Did you know there are more than 8,50,000 HNIs in India, and this number is expected to grow to approximately 1.65 million by 2027? This growth in the HNIs has led to a new stream of niche investments in the form of Portfolio Management Services. Have you heard of them? PMS are more than investments in mere mutual funds and can help boost wealth creation for HNIs, NRIs, etc. Learn all about Portfolio Management Services and the latest rules surrounding them in this blog.

Investing in equity and mutual funds can fast-track wealth creation compared to any other investment option. However, have you ever wondered how the rich invest their money to increase their wealth substantially? This is where the Portfolio Management Services come into the picture. Portfolio Management Services are a niche investment advisory service that brokers and portfolio managers offer as part of wealth management. The essence of PMS is managing the client's investment portfolio to meet specific financial goals by considering the unique risk-return parameters, investment tenure, etc. Portfolio managers are in charge of curating a unique portfolio for their clients that is based on thorough research. PMS are usually preferred by HNIs (High-Net-Worth Individuals) or UHNIs (Ultra High-Net-Worth Individuals) for their tailored services and can include estate management, tax planning, retirement planning and more.

Portfolio Management Services started gaining traction in India in the 1990s with the rise in Indian financial markets and have become an integral part of many investment advisory firms today. The need for these services arose due to the increasing need for investors to have professional guidance for their wealth management. Seeing the increasing market for PMS, SEBI, the financial market, issued many guidelines and rules to be adhered to by firms offering these services with the aim of ensuring transparency and protection of investor’s interests.

PMS caters to investors with a minimum of Rs. 50,00,000 investible corpus and helps them with a focused investment approach enabling investors to meet their investment objectives in a timely manner. The prime objectives of portfolio management services in India include,

The crux of portfolio management services is offering investors personalised or tailored investment strategies based on their risk appetites and investment goals. This personalised approach ensures that the investment portfolio is unique to the investor's preferences and investment parameters rather than being a run-of-the-mill or routine portfolio. Firms offering these portfolio management services charge huge fees from their investors to provide these customised services and ensure that their clients get the benefit of the latest market analysis, advanced investment strategies and diversification to not only but also safeguard their portfolio.

One of the primary objectives of using the PMS is to grow corpus significantly over time which may not be otherwise possible through standard investment options or portfolios. PMS can help investors achieve this objective by diversifying their portfolio into different asset classes ranging from equities (domestic and international), debt, gold, ETFs (Exchange Traded Funds), derivatives, commodities and more. The portfolio managers use their expertise and in-house tools for an in-depth and continuous market analysis to identify profitable investment opportunities that can lead to significant capital appreciation over the tenure of investment.

Tax planning is an important aspect of portfolio management services. The investors availing PMS are usually HNIs and UHNIs who belong to the highest tax bracket. Therefore, tax planning is a significant need for such investors to minimise their tax liability with a focus on maximising their returns from investments. It is the responsibility of portfolio managers to give their investors such investment options and advice that can lead to efficient tax planning.

Portfolio managers offering PMS services often invest in high-risk high returns investment options to fastrack wealth creation for their investors. This can lead to a significant increase in the overall risk of the portfolio thereby making risk management an integral part of portfolio management services (PMS). Portfolio managers use various risk management strategies like diversification of the portfolio, rebalancing the portfolio to realign the overall portfolio risk according to the investor’s parameters, finding suitable exit opportunities from high-risk investments, etc. These techniques ensure that the portfolio can stay resilient against market fluctuations while delivering desired returns.

The USP of portfolio management services is to provide the professional guidance and expertise of portfolio managers who have years of experience with markets and have a deep insight into market cycles as well as asset dynamics. These qualified and certified portfolio managers are responsible for extensive research and tracking market trends to make informed investment decisions for optimising portfolio performance. This professional guidance and expert advice is especially beneficial to investors who have limited market knowledge or understanding of creating a profitable portfolio.

