Stock trading is not a simple and straightforward concept and requires a detailed understanding and analysis of the various concepts and terms along with a fundamental understanding of the underlying assets. This includes understanding the various forms of trading like intraday trading, swing trading, position trading, and more. Understanding them enables traders to identify the trading pattern convenient to them meeting their various parameters. The concept of swing trading and its related details are mentioned hereunder. Read More: What is simple moving average(SMA) technical analysis?

Stock trading is not a simple and straightforward concept and requires a detailed understanding and analysis of the various concepts and terms along with a fundamental understanding of the underlying assets. This includes understanding the various forms of trading like intraday trading, swing trading, position trading, and more. Understanding them enables traders to identify the trading pattern convenient to them meeting their various parameters. The concept of swing trading and its related details are mentioned hereunder. Read More: What is simple moving average(SMA) technical analysis?

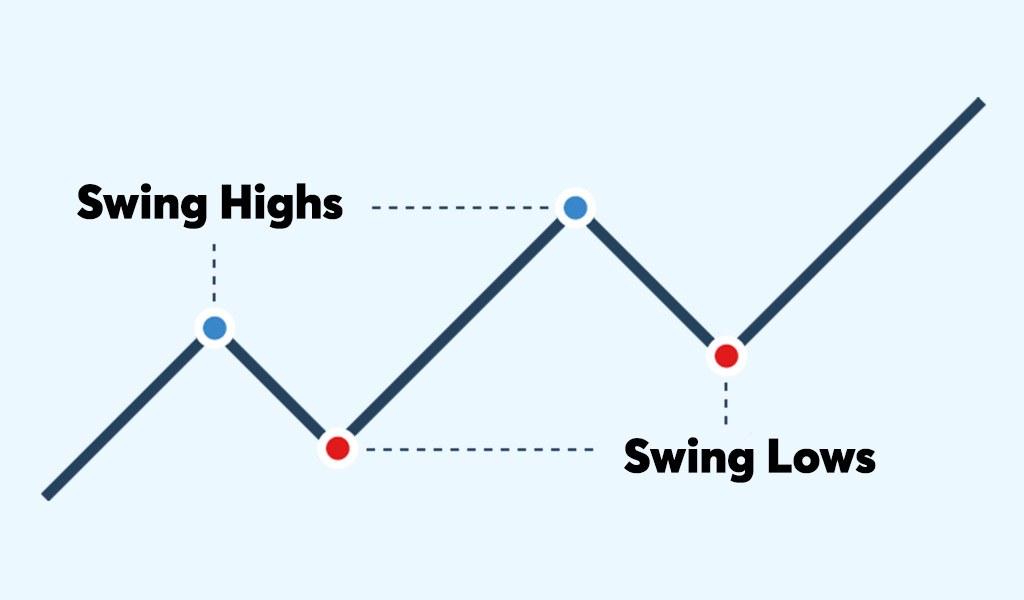

Swing trading is a trading strategy that involves buying and selling financial assets, such as stocks, within a short to medium-term timeframe, typically a few days to several weeks. The goal of swing trading is to capture short-term price movements or "swings" in the market. Here's a simple explanation, imagine being in a marketplace where goods are bought and sold. Swing trading is like buying something at a lower price and selling it at a higher price within a short time. Swing trading requires careful analysis of stock charts, market trends, and indicators to identify potential opportunities. It also involves setting specific entry and exit points to manage risk and maximize profits. The basic premise of swing trading is to take advantage of short-term price fluctuations in the market and instead of holding the securities for the long term, swing traders aim to make profits by capturing these shorter price movements.

The strategies adopted for swing trading aim to maximize profits within a short to medium-term timeframe, differentiating it from day trading. Swing traders analyze stocks using technical or fundamental analysis to find undervalued or overvalued ones that have the potential for price volatility and sufficient liquidity to enable swift entry and exit points. Swing traders use various technical indicators to find potential price reversals as well for effective trading opportunities. Swing traders set profit targets based on their analysis and market conditions but it is equally important to not forget to use stop loss while entering a trade to ensure capital protection and avoid monumental losses. Swing trading can be applied to a diverse group of securities making it versatile and adaptable for traders. Traders choose stocks based on their risk appetite. They may opt for small-cap stocks with higher returns but greater unpredictability, or large-cap stocks for more stable returns with lower risk.

