Technical analysis is the study of price and volume movements of stocks and other securities to create a successful trading portfolio. This involves the use of various trading strategies and indicators by traders to understand the volatility and the pace of change in market fluctuations. Bollinger Bands are among such technical indicators that help in a deeper understanding of the markets and the securities making them a useful tool of technical analysis. Read on to know more about Bollinger Bands and how they can be used for successful trading. Read More: ADX Indicator-All you need to know

Technical analysis is the study of price and volume movements of stocks and other securities to create a successful trading portfolio. This involves the use of various trading strategies and indicators by traders to understand the volatility and the pace of change in market fluctuations. Bollinger Bands are among such technical indicators that help in a deeper understanding of the markets and the securities making them a useful tool of technical analysis. Read on to know more about Bollinger Bands and how they can be used for successful trading. Read More: ADX Indicator-All you need to know

Bollinger Bands are a technical analysis tool created by John Bollinger in the 1980s. They are designed to provide insights into price volatility, potential price reversals, and the overall strength of a market trend. It uses standard deviation to capture extreme price movements and offer a nuanced understanding of market conditions. Bollinger Bands consist of three components: a middle line called the Simple Moving Average (SMA) and two outer bands that represent standard deviations from the SMA.

Bollinger Bands are a technical analysis tool created by John Bollinger in the 1980s. They are designed to provide insights into price volatility, potential price reversals, and the overall strength of a market trend. It uses standard deviation to capture extreme price movements and offer a nuanced understanding of market conditions. Bollinger Bands consist of three components: a middle line called the Simple Moving Average (SMA) and two outer bands that represent standard deviations from the SMA.

The SMA is the centrepiece of Bollinger Bands. It calculates the average price of an asset over a specific time period, typically 20 days. The SMA provides a baseline for assessing the trend direction and can act as a support or resistance level.

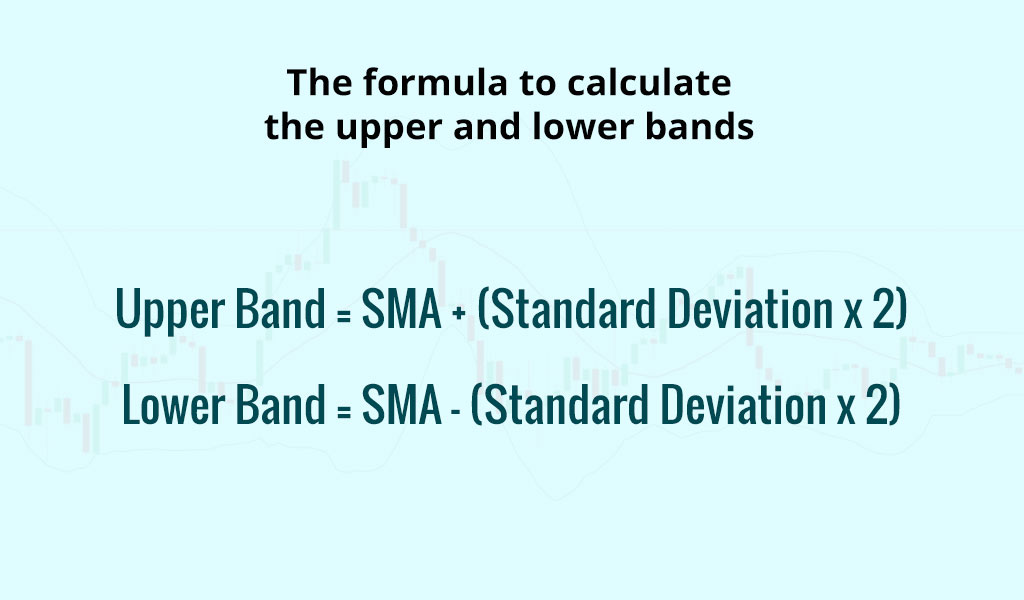

The upper band is constructed by adding a certain number of standard deviations to the SMA. The standard deviation is a statistical measure that quantifies the dispersion of prices around the average. The default value for the standard deviation is usually set to two. The upper band serves as a line of potential resistance, indicating that the price might be overbought or nearing a point of exhaustion.

The lower band is formed by subtracting the same number of standard deviations from the SMA. It acts as a line of potential support, indicating that the price might be oversold or approaching a level where buying interest could increase.

To calculate Bollinger Bands, you need to follow these steps.