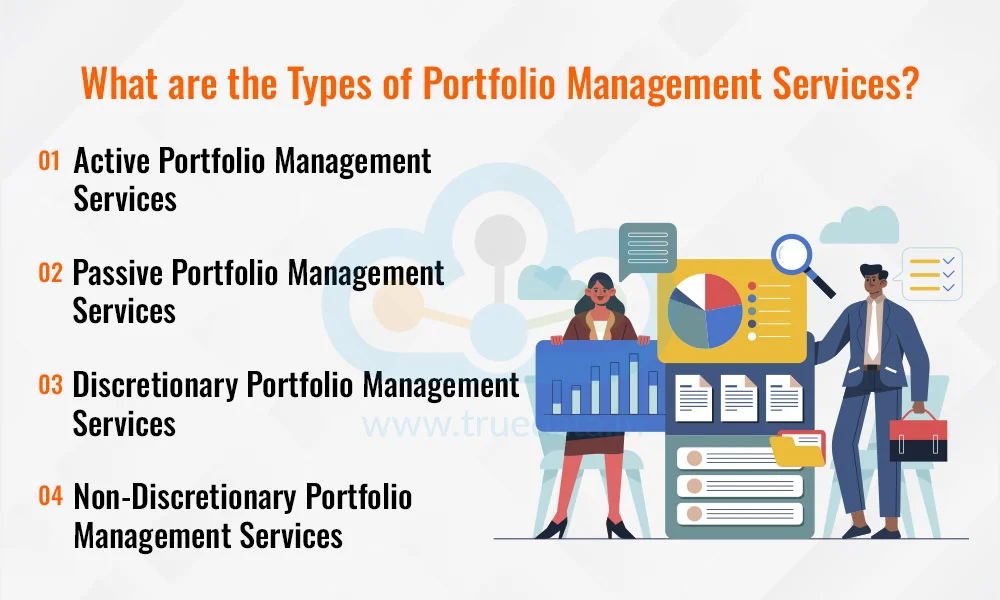

Portfolio management services can be classified into many categories. The core types of portfolio management services offered in India are,

Active portfolio management services are more like targeted services offered by portfolio managers where the goal is to beat market returns or benchmark returns. Portfolio managers are the driving force behind this type of PMS and they utilise various tools for deep market analysis coupled with dynamic investment strategies to achieve this goal. This type of PMS can offer higher returns but they come with higher risks. Therefore, this type of PMS is typically suitable for investors with a higher risk appetite and a focus on higher returns or wealth creation using an aggressive approach.

This type of PMS is where the investment objective is to match benchmark returns and not beat them. This is, therefore, a more conservative approach where the portfolio managers do not usually have a hands-on approach to curating the portfolio. Investors can expect low to moderate but consistent returns from this type of investment approach making this a low-cost, low-risk option. Passive PMS is typically suitable for risk-averse investors seeking stable returns and long-term wealth creation. It is mandatory for such PMS to disclose the indexing strategy and ensure that they closely mirror the benchmark index with minimal tracking errors.

Discretionary PMS is the most aggressive form of PMS offered by portfolio managers to their clients. Under this type of service, the portfolio manager is in complete control of the client’s portfolio and decides the securities to be bought or sold to meet the investment objectives. The portfolio is curated based on a thorough understanding of the client’s risk-return perception, investment horizon and investment goals. These types of services are typically suitable for aggressive investors and investors who lack the time, knowledge or expertise to manage their investment portfolio. SEBI regulations mandate that portfolio managers align the investment decision to the agreed investment strategy and provide periodic disclosures to their clients. The minimum investment amount required for PMS is Rs. 50,00,000 as per SEBI rules to ensure that only HNIs and investors who are aware of the risks participate in this niche investment form.

Non-discretionary PMS is where the investors get better control over their investment portfolio. Under these services, the portfolio managers provide expert advice to their clients based on their experience and market expertise, however, the final decision to shape the portfolio lies with the client. It is the client's discretion to take the portfolio manager’s advice and the execution is then the portfolio manager’s responsibility. These types of services are best suited for investors who seek professional guidance but want to take charge of their portfolio.

