If you are a new trader in the stock market, you will encounter multiple trading strategies and tips and tricks that can help you create a successful trading portfolio. However, these trading strategies are broadly classified into short-term and long-term trading strategies. But how do you identify them and what are the parameters that make them distinct? Here is a detailed analysis of short-term and long-term trading strategies to how to shape the trading portfolio using them effectively.

Short-term trading involves buying and selling financial instruments, such as stocks, currencies, or commodities, over a brief period, ranging from minutes to a few weeks. The primary objective is to profit from small price movements, making quick returns through active market participation. This type of trading demands constant market monitoring, and swift decision-making, and often relies on technical analysis and market trends. Due to the frequency of trades and the volatility of stock markets, short-term trading is considered high-risk, but it can offer significant rewards for traders who can effectively manage risks, adapt to market conditions, and execute trades efficiently.

Short-term trading strategies are broadly classified as under depending on the trading time frame or trading style.

Intraday Trading (Day Trading) - Intraday trading involves traders buying and selling stocks within the same day. The positions are opened and closed before the market closes, and no stock is held overnight. The goal is to take advantage of small price movements throughout the day.

Swing Trading - Swing trading involves holding positions for a few days to a couple of weeks. Traders aim to capture short- to medium-term price swings by analysing market trends and technical indicators. It is a more relaxed form of short-term trading compared to day trading.

Scalping - Scalping is the quickest form of trading, where traders execute multiple trades within minutes or even seconds. The idea is to make small but frequent profits by taking advantage of tiny price changes. It requires high focus and quick execution.

Momentum Trading - Momentum traders buy assets that are moving strongly in one direction, whether up or down, with the expectation that the trend will continue for a short period. They rely on market sentiment and trends to guide their trades.

Short-term trading strategies and indicators that are commonly used by traders across the globe are explained in brief hereunder.

Breakout trading involves entering a trade when the price moves beyond a specific support or resistance level, expecting a significant price move. Traders aim to capture the momentum when a stock ‘breaks out’ of its usual range, signalling a new trend.

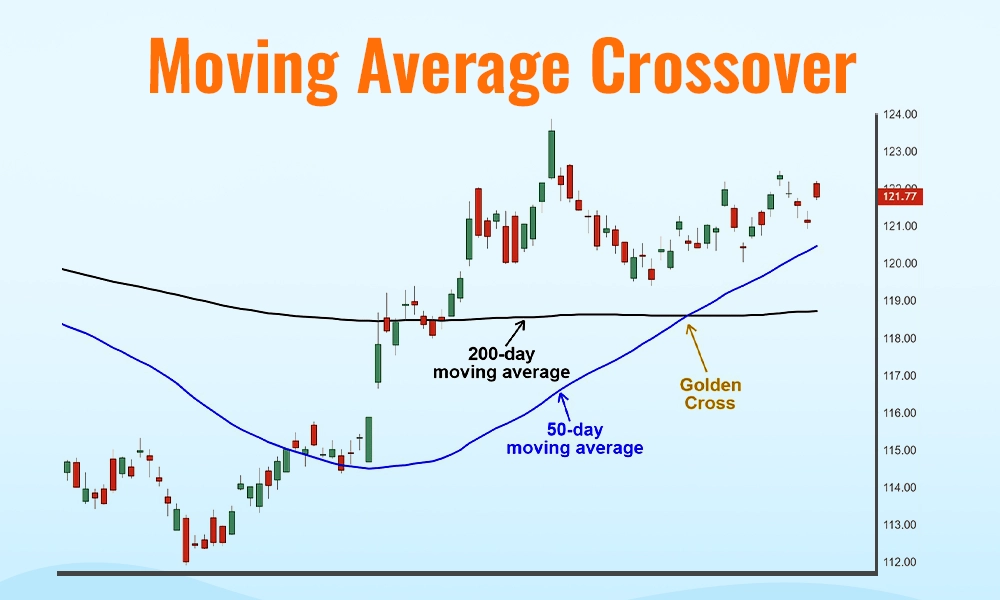

In this strategy, traders use two moving averages (like 50-day and 200-day). When a shorter-term moving average crosses above a longer-term moving average, it is a buy signal while when it crosses below, it is a sell signal. It helps traders catch potential trend reversals.

Range trading is based on identifying support and resistance levels in a stock's price. Traders buy when the price hits the lower support level and sell when it approaches the upper resistance level, repeating the process as long as the stock trades within that range.

