It is almost the end of the third quarter of financial year 2024-25 and one of the many things to take care of includes investment planning. It is advisable to plan your investments right from the start of the financial year to maximise the benefit of compounding and have a planned investment portfolio rather than a rushed one. Among the diverse investment options available today, a PPF account stands as an evergreen option for any class of investors. Are you interested in opening a PPF account too? Then here is all you need to know about the PPF investment and why it is an excellent addition to your investment portfolio.

PPF stands for Public Provident Fund and is a popular long-term savings scheme backed by the Government of India. This scheme is available for all the citizens of the country and provides them with retirement benefits by offering regular interest payments along with tax benefits. This makes PPF a favoured investment option for citizens across the country. The money invested in a PPF account is also eligible for tax deduction under section 80C of the Income Tax Act up to Rs. 1,50,000. A PPF account comes with a lock-in period of 15 years, however, investors are allowed to make partial withdrawals too after a certain time period. The corpus received after the maturity of the PPF account is also tax-free in the hands of the investors.

A PPF account can be opened by any citizen in India. The details of eligibility criteria and the process to open it are mentioned hereunder.

The eligibility criteria for a PPF account includes

Resident Indian - Only resident individuals are eligible to open a PPF account. Non-resident Indians (NRIs) are not allowed to open new PPF accounts, although they can continue existing accounts opened while they were residents.

Age Limit - Any resident individual can open a PPF account, regardless of age. This means minors can also have a PPF account opened in their name by a parent or guardian.

Choose a Bank/Post Office - PPF accounts can be opened at authorised banks (such as SBI, HDFC Bank, etc.) or at designated post offices across India.

Documents Required - An investor will need the following documents to open a PPF account:

Identity proof (Aadhaar card, PAN card, passport, voter ID, etc.)

Address proof (Aadhaar card, passport, utility bills, etc.)

Passport-size photographs

PPF account opening form (available at banks/post offices)

Visit the Bank/Post Office - The next step is to take all the required documents to the bank or post office where one wants to open the PPF account. Fill out the account opening form and submit the necessary documents along with the initial deposit amount.

Deposit Amount - The minimum deposit amount required to open a PPF account is Rs. 500, and the maximum allowed in a financial year is Rs. 1,50,000. Investors can make these deposits in cash, cheque, or through an online transfer.

PPF Passbook - Once the account is opened and the initial deposit is made, investors will be issued a PPF passbook. This passbook records all transactions, including deposits, withdrawals, and interest earned.

Manage the Account - Investors can manage their PPF accounts through online banking portals if the bank provides this service. On the other hand, investors can also visit the bank/post office to make deposits, check balances, and make withdrawals.

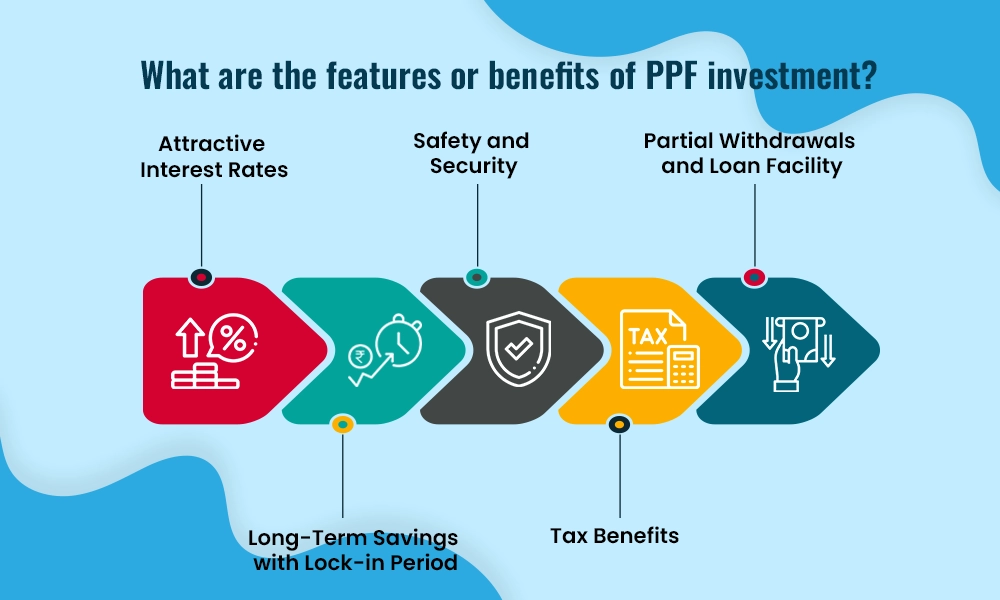

The Public Provident Fund features and benefits are highlighted below.

PPF accounts provide investors with attractive interest rates that are set by the government and are typically higher than those offered by regular savings accounts. Currently, PPF offers interest at an annual rate of 7.1%. This interest is compounded annually, contributing to the growth of the invested amount over time. PPF interest rates are revised quarterly and declared by the government from time to time.

One of the key features of a PPF investment is its long-term nature. PPF accounts have a lock-in period of 15 years, encouraging investors to build a disciplined approach towards savings and investment. While the lock-in period ensures commitment to long-term financial goals, investors also have the flexibility to extend the account in blocks of five years after maturity.

PPF investment is considered to be a safe and secure investment option as it is backed by the Government of India. The capital invested in a PPF account is guaranteed, providing investors with peace of mind about the safety of their corpus. This feature makes PPF a preferred choice for risk-averse investors looking for stable and reliable investment avenues.

