For the past few years, we have been constantly saying that Indian stock markets are on a bull run and will see many milestones on the way ahead. Just recently in September 2023, Sensex and Nifty saw an all-time high followed by a brief market correction. This, however, has not changed the perception of the Indian stock markets across the globe which affirms the rising position of India not only in the global south but also as the third largest economy in the coming years. So how did the Indian stock markets perform against their global counterparts and what are the possible reasons for such a positive outlook of the Indian indices? Let us delve into all this and more in this blog.

How have the Indian stock markets performed as compared to world indices?

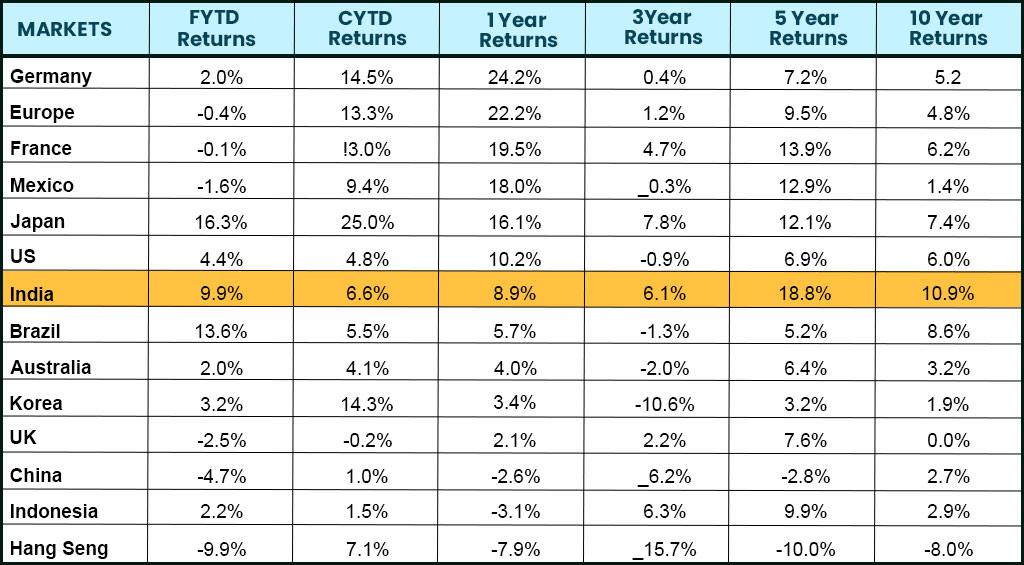

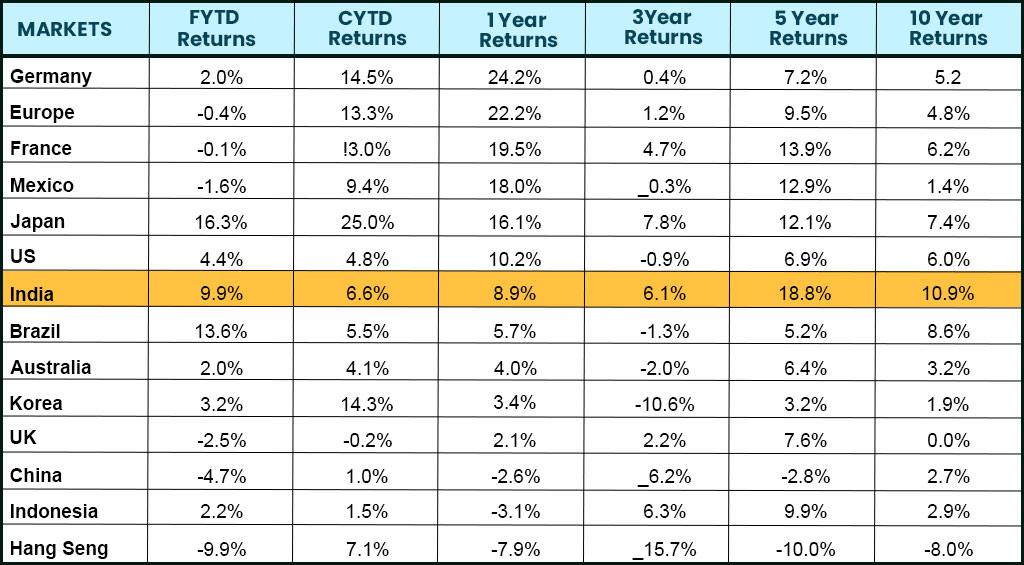

When we talk about the major stock markets across the globe, the US indices top the chart. The European stock markets, Hong Kong, Taiwan, and Japanese markets are also considered quite important on the global scale. Over the past decade, the Indian stock market has demonstrated remarkable performance, with the Nifty large-cap index delivering an annualised return of 10.9%. This outpaces the 6% return of the US index and the 2.7% return of China's market, according to ASK Investment Managers' report. In the last five and three years, India has also excelled, with annualised returns of 18.8% and 6.1%, respectively, surpassing major global indices. Impressively, over the last 123 years, India's stock market has consistently provided a real return of 6.6% outperforming both the US and China, underscoring its robust compound annual growth rate (CAGR) of 6.6% compared to 6.4% for the United States and 3.3% for China since 1900.

The Indian stock markets have showcased its strength as a lucrative investment destination, consistently delivering superior returns over the short-term and long-term thereby outshining major global markets and maintaining a strong compound annual growth rate (CAGR) over its extensive history.

A snapshot of the performance of the Indian stock markets in comparison to the other countries is given below

(Source: Bloomberg, ASK IM Research, in local currency - till 31st August 2023)

(Source: Bloomberg, ASK IM Research, in local currency - till 31st August 2023)

What are the reasons behind the rise in Nifty and Sensex?

