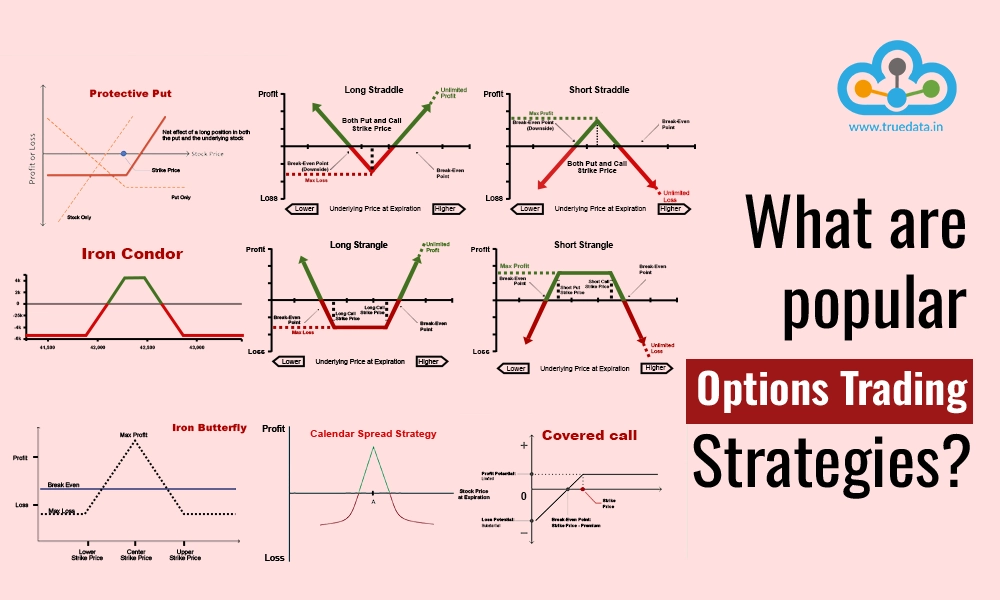

What are the requirements for effective options trading? It is a clear understanding of the price and volume movements of the underlying assets as well as the various trading strategies to successfully execute the trading plan. Some of the popular options trading strategies include iron condor, covered call, long or short straddle, and iron butterfly. While we have discussed the iron condor strategy in detail in our previous blog, let us now understand the iron butterfly options trading strategy and the differences between the two. Read More: What is the Morning Star Candlestick Pattern?

What are the requirements for effective options trading? It is a clear understanding of the price and volume movements of the underlying assets as well as the various trading strategies to successfully execute the trading plan. Some of the popular options trading strategies include iron condor, covered call, long or short straddle, and iron butterfly. While we have discussed the iron condor strategy in detail in our previous blog, let us now understand the iron butterfly options trading strategy and the differences between the two. Read More: What is the Morning Star Candlestick Pattern?

