When we talk about trading, which security is the most common one that comes to your mind? Most of you will say stocks of course. Well, what if I told you this is not entirely true? In recent years, India has topped the charts to become an option trading hub in the global options markets. The total number of options contracts traded in India in 2023 was about 85 billion as compared to 11.2 billion in the US market. Yes, you heard that right! This increasing number of options contracts is backed by the increasing number of options traders entering the market. Are you too among these beginners and learning the ropes of option trading? Then here are a few popular options trading strategies that you need to be aware of. Read on to know about them in detail.

Read More: What are popular futures trading strategies?

The first step to start trading stocks or options trading is understanding the related concepts in detail. This understanding helps in navigating the options market and creating a basis for a successful trading portfolio using various option trading strategies. Some of these popular or best options trading strategies are discussed hereunder.

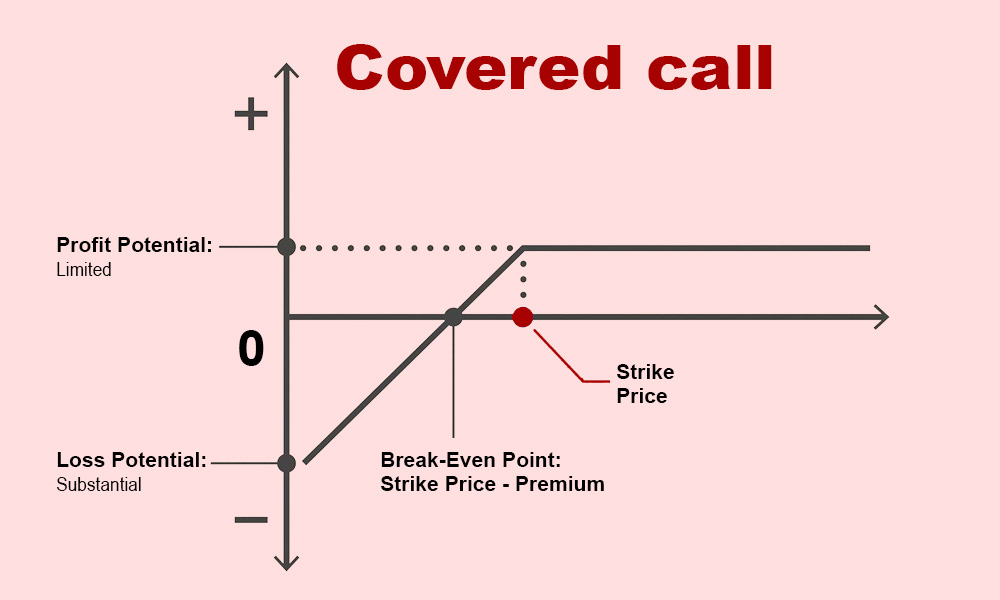

The covered call strategy is considered one of the most conservative option trading strategies. This strategy is used by traders who already own the underlying stock by selling call options against it. Traders receive a premium on selling the call option which serves as a downside protection against potential losses against fluctuations in the stock price. If the stock price remains below the strike price of the call option at expiration, the trader gets to keep the premium as profit. However, if the stock price rises above the strike price, the trader may have to sell the stock at that price which may potentially lead to a loss and missing out on further gains. Covered calls are often used by investors who are bullish on a stock but want to generate additional income from their holdings.

