Investing in stocks is one of the fastest ways to wealth creation. However, the risk of investing in pure equities is also higher as one market downturn can lead to wiping out your investment corpus. Mutual funds provided an answer to this issue, however, they have limited liquidity when compared to stocks. This is where ETFs come into the picture. They offer the benefits of mutual funds and liquidity of stocks making it a perfect solution for investors seeking investment in stocks with stability. Check out this blog to learn all about ETFs, how to invest in them as well as the dos and don'ts of this investment.

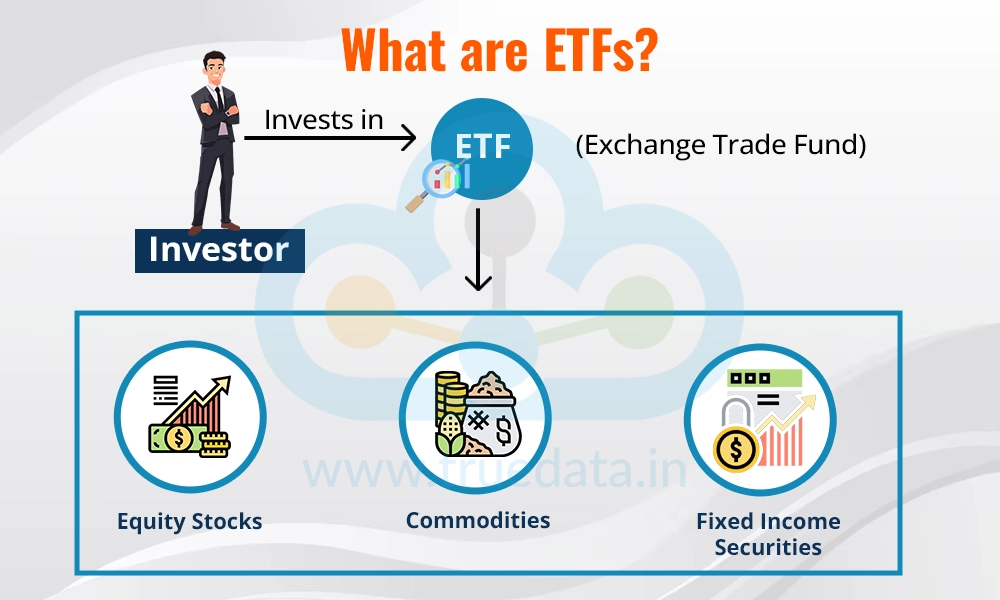

ETFs (Exchange Traded Funds) are mutual funds with qualities like stocks. Similar to mutual funds, ETFs also pool funds from investors and invest in various stocks based on the composition of the benchmark index that they follow. The critical difference between ETFs and mutual funds lies in the liquidity feature of the ETFs as they can be traded like stocks and are listed on stock exchanges, unlike regular mutual funds. These funds like index funds belong to the passive fund category and hence, have a lower expense ratio. ETFs track a benchmark index for their performance having the same composition or weightage of assets as the index and are also prone to tracking errors. ETFs make a good investment option for investors to buy and sell units through a Demat account making them a popular choice for seasoned and novice investors.

