The world as we knew it changed forever after COVID-19. While countless lives were impacted due to the pandemic, one of the most significant changes was seen in the need for insurance. Post-Covid, the insurance industry in India has grown significantly with a CAGR of approximately 12-15% and is expected to reach a market size of USD 280 billion by 2025. However, for most young investors, insurance does not seem like an immediate or urgent investment option as it does not give higher returns like equity. But wait, what if there was an investment option that gave market-linked returns along with insurance benefits? Sounds like a game-changer? Well, it is not a new product but your humble ULIP? Read on to know all about ULIPs and why they should be part of your investment portfolio.

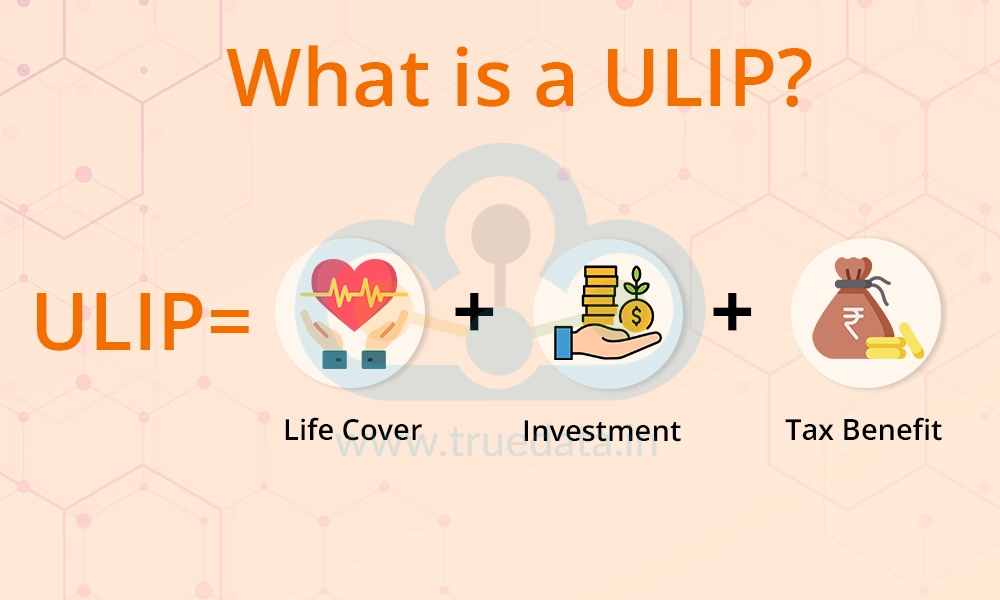

ULIPs stand for Unit Linked Insurance Plans and are a classic combination of insurance and stock market investments. The concept of ULIPs was first introduced in India in 1971 by UTI and then expanded by LIC by offering more products in 1989. Over the years, ULIPs have offered many types of market-linked products for investment that suit different classes of investors based on their risk-return profile or investment goals (like retirement planning, and children’s education, etc.).

This unique feature of ULIPs combining insurance and investments gives it an edge over other investment options providing them with dual benefits. Investors get the opportunity for wealth creation in the long term with the benefit of a safety net of insurance for themselves and their families protecting them from future uncertainties.

The amount invested in ULIPs provides insurance cover and investment in market-linked instruments like stocks, bonds, or mutual funds, chosen by the investor at the time of initiating ULIP investment. Investors get returns on these investments throughout the tenure of the insurance policy. The accumulated corpus, based on the performance of the selected investment, is disbursed at the time of maturity subject to the terms of policy agreed upon initially at the time of buying ULIPs.

Investors can select the notified investments or funds based on their risk profile and financial goals, i.e., equity investments yielding higher returns with higher risk, debt options for stability or balanced options through hybrid funds. Furthermore, investors also have the option to switch between funds during the policy term which can help them adapt to the market conditions or changing financial goals at different stages of life. ULIPs also come with a mandatory lock-in period of 5 years (depending on the type of investment option) where investors cannot withdraw their investment leading to a disciplined approach towards investing and compounding benefits.