Portfolio Management Services (PMS) is a unique concept developed by investment management firms to provide enhanced services to investors with a huge corpus. The minimum investment needed to utilise portfolio management services (PMS) is Rs. 50,00,000. This number has been revised over the years as it was initially Rs. 5,00,000 in 1993 which was then enhanced to Rs. 25,00,000 in later years finally being raised to Rs. 50,00,000 in 2019. This increase by SEBI in the minimum investment value to utilise PMS was to ensure that only investors with significant corpus participate in these high-risk high-reward scenarios.

PMS is ideal for investors like HNIs, UHNIs, NRIs, and Institutional Investors who seek professional expertise to manage their wealth and prefer a personalised approach and attention from portfolio managers. Thus, these services are essentially beneficial for investors who lack the time or knowledge to manage their investment portfolios but want superior returns than traditional investment options like mutual funds or fixed deposits.

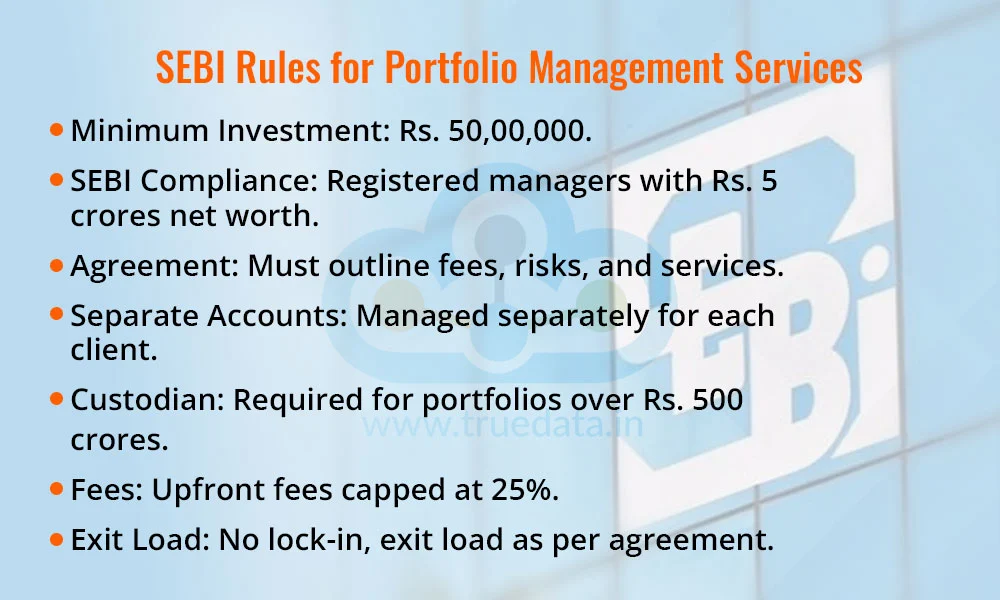

SEBI is the financial regulator that is in charge of laying down the rules and regulations for governing portfolio management services. Here are some of the rules as per SEBI regulations related to portfolio managers and investors utilising their services.

Investors are required to invest a minimum of Rs. 50,00,000 in PMS either in cash or in the form of securities.

SEBI allows only registered portfolio managers to provide portfolio management services and also comply with SEBI regulations. Moreover, SEBI requires portfolio managers need to have a minimum networth of Rs. 5 crores to provide these services.

There has to be a formal agreement between the portfolio manager and the client to ensure optimum transparency. This agreement has to highlight important details like fees, risk factors, portfolio manager’s limitations, scope of services, etc.

Portfolio managers should maintain each client account separately.

Portfolio managers must appoint a SEBI-registered custodian if the size of the client’s portfolio exceeds Rs. 500 crores.

PMS cannot charge upfront fees of more than 25% of the total fees charged to the client during the PMS tenure.

PMS cannot impose any lock-in period on their client but can levy an exit load depending on the terms mentioned in the agreement.

