What is the one thing that is driven in our minds right from our childhood? It is to save money for a rainy day. However, with the increasing cost of living and the changing lifestyles, merely saving your money is not enough. It needs to grow as well. This is where investing your money in the right assets comes into the picture. But even today most individuals, think that saving and investing are the same thing. So are you among them? Read on to clear these basic concepts and how they help you in meeting your goal of financial stability. Read More: Social Media Impact on Investing

What is the one thing that is driven in our minds right from our childhood? It is to save money for a rainy day. However, with the increasing cost of living and the changing lifestyles, merely saving your money is not enough. It needs to grow as well. This is where investing your money in the right assets comes into the picture. But even today most individuals, think that saving and investing are the same thing. So are you among them? Read on to clear these basic concepts and how they help you in meeting your goal of financial stability. Read More: Social Media Impact on Investing

Savings, in simple terms, refers to the money you set aside and don't spend immediately. It's like having a special piggy bank or a dedicated jar where you put some of your income for safekeeping and future use. Let us put it this way, savings is like time travel of your money from the present to the future. It allows you to move one further towards building financial security for your future and having a surplus income that can be put to better use. So, in a nutshell, savings is like planting seeds for a better future – it helps you be prepared in case of an emergency, achieve your goals, and enjoy the fruits of your efforts down the road in your retirement. Every small rupee saved counts, and as it is rightly said, it is never too early or too late to start this amazing financial journey!

Savings, in simple terms, refers to the money you set aside and don't spend immediately. It's like having a special piggy bank or a dedicated jar where you put some of your income for safekeeping and future use. Let us put it this way, savings is like time travel of your money from the present to the future. It allows you to move one further towards building financial security for your future and having a surplus income that can be put to better use. So, in a nutshell, savings is like planting seeds for a better future – it helps you be prepared in case of an emergency, achieve your goals, and enjoy the fruits of your efforts down the road in your retirement. Every small rupee saved counts, and as it is rightly said, it is never too early or too late to start this amazing financial journey!

Now let us go to the next part of attaining your financial goals and that is investing. The simple meaning of investing is like giving your savings a power boost and allowing them to multiply at a rapid pace. In earlier days, people used to put their money in a safe or simply in a savings bank account. This will just let your money be secure for the future but it is still not the efficient way of using your money as it will take a long time for you to achieve your financial goals. Rather than simply letting them be idle in such places, it is better to invest them in various investment options like shares, debt instruments, NPS, PPF, gold, real estate, and more. Investing your money in these investment options allows your money to grow and you get better returns on your investment in the form of capital appreciation and/or more or less regular income depending on the nature of the investment. Investors can take advantage of the power of compounding by investing in dynamic assets like mutual funds, NSC, index funds, digital gold, RDs, FDs, etc. This will put your money to work and over time your money will generate more money.

Now let us go to the next part of attaining your financial goals and that is investing. The simple meaning of investing is like giving your savings a power boost and allowing them to multiply at a rapid pace. In earlier days, people used to put their money in a safe or simply in a savings bank account. This will just let your money be secure for the future but it is still not the efficient way of using your money as it will take a long time for you to achieve your financial goals. Rather than simply letting them be idle in such places, it is better to invest them in various investment options like shares, debt instruments, NPS, PPF, gold, real estate, and more. Investing your money in these investment options allows your money to grow and you get better returns on your investment in the form of capital appreciation and/or more or less regular income depending on the nature of the investment. Investors can take advantage of the power of compounding by investing in dynamic assets like mutual funds, NSC, index funds, digital gold, RDs, FDs, etc. This will put your money to work and over time your money will generate more money.

