The world of investing is quite tricky to navigate with multiple investment options and a tightrope to maintain the right balance of maximising returns and minimising risks. While mutual funds are the most obvious and the most popular investment options for retail investors, did you know that you can also curate your own fund like portfolio based on your individual risk and return perceptions? These are small stock baskets that help you in meeting your investment goals in a more structured and effective manner. So check out this blog to learn more about the concentrated stock baskets and the optimum choice between this dynamic option or the more standard mutual fund. Read More: Difference between Large-cap,Mid-cap and Small-cap Stocks - How-to-choose?

The world of investing is quite tricky to navigate with multiple investment options and a tightrope to maintain the right balance of maximising returns and minimising risks. While mutual funds are the most obvious and the most popular investment options for retail investors, did you know that you can also curate your own fund like portfolio based on your individual risk and return perceptions? These are small stock baskets that help you in meeting your investment goals in a more structured and effective manner. So check out this blog to learn more about the concentrated stock baskets and the optimum choice between this dynamic option or the more standard mutual fund. Read More: Difference between Large-cap,Mid-cap and Small-cap Stocks - How-to-choose?

A concentrated stock basket is the strategy of selecting stocks based on a particular theme or investment strategy. A concentrated stock basket is a portfolio strategy that focuses on a limited number of individual stocks rather than diversifying across a wide range of companies. Typically, this approach involves selecting a handful of stocks that the investor believes have strong growth potential. While it can lead to significant returns if the chosen stocks perform well, it also comes with higher risk due to the lack of diversification. This strategy requires a deep understanding of the selected stocks and a high tolerance for risk. Investors might consider concentrated stock baskets as a way to bet on specific sectors or companies they have strong convictions about.

A concentrated stock basket is the strategy of selecting stocks based on a particular theme or investment strategy. A concentrated stock basket is a portfolio strategy that focuses on a limited number of individual stocks rather than diversifying across a wide range of companies. Typically, this approach involves selecting a handful of stocks that the investor believes have strong growth potential. While it can lead to significant returns if the chosen stocks perform well, it also comes with higher risk due to the lack of diversification. This strategy requires a deep understanding of the selected stocks and a high tolerance for risk. Investors might consider concentrated stock baskets as a way to bet on specific sectors or companies they have strong convictions about.  On the other hand, mutual funds are investment vehicles that pool money from multiple investors to create a diversified portfolio of stocks, bonds, or other assets. In India, mutual funds have gained popularity as they offer diversification, professional management, and liquidity. Mutual funds come in various types, including equity funds that invest in stocks. These can range from actively managed funds, where fund managers make investment decisions, to passively managed index funds that aim to replicate the performance of a market index. Mutual funds are particularly attractive to mass retail investors due to their multiple benefits like the flexibility of capital investment, potentially more stable returns, diversified risk and investment in diverse assets.

On the other hand, mutual funds are investment vehicles that pool money from multiple investors to create a diversified portfolio of stocks, bonds, or other assets. In India, mutual funds have gained popularity as they offer diversification, professional management, and liquidity. Mutual funds come in various types, including equity funds that invest in stocks. These can range from actively managed funds, where fund managers make investment decisions, to passively managed index funds that aim to replicate the performance of a market index. Mutual funds are particularly attractive to mass retail investors due to their multiple benefits like the flexibility of capital investment, potentially more stable returns, diversified risk and investment in diverse assets.

