There is a popular saying in stock markets that the markets are either driven by fear or greed. There is also a dedicated fear and greed index that measures the market movements to track if the stocks are fairly priced. This general market mood is often the tipping factor that either makes or breaks a company by impacting its stock prices. With such significant importance, the concept of market sentiment can be considered to be one of the fundamental concepts in trading which needs proper understanding and evaluation. This is what we will pursue in this article. Read on to understand the meaning of market sentiment and how to navigate it effectively to create a successful trading portfolio.

Read More: What is Dow Theory?

To put it simply, market sentiment refers to the overall attitude or emotional state of investors and traders towards a particular financial market or asset. It reflects the collective perception of market participants regarding the direction in which prices are likely to move. There are a number of factors that can influence the overall market sentiment for a stock or the market in general. These factors include macro factors like economic indicators, central bank policies, and geopolitical events or micro factors like corporate earnings reports and even social media trends.

It is important for traders to understand the concept of market sentiment as it can significantly impact their trading decisions. By analysing market sentiment, traders aim to gain insight into whether the prevailing mood among investors or traders is bullish (optimistic) or bearish (pessimistic). This insight can help traders anticipate potential market movements and adjust their trading strategies accordingly.

Trading based on market sentiment is like dancing to the market's tune. However, it is not as easy as it seems. Traders need to adopt a comprehensive approach to fundamental and technical analysis along with sentiment indicators to back their analysis. Traders can begin by monitoring sentiment indicators like the Fear and Greed Index or sentiment analysis tools tailored to the Indian stock markets. The next step is to align the trading strategies with the prevailing sentiment. For example, traders can consider buying during periods of extreme fear where market sentiment can lead to potentially oversold conditions. It is also important to note that the market sentiment analysis has to be backed by other technical analysis tools chart patterns, support and resistance levels, and momentum indicators to confirm trading signals derived from market sentiment. This analysis should be further backed by combining fundamental analysis of the stocks to develop a well-rounded trading strategy that capitalizes on market sentiment while minimizing risks in the stock market.

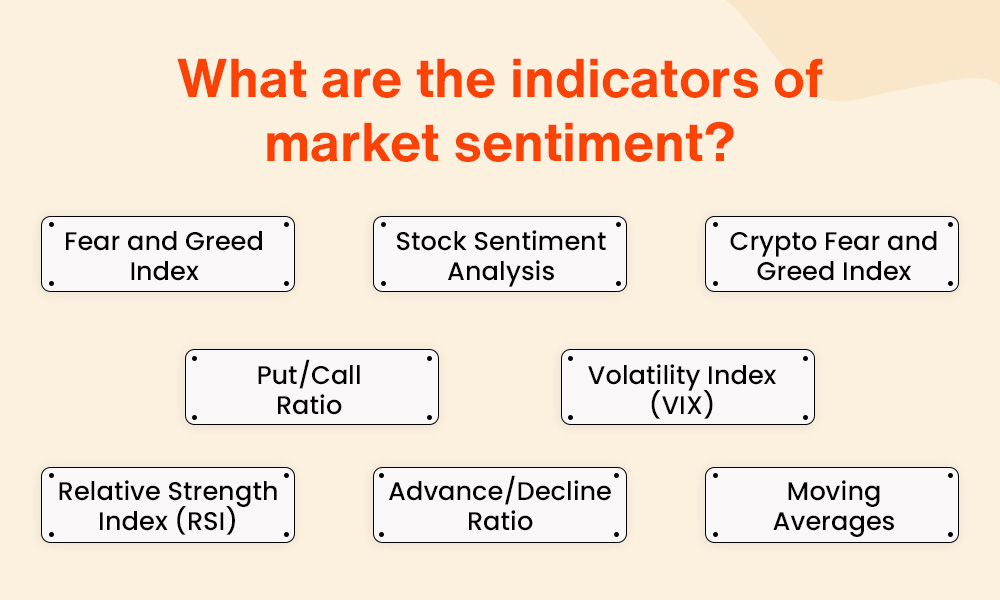

Market sentiment indicators are crucial tools for traders to gauge the prevailing mood of investors and make informed trading decisions. These indicators include various metrics and analyses to provide insights into the overall sentiment towards a particular stock or the market as a whole. Some of the prime market sentiment indicators often used by traders across the globe are discussed hereunder.

The Fear and Greed Index is a widely recognised market sentiment indicator that amalgamates multiple factors such as stock price momentum, market volatility, put/call ratios, and safe-haven demand. It measures the level of fear or greed prevailing in the market which further offers traders insights into potential buying or selling opportunities. Traders can track the Fear and Greed Index live to stay updated on the current market sentiment and thereby adapt their trading strategies.

Sentiment analysis tools tailored for the stock market employ advanced algorithms to gather and analyse vast amounts of data. The data is evaluated from various sources like news articles, social media, and financial reports to gauge investor sentiment towards specific stocks. By assessing the sentiment surrounding individual stocks, traders can identify sentiment-driven price movements and adjust their trading strategies accordingly. For example, if stock sentiment analysis indicates overwhelmingly positive sentiment towards a particular stock, traders may interpret this as a signal to consider buying or holding positions in anticipation of potential price increases and vice-versa.

The Crypto Fear and Greed Index is specific for traders involved in cryptocurrency markets providing insights into the sentiment of cryptocurrency investors. Similar to the traditional Fear and Greed Index, this indicator tracks emotions such as fear and greed prevalent in the crypto market, helping traders anticipate potential market movements and adjust their trading strategies.