Bollinger Bands are a versatile tool used by traders in various trading strategies. Here's a detailed explanation of how Bollinger Bands can be used in trading.

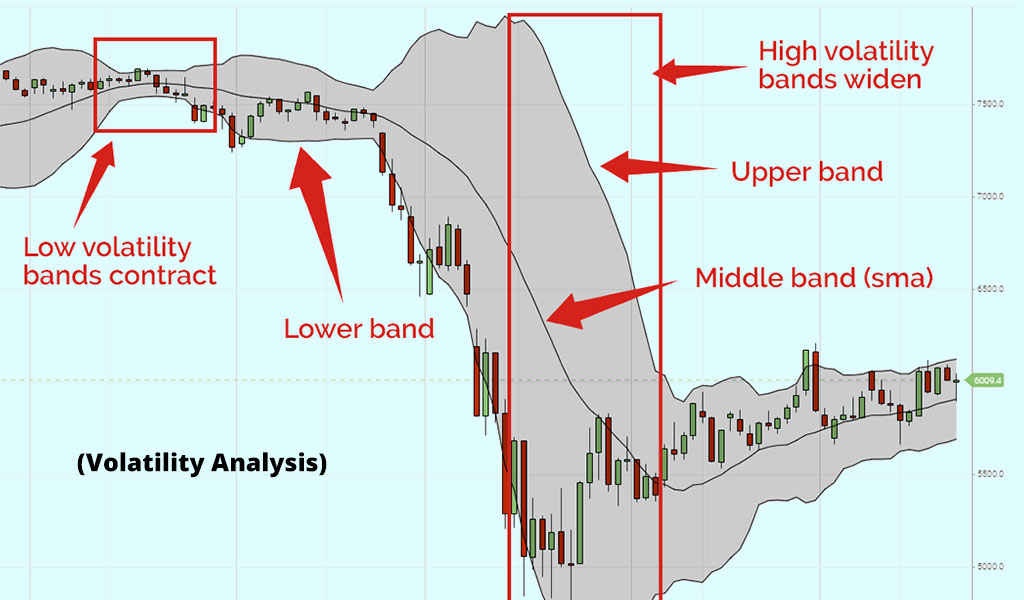

Bollinger Bands provide a visual representation of market volatility. When the bands are narrow, it indicates low volatility, suggesting a period of consolidation or range-bound trading. Conversely, when the bands widen, it indicates high volatility, signalling potential significant price movements. Traders can use this information to assess market conditions and adjust their trading strategies accordingly.

Bollinger Bands provide a visual representation of market volatility. When the bands are narrow, it indicates low volatility, suggesting a period of consolidation or range-bound trading. Conversely, when the bands widen, it indicates high volatility, signalling potential significant price movements. Traders can use this information to assess market conditions and adjust their trading strategies accordingly.

Bollinger Bands can help identify overbought and oversold conditions in the market. When the price touches or exceeds the upper band, it suggests that the market may be overbought, indicating a potential price reversal or pullback. Similarly, when the price touches or falls below the lower band, it suggests that the market may be oversold, indicating a potential price bounce or reversal to the upside. Traders can use these signals to enter or exit trades.

Bollinger Bands can help identify overbought and oversold conditions in the market. When the price touches or exceeds the upper band, it suggests that the market may be overbought, indicating a potential price reversal or pullback. Similarly, when the price touches or falls below the lower band, it suggests that the market may be oversold, indicating a potential price bounce or reversal to the upside. Traders can use these signals to enter or exit trades.

Bollinger Bands are commonly used to identify potential breakout opportunities. Breakouts occur when the price moves beyond the upper or lower band. An upside breakout above the upper band suggests a potential continuation of an uptrend or the start of a new one. Conversely, a downside breakout below the lower band indicates a potential continuation of a downtrend or the start of a new one. Traders often wait for a confirmed breakout by looking for the price to close outside the band before initiating trades in the direction of the breakout.

Bollinger Bands are commonly used to identify potential breakout opportunities. Breakouts occur when the price moves beyond the upper or lower band. An upside breakout above the upper band suggests a potential continuation of an uptrend or the start of a new one. Conversely, a downside breakout below the lower band indicates a potential continuation of a downtrend or the start of a new one. Traders often wait for a confirmed breakout by looking for the price to close outside the band before initiating trades in the direction of the breakout.

Bollinger Bands can also help identify potential trend reversals. When the price touches or crosses the upper or lower band and then reverses its direction, it may indicate a possible reversal in the current trend. Traders often look for confirmation signals such as candlestick patterns or other technical indicators to increase the reliability of trend reversal signals.

