Traders in stock markets use various tools to evaluate a trading opportunity for their target security or asset. These tools are essentially categorised into fundamental analysis or technical analysis tools. While fundamental analysis has its importance, no trader can ignore the technical analysis portion for evaluating the optimum entry and exit points for their trades. When we talk about the most common technical analysis indicators or tools, the use of moving averages is among the top answers across the world. So what is the meaning of moving averages and why are they so important in trading? Read on to get answers to these questions and understand moving averages in a slightly better manner.

Read More: What is an Iron Butterfly?

The simple explanation of the term average is the average of the stock prices or the data points of an asset or a security. Add the term moving to it and it represents the average prices of the security for the latest time frame which can be 10 days, 20 days, 50 days, 100 days, and so on. A moving average can be explained as a statistical calculation used to analyse data points over a specific period and smooth out fluctuations as well as highlight the overall trend. The moving average is an important technical analysis indicator for both seasoned traders as well as beginners in stock markets. A moving average is then represented in the form of a line that is used to provide valuable insights into the underlying trends of a financial instrument.

The use of moving averages is crucial for traders seeking to make informed decisions based on historical price data. The importance of moving averages for traders can be explained hereunder.

One of the primary reasons moving averages are essential for traders is their effectiveness in identifying trends in the market. By smoothing out short-term fluctuations, moving averages help traders focus on the overall direction of the price movement. The moving average acts as a reliable indicator to discern the prevailing trend in Indian markets where volatility can be influenced by various factors, including economic indicators and geopolitical events.

Moving averages also serve as dynamic support and resistance levels. In an uptrend, the moving average often acts as a support level, indicating potential buying opportunities when prices approach or touch the moving average. Conversely, in a downtrend, the moving average can act as a resistance level, providing insight into potential selling points.

Traders can also use moving averages to generate trading signals for target securities. The crossover of short-term and long-term moving averages can signal potential entry or exit points. The golden cross, where a short-term moving average crosses above a long-term moving average, is considered a bullish signal. Conversely, the death cross, where a short-term moving average crosses below a long-term moving average, is viewed as a bearish signal. These signals are instrumental in guiding traders on when to enter or exit positions in the stock market.

Volatility is a significant factor in the Indian financial markets, and moving averages help traders gauge the degree of price volatility. Bollinger Bands, which incorporate a moving average and standard deviations, are commonly used to identify periods of high or low volatility. This information is invaluable for traders allowing them to adjust their trading strategies based on the prevailing market conditions.

Traders rely on moving averages to look at price trends systematically. This helps them decide where to set stop-loss orders and take-profit levels by looking at how prices have moved in the past using these moving averages. This method keeps traders disciplined and helps them handle risks well, especially when the market is unpredictable and emotions can make decisions harder.

