India is increasingly becoming a dominant options trading market with the highest number of options contracts traded globally in 2023. While options trading requires a huge amount of analysis and understanding of a wide variety of concepts, options greeks are an integral concept of options trading. In our earlier blogs, we have covered the basics of options greeks and a few primary greeks like Delta, Gamma, Theta, and Vega. In this article, we will cover the next level of greek, Omega. Have you heard about it? Here is a detailed discussion on this topic and how to use it for options trading.

Omega is a relatively lesser-known option as compared to the other popular ones. It is also known as elasticity or the third derivative of options pricing. Omega is particularly relevant to traders who focus on the sensitivity of an option's value to changes in the underlying asset's price. Omega is the measure of percentage change in the value of the option for a 1% change in the price of the underlying asset. This metric is used to analyse and understand the leverage effect of options which can further be translated to the potential for profit or loss from any trade.

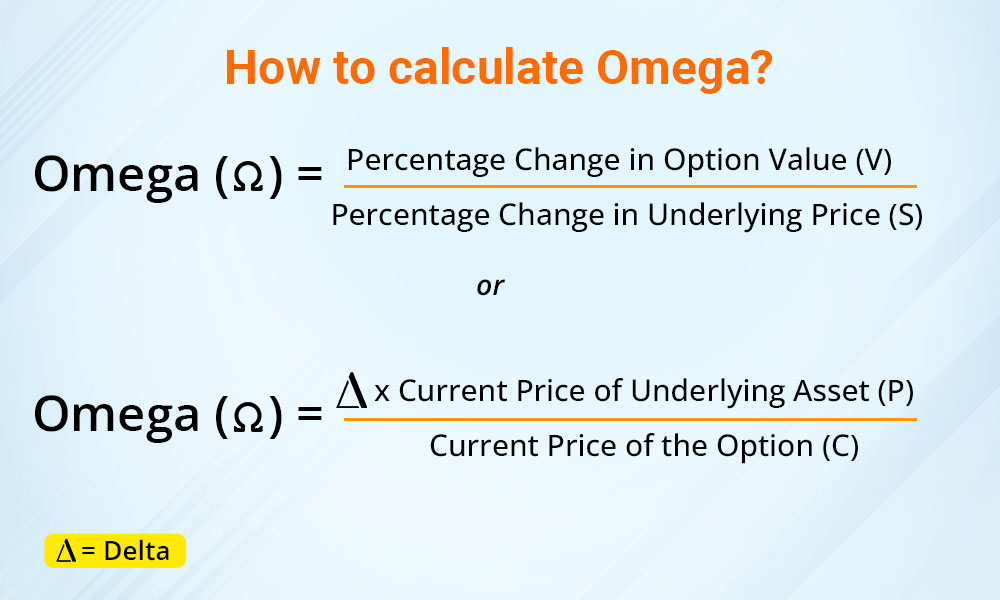

Omega is calculated based on two other Greeks, namely, delta (Δ), which measures the change in option value with respect to the change in the underlying price, and gamma (Γ), which measures the change in delta with respect to the change in the underlying price. The formula to calculate the omega for an option is given below.

Omega (Ω) = Percentage Change in Option Value (V) / Percentage Change in Underlying Price (S)

Or

Omega (Ω) = Δ x Current Price of Underlying Asset (P) / Current Price of the Option (C)

Where,

Δ = Delta, which indicates how much the option's price is likely to change when the price of the asset moves. The formula to calculate Delta is,

Delta = (Change in Option Price) / (Change in Price of the Underlying Asset)

Consider a trader having an option on a stock which is currently priced at Rs. 1000. The option for the stock is priced at Rs. 40. If the stock price increases by 1% resulting in Rs. 1010, the option price increases to Rs. 44.

The calculation of the omega of the option in this example is shown below.

Calculating the percentage change in the option’s value (V) and the underlying stock’s price (S)

Percent Change in Option Value (V) = [(44-40) / 40] * 100 = 10%

Percent Change in Underlying Price (S) = [(1010-1000) / 1000] * 100 = 1%

Calculating Omega using the above data,

Omega (Ω) = Percentage Change in Option Value (V) / Percentage Change in Underlying Price (S)

Omega (Ω) = 10% / 1% = 10

An Omega of 10 here means that for every 1% change in the price of the underlying stock, the option’s value changes by 10%.