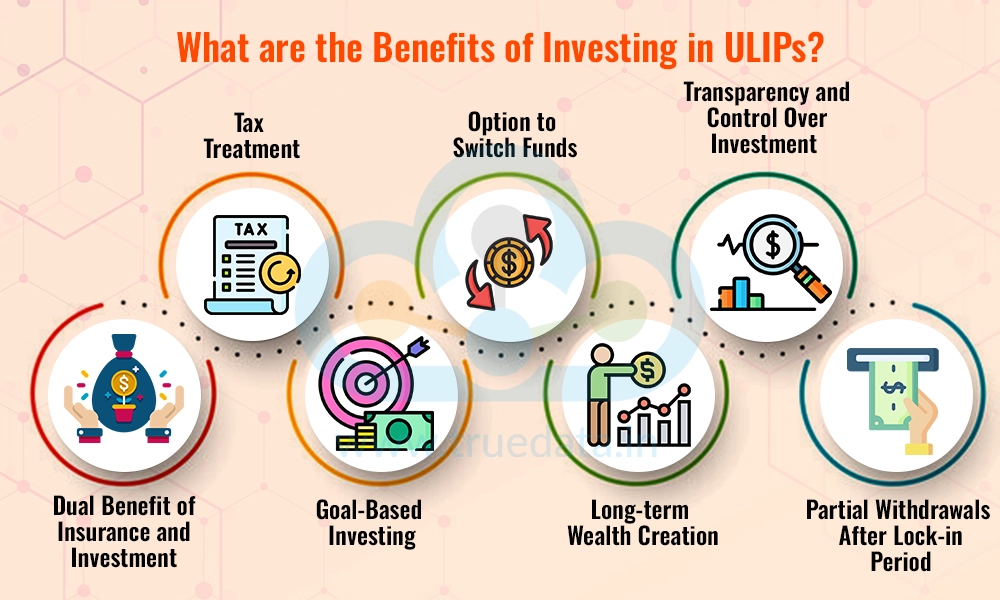

ULIPs were first introduced in 1971 but even after decades today, they remain an evergreen investment option for investors due to the multiple benefits they offer. Some of these benefits are highlighted hereunder.

The dual benefit of investment and insurance is the most unique feature and benefit offered by ULIPs. They give investors a chance to get financial protection for their family with the opportunity for wealth creation in the long term with a single product. This significantly simplifies financial planning, especially for novice investors.

Most investors invest with the aim of tax savings and ULIPs are an excellent tool to meet this end. Investors get the benefit of deduction under section 80C up to Rs. 1,50,000 for the premiums paid towards ULIPs. The maturity proceeds under the ULIPs are exempt or considered tax-free in the following cases,

ULIPs issued on or after 1st February 2021-

Maturity proceeds are tax-free if the annual premium paid collectively is up to Rs. 2,50,000.

Premium must be less than 10% of the sum assured.

ULIPs issued between April 2012 and February 1, 2021-

Maturity proceeds are tax-free if the premium is less than 10% of the sum assured.

ULIPs issued before April 2012-

Maturity proceeds are tax-free if the premium is less than 20% of the sum assured.

Furthermore, returns or maturity proceeds (including bonuses) on ULIP policies issued on or after 1st February 2021 with a total annual premium of Rs. 2,50,000 or more will be taxable as per the Income Tax Act. However, the death benefits received from ULIPs are always considered tax-free under section 10(10D) of the Income Tax Act, irrespective of the annual premium amount.

ULIPs offer investors a flexible investment option that allows them to focus on goal-based investing, tailoring the investments to specific financial goals and risk-return preferences. Investors can invest their funds in equity, debt, or balanced hybrid funds that provide multiple benefits.

ULIPs allow investors to switch between equity, debt, and balanced funds during the policy term. This benefit makes it especially useful for adapting to changing market conditions or financial needs. Furthermore, most insurers provide a limited number of free switches annually.