The average annual returns from PMS in India ranged from 36% to 48% while the average 10-year returns ranged from 20%-30% approximately. The tax treatment of returns from PMS is as per the prescribed rules under the Income Tax Act, 1961. Investors are liable to pay capital gains tax on the sale of assets like real estate, equities or equity mutual funds, debt instruments or debt mutual funds, etc. This capital gains tax is further classified as short-term capital gains and long-term capital gains based on the nature of the asset and the period of holding. For example, capital gains from equities or equity mutual funds held for less than 12 months are classified as short-term capital gains and taxed at 20% while long-term gains are taxed at 12.5% after the initial exemption of Rs. 1,25,000. Similarly, capital gains from debt instruments or debt mutual funds held for less than 24 months are taxed at applicable slab rates while long-term gains from such assets are taxed at 12.5% without indexation benefits.

The returns in the form of dividends or interest income from the assets invested under PMS are also taxable in the hands of the investors. These incomes are added to the total taxable income of the investor and taxed at applicable slab rates.

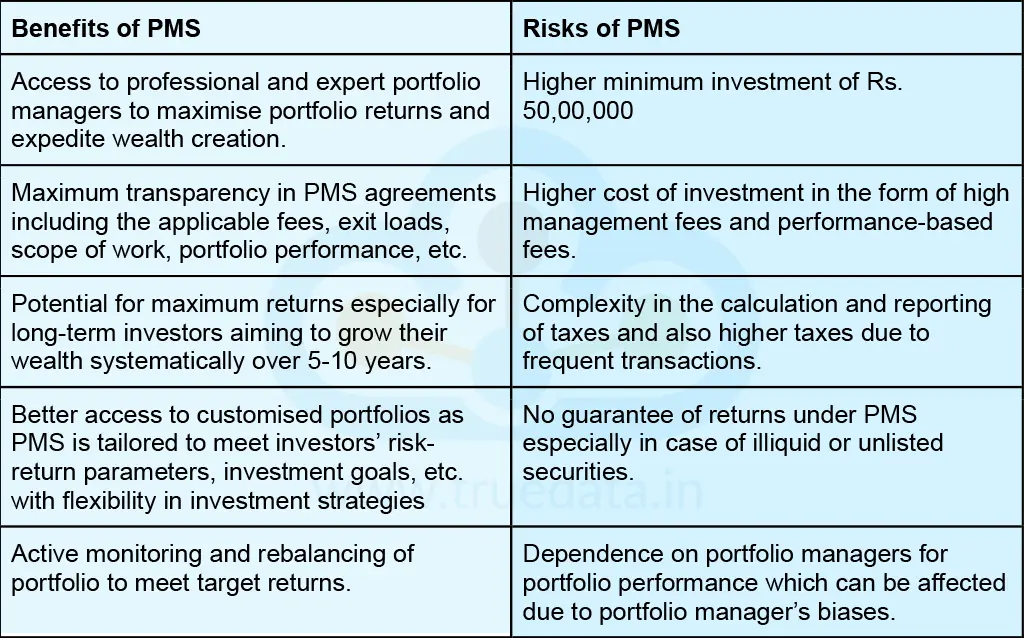

PMS in India is increasingly becoming a preferred choice for investors with higher investible income. However, before utilising their maximum potential it is also important to understand the benefits and risks of PMS so investors can make informed decisions. These benefits and risks of PMS are tabled below.