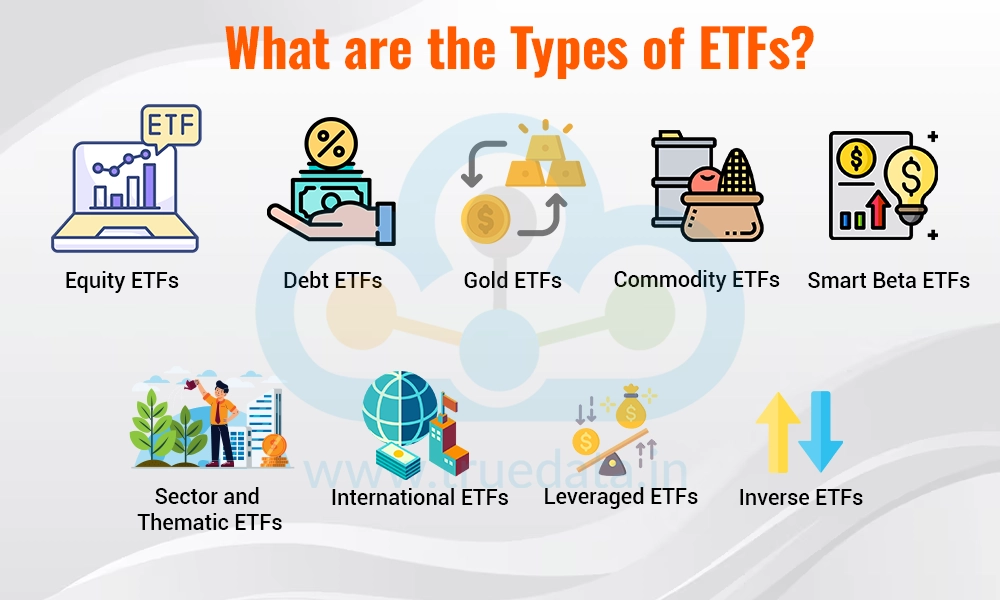

ETFs are an easier way to invest in a pool of stocks leading to lower risks and stability in returns. However, investors have the option to invest in many types of ETFs depending on their risk appetite and target assets. Here are the different types of ETFs and their asset compositions for investors to make informed investment decisions.

Equity ETFs invest in a basket of stocks that track a specific stock market index, such as the Nifty 50, Sensex, or sector-specific indices like IT or pharma. These ETFs aim to mirror the performance of their underlying index. For example, a Nifty 50 ETF will contain stocks of the Nifty 50 companies in the same proportion as the index. They are ideal for investors looking for broad market exposure or sector-specific diversification.

Debt ETFs focus on fixed-income securities such as government bonds, corporate bonds, or treasury bills. These are suitable for conservative investors looking for stable returns with lower risk. For example, Bharat Bond ETFs invest in high-quality public sector bonds and provide predictable returns while being tax-efficient compared to traditional fixed deposits.

Gold ETFs allow investors to invest in gold without physically owning it. Each unit of a Gold ETF represents a certain amount of gold, usually 1 gram. These ETFs are an excellent choice for investors seeking to hedge against inflation or economic uncertainty. They are more liquid and secure compared to physical gold, as they can be easily traded on the stock exchange and eliminate storage and purity concerns.

The commodity market is a thriving segment of the Indian stock market. With the addition of commodity ETFs (ETFs investing in commodities like silver or crude oil), investors have an additional option to participate in commodity trading at reduced risks. These ETFs are ideal for investors seeking to gain exposure to commodity prices without physically owning the assets or participating in derivative trading. However, commodity ETFs are less common in India compared to global markets.

Smart Beta ETFs use advanced strategies to select and weigh stocks based on factors such as value, quality, momentum, or low volatility, rather than just market capitalisation. These ETFs aim to provide better returns or reduced risks compared to traditional index ETFs. These are ideal for investors looking for a blend of active and passive management styles.

These ETFs target specific sectors (like IT, banking, or energy) or investment themes (such as clean energy or emerging markets). They are suitable for investors who believe in the growth potential of a particular sector or theme making strategic investments in them. While these ETFs offer higher growth potential, they come with concentrated risks, as their performance depends heavily on the targeted sector or theme.

The advanced technology and unique products offered today have made global markets more accessible for Indian investors. These products include International ETFs providing an easier route for exposure to global markets by investing in foreign indices or stocks, such as the NASDAQ 100 or S&P 500. These ETFs provide a relatively safer and low-risk option for investors looking to diversify their portfolios beyond the Indian market and benefit from the growth of global companies. They also help hedge against currency risks as the returns are often influenced by exchange rate fluctuations.

Leveraged ETFs aim to amplify the returns of an underlying index or asset. For instance, if an index rises by 1%, a 2x leveraged ETF will aim to deliver a 2% gain, and a 3x leveraged ETF will aim for a 3% gain. They achieve this by using financial instruments like derivatives. While leveraged ETFs can provide higher returns in the short term, they are also riskier because losses are magnified in the same proportion. They are primarily designed for short-term trading rather than long-term investment and are suitable for experienced investors who understand market trends and the risks involved.

