When we talk about trading in stock markets, there are multiple segments that traders can focus on. One of these popular segments is futures trading. While it is a fact that every form of trading needs an in-depth understanding of the markets and the price and volume movements of their target security, futures trading requires a thorough understanding of various concepts like strike price, expiration date, historical and implied volatility, lot sizes, margin trading and more. After a clear understanding of these concepts, the key to successful trading is knowing and implementing the futures trading strategies based on the trading plan. Read on to learn the popular futures trading strategies that novice as well as seasoned traders can use to create a successful futures trading portfolio.

Read More: Best Trading Strategies for Beginners

Futures trading involves buying and selling standardised contracts for the future delivery of a specified asset, such as commodities, currencies, or stock indices. These contracts set a predetermined price and date for the transaction, providing traders with a way to speculate on the future price movements of the underlying asset. Traders can go long (buy) if they anticipate an increase in prices or go short (sell) if they expect a decrease. Futures trading allows for potential profit in both rising and falling markets, but it also involves significant risks, including the possibility of substantial losses. Therefore, traders need to understand market dynamics, risk management, and regulations before trading futures.

Some key factors to consider while framing a profitable futures trading strategy are listed below.

A comprehensive understanding of the market which involves examining the current trends, asset selection based on their level of expertise, supply and demand factors of their target securities, and potential price drivers should be factored in devising the trading strategy.

Traders should also understand key concepts like stop loss, position sizing, and preferred time horizon of trading for effective risk management and safeguarding against potential losses.

Technical and fundamental analysis both play a crucial role in the process of understanding the price and volume movements of the underlying asset and therefore, they should not be ignored in order to make well-informed trading decisions.

Understanding how leverage works is another crucial aspect of futures trading and traders should exercise caution in the same way as it can amplify profits but also increase the risk of substantial losses.

A well defined trading plan also includes a clear understanding of entry and exit points for maximising the gains at the same time minimising the losses from trading.

The other factors to consider include

Transaction costs involved in futures trading like brokerage fees and taxes

Psychological factors like discipline, patience, and emotional control, regulatory compliance

Developing contingency plans for unexpected events or adverse market conditions

Adapting the strategy based on prevailing market conditions (whether the market is trending, ranging, or experiencing heightened volatility)

Futures trading involves the use of various trading strategies based on the risk appetite and the level of expertise of the traders. Some popular futures trading strategies often used by traders are explained hereunder.

Traders often find success with the trend-following strategy, which involves identifying and capitalising on existing market trends. This approach relies on technical analysis indicators such as moving averages to determine the prevailing trend's direction. By aligning trades with the established trend, traders aim to ride prolonged price movements, making it effective in markets showcasing clear trends. This strategy, however, requires a disciplined approach to enter and exit positions based on the evolving trend dynamics.

This strategic approach revolves around the recognition of substantial price movements that occur after a phase of consolidation or within a predefined range. Traders employing breakout strategies meticulously identify critical support and resistance levels, strategically executing trades when prices decisively breach these established thresholds. The essence of breakout trading lies in its adeptness at capturing significant market shifts and exploiting emerging trends. This method is especially well-suited for navigating volatile markets, as it aims to harness the inherent rapid price fluctuations characteristic of such conditions. By skillfully leveraging breakout trading techniques, investors seek to capitalise on these swift and pronounced price movements, positioning themselves to seize opportunities and navigate the complexities of the ever-evolving financial landscape in India.

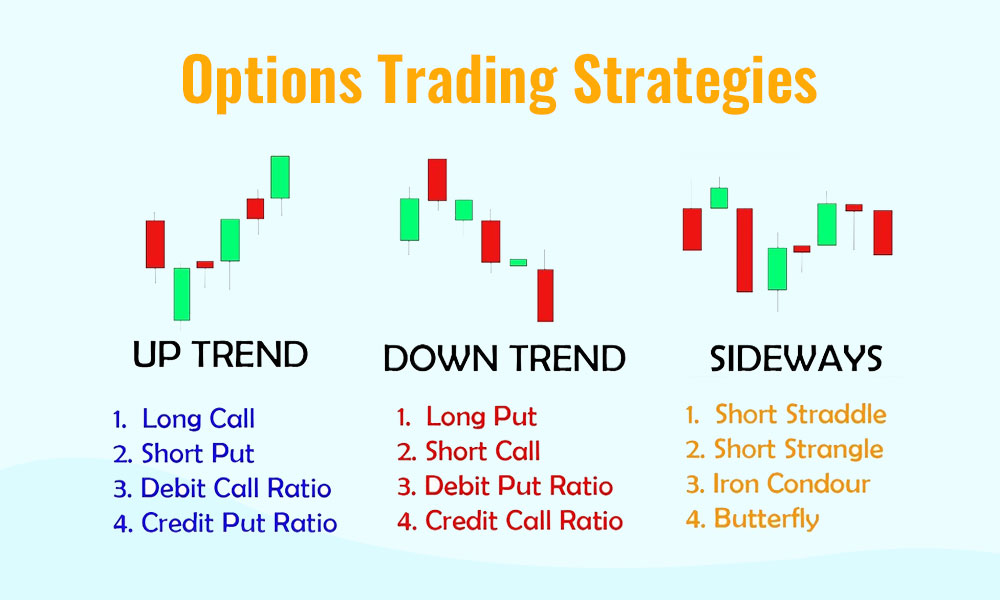

Options trading is gaining popularity in the Indian futures market, with strategies such as covered calls and protective puts taking centre stage. These sophisticated approaches utilise options contracts to hedge against potential losses and generate additional income. Traders can integrate options with futures positions, creating a dynamic synergy that enhances risk management and overall portfolio performance. Covered calls involve simultaneously holding a long position in an asset and selling call options, providing downside protection, while protective puts entail acquiring put options to safeguard existing long positions. Successful implementation of these strategies hinges on a thorough understanding of options dynamics, including pricing and exercise mechanics, enabling traders to navigate the complexities of the Indian futures market effectively.

