Options trading is one of the most significant trading segments and is gaining increasing popularity in various markets. For many options traders, Options Greeks often seem to be a technical and difficult concept to understand and successfully implement in their options trading. We have attempted to simplify this concept in our previous blogs and shed light on the Delta Greeks, Gamma Greeks and Theta Greeks. This blog is a step further in the Options Greeks Segment which talks about Vega Greeks. Have you heard about them? Check out this blog to learn the basics of Vega Greeks and how to use it for options trading.

Read More: What are Options Greeks?

The concept of Vega Greeks is linked to the concept of implied volatility. Therefore, to understand Vega Greeks, first, you need to understand implied volatility and its impact on options trading.

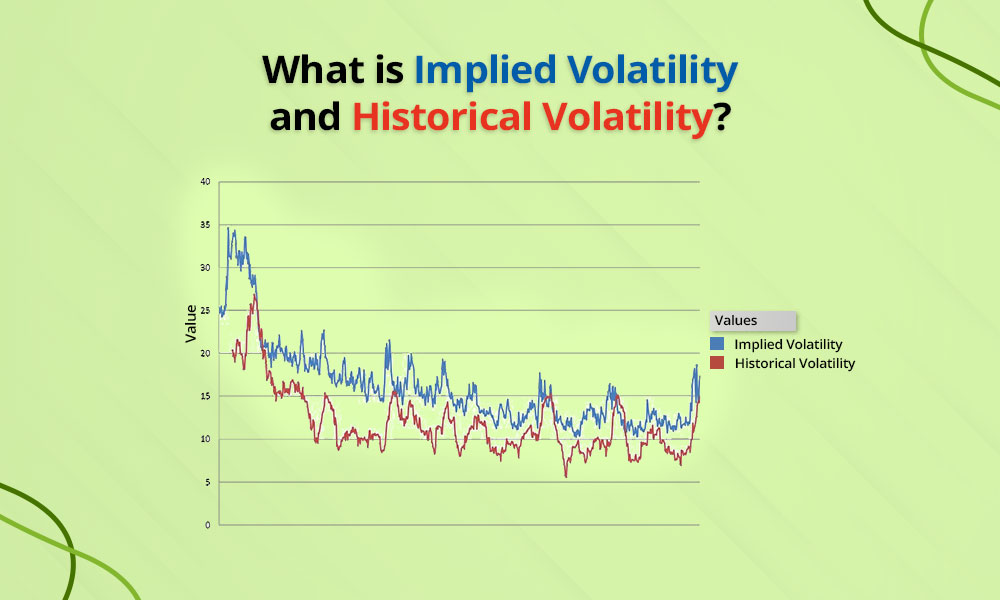

Implied Volatility (IV) is a measure of the market expectations regarding future price fluctuations of the underlying security and is, therefore, a crucial component in determining the pricing of options. When market participants anticipate increased price volatility, the demand for options often rises, causing their prices to increase. On the other hand, low implied volatility usually results in lower option prices. IV is not derived from historical price movements but is rather an output of option pricing models, such as the Black-Scholes model. Traders use IV to gauge the market's sentiment and expectations about potential future price swings. A high IV may suggest uncertainty or an upcoming event, influencing a trader's decision on whether to buy or sell options.

Historical Volatility (HV), on the other hand, measures the past price fluctuations of the underlying asset. It is calculated by analysing the actual price movements over a specific period, often using standard deviation. HV helps traders understand how much the price of the underlying asset has deviated from its average in the past. While historical volatility doesn't predict future market movements, it provides a reference point for assessing the potential risk associated with an asset. Traders often use HV to identify periods of relative price stability or volatility in the past which in turn helps them make informed decisions about the appropriateness of certain options strategies.