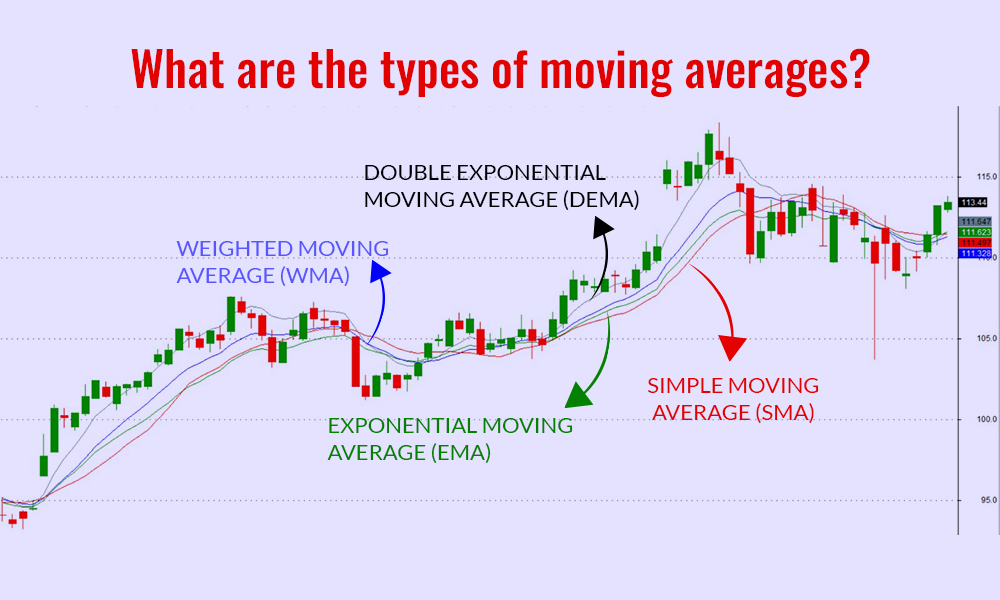

There are many types of moving averages that can be used by traders to understand the movement of securities and make suitable trading decisions. The common types of moving averages often used by traders are explained hereunder.

The Simple Moving Average (SMA) is a basic and widely used type of moving average that provides a smoothed representation of price trends. For a trader in India, calculating the SMA involves summing up the prices over a specified period and dividing by the number of periods.

The formula for SMA is,

SMA = (P1+P2+P3+P4+.….Pn) / n

Where, n is the number of periods.

The SMA helps traders in India identify the overall direction of the market by smoothing out short-term fluctuations and highlighting long-term trends.

The Weighted Moving Average (WMA) is similar to the SMA with a small variation where weights are assigned to the prices or the data points different weights to each price point within the selected time frame.

The formula for WMA is,

WMA = (W1xP1 + W2xP2 + W3xP3 +W4xP4 + .….WnxPn) / (W1+W2+W3+W4+... Wn)

Where,

P1, P2, P3, … Pn are the prices over the selected period.

W1+W2+W3+W4+... Wn are the weights assigned to the respective prices.

The Exponential Moving Average is a more dynamic variant that places greater weight on recent prices, making it responsive to the latest market developments. In the calculation of EMAs, more weight is given to the most recent data points, resulting in quicker adjustments to changing market conditions. This makes EMAs particularly useful for traders who seek to capture short-term price movements and respond promptly to emerging trends.

To calculate the EMA, you need the multiplier, which is derived from the chosen time frame.

The common formula to find the multiplier is 2 / (N+1)/2

Where, N is the number of periods.

The formula to calculate EMA is,

EMA = [(Closing Price−Previous EMA) × Multiplier] + Previous EMA

The Double Exponential Moving Average (DEMA) is considered an enhanced form of the exponential moving average, prioritising recent data sets for analysis. Notably, DEMA is designed to reduce lag results, making it a valuable tool for short-term traders aiming to swiftly identify shifts in trends. Its distinctive feature lies in having values closest to current price points, rendering it highly responsive to price volatility. This sensitivity makes DEMA an effective choice for traders seeking real-time insights into market movements.

The formula for DEMA is,

DEMA = 2 * EMA1 – EMA2

After understanding the various details of moving averages mentioned above, it is also important to understand the pros and cons of using moving averages for using them effectively. A brief analysis of the pros and cons of using moving averages is tabled below.

Moving averages are an effective tool for understanding the price movements of the target securities. Although it is a very basic and simple concept as compared to various other technical analysis indicators, it provides a deeper analysis of the movement of the asset and thereby helps in making suitable trading decisions.

This article was a brief attempt to simplify the concept of moving averages which is often considered to be one of the stepping stones of technical analysis in stock markets. Let us know if you need any further information on this topic or have any queries relating to the same and we will address them right away.

Till then Happy Reading!

When we take our first step into the trading game, we choose the best resource...

The key tosuccessful trading is understanding price variations and the degree of...

It is a fact that technical analysis is the basis of analysing stocks. What does...