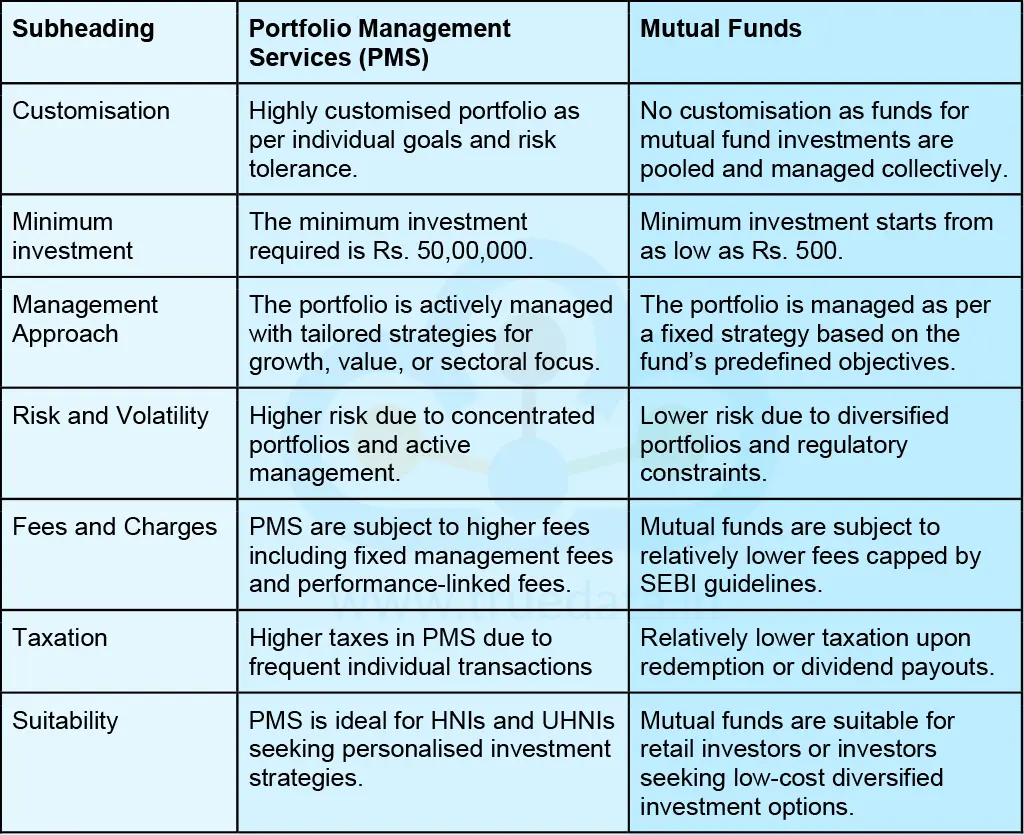

We have discussed above that portfolio management services are a more diversified and strategic form of portfolio management rather than investing directly in assets like mutual funds. But how are PMS different from mutual funds as a whole? Here are a few key differences between utilising PMS and investing in mutual funds.

The Specialised Investment Funds are a new category of investment options of investment vehicles introduced by SEBI in December 2024. These funds were introduced as an effort to provide investors with a more sophisticated investment option than mutual funds but more affordable than PMS, thus bridging the gap between the two.

SIFs are professionally managed funds that are based on sophisticated investment strategies and offer diversified asset options like equity, debt, real estate investment trusts (REITs), and derivatives like futures and options (F&O).

The top features of SIFs that make them a unique investment option are,

Lower minimum investment in SIFs of Rs. 10,00,000 as compared to Rs. 50,00,000 for PMS making them accessible to a wide range of investors.

Diversified asset classes enhance the potential for higher returns through sophisticated investment strategies.

Mandatory compliance with stringent SEBI regulations to ensure transparency, compliance, and strategic diversification.

SEBI enforced investment restrictions like,

Maximum investment in a single listed company is restricted to 10%

Maximum exposure to a debt issuer is restricted to 20% (except in the case of Government Securities or Treasury Bills)

SIFs to be managed by certified fund managers [certified by the National Institute of Securities Market (NISM)].

The aim of launching these funds was to make diversified investments more approachable for investors without them belonging to the HNI or the UHNI category. These funds can benefit a larger investor base by simplifying access to professional expertise and enabling them to gain the benefits of potentially higher returns through dynamic investment strategies.

Portfolio Management Services (PMS) offer personalised and professionally managed investment solutions tailored to individual goals and risk tolerance, making them ideal for high-net-worth investors. With the increasing presence of HNIs and the requirement for tailored investments in India, SEBI regulations for PMS ensure the protection of investors’ interests and accountability along with transparency of transactions. However, investors should also account for the higher costs and higher risks associated with PMS like increased taxation and complexities of investments as compared to assets like mutual funds.

This article explains the increasing presence and importance of PMS in India and the benefits of utilising this option for creating successful portfolios. Let us know your thoughts on this topic or if you need more information on the same and we will address it.

Till then Happy Reading!

Read More: Elliot Wave Theory - What is it?

Introduction For the longest time, investment in stock markets was thought to b...

It is a very well-known fact that mutual funds are considered to be among the st...

‘Mutual funds are subject to market risk’, this line is what most pe...