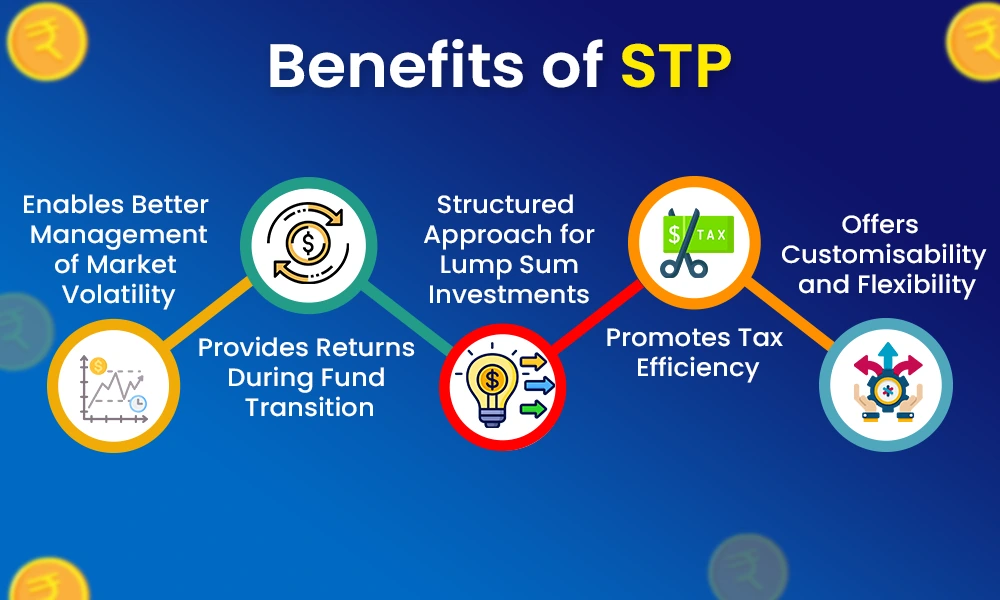

STPs allow a gradual shift from one investment plan to another to maximise the benefit for the overall portfolio. The benefits of STP are highlighted below.

With STP, investors can gradually shift funds from one mutual fund type (typically a debt fund) to another (often an equity fund). This staggered transition minimises exposure to sudden market fluctuations, effectively managing market volatility. STP is particularly useful for deploying a large investment, as it allows risk to be spread over time.

An STP keeps funds invested in a debt fund, which earns stable returns until the funds are transferred to an equity fund. This ensures capital continues to generate income rather than sitting idle, combining the stability of debt returns with the growth potential of equities. By initially holding funds in debt, STP enhances overall returns before the money reaches higher-growth investments.

For those holding a substantial lump sum, STP provides a systematic path for entering equity markets. Rather than investing the entire amount at once and risking market downturns, STP allows a phased entry, helping to reduce exposure to market volatility. This gradual approach is especially suitable for investors with a lower risk appetite.

STP offers potential tax benefits when moving funds over time from debt to equity. Each transfer may be treated as a separate transaction, and in certain cases, investors can benefit from lower tax rates on short-term gains from debt funds based on holding periods and tax regulations. This planned movement can help optimise tax liabilities and support effective asset allocation.

STP allows investors to customise the transfer frequency and duration, choosing how often transfers occur (e.g., weekly, monthly) and for how long. This flexibility enables tailoring the transfer schedule to align with both market conditions and financial goals, providing better control over the investment process.

SIP and STP serve distinct investment purposes, yet both provide structured approaches to achieving financial goals for Indian investors. SIP is designed for those looking to build wealth over time in a gradual manner. STP, on the other hand, is ideal for investors with a lumpsum corpus looking to make a gradual transition into equity markets. This helps in minimising risk from market volatility while earning returns from debt funds in the interim. Both options offer flexibility and risk management for investors and the opportunity to take advantage of market conditions. Choosing between SIP and STP depends on the capital availability and the individual investment goals making it suitable for different classes of investors.

This blog talks about STPs which is a fundamental part of mutual fund investments. Learning about SIPs, STPs and Systematic Withdrawal Plan (SWP) allows investors to harness the power of mutual fund investments and to maximise the investment benefits over time. So did you know about STPs and are you too taking advantage of these plans? Let us know your thoughts or if you have any queries on this topic and we will address them.

Till then Happy Reading!

Read More: Pros and Cons of Mutual Fund Investing

Introduction For the longest time, investment in stock markets was thought to b...

The year 2025 has started with huge volatility in the Indian stock markets and t...

Every investor knows that the stepping stones to a good investment in thestock m...