Mutual funds offer a wide variety of benefits for investors making them one of the top investment choices. However, one of the major disadvantages of active funds is the higher risk and often fund manager bias. Enter Index funds and ETFs. While index funds are more like any other mutual funds, ETFs are more like stocks as they are traded on stock exchanges. The latest rules from SEBI for ETFs pertain to the NAV of the ETF also known as the iNAV or the indicative NAV for the ETF. Have you heard about it? Check out this blog to learn the meaning of iNAV and its importance for traders to have a successful portfolio.

iNAV, or Indicative Net Asset Value, is an intraday, real-time estimate of the Net Asset Value (NAV) of an Exchange Traded Fund (ETF). Unlike the end-of-day NAV for other mutual funds, which is calculated only once after the market closes, the iNAV gives an ongoing, minute-by-minute estimate of the value of a fund’s holdings during market hours. It helps investors gauge whether the price of the ETF on the exchange is trading at a premium or discount compared to its actual value. This is particularly useful for traders and investors who want to make quick buying or selling decisions, as it gives them an updated view of the fund's worth as its underlying assets fluctuate throughout the day. In India, where ETF trading has multiplied, iNAV provides a checkpoint as a transparency tool, helping retail and institutional investors stay informed and make more accurate trades.

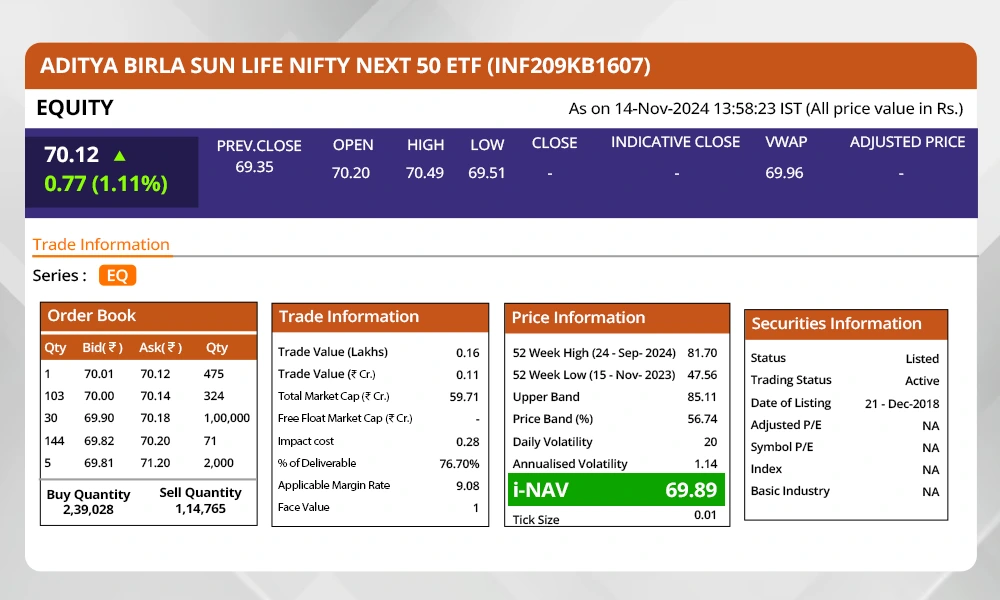

Traders can find the iNAV of any ETF through the NSE or BSE website, the AMC website directly or their broker’s website where it is updated continuously.

For example, iNAV data on the NSE website for Aditya Birla Sun Life Nifty Next 50 ETF

The Net Asset Value (NAV) for mutual funds is calculated at the end of the day and is based on the assets and liabilities of the fund. The formula to calculate a simple NAV of any mutual fund is

NAV (Net Asset Value) Formula = (Total assets - Total Liabilities) / Number of Outstanding units of the mutual fund.