Inverse ETFs, also known as short ETFs, aim to deliver returns opposite to the performance of an underlying index or asset. For example, if the index falls by 1%, an inverse ETF will aim to gain 1%. They achieve this by using derivatives like futures contracts. Inverse ETFs are often used by investors looking to profit from declining markets or to hedge their existing portfolios against potential losses. Like leveraged ETFs, inverse ETFs are designed for short-term use and carry higher risks due to the use of complex financial strategies.

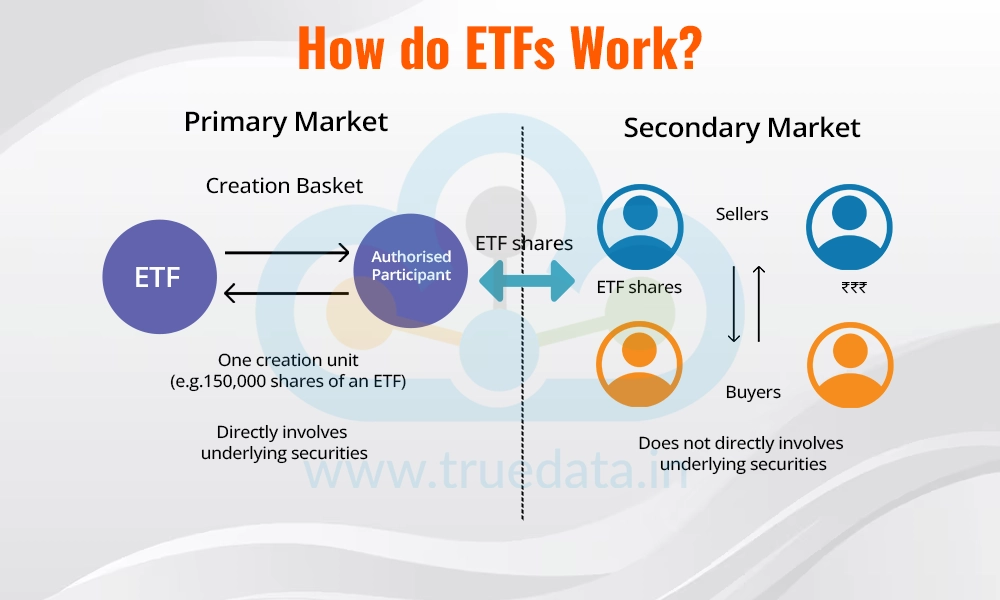

ETFs operate by pooling money from multiple investors and investing it in a diversified portfolio of assets, such as stocks, bonds, or commodities. Each ETF is structured to track the performance of a specific index, sector, or asset class. Unlike mutual funds, ETFs are traded on stock exchanges, allowing investors to buy or sell them throughout the trading day at market prices, similar to individual stocks. Investors can buy or sell ETFs through a Demat account and trading platforms making them a transparent, efficient, and cost-effective investment option for a broad spectrum of investors.

Investors in ETFs do not own the individual assets directly but hold units of the ETF, which reflect the value of the underlying portfolio. The price of ETF units fluctuates during the day based on market demand, supply, and changes in the value of the underlying assets.

