Mutual funds are one of the most popular investment options today. Their key features like diversity, ease of investment, etc. make it an attractive investment option for every category of investors with different investment goals or risk appetite. However, you would still have heard the famous like ‘mutual funds are subject to market risk’. What if we tell you that you can invest in mutual funds but still have reduced risk exposure as compared to equity or debt mutual funds? This is where index funds and ETFs come into the picture. These are classified as passive funds and are a very good addition to your investment portfolio. Want to learn more about them? Check out this blog for all the details related to index funds and ETFs and how to choose among them. Read More: How do mutual funds work?

Mutual funds are one of the most popular investment options today. Their key features like diversity, ease of investment, etc. make it an attractive investment option for every category of investors with different investment goals or risk appetite. However, you would still have heard the famous like ‘mutual funds are subject to market risk’. What if we tell you that you can invest in mutual funds but still have reduced risk exposure as compared to equity or debt mutual funds? This is where index funds and ETFs come into the picture. These are classified as passive funds and are a very good addition to your investment portfolio. Want to learn more about them? Check out this blog for all the details related to index funds and ETFs and how to choose among them. Read More: How do mutual funds work?

Index funds are a type of investment fund that aims to replicate the performance of a specific stock market index, such as the Sensex and Nifty. These funds are passive funds in nature and are designed to provide investors with a straightforward and low-cost way to invest in a broad range of securities like stocks, bonds, or other assets that make up the chosen index. These funds track the performance of their benchmark index with the aim to minimise tracking errors and replicate the returns of the index. Some of the key features of index funds are highlighted hereunder.

Index funds are a type of investment fund that aims to replicate the performance of a specific stock market index, such as the Sensex and Nifty. These funds are passive funds in nature and are designed to provide investors with a straightforward and low-cost way to invest in a broad range of securities like stocks, bonds, or other assets that make up the chosen index. These funds track the performance of their benchmark index with the aim to minimise tracking errors and replicate the returns of the index. Some of the key features of index funds are highlighted hereunder.

Exchange-Traded Funds (ETFs) are a type of investment product that combines the features of both stocks and mutual funds. Similar to index funds, ETFs are also passive funds that track the performance of their benchmark index. They are designed to provide investors with a flexible and cost-effective way to diversify their portfolios and gain exposure to various assets, including stocks, bonds, commodities, or a combination of these. Some of the top features of ETFs are highlighted hereunder.

Exchange-Traded Funds (ETFs) are a type of investment product that combines the features of both stocks and mutual funds. Similar to index funds, ETFs are also passive funds that track the performance of their benchmark index. They are designed to provide investors with a flexible and cost-effective way to diversify their portfolios and gain exposure to various assets, including stocks, bonds, commodities, or a combination of these. Some of the top features of ETFs are highlighted hereunder.