Momentum trading is a strategy embraced by traders seeking to capitalise on the continuation of existing price trends. This approach involves identifying assets with strong recent price movements and entering trades with the expectation that these trends will persist. Technical indicators, like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI), are often used to confirm momentum signals. Successful momentum trading requires a keen eye for identifying emerging trends and swift execution of the trading plan.

The pullback strategy in futures trading, commonly employed by traders, involves capitalising on temporary reversals within an established trend. Traders identify the prevailing trend using technical tools, such as moving averages and seize opportunities when a pullback occurs (a brief counter-trend movement). In an uptrend, traders look for signs of a pullback losing steam before entering a long position, anticipating the uptrend's continuation. Conversely, in a downtrend, traders seek entry points for short positions during temporary upward movements. Successful execution requires a disciplined approach to risk management, careful analysis of trend strength, and the use of technical indicators to confirm the end of a pullback and the likely resumption of the primary trend.

Futures trading is a very complex trading process that requires the traders to gain a substantial knowledge base and then take a plunge. It is also important for traders to understand and test these strategies, considering factors like transaction costs, market conditions, and regulatory requirements for their successful implementation. Additionally, risk management should always be a central component of any trading strategy to mitigate potential losses and protect capital. As market conditions can vary, adapting and combining these strategies based on the evolving landscape can contribute to a well-rounded and resilient trading approach.

We hope this article was able to provide you with the starting point for future trading strategies. Let us know if you have any queries or need more information on these strategies and we will address them.

Till then Happy Reading!

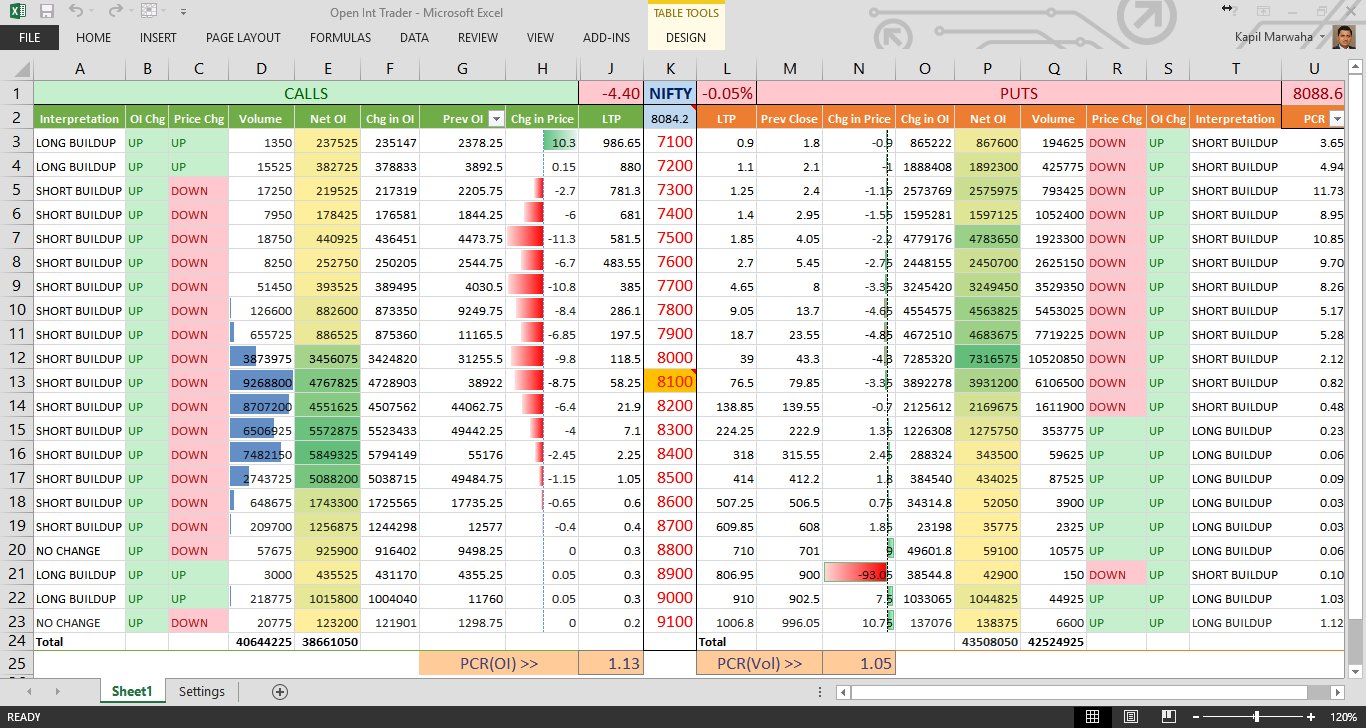

The two most common components of derivative trading are options trading and fu...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Indian Stock market has two leading stock exchanges - BSE (Bombay Stock Exchange...