ULIPs come with a lock-in period of 5 years which encourages investors to have a disciplined approach towards savings and investment. The lock-in period allows the investment in the notified funds to grow and compound annually thereby aiding in meeting the financial goals in a timely manner. This makes it an excellent investment option for long-term wealth creation and building a substantial retirement corpus.

As per the rules of the IRDAI and SEBI, ULIPs have to provide a detailed account of all the charges involved along with crucial details like fund performance, investment value, asset allocation, etc. This detailed insight into the investment along with the option to switch funds allows investors to have a better sense of control and confidence in the investment journey.

ULIPs also offer the flexibility of partial withdrawals after the initial lock-in period of 5 years. This benefit allows investors to access their funds in emergencies or meet specific financial needs without endangering their financial plans.

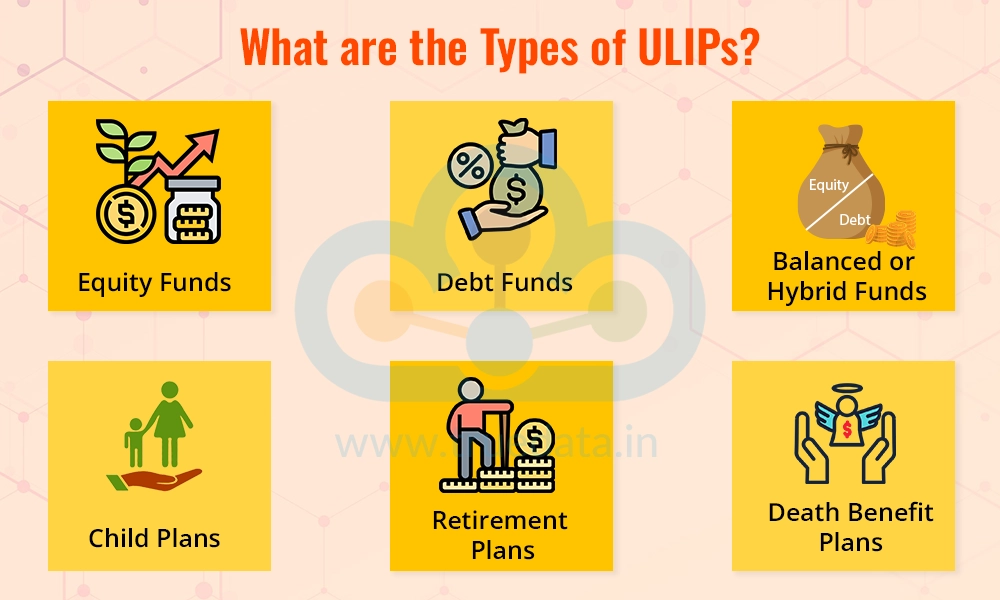

Investors can invest in various types of funds catering to a diverse class of investors. These funds are classified based on the risk appetite and investment goals. The types of funds available under ULIPs are explained hereunder.

Equity funds invest primarily in stocks or equity-related instruments. These funds are ideal for investors with a higher risk appetite and a long-term investment horizon. This gives investors an excellent opportunity for wealth creation in the long term but also suffers from short-term fluctuations.

Debt mutual funds invest in debt instruments like government bonds, corporate bonds, and similar fixed-income instruments. These investments are considered safer as compared to equity instruments since they provide stability as well as predictable returns in the form of fixed-income options. This makes them suitable for risk-averse investors and ideal for meeting medium-term goals or balancing the risk of the overall portfolio.

Hybrid funds offer the best of equity and debt investments thereby providing a balanced investment option. These funds provide an ideal mix of growth and stability making them suitable for investors with moderate risk appetite and looking for balanced returns. Balanced funds also help in meeting long-term goals while managing market volatility.

Child plans available under ULIPs are centred on providing corpus to meet various needs of the child’s future like their education, wedding, etc. These funds help in securing the financial future of the children even in the absence of their parents ensuring the continuation of the policy in the event of the policyholder’s death.

Retirement plans are also part of the goal-based investing approach under ULIPs where investors can accumulate corpus to meet their needs in their retirement. These plans focus on disciplined investment over the years to ensure sufficient corpus at the time of retirement. Investors can use the corpus received at the time of maturity to purchase target annuities or receive regular payouts thereby ensuring financial independence during retirement.