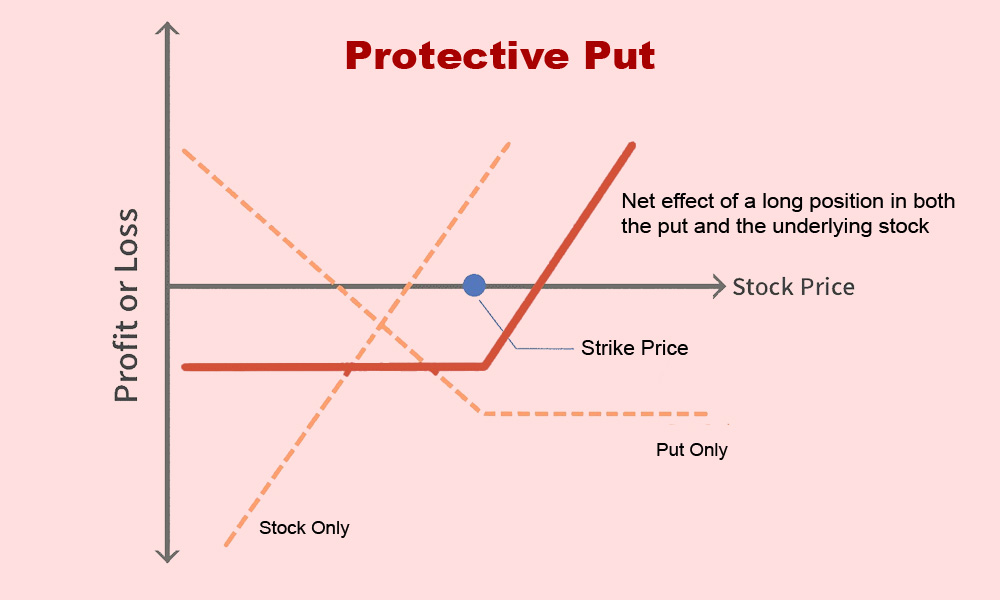

The protective put strategy, also known as a married put, involves buying a put option on a stock that the trader already owns. The put option acts as insurance against potential losses from the fluctuations in the stock price. In the event of a decline in the stock price, the put option increases in value which results in offsetting the losses in the stock position. However, the cost of buying the put option reduces the potential profit from the stock position. Protective puts are often used by investors or traders who are concerned about potential downside risk in their stock holdings but still want to maintain ownership of the underlying stock.

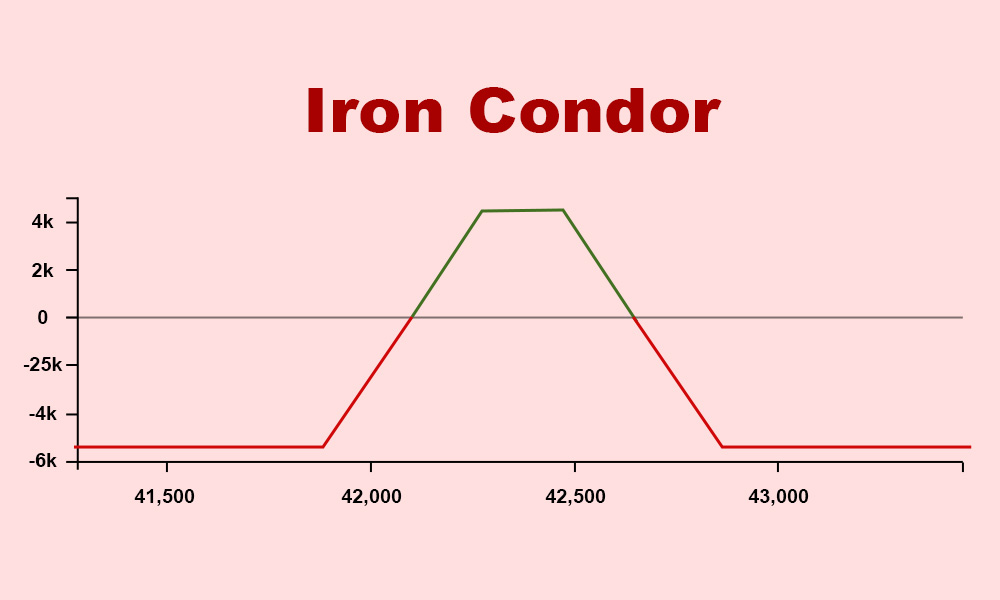

The iron condor strategy is a neutral options trading strategy that aims to profit from the case of low volatility in the underlying stock. This strategy involves selling an out-of-the-money call spread and an out-of-the-money put spread with the same expiration date. Creating this dual position of selling both a call spread and a put spread enables the trader to collect premiums from both options. In the event of the stock price remaining within a certain range at the time of options expiration, both options will expire worthless. This will lead to the trader keeping the premiums collected as profit. On the other hand, if the stock price moves outside of this specific range, the trader may face potential losses.