Investing in a Public Provident Fund (PPF) offers significant tax benefits to investors. Contributions made to a PPF account are eligible for tax deductions under Section 80C of the Income Tax Act, up to a maximum limit of Rs. 1,50,000 per financial year. The interest earned is tax-free as well as the entire corpus received at the time of maturity of the PPF account making PPF an EEE category investment.

While PPF has a lock-in period of 15 years, investors can avail of partial withdrawals from the 7th year onwards. This feature offers liquidity and flexibility, allowing investors to address financial needs or emergencies without completely liquidating their PPF investment. Additionally, after completing three years of opening the PPF account, investors can also avail of a loan against the balance in their PPF account, providing access to funds when required.

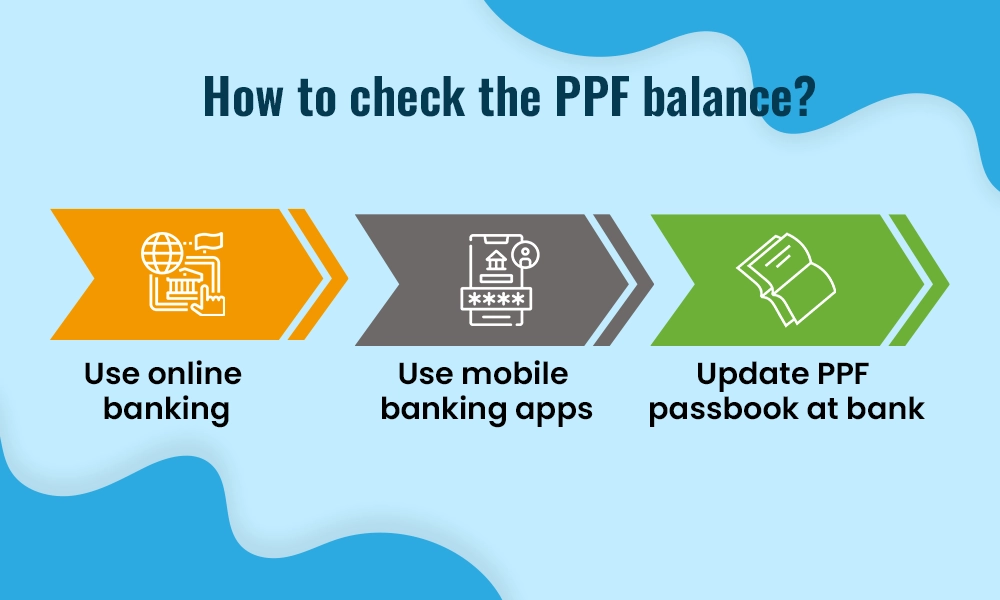

With the age of the internet, it is quite easy to check the PPF balance and stay updated. The various ways to check the PPF balance are mentioned hereunder.

Access online banking services offered by banks like SBI or private banks to check PPF balances.

Utilise mobile banking apps for quick access to PPF balance, interest earned, and transaction history.

Visit the bank or post office to update the PPF Passbook for the latest balance, deposits, withdrawals, and interest earned.

A PPF account becomes inactive if investors fail to make the minimum investment of Rs. 500 to their active PPF account during the tenure of 15 years. In such a case, investors will have to revive the inactive account to continue making deposits to the same. The process to revive or reactivate a PPF account is,

Write a formal letter addressed to the bank or post office branch requesting the reactivation of the inactive PPF account.

Pay the minimum required amount of Rs. 500 for each year that the account remained inactive, along with the applicable penalty of Rs. 50 per inactive year.

Submit the letter along with the necessary payment to the bank or post office. They will process the request and reactivate the PPF account accordingly.

A PPF can be closed after the maturity of the PPF account which is after the completion of the tenure of 15 years. The process for closing the PPF account after maturity is listed below.

Obtain the PPF account closure form from the bank, or post office, or download it from the official website of the respective bank or India Post.

Complete the closure form by providing the necessary details, including the PPF account number, personal information such as name and address, nominee details, and optionally, the reason for closing the account.

Attach the PPF passbook along with the completed closure form.

Submit the documents to the relevant bank or post office where the PPF account is held.

The closure request will be processed by the bank or post office after verifying the details provided in the form and passbook.

Upon processing, the PPF account will be closed, and the remaining balance along with accrued interest will be credited to the investor's linked bank account or post office savings account.

Although the PPF account is one of the most popular investment options available to investors today, it is not free from a few limitations. Here are a few limitations of investing in the PPF account.

PPF has a mandatory lock-in period of 15 years, making it unsuitable for short-term investments.

The maximum annual investment is capped at Rs. 1,50,000, limiting the potential for larger corpus creation.

Only Indian residents are eligible to open PPF accounts. NRIs, HUFs, and trusts cannot open PPF accounts.

Returns from PPF may not significantly beat inflation, current interest rates are around 7.1%.

Withdrawals from PPF are restricted until the seventh financial year from the account opening date.

PPF is a very traditional form of investment and was introduced by the government to provide retirement benefits to the masses who do not have the benefit of EPF. Although there is an abundance of investment options today, investing in PPF is still considered to be a safe haven due to the multiple benefits it offers.

We have mentioned the basics of PPF investment in this blog to help investors understand PPF investment in a better manner. Let us know if you have any queries related to this investment and we will address them soon.

Till then Happy Reading!

Read More: What is Financial Planning?

Mr. Warren Buffet has a very famous quote: 'If you don't find a way to make mone...

The world of investments has been constantly evolving. Gone are the days of rely...

A famous quote by legendary investor Mr. Warren Buffet: 'Someone's sitting in th...