The strategies adopted for swing trading aim to maximize profits within a short to medium-term timeframe, differentiating it from day trading. Swing traders analyze stocks using technical or fundamental analysis to find undervalued or overvalued ones that have the potential for price volatility and sufficient liquidity to enable swift entry and exit points. Swing traders use various technical indicators to find potential price reversals as well for effective trading opportunities. Swing traders set profit targets based on their analysis and market conditions but it is equally important to not forget to use stop loss while entering a trade to ensure capital protection and avoid monumental losses. Swing trading can be applied to a diverse group of securities making it versatile and adaptable for traders. Traders choose stocks based on their risk appetite. They may opt for small-cap stocks with higher returns but greater unpredictability, or large-cap stocks for more stable returns with lower risk.

Some of the popular swing trading strategies are mentioned hereunder.

In this strategy, traders focus on stocks that are breaking out of a specific price range or chart pattern. They look for stocks that surpass a resistance level, which indicates potential upward momentum. When the breakout occurs, the traders enter a buy trade and set a stop-loss order below the breakout point to manage risk. The idea is to capitalize on the stock's continued upward movement following the breakout.

In this strategy, traders focus on stocks that are breaking out of a specific price range or chart pattern. They look for stocks that surpass a resistance level, which indicates potential upward momentum. When the breakout occurs, the traders enter a buy trade and set a stop-loss order below the breakout point to manage risk. The idea is to capitalize on the stock's continued upward movement following the breakout.

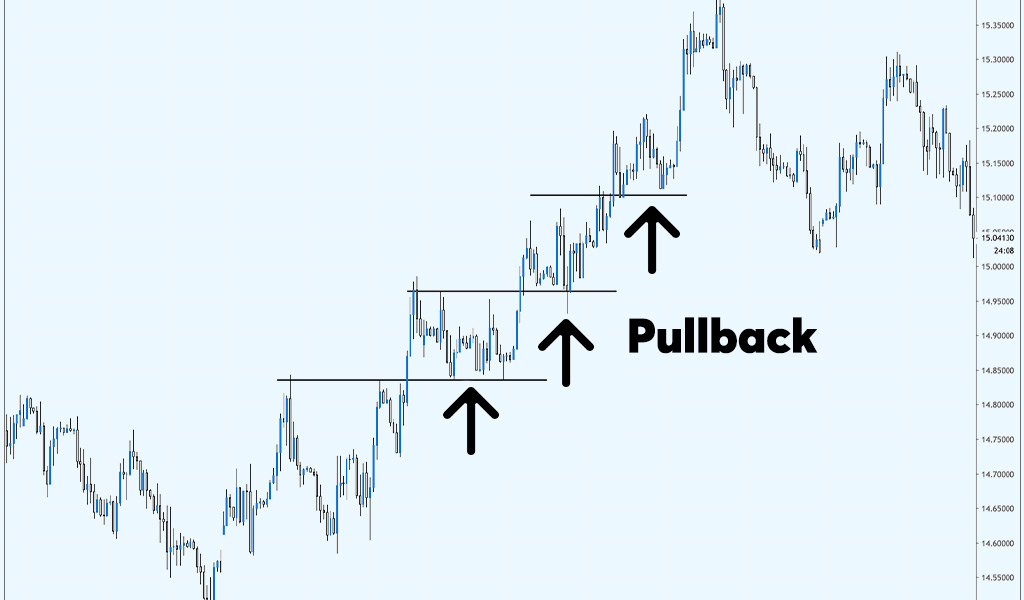

The pullback strategy involves entering trades during temporary price retracements within an established trend. Traders wait for the price to pull back to a support level, which provides an opportunity to enter a long position. By placing a stop-loss order below the support level, traders can protect themselves against further downward movement. The goal is to catch the stock as it resumes its upward trend.

The pullback strategy involves entering trades during temporary price retracements within an established trend. Traders wait for the price to pull back to a support level, which provides an opportunity to enter a long position. By placing a stop-loss order below the support level, traders can protect themselves against further downward movement. The goal is to catch the stock as it resumes its upward trend.

This strategy utilizes two or more moving averages to generate trading signals. Traders observe the crossing of a shorter-term moving average (e.g., 20-day MA) above a longer-term moving average (e.g., 50-day MA) to identify a buy signal. Conversely, a sell signal is generated when the shorter-term moving average crosses below the longer-term moving average. This strategy helps traders capture potential trend reversals and align their trades with the prevailing market direction.

This strategy utilizes two or more moving averages to generate trading signals. Traders observe the crossing of a shorter-term moving average (e.g., 20-day MA) above a longer-term moving average (e.g., 50-day MA) to identify a buy signal. Conversely, a sell signal is generated when the shorter-term moving average crosses below the longer-term moving average. This strategy helps traders capture potential trend reversals and align their trades with the prevailing market direction.