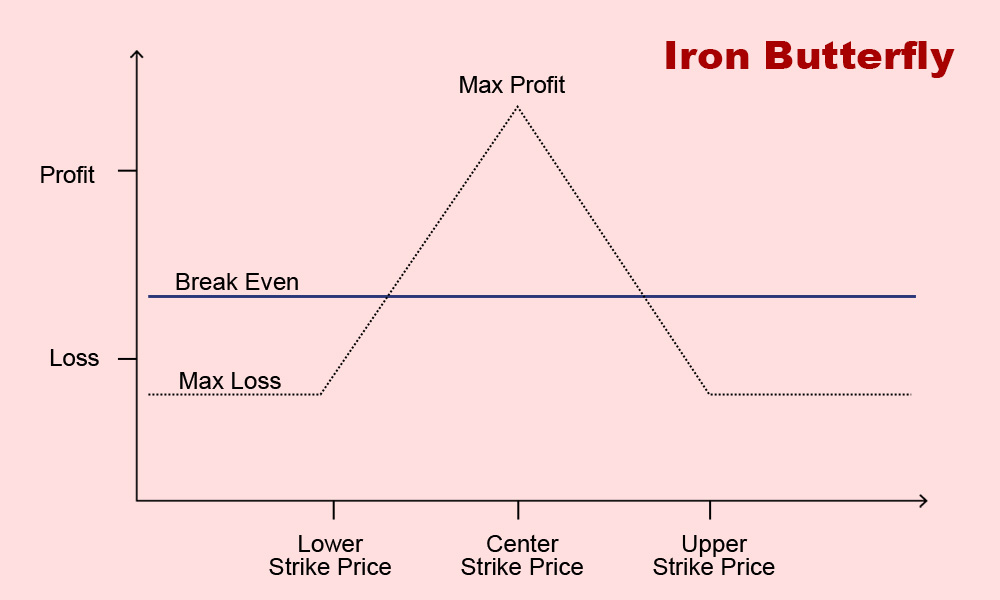

The iron butterfly strategy is similar to the iron condor but involves selling an at-the-money call spread and an at-the-money put spread with the same expiration date. This strategy also aims to profit from low volatility in the stock market, especially in the underlying stock. It is often used when the trader expects the underlying stock to remain relatively stable up to the expiration date of the options. Traders can earn the maximum profit if the stock price remains at the strike price of the sold options at the time of expiration. On the other hand, traders can encounter maximum loss if the stock price moves significantly away from the strike prices of the sold options.

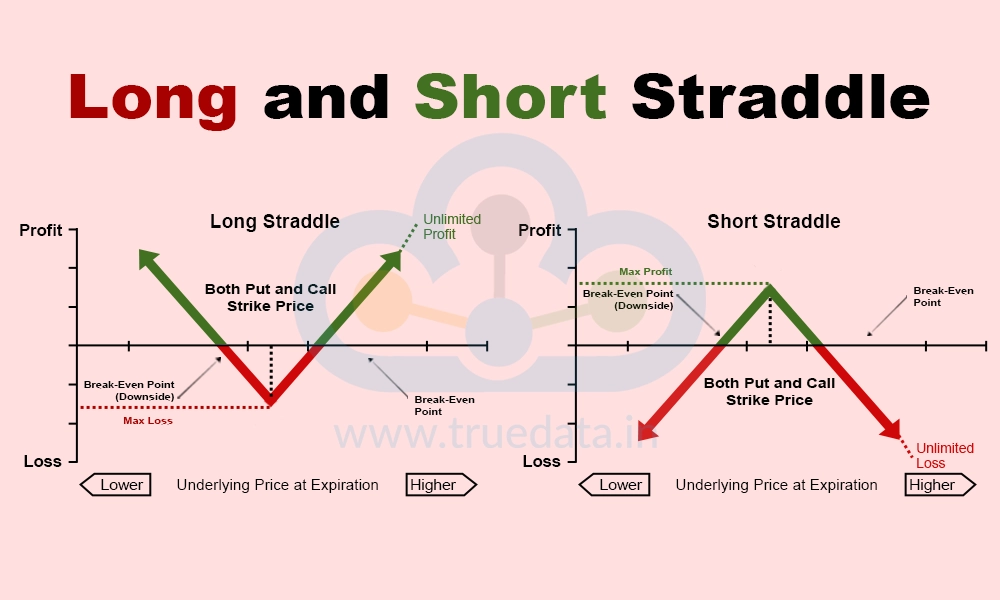

The Straddle strategy in options trading involves buying (long) or selling (short) both a call and a put option with the same strike price and expiration date. This strategy is often used to profit from either significant price movements or stability in the underlying asset. A long straddle aims to capitalise on the volatility of the underlying asset with limited risk involved. However, this strategy requires substantial price swings for it to be profitable. On the other hand, a short straddle bets on the price stability of the underlying asset but comes with unlimited risk exposure if the price moves significantly in either direction.