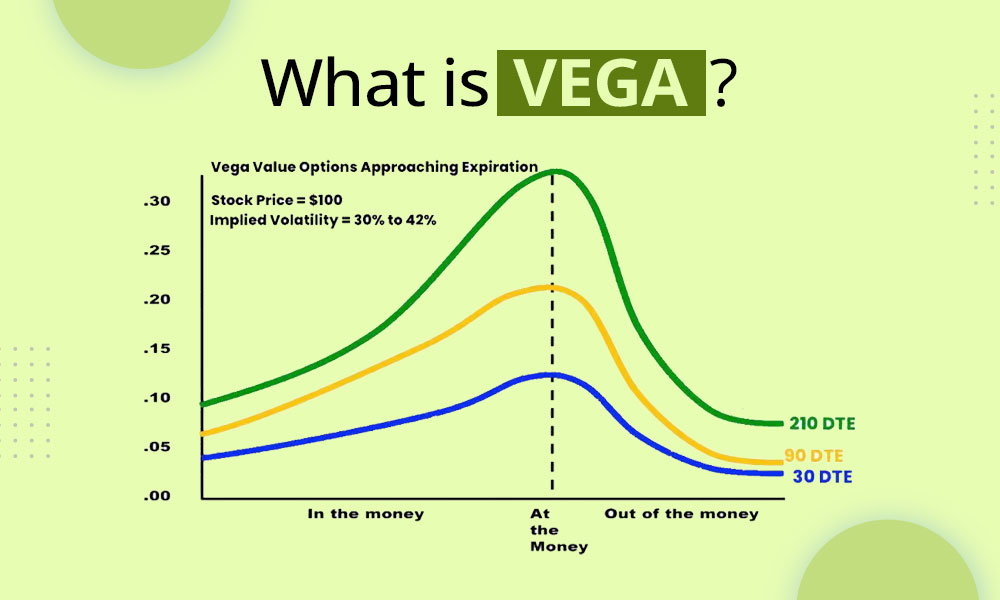

Vega is part of the Options Greeks that measures the sensitivity of an option's price to changes in implied volatility. In options trading, volatility refers to the degree of variation of a trading price series over time. Vega quantifies how much an option's price is expected to change for a 1% increase in implied volatility. Understanding Vega is crucial for traders as it directly impacts option prices. When implied volatility increases, the demand for options typically rises, leading to an increase in their prices. Conversely, when implied volatility decreases, option prices tend to fall.

Traders can use Vega to assess the potential impact of changes in market sentiment and adjust their strategies accordingly. If a trader expects volatility to increase, they may favour options with higher Vega to capitalise on potential price movements. Conversely, in periods of expected low volatility, they may prefer options with lower Vega to manage costs. Vega is particularly important for option buyers and sellers, influencing their risk management decisions and overall trading strategies in the options market.

The use of Vega and its significance in options trading can be explained hereunder.

Vega helps traders gauge market sentiment by measuring the impact of expected changes in implied volatility. When Vega is high, it suggests that options traders anticipate significant future price swings. High Vega values may indicate uncertainty or upcoming events affecting the market, allowing traders to align their strategies accordingly.

Vega is a vital factor when selecting options. Traders can use Vega to identify options that are likely to benefit from an increase in implied volatility. For instance, during anticipated market events, choosing options with higher Vega can potentially amplify profits if volatility rises as expected.

The impact of Vega on options premiums is particularly relevant for traders, where markets can experience sudden shifts. A rise in implied volatility often accompanies market uncertainty. Understanding how Vega influences option premiums enables traders to anticipate potential changes in option prices. This knowledge empowers traders to make strategic decisions, such as entering positions when volatility is expected to increase or avoiding excessive premium exposure in stable market conditions.

Markets can be influenced by various factors, including economic data releases and global events. Vega plays a crucial role in managing volatility risk. Traders can employ hedging strategies that involve offsetting Vega values, aiming to neutralise the impact of changes in implied volatility. This is particularly relevant for traders seeking to protect their portfolios from unexpected market swings while still maintaining exposure to their desired market direction.

Given the dynamic nature of the Indian market, traders must adapt swiftly to changing conditions. Vega provides a means to do this effectively. Traders can adjust their option positions based on Vega exposure, allowing them to navigate evolving market scenarios. Whether it's tightening risk management during periods of heightened volatility or capitalising on opportunities presented by changing market conditions, Vega becomes a valuable tool for traders to stay flexible and responsive.

Vega is the next stage of understanding Options Greeks and implementing them for successful options trading. By incorporating Vega analysis into their decision-making process, traders can gain insights into market sentiment as well as adapt their trading plan based on the changing market conditions.

This blog was a brief attempt to understand Vega and its importance in options trading. Let us know if you have any queries related to this topic or any other Options Greeks covered before.

Till then Happy Reading!

India is increasingly becoming a dominant options trading market with the highes...

There has been a significant increase in the number of traders in the Indian st...

In India F and O trading has seen record-breaking volumes, but most retail trade...