Consider a trader having an option with the current price of Rs. 50 and the current price of its underlying asset at Rs. 1000. The Delta for the option is 0.6.

Calculating the Omega of the option using the above data.

Omega (Ω) = Δ x Current Price of Underlying Asset (P) / Current Price of the Option (C)

Omega (Ω) = 0.6 x 1000 / 50 = 12

The Omega of 12 here implies that for a 1% change in the price of the underlying asset, the price of the option is expected to change by 12%. If the price of the underlying asset increases by 1% (Rs. 10 in this case), the price of the option would increase by 12% of Rs. 50, which is Rs. 6. Therefore, the new option price would be Rs. 56.

The concept of Omega, although less popular is of significant importance to traders across the globe. As mentioned above, omega provides a deeper insight into the leverage effect of an options position. The understanding and interpretation of omega is particularly important when it comes to volatile markets where any small movements in the underlying asset can lead to significant changes in the value of the option. For example, a high omega indicates that the option is highly sensitive to price changes, which can lead to substantial gains if the market moves favourably, but also to significant losses if it moves against the trader's position. With a better understanding of omega, traders can better assess the potential risk and return, manage their exposure more effectively, and make more strategic decisions regarding entry and exit points in their trading strategies. This knowledge is essential for optimising trading performance and ensuring that risk management practices are adequately aligned with market conditions.

Omega of the options can tell the traders the sensitivity of the price of the option to that of the underlying asset. This knowledge can be a very useful tool for traders in multiple ways. The uses of omega in options trading are highlighted hereunder.

Omega plays a crucial role in enhancing trading strategies. Traders can use Omega to identify options with the desired level of sensitivity to market movements. For example, if a trader anticipates a significant upward move in the underlying asset, they may prefer options with a higher omega to maximise their potential gains. On the other hand, in a less volatile market or when traders are aiming to reduce risk, they may choose options with a lower omega. Therefore, the integration of omega into the trading strategy allows traders to tailor their positions in alignment with their market outlook and risk tolerance.

Effective risk management is paramount in options trading, and Omega is instrumental in this aspect. A high Omega indicates that an option's price is highly sensitive to changes in the underlying asset's price, which can lead to substantial gains or losses. Traders can use omega to manage their risk exposure by adjusting their positions accordingly. For example, in volatile markets, traders might reduce their position size in options with higher omega or implement hedging strategies to mitigate potential losses. A clear understanding of omega is useful for traders to maintain a balanced risk profile and avoid overexposure to market fluctuations.

Furthermore, omega can be used for developing and refining hedging strategies. Hedging allows traders to protect their portfolio against the downward risk. Traders who hold positions in the underlying asset and seek to protect against downside risk can use omega to select appropriate options. For example, lower omega options can provide more stable hedging by reducing the impact of market volatility on the portfolio. This helps in achieving a more controlled and predictable outcome for traders which is crucial for capital preservation in uncertain market conditions.

Omega assists traders in selecting the most appropriate options contracts based on their trading goals. Omega can help traders, particularly those navigating the NSE and BSE markets, in identifying which options provide the desired level of exposure to price changes in the underlying asset. This selection process is crucial for both speculative and conservative trading strategies. For example, traders looking for aggressive growth might opt for high-Omega options, while those seeking stability might prefer lower-Omega options.

The Indian options market, like any other, is influenced by changing market conditions, including volatility, interest rates, and time decay. Omega helps traders stay agile by allowing them to make dynamic adjustments to their strategies based on real-time data. Regularly updating omega calculations ensures that traders can respond promptly to market shifts, optimising their positions to align with the current market environment.

Read More: What are popular options trading strategies?

Omega is a step further in understanding the dynamics of options trading and refining a trading portfolio in the face of constant market volatility. While the use of omega is not as frequent as it should be for an average trader, a deeper understanding of this concept is a crucial step in the path to becoming a successful options trader.

This article is an extension of our series on options greeks. Let us know if you have any queries on this topic and we will address them soon. Watch out this space for more information on options greeks and options trading in general.

Till then Happy Reading!

Read More: Get Real-time Market Data for Quick Trading Decisions

There has been a significant increase in the number of traders in the Indian st...

Options trading is one of the most significant trading segments and is gaining i...

In India F and O trading has seen record-breaking volumes, but most retail trade...