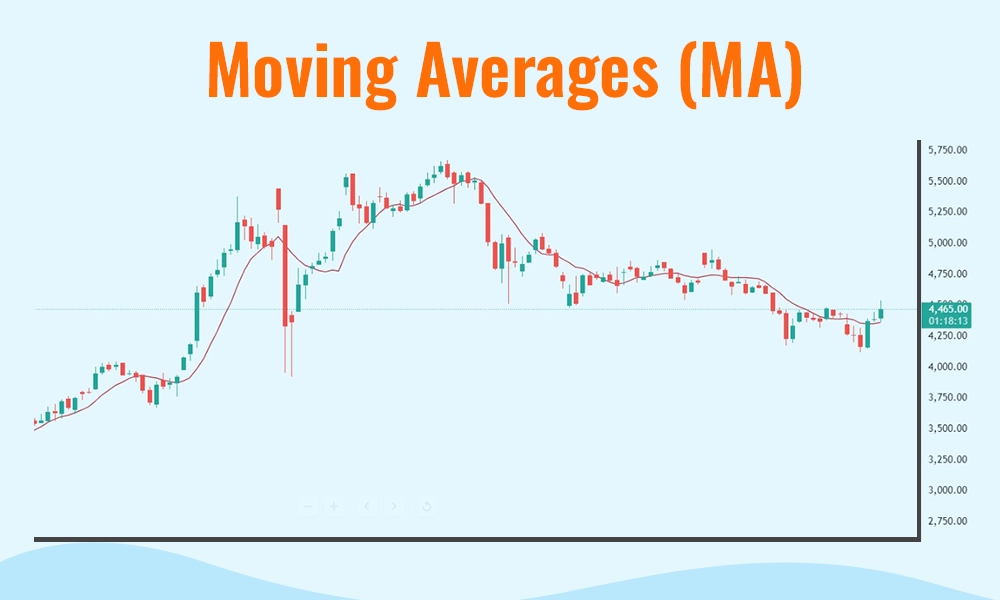

Moving Averages smooth out price data to identify trends over time. Simple Moving Average (SMA) and Exponential Moving Average (EMA) are used to spot trends and reversals. A rising MA suggests an upward trend, while a falling MA signals a downward trend.

RSI measures the speed and change of price movements. It ranges from 0 to 100. An RSI above 70 is considered overbought, signalling a potential sell, while below 30 is oversold, suggesting a buying opportunity.

Bollinger bands consist of a moving average with two bands above and below it. When the price moves towards the upper band, the asset is considered overbought, while approaching the lower band indicates it's oversold. It helps traders spot volatility and potential price reversals.

MACD shows the relationship between two moving averages of a stock’s price. When the MACD line crosses above the signal line, it’s a buy signal. When it crosses below, it is a sell signal, helping traders gauge momentum and potential trend changes.

Long-term trading involves purchasing and holding financial instruments like stocks, bonds, or mutual funds for an extended period, often spanning years or even decades. The primary aim is to benefit from the gradual growth of the market or a specific company, allowing investments to compound over time. Unlike short-term trading, this strategy emphasises fundamental analysis, focusing on a company’s financial health, industry prospects, and broader economic trends rather than daily price fluctuations. Long-term traders typically engage in fewer trades, preferring a more patient, low-risk approach that seeks to build wealth steadily over time. This method is ideal for investors looking for stability and the potential for significant capital appreciation through consistent market growth.

The popular long-term trading strategies and indicators commonly used by traders or investors are explained in brief here,

The buy-and-hold strategy involves purchasing stocks or other financial assets and holding them for many years, regardless of market ups and downs. The aim is to benefit from long-term price appreciation and compound growth. Investors often pick fundamentally strong companies and hold them for decades to ride through market cycles.

Value investors look for stocks that are undervalued by the market but have solid financials and growth potential. They buy these stocks at a discounted price and hold them until the market corrects the price. Value Investing requires an in-depth analysis of a company’s earnings, cash flow, and overall business model.

Growth investors focus on companies that are expected to grow rapidly in the future, even if their current price is high. These companies reinvest their profits into expanding the business, which can lead to significant price appreciation over time. This strategy often targets sectors like technology or healthcare.

This strategy involves investing in companies that consistently pay and increase dividends over time. Investors benefit from both regular income through dividends and long-term price appreciation. Reinvesting dividends allows for compounding returns, making it a popular choice for long-term wealth building.

Index funds investing is a passive strategy where investors buy mutual funds or ETFs that track a specific market index (such as the Nifty 50 or Sensex). This strategy provides broad market exposure, diversification, and steady returns over the long term. It’s a simple and low-cost way to invest in the overall market.