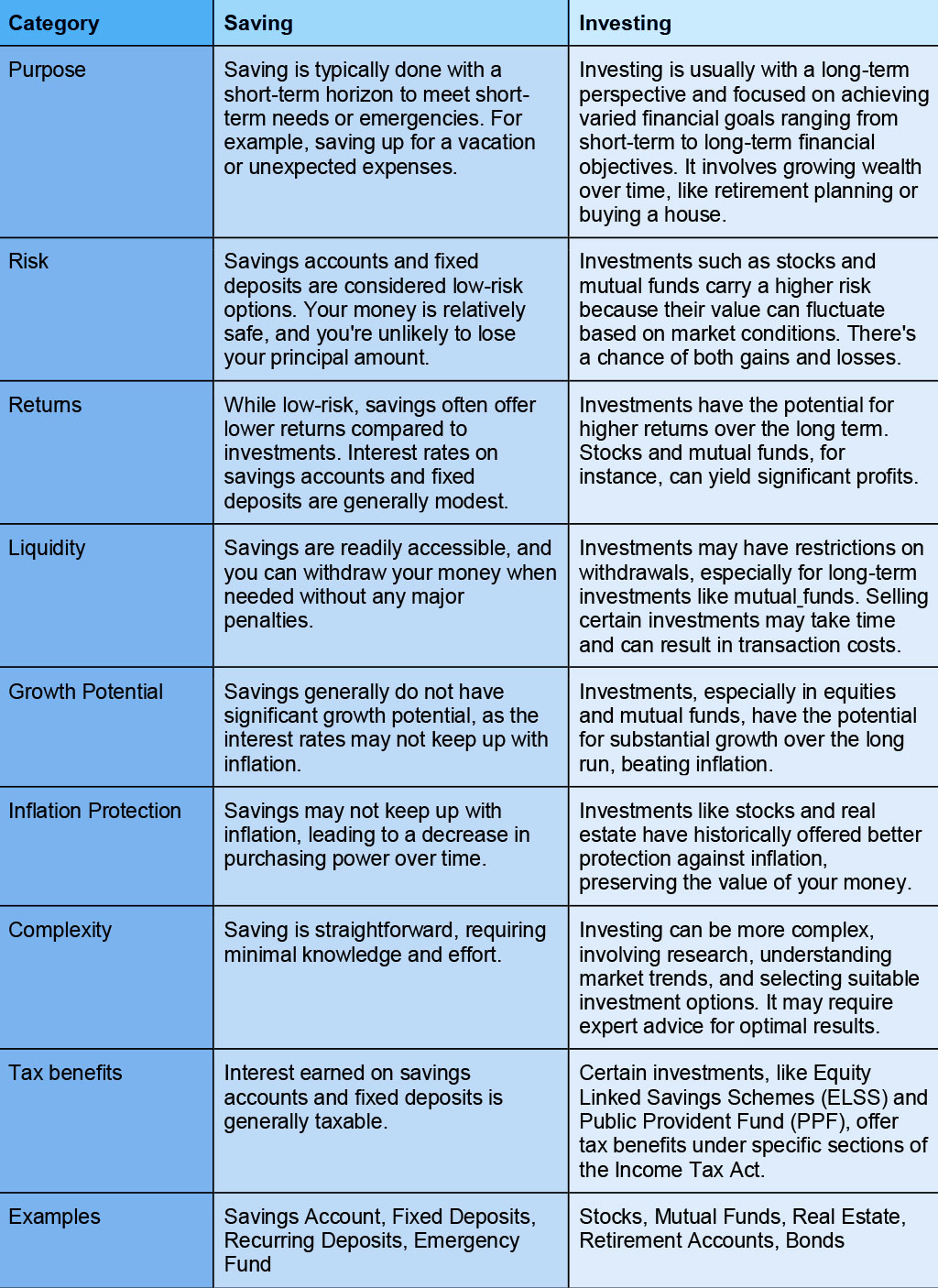

The differences between saving and investing are tabled below.  Saving or investing - what should you do? The ideal approach is to do both! Saving and investing serve different purposes in your financial journey. Start by building an emergency fund through regular savings to handle unexpected expenses. Once you have a safety cushion, focus on long-term goals like retirement or buying a house by investing. A balanced approach to saving and investing helps you meet short-term needs while building wealth for a secure future.

Saving or investing - what should you do? The ideal approach is to do both! Saving and investing serve different purposes in your financial journey. Start by building an emergency fund through regular savings to handle unexpected expenses. Once you have a safety cushion, focus on long-term goals like retirement or buying a house by investing. A balanced approach to saving and investing helps you meet short-term needs while building wealth for a secure future.

The concept of saving and investing are like two sides of the same coin. The first step to investing is saving and thereby investing efficiently to meet all your needs and goals like planning for retirement, children’s education, or just exploring the world. Hope this blog was helpful in explaining these basic concepts and their importance in our lives. If you have any queries regarding the same or want to know more about any investment options, do let us know and we will take it up in our future blogs. Till then Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

There is a famous quote from Mr.Warren Buffett, and it says that if your money i...

Process of Selecting Top Stocks for Investing The first step towards picking a ...