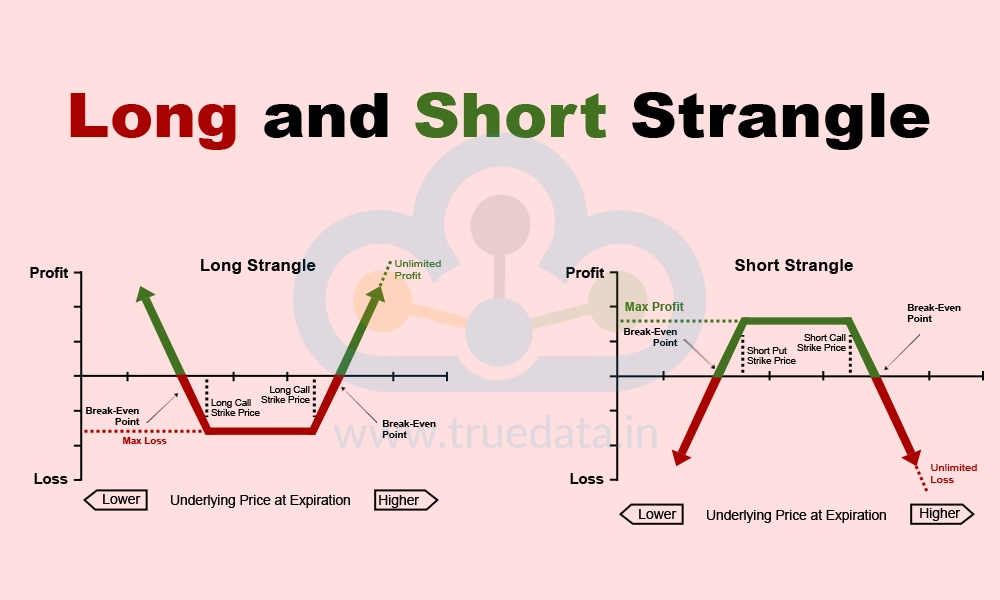

The Strangle options trading strategy is similar to the straddle strategy as it also involves buying or selling both call options and put options. The underlying difference, however, is that these options have different strike prices but the same expiration date. This strategy also aims to profit from the substantial price movements or stability in the underlying asset. A long strangle seeks gains from significant price fluctuations, while a short strangle aims to capitalise on price stability. The long strangle requires substantial price movement to be profitable and is vulnerable to time decay, while the short strangle faces risks from unexpected price movements and time decay.

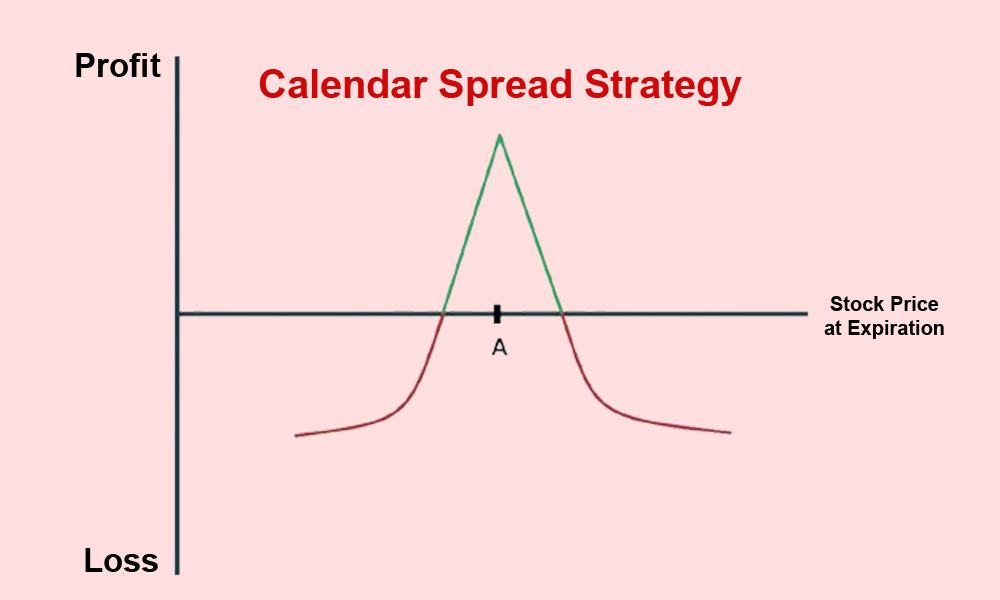

A calendar spread strategy, also known as a time spread or horizontal spread, involves buying and selling options with the same strike price but different expiration dates. In this strategy, traders typically buy a longer-term option and simultaneously sell a shorter-term option with the same strike price. The aim of this strategy is to profit from the difference in time decay between the two options. As time passes, the value of the short-term option erodes faster than the long-term option. Calendar spreads are employed when traders expect the underlying asset to remain relatively stable in the short term but anticipate volatility in the longer term.

Although options trading is gaining huge popularity in the Indian stock market, it is important to note that retail investors account for up to 35% of the options trades and about 90% of active retail traders lose money trading options and other derivative contracts. Therefore, getting the basics right and understanding these options trading strategies in detail is crucial before taking the plunge.

Hope this article was able to provide valuable insights into options trading strategies. Let us know if you have any queries regarding this topic or want to know more about other options trading strategies.

Till then Happy Reading!

India is increasingly becoming a dominant options trading market with the highes...

A famous quote by legendary investor Mr. Warren Buffet: 'Someone's sitting in th...

Options trading is one of the most significant trading segments and is gaining i...