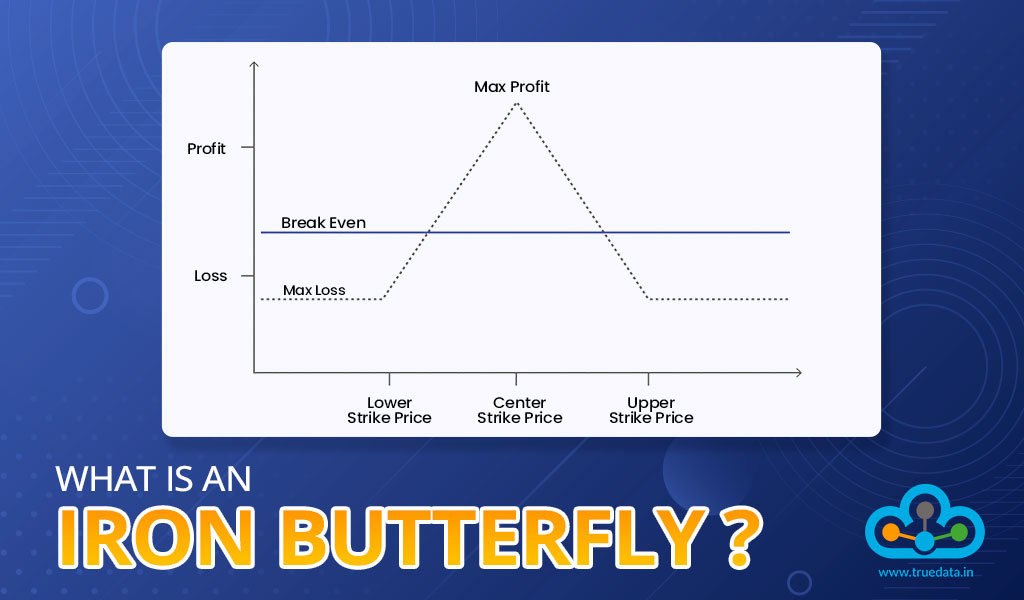

The Iron Butterfly is an options trading strategy that uses both call and put options to create a position with limited risk and limited profit potential. This strategy is typically employed when a trader expects minimal price movement in the underlying asset. an investor might use the Iron Butterfly strategy when they anticipate that the price of the underlying asset will remain relatively stable in the near term. This strategy allows them to collect premiums from selling both the call and put options, providing a source of income. However, the capped profit potential and limited risk make it crucial for the trader to carefully assess market conditions and choose strike prices that align with their expectations. traders often consider the Iron Butterfly as a neutral strategy suitable for low-volatility scenarios. By leveraging both call and put options, the strategy offers a balanced approach to capitalising on stability in the market, making it appealing for investors seeking income generation in relatively quiet market conditions. Factors like implied volatility and time decay play a significant role in the success of this strategy, so thorough analysis and monitoring are essential. Furthermore, traders should be vigilant about market changes and carefully manage the trade, as sudden shifts in volatility or significant price movements could impact the outcome of the Iron Butterfly strategy.

The Iron Butterfly options trading strategy involves using multiple options contracts to create a position with limited risk and limited profit potential. It is essentially a combination of a long straddle and a short strangle. There are two versions of the Iron Butterfly strategy, namely, the long Iron Butterfly and the Short Iron Butterfly. These strategies are explained in detail hereunder.

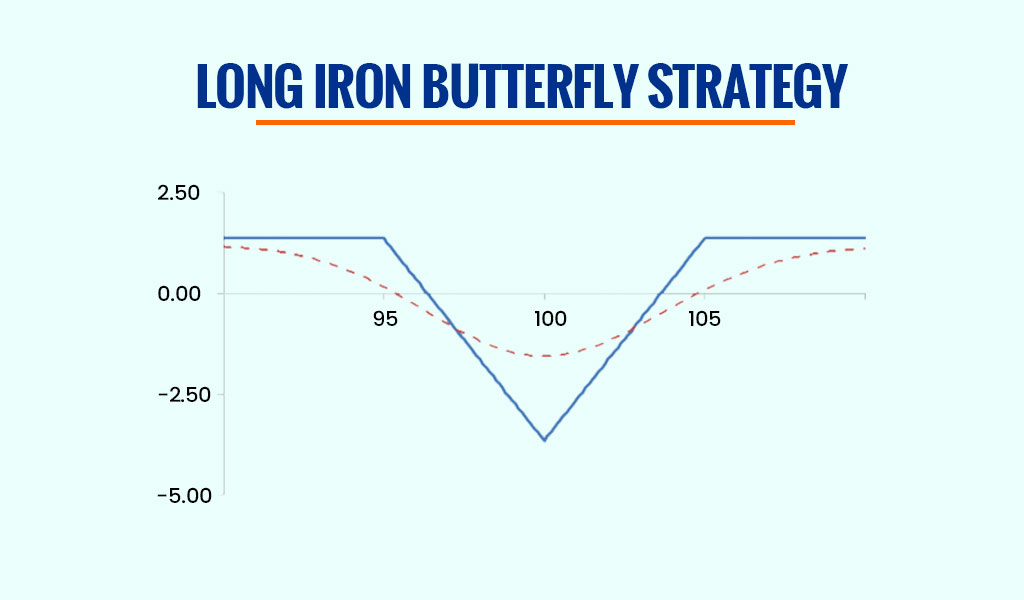

This strategy is implemented when an investor expects minimal price movement in the underlying asset. It involves buying both a call and a put option with the same expiration date. There are three strike prices in this strategy, Strike Price A (this is the at-the-money strike, where the underlying asset's price is currently trading), Strike Price B and Strike Price C (these are out-of-the-money strikes, with B being lower than A, and C being higher than A). The steps to implement this strategy are explained below.

This strategy is implemented when an investor expects minimal price movement in the underlying asset. It involves buying both a call and a put option with the same expiration date. There are three strike prices in this strategy, Strike Price A (this is the at-the-money strike, where the underlying asset's price is currently trading), Strike Price B and Strike Price C (these are out-of-the-money strikes, with B being lower than A, and C being higher than A). The steps to implement this strategy are explained below.