The Put/Call Ratio is a sentiment indicator that compares the volume of put options (which increase in value when the market falls) to call options (which increase in value when the market rises). A high put/call ratio suggests that investors are bearish, indicating potential market downside, while a low ratio may indicate bullish sentiment. In the former scenario, investors may be purchasing more put options as a hedge against potential losses or speculating on market declines while in the latter case, investors reflect confidence in the upward trajectory of the market or anticipate reduced volatility. Such scenarios often precedes market rallies as investors position themselves for potential gains.

The Volatility Index (VIX), often referred to as the "fear index," measures the expected volatility in the market over the next 30 days. The VIX is derived from options pricing and reflects the collective perception of investors in relation to uncertainty and risk in the market. A high VIX typically indicates an increased fear and uncertainty among investors which is often associated with periods of market downturns or heightened volatility. During such times, investors may become more risk-averse, leading to selling pressure and potential declines in stock prices. On the other hand, low VIX readings suggest a sense of complacency among investors which can signal relatively low expected volatility thereby potentially paving the way for market rallies.

The Advance/Decline Ratio compares the number of advancing stocks to declining stocks within a particular market index or sector. A high ratio indicates bullish sentiment, as more stocks are advancing compared to declining, while a low ratio suggests a bearish sentiment. Traders can use this ratio to assess the breadth of market movements thereby facilitating a better understanding of the overall market.

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Traders often use the RSI to identify overbought or oversold conditions in a market. An RSI reading above 70 indicates overbought conditions, suggesting a potential reversal, while a reading below 30 indicates oversold conditions, signalling potential buying opportunities.

Moving Averages can also serve as sentiment indicators. For example, the relationship between short-term and long-term moving averages can indicate the prevailing sentiment. A bullish sentiment may be signalled when short-term moving averages cross above long-term moving averages, while a bearish sentiment may be indicated by the opposite.

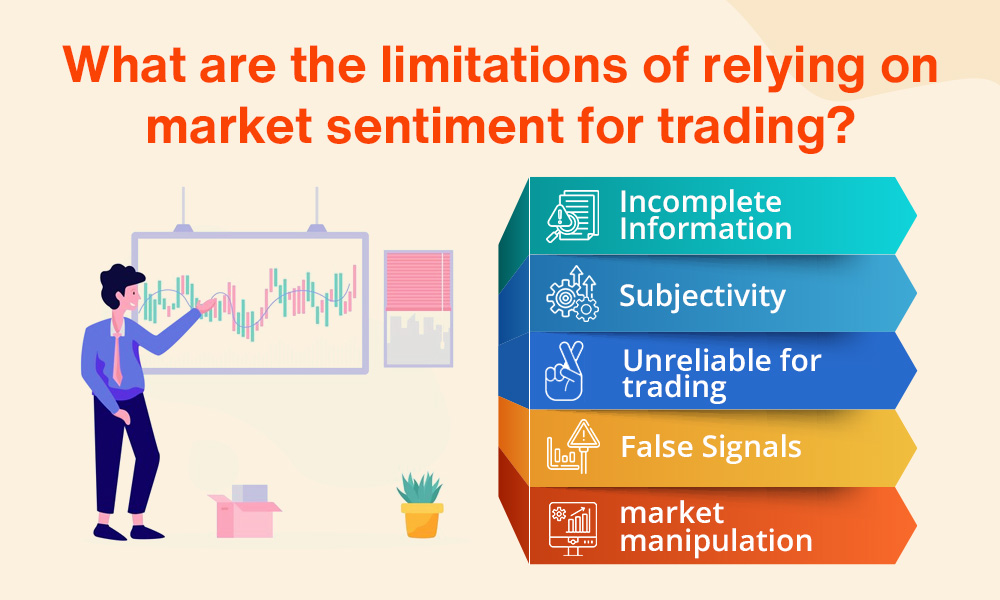

While market sentiment is an important factor to understand in developing or curating a trading portfolio, there are a few limitations of this concept that should not be ignored. Some of these limitations are highlighted below.

Market sentiment is inherently subjective and can be influenced by emotions, biases, and herd mentality, making it unpredictable at times.

Sentiment indicators offer a general view but may not pinpoint specific price movements.

Market sentiment indicators can generate false signals, leading to incorrect trading decisions and potential losses.

Market sentiment can be swayed by external factors such as news events, geopolitical tensions, or macroeconomic data, making it challenging to rely solely on sentiment for trading decisions.

Sentiment indicators may be susceptible to manipulation by large institutional traders or market participants, leading to distorted signals.

Market sentiment reflects the collective mood and emotions of investors and can significantly influence market movements and trends. Therefore, evaluating and understanding market movements should be a crucial part of any trading plan. A comprehensive understanding of market sentiment empowers traders to adapt to changing market conditions and make strategic decisions that align with prevailing sentiment. This robust understanding can enhance the overall success rate for not only seasoned traders but beginners in trading as well.

We hope this article was able to clarify the concept of market sentiment in a more simplified manner and help you in your trading journey. Let us know if you need further input on this concept and we will address them.

Till then Happy Reading!

Read More: Best Real-Time Datafeed in India

Thestock market never stands still, and prices swing constantly with every new h...

In the world of high-speed trading, success often hinges on capitalising on even...

The world of trading is constantly evolving with the use of advanced technology ...