ULIPs offer two types of death benefit plans based on the risk appetite and the target benefit to be received by the beneficiaries. The death benefit plans available under ULIPs include,

These plans offer higher of the sum assured or the fund value as the death benefit. The policyholder’s nominee receives the assured benefit, making this option more suitable for risk-averse investors.

Under these plans, the beneficiaries get both the sum assured and the fund value as the death benefit. While this option comes with higher premiums, it is ideal for those seeking comprehensive financial security for their loved ones.

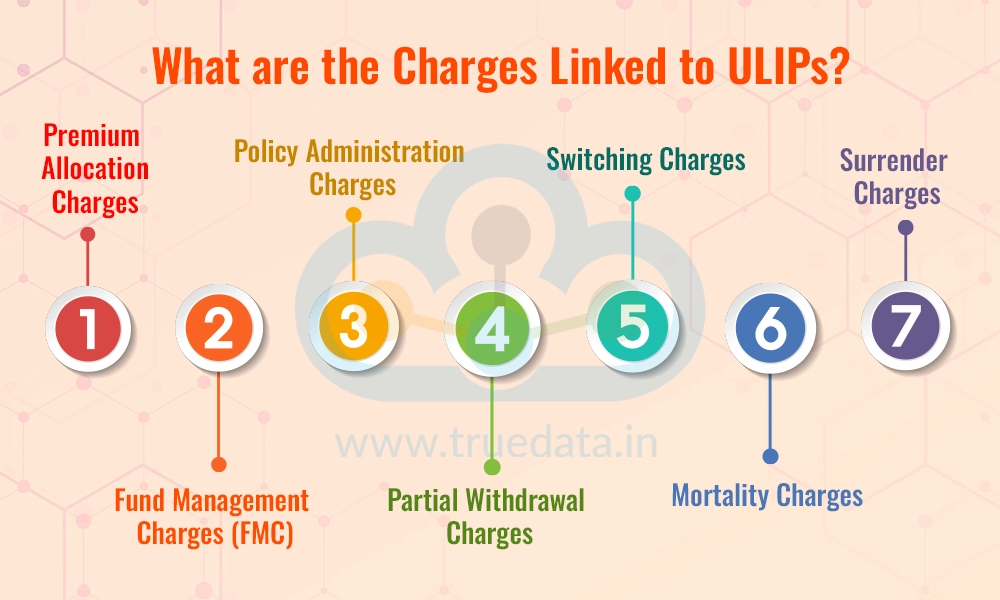

Investment in ULIPs should be an informed decision after having a comprehensive knowledge of all the charges associated with this investment. These charges include,

This charge is deducted from the premium investors pay before it is invested in funds. It covers initial expenses like distribution, marketing, and underwriting. The remaining portion of the premium is invested in the chosen funds. Premium allocation charges are typically higher in the initial years of the policy and tend to reduce over time.

Fund management charges are fees for managing the investments in the ULIP. These charges are deducted as a percentage of the fund value and capped by IRDAI at 1.35% per annum for equity funds. This charge may vary depending on the type of fund (equity, debt, or balanced) and the AMC terms.

These are fees for managing the policy, such as maintaining records, issuing statements, and other administrative activities. Policy administration charges are usually fixed or calculated as a percentage of the premium and are deducted monthly.

ULIPs allow partial withdrawals after the mandatory lock-in period of 5 years. However, some policies may charge a fee for these withdrawals, especially if the frequency or amount exceeds specified limits.

ULIPs offer the flexibility to switch between equity, debt, and balanced funds based on investor’s risk preferences and market conditions. While some policies allow a limited number of free switches per year, additional switches may incur charges.

Mortality charges are the cost of providing life insurance coverage in ULIPs. They are calculated based on various factors like the policyholder's age, sum assured, and health condition and are deducted monthly from the fund value.

In case the policyholder decides to surrender their ULIPs before the end of the lock-in period, they are liable to pay surrender charges. These charges are regulated by IRDAI and typically decrease over time.