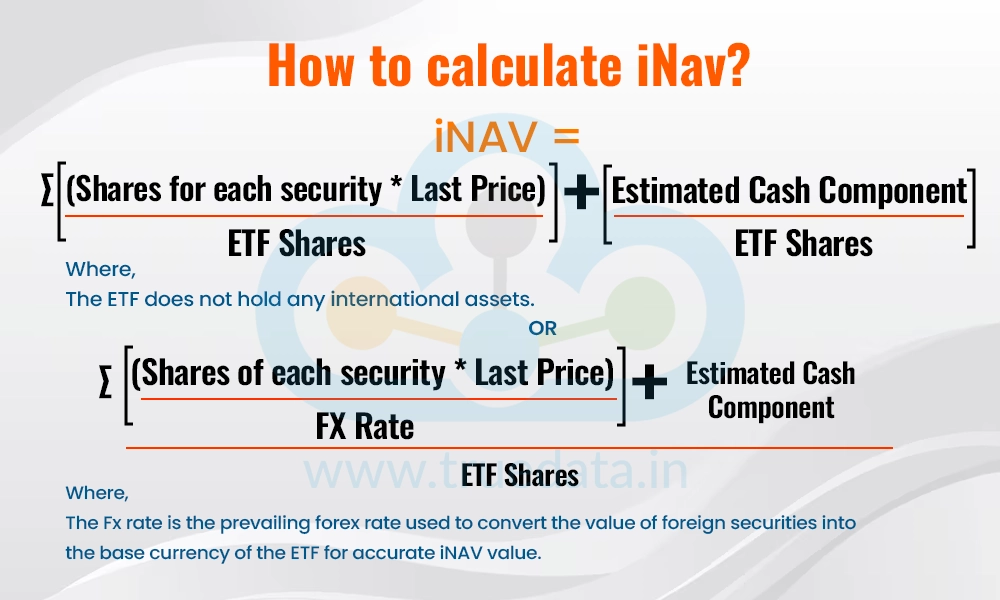

A key concept in ETFs is the iNAV or Indicative Net Asset Value. The iNAV represents the real-time value of the ETF's underlying assets during market hours. It is calculated based on the current prices of the assets in the ETF's portfolio, providing an indication of whether the ETF is trading at a premium (above its actual value) or a discount (below its actual value).

Tracking error refers to the difference between the returns of an ETF and the returns of its underlying index or benchmark over a specific period. Ideally, an ETF should perfectly mirror the performance of its benchmark index, but in reality, small deviations occur due to factors like management fees, transaction costs, cash holdings, and timing differences in asset prices. For example, if a Nifty 50 ETF delivers a return of 10% while the Nifty 50 index gains 10.2%, the tracking error is 0.2%.

Tracking error is crucial for investors in India because it indicates how closely an ETF follows its benchmark and reflects the efficiency of the fund manager. A lower tracking error means the ETF is more accurate in replicating the index, making it a better choice for investors seeking predictable performance. High tracking errors can result in returns significantly different from the index, defeating the purpose of investing in an ETF. Therefore, investors should consider tracking error as an important factor when selecting ETFs to ensure their investment aligns closely with the intended benchmark.

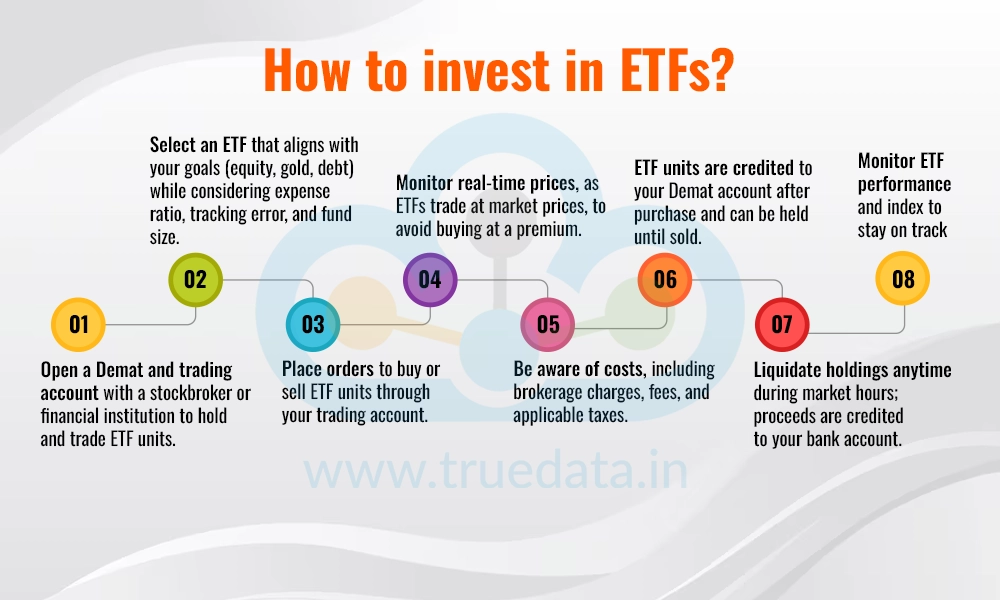

Investing in ETFs is similar to investing in stocks. The steps to invest in ETFs are detailed hereunder.