Bollinger Bands can also help identify potential trend reversals. When the price touches or crosses the upper or lower band and then reverses its direction, it may indicate a possible reversal in the current trend. Traders often look for confirmation signals such as candlestick patterns or other technical indicators to increase the reliability of trend reversal signals.

The upper and lower bands of Bollinger Bands can act as dynamic support and resistance levels. Traders can use these levels to set stop-loss orders, take-profit levels, or identify potential entry or exit points. When the price approaches the upper band, it may encounter resistance, providing an opportunity to sell or take profits. Similarly, when the price approaches the lower band, it may find support, presenting a buying opportunity.

The upper and lower bands of Bollinger Bands can act as dynamic support and resistance levels. Traders can use these levels to set stop-loss orders, take-profit levels, or identify potential entry or exit points. When the price approaches the upper band, it may encounter resistance, providing an opportunity to sell or take profits. Similarly, when the price approaches the lower band, it may find support, presenting a buying opportunity.

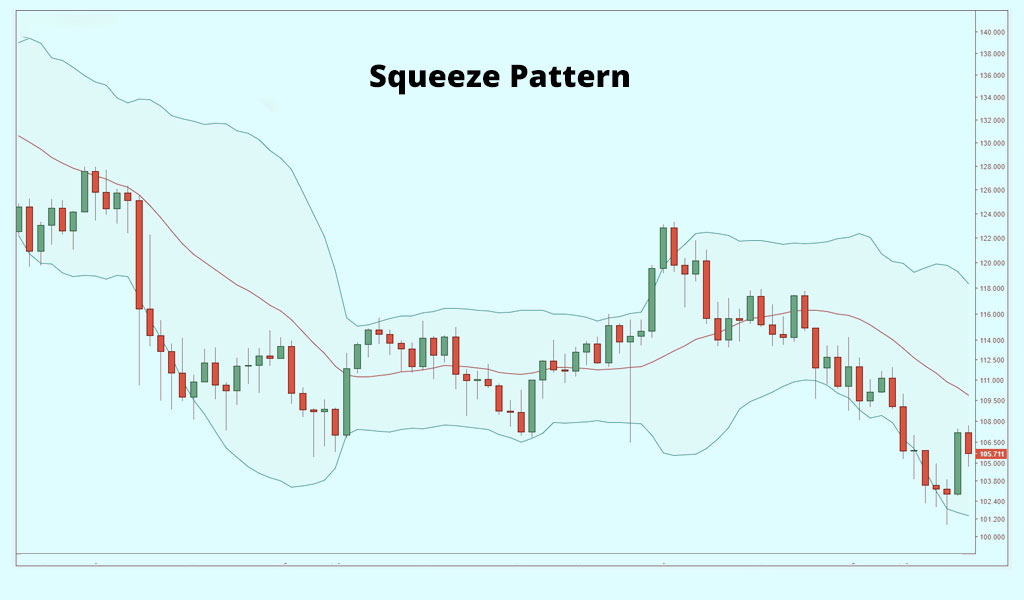

The Bollinger Bands "squeeze" pattern occurs when the bands contract significantly, indicating a period of low volatility. Traders anticipate that the squeeze will be followed by a period of high volatility and a potential breakout. They wait for the bands to expand again, indicating the end of the squeeze, and position themselves for potential trades in the direction of the breakout.

The Bollinger Bands "squeeze" pattern occurs when the bands contract significantly, indicating a period of low volatility. Traders anticipate that the squeeze will be followed by a period of high volatility and a potential breakout. They wait for the bands to expand again, indicating the end of the squeeze, and position themselves for potential trades in the direction of the breakout.

Bollinger Bands are a useful trading indicator for traders to help them understand trading patterns and take suitable trading positions. However, it is important to note that Bollinger Bands cannot be used as standalone indicators to analyse the stock markets. Traders should combine this indicator with oscillators, trendlines, and other indicators to validate signals and enhance their trading strategies. We hope that this blog is successful in providing basic knowledge about Bollinger Bands and how that can be used by traders to curate their portfolios. Let us know if you need any further information on this topic or have any queries regarding the same. Till then Happy Reading!

The key tosuccessful trading is understanding price variations and the degree of...

When we take our first step into the trading game, we choose the best resource...

It is a fact that technical analysis is the basis of analysing stocks. What does...