ULIPs are ideal for investors in India who want to combine life insurance with investment opportunities. They are a good choice for people with long-term financial goals, such as saving for a child’s education, buying a house, or planning for retirement. ULIPs are suitable for those who want flexibility in choosing how their money is invested, whether in equity funds for higher returns, debt funds for stability, or a mix of both. They also work well for investors who can commit to disciplined, regular investments over a longer time frame, as ULIPs have a lock-in period of five years. Additionally, ULIPs offer tax benefits under Section 80C and Section 10(10D) of the Income Tax Act, making them attractive for tax-conscious investors. Thus, ULIPs are ideal for investors who are comfortable with some market risk and value the combination of insurance and investment in one product.

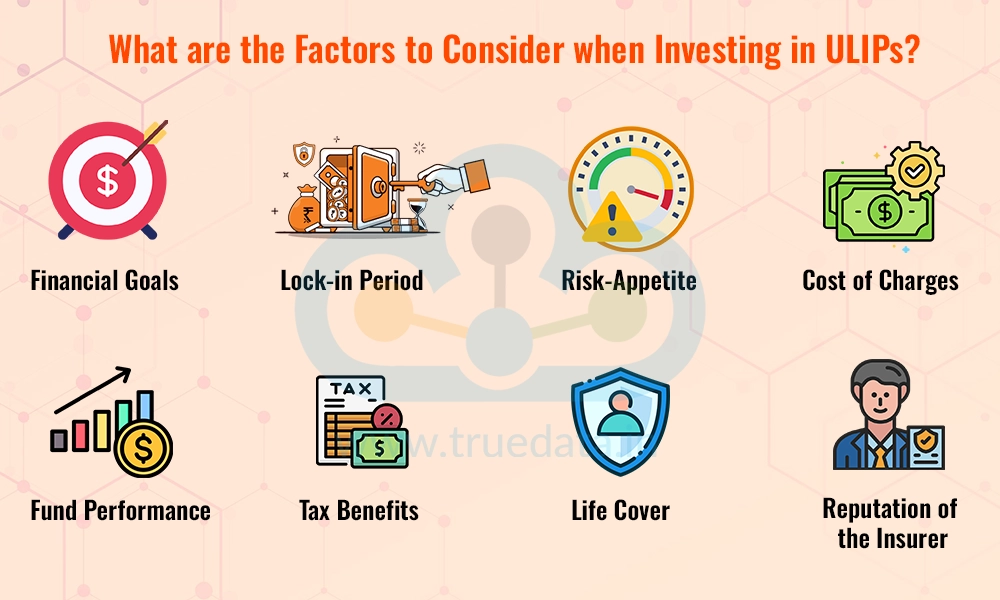

Investment in ULIPs, like any other investment option, requires careful consideration of various factors that can influence the investment decision. Some of these factors are explained hereunder.

Investors should clearly define their financial goals before investing in ULIPs. These plans are most effective for long-term objectives such as wealth creation, retirement planning, or saving for a child’s education. A clear understanding of goals helps in selecting the right type of ULIP plan and fund allocation, whether equity, debt, or balanced.

ULIPs come with a five-year mandatory lock-in period. Investors need to ensure they can keep their funds invested without withdrawal during this time. ULIPs are not suited for short-term goals, as early withdrawals or surrendering the policy may lead to charges and reduced returns.

Assessing risk tolerance is essential. Investors comfortable with high market fluctuations can opt for equity-oriented ULIPs to seek higher returns. Those preferring stability and lower risk should consider debt or balanced ULIPs. The chosen fund mix should match the investor's risk appetite.

ULIPs involve various charges such as premium allocation, fund management, and mortality charges, which can affect overall returns. Investors should compare the charges across different ULIP policies and select one with reasonable fees. Reviewing the policy brochure for a detailed breakdown of charges is recommended.

Investors should evaluate the historical performance of ULIP funds offered by the insurer. While past performance does not guarantee future returns, it provides insight into how well the funds are managed. Policies with a consistent performance track record and suitable fund allocation are ideal.