A few reasons that can be attributed to the rise in the Indian stock markets and the bullish approach of domestic and international investors towards them are explained below.

India's Strong Economic Fundamentals

- India's consistent long-term economic performance is attributed to a stable domestic macroeconomic environment and robust real GDP growth.

- In 2022-23, India achieved a GDP growth rate of over 7%, with expectations of maintaining over 6% growth in 2023-24.

- India's growth rates are driven by structural factors, reducing vulnerability to global macroeconomic fluctuations.

Demographic Advantage

- India benefits from a youthful and expanding population, positioning it competitively.

- By 2030, India is expected to have a significant working-age population with growing incomes, creating a demographic dividend.

Strong Corporate Performance

- The first quarter of the year showcased strong corporate performance, with Nifty posting a year-on-year PAT growth of over 30%.

- Oil marketing companies played a significant role in this growth due to a favourable Q1FY23 base, while Nifty (Ex OMCs) also performed well with around 19% PAT growth.

- Margin expansion across sectors, driven by falling input costs, contributed to superior profit growth despite a 4% growth in aggregate sales for the top 500 businesses.

Sectoral Growth Dynamics

- Key sectors driving growth included automobiles, oil and gas, insurance, banks, and capital goods.

- Conversely, sectors linked to global markets such as chemicals, IT sector, and metals, as well as low-ticket consumption, experienced more significant slowdowns.

What are the factors affecting Indian Stock markets?

It is a fact that the stock markets are volatile and are influenced by many micro and macroeconomic factors. Some of the common factors affecting stock markets include the financial reports of the company, the political stability in the country, the increase in inflation in the country, etc. Apart from such factors, the common macroeconomic factors or the global factors and their relationship with the Indian stock markets are explained below.

US Federal Reserve Rates and Indian Stock Markets

- The US Federal Reserve's interest rate decisions have a substantial impact on Indian stock markets.

- When the Federal Reserve (often referred to as the Fed) raises interest rates, it can have ripple effects globally, including in India.

- An increase in US interest rates tends to attract capital flows into the United States, as it offers higher returns on investments denominated in US dollars.

- This can result in Foreign Institutional Investors (FIIs) withdrawing funds from Indian markets, leading to potential declines in Indian stock prices.

- Conversely, when the Fed lowers interest rates, it can encourage FIIs to invest more in Indian stocks, as the returns on US assets become relatively less attractive.

Dollar Index and Indian Stock Markets

- The Dollar Index plays a crucial role in influencing Indian stock markets.

- Typically, there exists an inverse relationship between the Dollar Index and the Indian stock market.

- When the Dollar Index falls, it tends to attract more investments from Foreign Institutional Investors (FIIs) in Indian stocks because they offer higher returns compared to holding dollars.

- Conversely, a strengthening Dollar Index often leads to FIIs pulling out capital from Indian markets, potentially causing declines.

US Treasury Bonds and Stock Markets

- US Treasury Bonds, considered one of the safest investments globally, have a significant impact on stock markets worldwide, including India.

- An increase in Treasury bond yields indicates higher borrowing costs for businesses, discouraging capital expenditure and expansion plans.

- Investors perceive rising yields negatively as it can affect business profitability, leading to a decline in equity markets.

- Hence, there is often an inverse relationship between rising Treasury yields and stock market performance, as investors shift from equities to safer assets like bonds.

Crude Oil Prices and Indian Equities

- India's heavy reliance on oil imports, accounting for over 85% of domestic consumption, makes crude oil prices a critical factor for Indian stock markets.

- Industries such as transportation, refineries, aviation, and more are directly impacted by global crude oil price fluctuations.

- Higher oil prices can lead to trade deficits, increased input costs, reduced corporate profitability, and inflation, all of which negatively influence market sentiment and stock prices.

- Consequently, there tends to be an inverse relationship between crude oil prices and the Indian equity market.

Nasdaq Index and Indian IT Sector

- The Nasdaq Index, a global tech benchmark, has a substantial impact on the Indian IT sector.

- Many Indian IT companies generate a significant portion of their revenues from the US market and have a strong presence there.

- A strong performance of the Nasdaq Index often boosts demand for Indian IT stocks, as it signals optimism in the global technology sector, and vice versa.

SGX Nifty as an Indicator

- The SGX Nifty, based in Singapore, acts as an early indicator of the Indian stock market's likely performance on the following day.

- It is essentially a futures contract linked to India's benchmark Nifty 50 index.

- Investors use the SGX Nifty to gain insights into the upcoming Indian stock market conditions, helping them make more informed investment decisions.

Indian ADRs and Their Impact

- Indian ADRs, or American Depositary Receipts, are shares of Indian companies traded on US stock exchanges.

- ADRs offer investors insights into the performance of Indian companies and can influence the Indian stock market.

- The prices of Indian ADRs are closely linked to their Indian counterparts, so fluctuations in ADR prices can lead to corresponding movements in the Indian stock market.

Conclusion

The fluctuations in Indian stock markets cannot be ignored and are often a result of the normal demand and supply function of the markets. However, the overall outlook of the domestic and international players towards the Indian economy and its stock markets can only be reiterated by the resounding response India received to the recently held G20 meetings in the country and the fact that ours is the only fastest growing economy before and after the impact of Covid pandemic and the ongoing war. We hope this blog was able to provide you with a brief outlook on the performance of the Indian stock markets against its global peers and help you gain the bigger picture. Let us know if you need any further details or explanation on any of the factors mentioned above or any other topic related to stock markets and we will take that up in our coming blogs.

Till then Happy Reading!

Read More: Financial Regulators in India

(Source: Bloomberg, ASK IM Research, in local currency - till 31st August 2023)

(Source: Bloomberg, ASK IM Research, in local currency - till 31st August 2023)