Investors need a Demat account to hold ETF units and a trading account to buy or sell them. These can be opened with a stockbroker or financial institution.

The next step is to select an ETF that aligns with investment goals, such as equity, gold, or debt ETFs along with considering factors like expense ratio, tracking error, fund size, etc.

Investors can buy and sell the desired number of units of the ETF by placing an order for the same through their trading account.

Unlike mutual funds, ETFs trade at real-time market prices, hence, investors should keep an eye on the price to ensure they are not buying at a premium.

It is also important to be aware of the associated costs of investment like brokerage charges, other fees, and taxes applicable on buying or selling ETF units.

Once purchased, ETF units are credited to the investor's Demat account, where they can be held until sold.

Investors can liquidate their holdings at any time during market hours through the trading account and the proceeds are credited to the investor's linked bank account.

Finally, investors should regularly monitor the ETF's performance and the underlying index to ensure it continues to meet investment objectives.

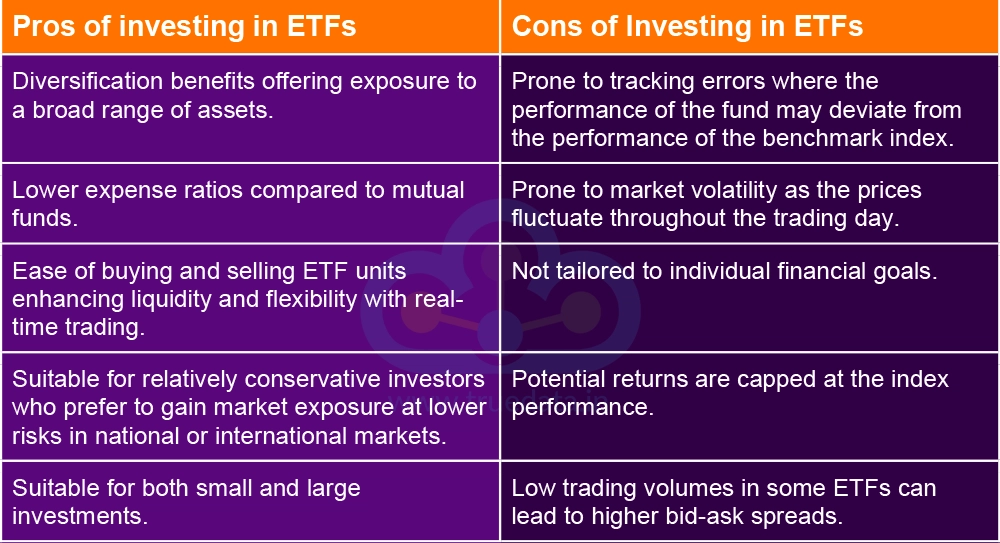

After all the above details related to ETFs, let us also consider the pros and cons of investing in them.

ETFs are a versatile and efficient investment option for Indian investors, offering a combination of low costs, diversification, and flexibility. They offer a wide range of investment options making them suitable for investors with diverse financial goals and risk appetite. Investors simply need a Demat account to start their investment in ETFs and can buy and sell units of their target ETFs in real-time based on iNAV (real-time NAV of the ETF). This makes them an excellent tool for building a diversified portfolio considering all the factors like expense ratio, tracking errors, asset composition, liquidity, etc.

ETFs are becoming a popular investment option among new and seasoned investors owing to their multiple benefits like transparency, real-time trading and passive nature of investment. Let us know what you think of this investment option, are you too an ETF investor? Which ETF is your top choice and why? Also, reach out to us if you need any information on this topic and we will address it.

Till then Happy Reading!

Read More: Index Trading vs Stock Trading

Introduction For the longest time, investment in stock markets was thought to b...

It is a very well-known fact that mutual funds are considered to be among the st...

‘Mutual funds are subject to market risk’, this line is what most pe...