ULIPs offer tax benefits under Section 80C (up to Rs. 1,50,000 annually) and tax-free maturity proceeds under Section 10(10D), subject to specific conditions. While these benefits are attractive, investors should prioritise alignment with financial goals rather than investing solely for tax savings.

Since ULIPs provide life insurance along with investment, investors should consider the adequacy of the life cover offered. The sum assured should be sufficient to secure the financial needs of their family in case of unforeseen circumstances.

Finally, the insurer’s reputation is one of the most critical factors that can significantly influence the investment decision. Investors with a better claim-settlement ratio are preferred as compared to others as it ensures smooth policy management and timely settlement of claims.

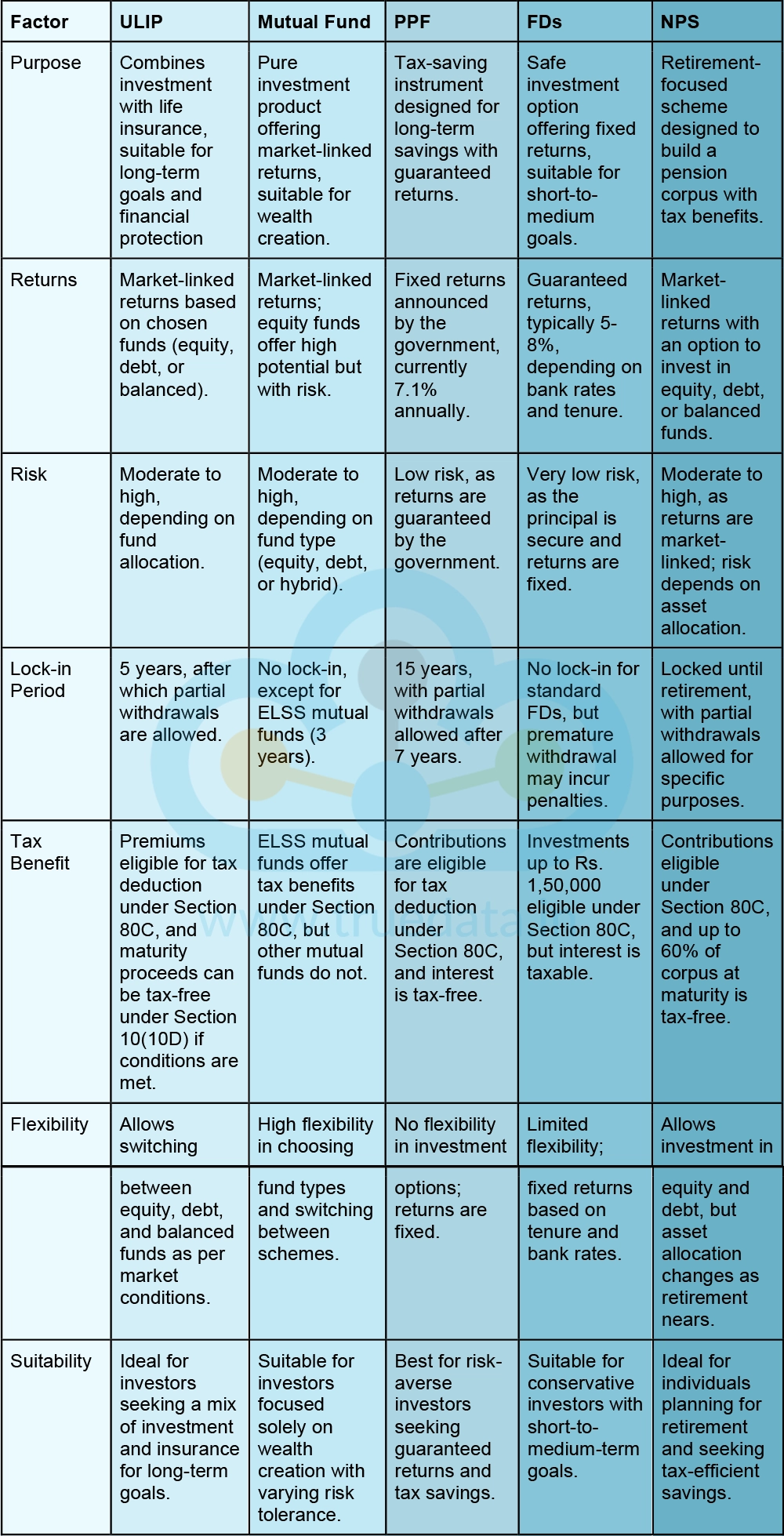

Investors today have access to multiple investment options that suit their financial goals or investment horizons, and ULIPs are one of them. However, are ULIPs a better investment option than other popular options like mutual funds or the Public Provident Fund (PPF)? Here is a comprehensive analysis of ULIPs and other popular investment options to help investors make an informed choice.

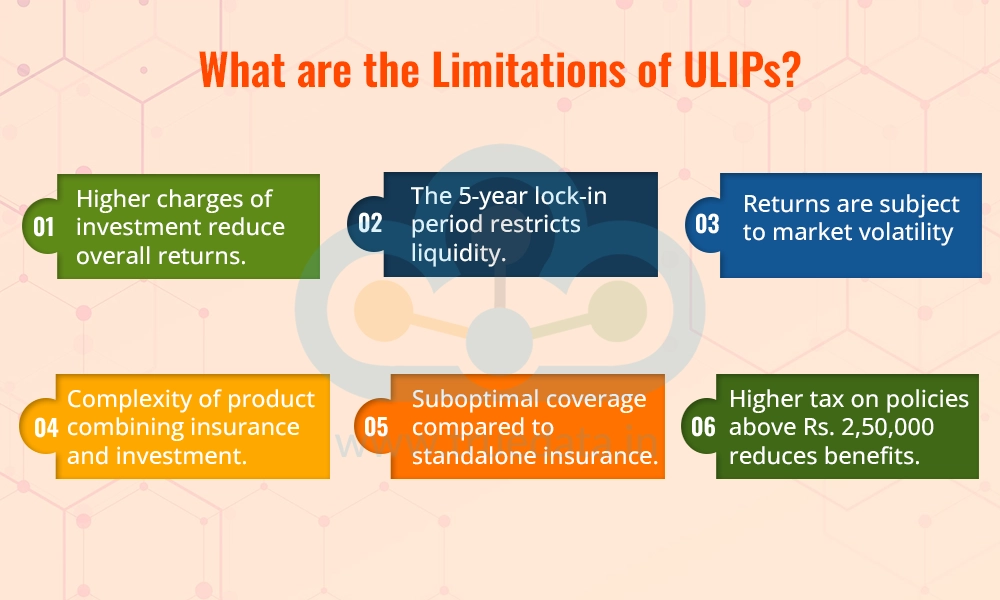

After focusing on all the details of ULIPs, let us finally consider the limitations of investing in this investment option.

Higher charges of investment like premium allocation, fund management, and mortality charges reduce overall returns.

The mandatory lock-in period of 5 years restricts liquidity and early access to funds.

Returns are subject to market volatility.

Complexity of product combining insurance and investment.

Suboptimal insurance cover as compared to standalone insurance cover.

Increased tax liability on policies purchased on or after 1st February 2021 with premiums more than Rs. 2,50,000 thereby reducing tax benefits.

ULIPs are considered to be one of the most favourable investment options despite them being decades old. Although they provide relatively less insurance coverage, they are an ideal option combining insurance and investment under one roof making them suitable for investors with long-term financial goals. They are favoured by investors seeking a mix of insurance and investment, however, it is essential to evaluate personal financial goals, risk appetite, and the costs involved to ensure they align with individual needs.

This article is a detailed insight into ULIPs enabling investors to make informed portfolio decisions. Let us know if you have any queries on this topic or need further clarification on any aspect.

Till then Happy Reading!

Read More: How do you do a fundamental stock market analysis?

Introduction For the longest time, investment in stock markets was thought to b...

It is a very well-known fact that mutual funds are considered to be among the st...

‘Mutual funds are subject to market risk’, this line is what most pe...