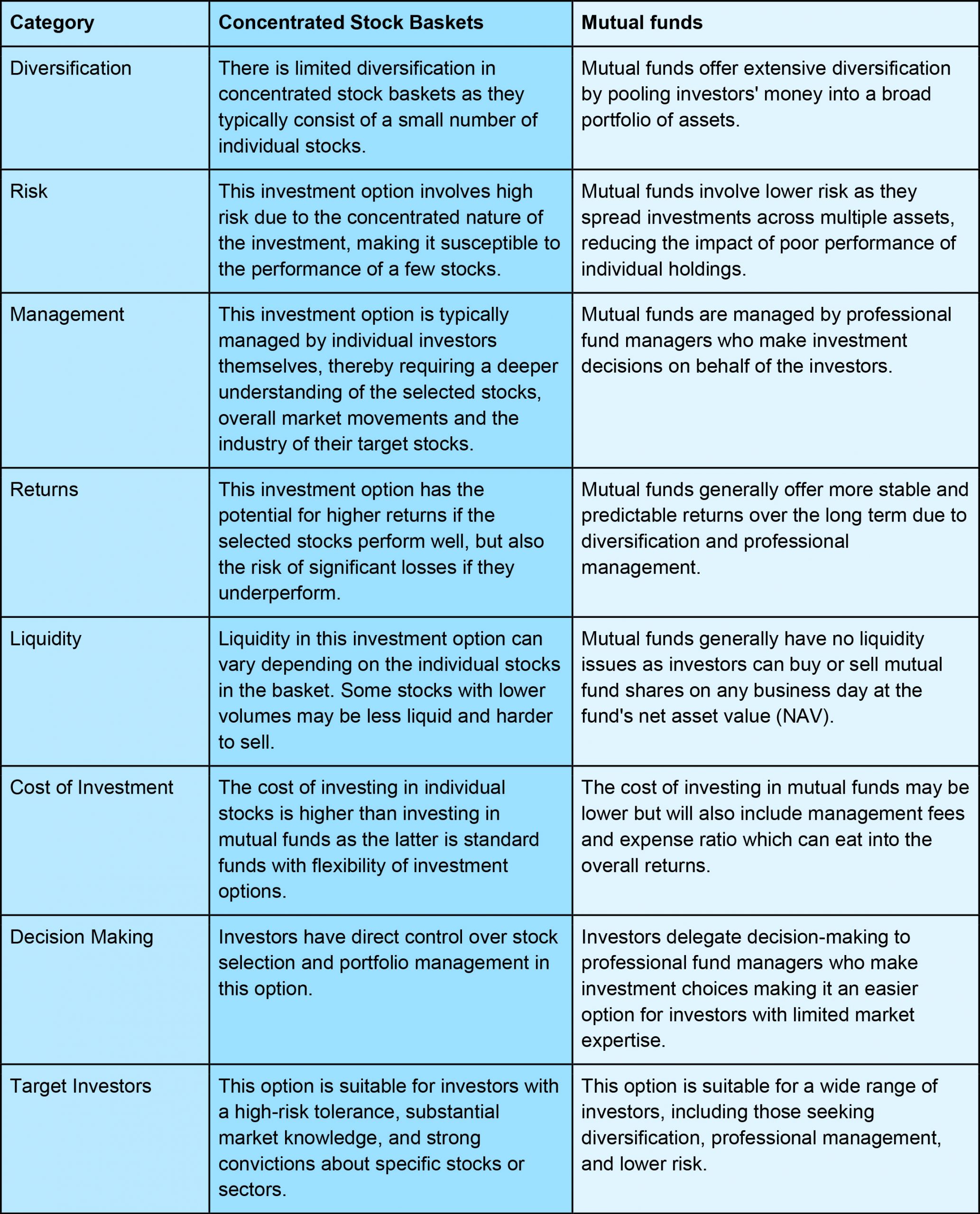

The key differences between concentrated stock baskets and mutual funds are essential to understand in order to make an effective decision between the two. These differences are tabled below.

Choosing between concentrated stock baskets and mutual funds ultimately depends on your investment goals and risk tolerance. If you have a deep understanding of specific stocks or sectors and a high appetite for risk, a concentrated stock basket may be exciting, offering the potential for high returns. However, it comes with substantial risk due to the lack of diversification. On the other hand, if you prefer a more diversified and stable approach with professional management, mutual funds could be your go-to choice. They offer a broader safety net and can be tailored to various investment objectives. So, it's like choosing between a thrilling roller coaster ride (concentrated stock baskets) or a more comfortable journey on a well-paved road (mutual funds). The decision should ultimately be based on your adventure level and financial goals!

Choosing between concentrated stock baskets and mutual funds ultimately depends on your investment goals and risk tolerance. If you have a deep understanding of specific stocks or sectors and a high appetite for risk, a concentrated stock basket may be exciting, offering the potential for high returns. However, it comes with substantial risk due to the lack of diversification. On the other hand, if you prefer a more diversified and stable approach with professional management, mutual funds could be your go-to choice. They offer a broader safety net and can be tailored to various investment objectives. So, it's like choosing between a thrilling roller coaster ride (concentrated stock baskets) or a more comfortable journey on a well-paved road (mutual funds). The decision should ultimately be based on your adventure level and financial goals!

Concentrated stock baskets are a dynamic way of curating an investment portfolio and a preferred option for investors who prefer taking the reins of their investment journey into their own hands. However, it is better to invest in mutual funds to diversify the overall investment portfolio as well as capitalise on the bullish outlook of the world on the Indian economy and the Indian stock markets. We hope this blog was able to provide a better understanding of two investment options and help you in curating your personalised investment portfolio. Let us know if you need more information on this topic or any other market-related investments and we will take it up in our coming blogs. Till then Happy Reading!

Introduction For the longest time, investment in stock markets was thought to b...

When discussing mutual funds, an average investor always focuses on the type of ...

One of the many features of investing inmutual funds is the ease of entering and...