The relationship between gold and Indian households is legendary and ancient as well. India is one of the top importers of gold and it is estimated that Indian households have approximately 11% of the total gold in the world. However, there are many limitations to investing in gold in the traditional format, i.e., physical or pure gold. This is where SGBs come into the picture. It is a dynamic way of investing in gold without the actual limitations of physical gold. The latest tranche of the SGBs Scheme 2022-23 (Series IV-Tranche 63) will be available from 6th March 2023 to 10th March 2023. Given here are the details of SGBs and how they differ from physical or pure gold investments. Read More: Investment ideas for new investors in 2023

The relationship between gold and Indian households is legendary and ancient as well. India is one of the top importers of gold and it is estimated that Indian households have approximately 11% of the total gold in the world. However, there are many limitations to investing in gold in the traditional format, i.e., physical or pure gold. This is where SGBs come into the picture. It is a dynamic way of investing in gold without the actual limitations of physical gold. The latest tranche of the SGBs Scheme 2022-23 (Series IV-Tranche 63) will be available from 6th March 2023 to 10th March 2023. Given here are the details of SGBs and how they differ from physical or pure gold investments. Read More: Investment ideas for new investors in 2023

Sovereign Gold Bonds (SGBs) are the government bonds issued by RBI on behalf of the Central Government. It is a type of government security denominated in grams of gold and is issued in tranches by the RBI at periodic intervals. Individual investors are allowed to invest a minimum of 1 gram to a maximum of 4 kgs in a financial year while HUF and trusts can invest up to 4 kgs and 20 kgs respectively. The nominal value of Gold Bonds shall be in terms of INR and will be determined based on the simple average of the closing price of gold of 999 purity for the last 3 business days of the week preceding the subscription period. For this purpose, the prices published by the India Bullion and Jewelers Association Limited will be considered. These bonds come with a maturity of 8 years with an option to exit after the completion of the 5th year. Investors get the benefit of earning interest at a fixed interest rate of 2.5% annually. The interest will be payable semi-annually on the nominal value of the investment. Furthermore, investors also get tax benefits in the form of exemption on capital gains when the bonds are held till maturity.

Sovereign Gold Bonds (SGBs) are the government bonds issued by RBI on behalf of the Central Government. It is a type of government security denominated in grams of gold and is issued in tranches by the RBI at periodic intervals. Individual investors are allowed to invest a minimum of 1 gram to a maximum of 4 kgs in a financial year while HUF and trusts can invest up to 4 kgs and 20 kgs respectively. The nominal value of Gold Bonds shall be in terms of INR and will be determined based on the simple average of the closing price of gold of 999 purity for the last 3 business days of the week preceding the subscription period. For this purpose, the prices published by the India Bullion and Jewelers Association Limited will be considered. These bonds come with a maturity of 8 years with an option to exit after the completion of the 5th year. Investors get the benefit of earning interest at a fixed interest rate of 2.5% annually. The interest will be payable semi-annually on the nominal value of the investment. Furthermore, investors also get tax benefits in the form of exemption on capital gains when the bonds are held till maturity.

The eligible investors for SGBs include individuals, HUFs, trusts, universities, and charitable institutions. SGBs are a good investment option for following investors.

The traditional form of investing in gold comes with a lot of risks like high storage costs, risk of theft, high making charges, risk of impure gold, etc. Investing in SGBs is free from all such risks as the gold will be stored in digital form in the investor’s Demat account or with the RBI record. Therefore by investing in SGBs, investors can get the benefits of investing in the dynamic form of gold without facing the risks of investing in pure gold.

The traditional form of investing in gold comes with a lot of risks like high storage costs, risk of theft, high making charges, risk of impure gold, etc. Investing in SGBs is free from all such risks as the gold will be stored in digital form in the investor’s Demat account or with the RBI record. Therefore by investing in SGBs, investors can get the benefits of investing in the dynamic form of gold without facing the risks of investing in pure gold.

SGBs come with a maturity period of 8 years. Therefore, investors with a long-term investment horizon can invest in these bonds.

SGBs come with a maturity period of 8 years. Therefore, investors with a long-term investment horizon can invest in these bonds.

SGBs are issued by the RBI on behalf of the Central Government. This makes them risk-free investment options and can therefore be used to diversify the investment portfolio and reduce the overall risk.

SGBs are issued by the RBI on behalf of the Central Government. This makes them risk-free investment options and can therefore be used to diversify the investment portfolio and reduce the overall risk.

SGBs provide income in the form of interest at the rate of 2.5% annually which is paid on a semi-annual basis. The redemption value of the SGBs is determined based on the simple average of the closing price of gold of 999 purity of the previous 3 business days from the date of repayment as published by the India Bullion and Jewelers Association Limited. The value of gold has always increased in the long term. Therefore, investors seeking capital appreciation as well as a stable source of income can invest in SGBs.