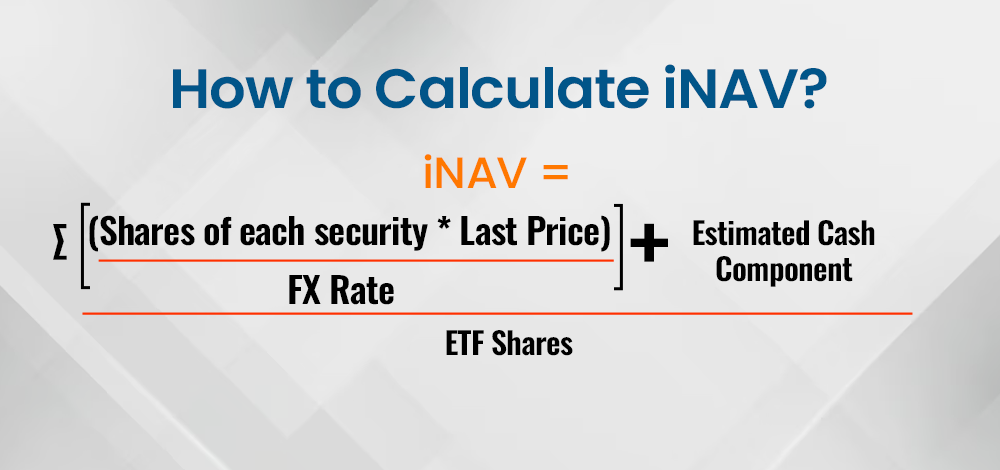

However, calculating the iNAV or the intraday NAV of ETFs is more complex. The intraday NAV (iNAV) of an ETF gives an up-to-the-minute estimate of the value of a single ETF share, based on the prices of its underlying holdings. This starts with the calculation basket, a selection of securities that represents the value of one ETF share. To calculate iNAV, a calculation agent multiplies the latest price of each security in this basket by the number of shares of that security in the basket. The total values of all securities are added together, along with any cash components, and liabilities are subtracted. This sum is then divided by the number of ETF shares in a standard creation unit to get the iNAV, or per-share value, of the ETF.

The formula for iNAV is explained below.

iNAV = {[∑ (Shares of each security * Last Price)] / Fx Rate / ETF Shares} + (Estimated Cash Component / ETF Shares)

The calculation of the iNAV explained with a simple example is given below.

Consider an ETF with 100 shares of Stock A at Rs. 200 each and 200 shares of Stock B at Rs. 150 each, Rs. 10,000 in cash, Rs. 5,000 in liabilities and 1,000 total ETF shares in the creation unit. The iNAV for this ETF will be calculated as under.

Calculating iNAV for the abovementioned ETF.

Step 1 - Stock A = 100*200 = Rs. 20000 ; Stock B = 200*150 = Rs. 30000

Step 2 - Sum of all securities = 20000+30000 = Rs. 50000

Step 3 - Add cash component = 50000+10000 = Rs. 60000

Step 4 - Subtract Liabilities = 60000 - 5000 = Rs. 55000

Applying the iNAV formula,

iNAV = {[∑ (Shares of each security * Last Price)] / Fx Rate / ETF Shares} + (Estimated Cash Component / ETF Shares)

iNAV = (50000+10000-50000) / 1000 = Rs. 55

Interpretation of iNAV

The iNAV of Rs. 55 represents the real-time, estimated value of one share of this ETF based on the current values of its underlying holdings, cash, and liabilities and acts as a benchmark for traders. If the ETF’s market price is higher than Rs. 55, it may be trading at a premium, meaning investors are paying more than the underlying asset value. Conversely, if the market price is below Rs. 55, it may be undervalued, potentially presenting a buying opportunity.

iNAV, thus, helps traders find suitable entry and exit positions and identify profitable arbitrage opportunities by providing real-time information on the ETF being overvalued or undervalued. This further enables traders to exploit price differences and make informed portfolio decisions.

SEBI in its circular dated May 23rd 2022 has provided detailed guidelines (on page 10 of the circular) for the iNAV to be updated and disclosed by the stock exchanges. These regulations are explained hereunder.