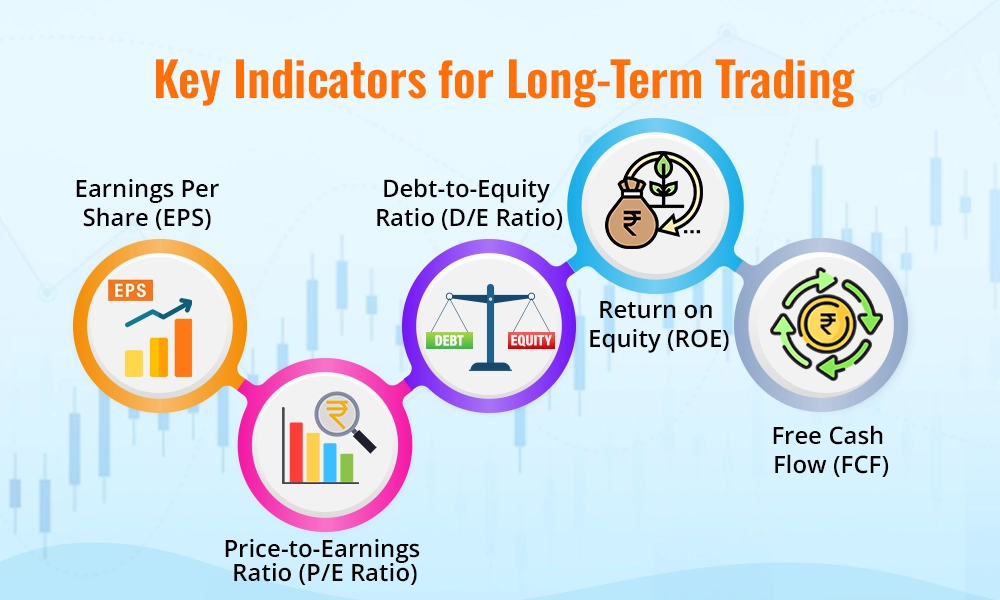

EPS shows how much profit a company makes for each outstanding share. A growing EPS indicates that the company is becoming more profitable, which is a positive sign for long-term investors.

The P/E ratio compares a company’s stock price to its earnings. A lower P/E ratio may indicate that a stock is undervalued, while a higher P/E ratio suggests the stock is expensive. Long-term investors use this ratio to determine if a stock is a good buy based on its earnings potential.

The D/E ratio measures a company’s financial leverage by comparing its total liabilities to shareholder equity. A lower ratio is generally preferable for long-term investments, as it indicates the company is less reliant on debt.

ROE measures how effectively a company is using its equity to generate profits. A high ROE indicates strong management and is a good sign for long-term growth potential.

Free cash flow represents the cash a company has left after paying for capital expenditures. A positive and growing FCF is an indicator of a company’s ability to generate profit and invest in its growth, which is attractive to long-term investors.

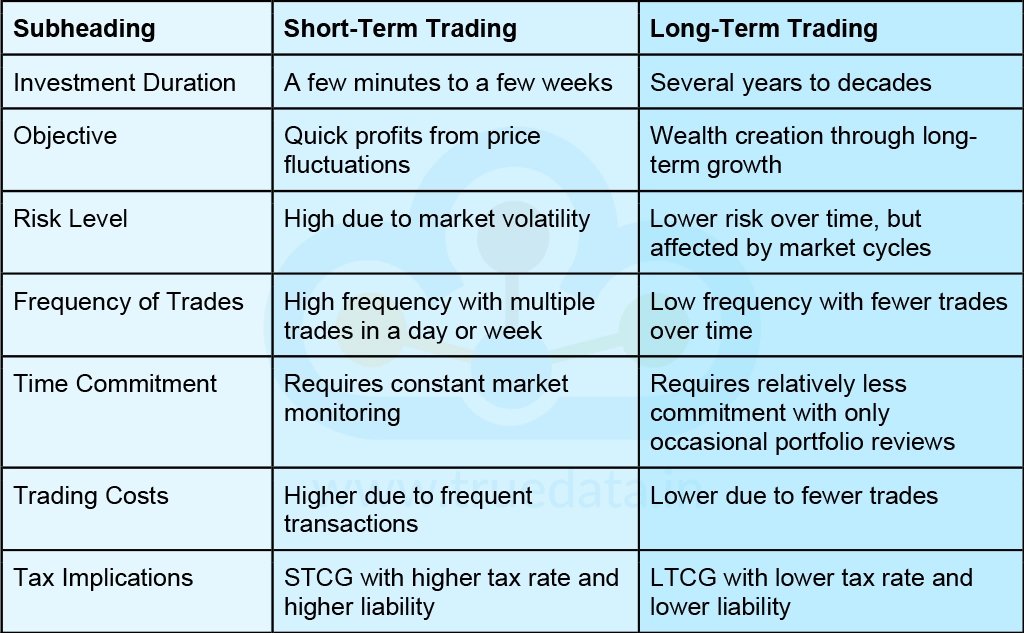

Some of the key differences between short-term trading and long-term trading are highlighted below.

Short-term and long-term trading both have their unique approaches and benefits, depending on a trader’s goals and risk tolerance. Short-term trading involves frequent trades to profit from quick price movements and relies heavily on technical analysis and market trends. Long-term trading, on the other hand, focuses on building wealth over time by investing in strong companies and holding onto them for years, using fundamental analysis to guide decisions. Deciding on the optimum trading style and trading strategy will depend on the individual parameters and financial goals to ensure the optimum allocation of resources.

This article talks about the different trading approaches and their related nuances in detail. So which type of trading are you more comfortable with and what are your go-to trading strategies or indicators? Also, let us know if you need further information on any of these trading indicators or strategies to enhance your trading knowledge.

Till then Happy Reading!

Read More: Index Trading vs Stock Trading

Did you know that stock trading is fast becoming one of the most popular searche...

In the world of high-speed trading, success often hinges on capitalising on even...

The world of trading is constantly evolving with the use of advanced technology ...