SGBs provide income in the form of interest at the rate of 2.5% annually which is paid on a semi-annual basis. The redemption value of the SGBs is determined based on the simple average of the closing price of gold of 999 purity of the previous 3 business days from the date of repayment as published by the India Bullion and Jewelers Association Limited. The value of gold has always increased in the long term. Therefore, investors seeking capital appreciation as well as a stable source of income can invest in SGBs.

There are numerous benefits to investing in SBGs. These benefits include

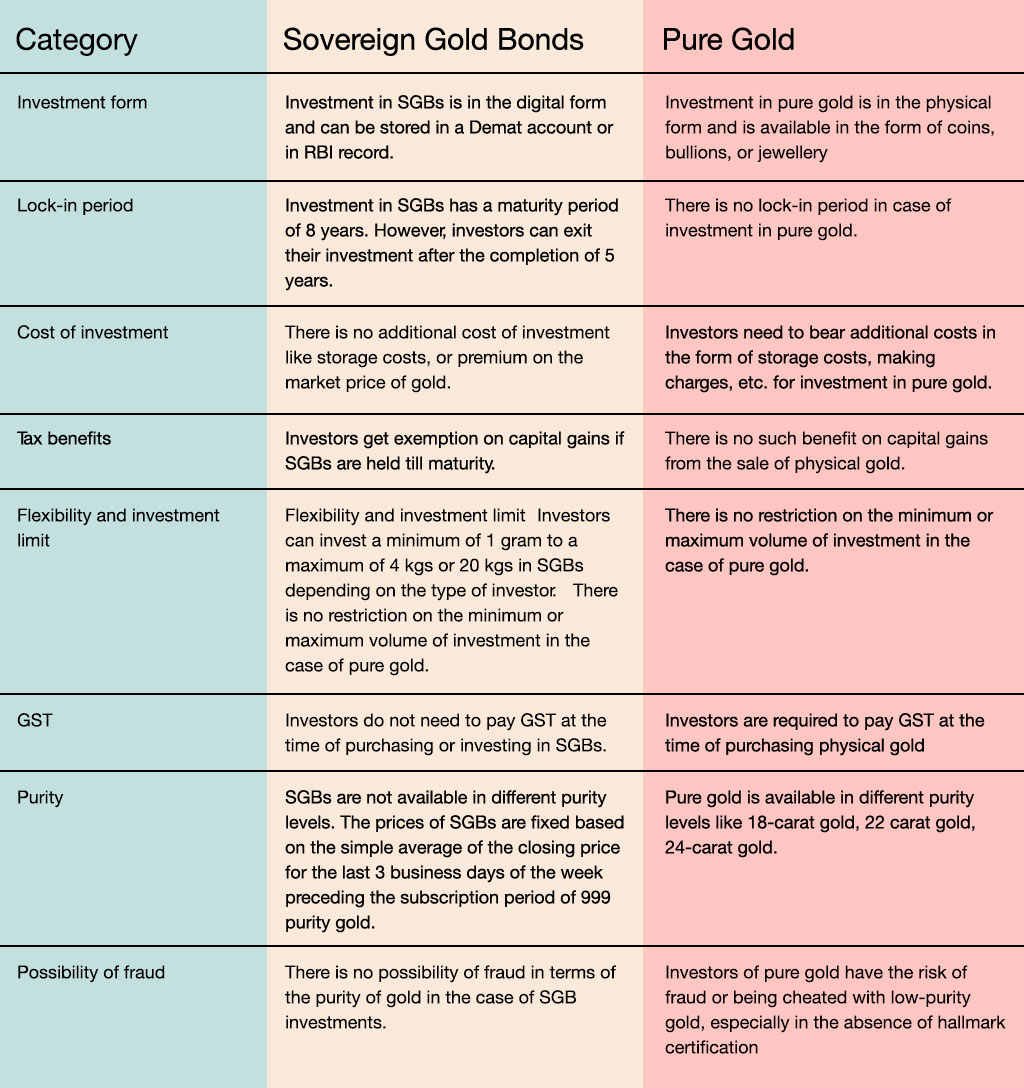

It is important for investors to understand the key differences between investing in SGBs and pure gold in order to make effective investment decisions. These differences are tabled hereunder.

SGBs are the new age form of investing in gold and are especially attractive to young investors who may not find investing in pure gold as attractive. Being backed by RBI and the government, these are risk-free investment options as compared to other forms of non-traditional investment in gold like Gold ETFs, Digital Gold, or gold mutual funds. We hope this article has been successful in providing the necessary details on SGBs and highlighting them to be a dynamic and better form of investment in many ways. Do let us know what you think of SGBs and do you find them attractive in comparison to traditional gold or pure gold. Also, TrueData provides real-time feed for SGBs traded on the NSE & also for the Gold Futures & Options traded on the MCX. Watch this space for more information on different investment products. Till then Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

There is a famous quote from Mr.Warren Buffett, and it says that if your money i...

Process of Selecting Top Stocks for Investing The first step towards picking a ...