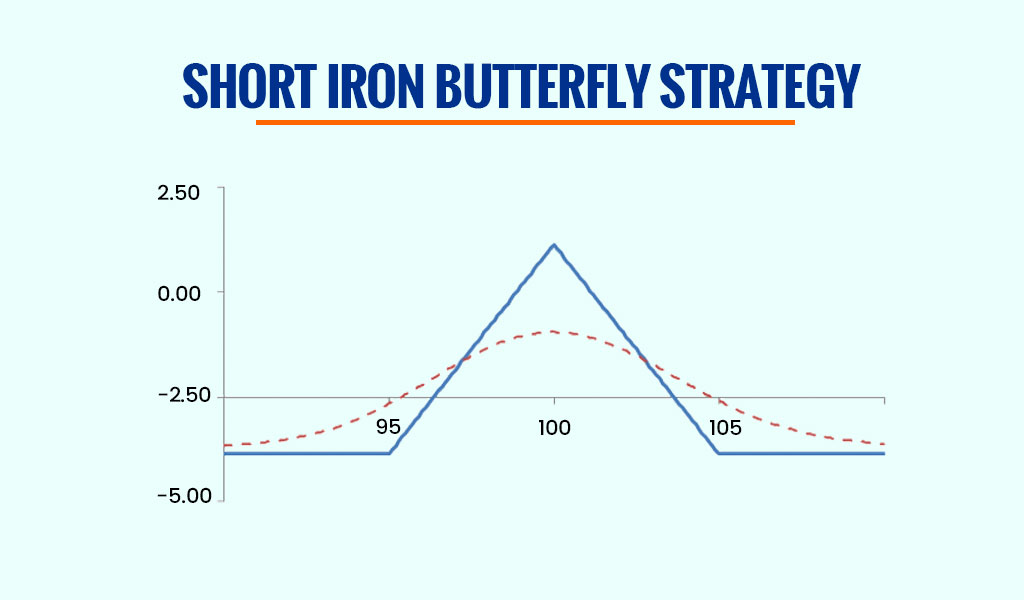

This strategy is implemented when an investor expects significant price stability in the underlying asset. It involves selling both a call and a put option with the same expiration date. There are three strike prices in this strategy, Strike Price A (this is the at-the-money strike, where the underlying asset's price is currently trading), Strike Price B and Strike Price C (these are out-of-the-money strikes, with B being lower than A, and C being higher than A). The steps to implement this strategy are explained below.

This strategy is implemented when an investor expects significant price stability in the underlying asset. It involves selling both a call and a put option with the same expiration date. There are three strike prices in this strategy, Strike Price A (this is the at-the-money strike, where the underlying asset's price is currently trading), Strike Price B and Strike Price C (these are out-of-the-money strikes, with B being lower than A, and C being higher than A). The steps to implement this strategy are explained below.

When establishing the Iron Butterfly position, it's crucial for the trader to carefully consider the cost of entering the trade. The goal is to ensure that the premiums received from selling the at-the-money options (A) effectively offset the cost of buying the out-of-the-money options (B and C). The trader aims to achieve a net premium inflow while maintaining a position with limited risk and limited profit potential. In terms of profit and loss, the maximum loss occurs if there is a significant move in either direction of the underlying asset's price. Conversely, the maximum profit is realised if the price of the underlying asset remains precisely at strike A at the time of expiration. This strategy is particularly advantageous in low-volatility scenarios where stability in the price of the underlying asset is anticipated.

The execution of the iron butterfly strategy is further explained with an example hereunder.

Suppose a trader is considering the Long Iron Butterfly strategy for stock XYZ Ltd., which is currently trading at Rs. 1,200. The trader expects minimal price movement over the next month and wants to capitalise on low volatility. Execution Steps -

Net Premium - The net premium paid is Rs. 20 (Rs. 10 + Rs. 15 - Rs. 10 - Rs. 15), representing the trader's maximum potential loss. Maximum Profit and Loss -

Break-Even Points -

Let us now consider a trader implementing the Short Iron Butterfly strategy for the same stock, XYZ Ltd., at Rs. 1,200. Execution Steps -

Net Premium Received - The net premium received is Rs. 20 (Rs. 10 - Rs. 15 + Rs. 10 - Rs. 15), representing the trader's maximum potential profit. Maximum Profit and Loss:

Break-Even Points

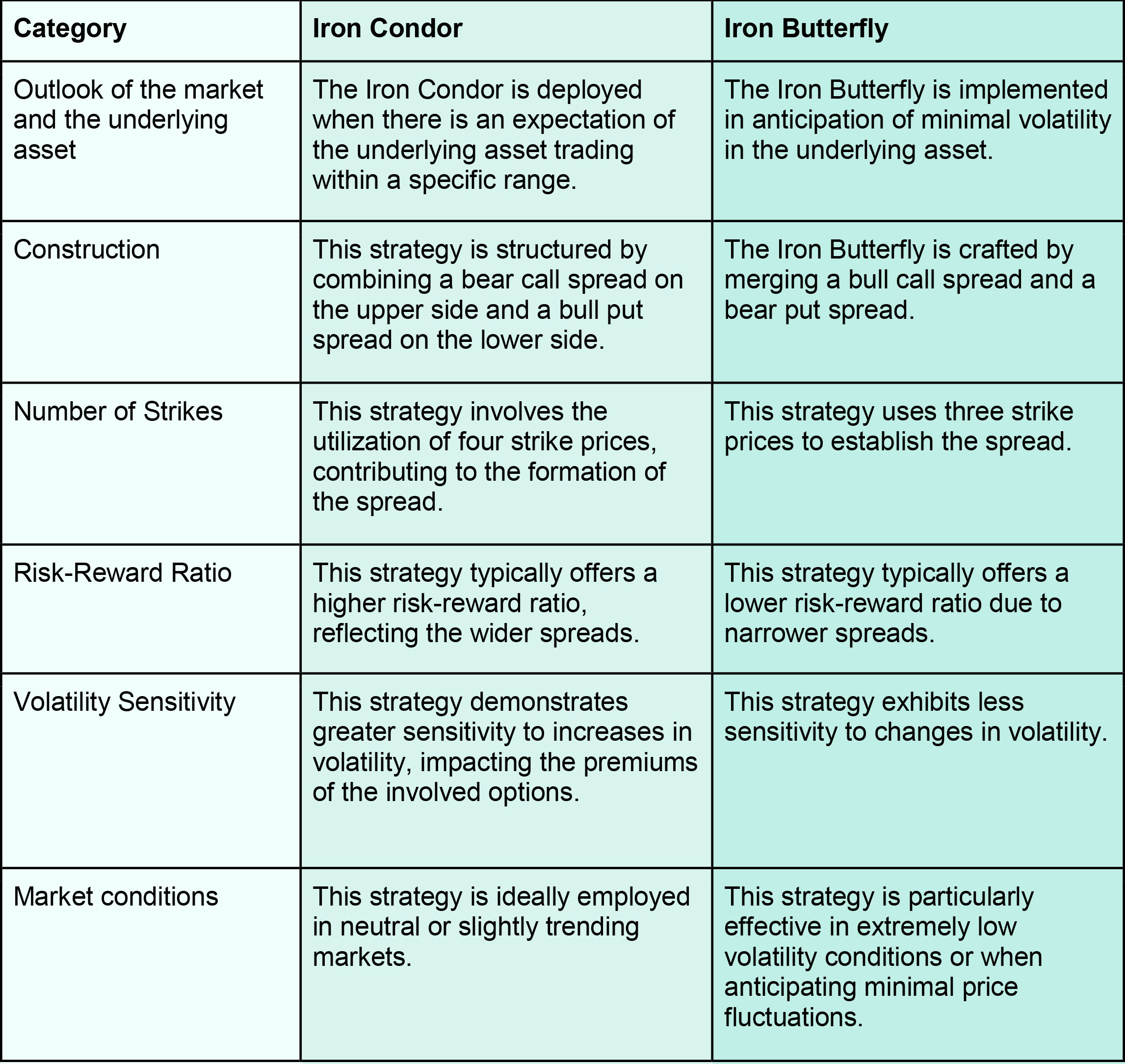

The iron condor strategy is another popular options trading strategy that is often used by traders and involves the use of call and put options. However, there are a few significant differences that traders need to understand for the successful implementation of these strategies. These pointers are tabled hereunder.

Options trading is often considered to be a fine art of balancing the price fluctuations of the underlying asset and profiting from the same. Strategies like Iron Butterfly allow traders to profit even from low volatile market conditions where the risk is limited thereby ideal even for risk-averse traders. This article attempts to simplify another important options trading strategy after the iron condor strategy from our previous blog. Let us know if you have any queries regarding the same or want to know more about such options trading strategies and we will take them up in our coming blogs. Till then Happy Reading!

Read More: Real-Time & Historical Stock Data with True Data Velocity Plugin

Did you know that the recent SEBI regulations have resulted in a drastic 75 redu...

When we talk about trading, which security is the most common one that comes to ...

India is increasingly becoming a dominant options trading market with the highes...