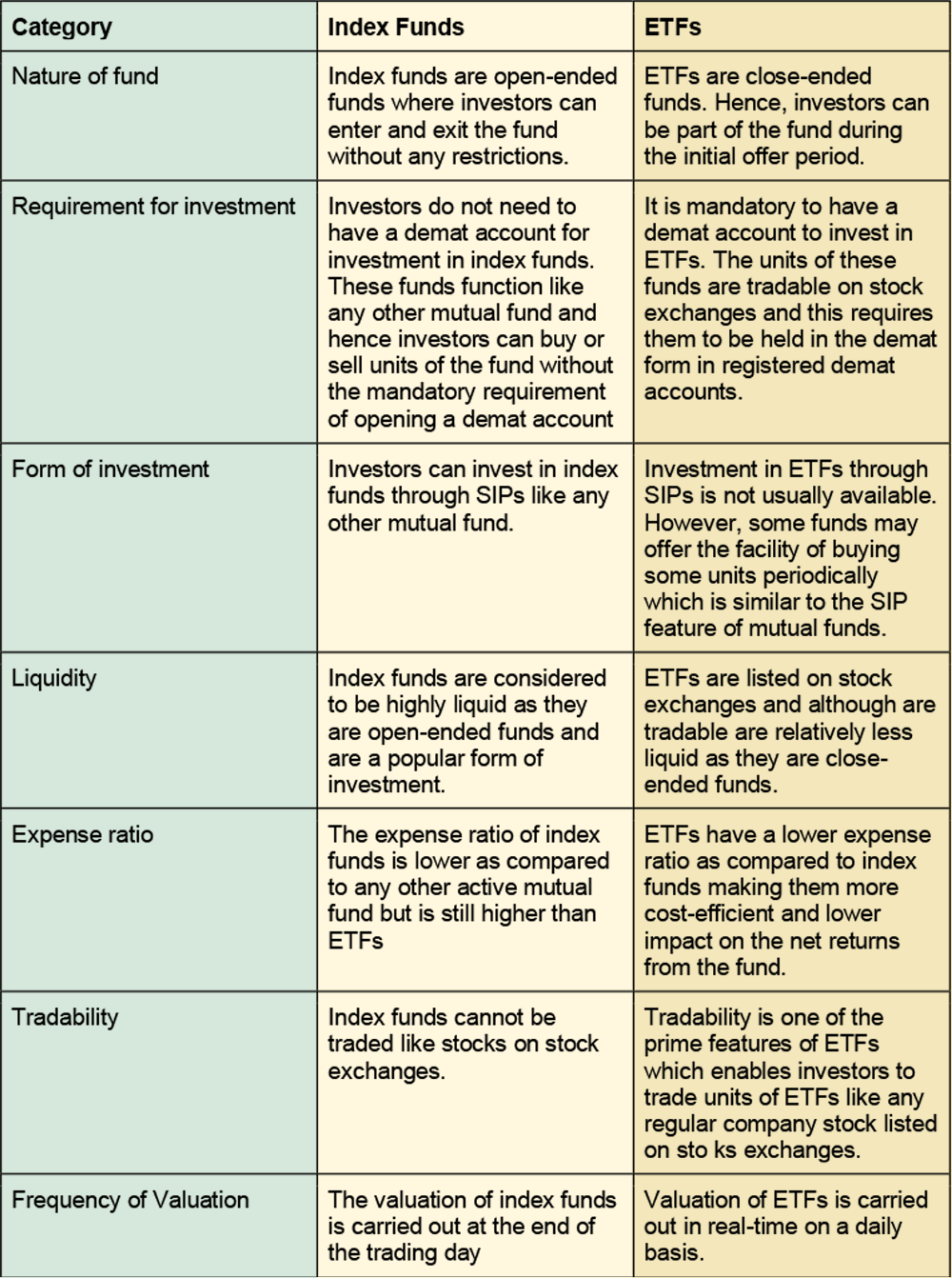

The above meaning of index funds and ETFs shows the similarity between these funds. However, there are a few key differences between these investment options. These differences are tabled below.

The answer to a choice between index funds and ETFs is not a ‘one shoe fits all’ answer. Rather, when making a choice between index funds and ETFs, an investor should consider their investment goals and preferences. If the investor favours a long-term, passive strategy with lower costs and is comfortable with end-of-day trading, index funds may be the suitable option. Conversely, if the investor seeks intraday trading flexibility, real-time transparency, and lower expense ratios, ETFs become a compelling choice. The more prudent choice would be to diversify the portfolio with a combination of both investment types to leverage the advantages of each

The answer to a choice between index funds and ETFs is not a ‘one shoe fits all’ answer. Rather, when making a choice between index funds and ETFs, an investor should consider their investment goals and preferences. If the investor favours a long-term, passive strategy with lower costs and is comfortable with end-of-day trading, index funds may be the suitable option. Conversely, if the investor seeks intraday trading flexibility, real-time transparency, and lower expense ratios, ETFs become a compelling choice. The more prudent choice would be to diversify the portfolio with a combination of both investment types to leverage the advantages of each

Index funds and ETFs are both passive investment options and cater especially to investors with a low-risk appetite as well as those seeking more or less stable market returns. This gives them an edge over active equity mutual funds that are more volatile as compared to these funds. Index funds and ETFs allow investors to diversify their investment portfolio and ensure that the overall risk of the portfolio is reduced. Index funds and ETFs are dynamic investment options that should definitely be part of your investment portfolio. This article aimed to shed more light on these investment options and help you in shaping your investment portfolio. Let us know if you have any queries relating to this topic or need more information on these products. Till then Happy Reading!

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...