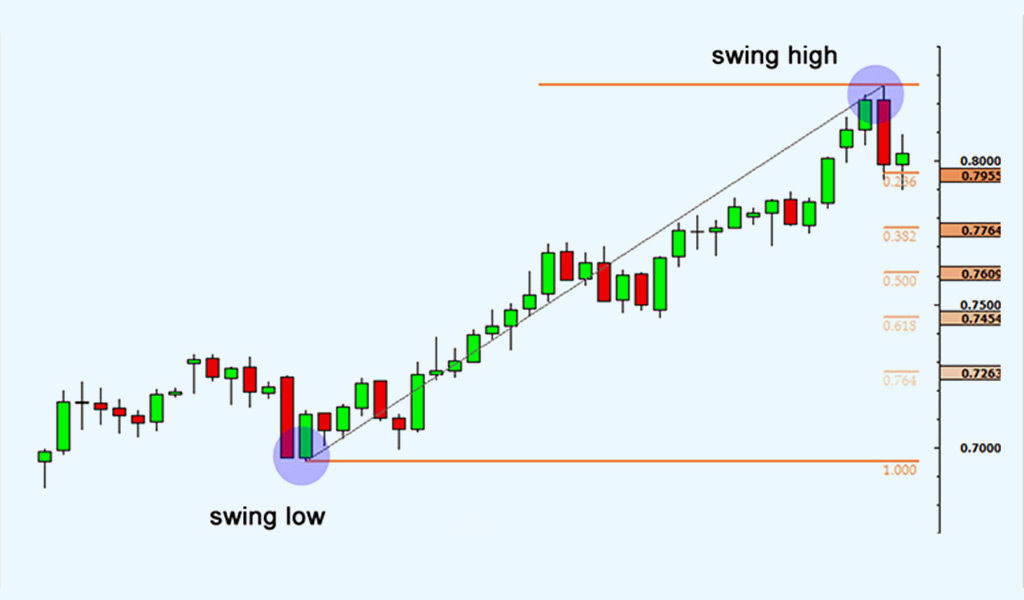

The retracement strategy seeks to identify stocks that have experienced a significant price move and are likely to pull back before continuing their trend. Traders utilize Fibonacci retracement levels or other support and resistance levels to determine potential entry points during the retracement. By placing stop-loss orders below the retracement level, traders can manage their risk and protect against further downside.

The retracement strategy seeks to identify stocks that have experienced a significant price move and are likely to pull back before continuing their trend. Traders utilize Fibonacci retracement levels or other support and resistance levels to determine potential entry points during the retracement. By placing stop-loss orders below the retracement level, traders can manage their risk and protect against further downside.

The range trading strategy focuses on stocks that trade within a specific price range. Traders aim to buy near the support level and sell near the resistance level. They capitalize on the price oscillations within the range, executing trades as the stock moves from one boundary to another. To mitigate risk, stop-loss orders are placed outside the range to limit losses if the stock breaks out.

The range trading strategy focuses on stocks that trade within a specific price range. Traders aim to buy near the support level and sell near the resistance level. They capitalize on the price oscillations within the range, executing trades as the stock moves from one boundary to another. To mitigate risk, stop-loss orders are placed outside the range to limit losses if the stock breaks out.

This strategy aims to identify potential trend reversals in stocks. Traders search for signals indicating that the current trend is weakening or ending, such as bearish chart patterns, divergences in technical indicators, or a breakdown below a key support level. They enter trades in the opposite direction of the prevailing trend, placing a stop-loss order to manage risk. The objective is to capture profits as the stock changes direction.

This strategy aims to identify potential trend reversals in stocks. Traders search for signals indicating that the current trend is weakening or ending, such as bearish chart patterns, divergences in technical indicators, or a breakdown below a key support level. They enter trades in the opposite direction of the prevailing trend, placing a stop-loss order to manage risk. The objective is to capture profits as the stock changes direction.

For traders to understand swing trading in a more effective manner, it is important to understand the benefits and limitations of using swing trading. The details of the same are mentioned below.

Swing trading is a very dynamic and versatile form of trading that requires the utmost understanding of the market and the price and volume movements of the security in consideration. Therefore, by building a strong foundation of knowledge, using risk management techniques, and continually refining their trading approach, traders can improve their chances of success in swing trading. We hope this blog was able to provide basic information about swing trading making it a little more approachable, especially to new traders. Let us know if you are seeking any further details related to swing trading or have any queries regarding the same. Till then Happy Reading!

Read More: The Best Source Of Real-time DataFeed in India

Did you know that stock trading is fast becoming one of the most popular searche...

In the world of high-speed trading, success often hinges on capitalising on even...

The world of trading is constantly evolving with the use of advanced technology ...