Continuous Disclosure of iNAV

The iNAV (indicative Net Asset Value) of an ETF represents the real-time per-unit NAV based on the current market value of the ETF's portfolio and must be displayed continuously during trading hours on stock exchanges where the ETF is listed and traded.

Update Requirements by ETF Type

Equity ETFs -

iNAV must be updated within a maximum time lag of 15 seconds in line with the changes in the underlying equity market.

Debt ETFs -

iNAV is required to be disclosed at least four times a day. This includes:

An opening and closing iNAV update.

At least two updates during trading hours, with a minimum 90-minute gap between these updates.

Gold or Silver ETFs

iNAV is based on the most recent price data for gold or silver.

The iNAV can be static (fixed) or dynamic (fluctuating) depending on the availability of the latest gold or silver price data.

International ETFs

iNAV is calculated using the latest data on the ETF’s underlying international portfolio.

The iNAV may be either static or dynamic, depending on the overlap in trading hours between the Indian and international markets.

Mechanism for Data Sharing

Asset Management Companies (AMCs) and stock exchanges must establish an efficient mechanism for sharing iNAV data to ensure accurate and timely updates.

This structure provides traders with transparent, real-time information on ETF values and allows them to track fluctuations in iNAV to make informed trading decisions based on the latest data specific to each type of ETF.

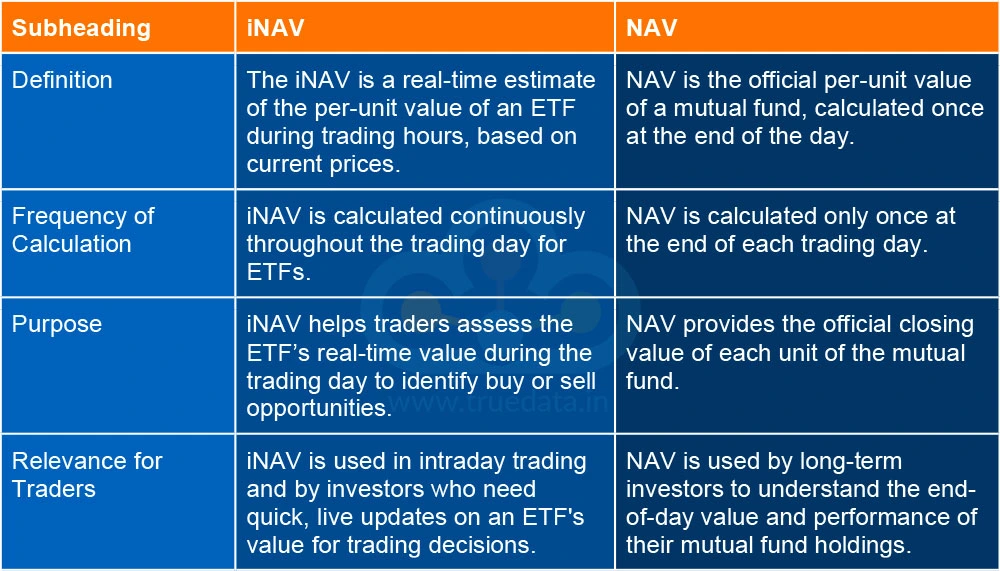

Now that we have seen the meaning and importance of iNAV, let us focus on the key differences between the iNAV and the regular NAV of a mutual fund to have a better understanding of the two.

iNAV or the Indicative Net Asset Value (iNAV) is a crucial tool for traders, providing a real-time estimate of an ETF's value during market hours based on the current prices of its underlying assets. Unlike the daily Net Asset Value (NAV), which is calculated once at the end of the trading day, iNAV is updated continuously (every 15 seconds for equity ETFs). This allows traders to monitor the price fluctuations throughout the day and identify trading opportunities to make informed decisions. Understanding iNAV helps traders spot potential price discrepancies and use the information for arbitrage or optimising their trades while the regulator can ensure transparency and real-time tracking of ETF values in the market.

TrueData also offers the live feed of the iNAV for ETFs traded on NSE and BSE. For more details, you can reach us at support@truedata.in.

This article talks about the iNAV for ETFs and how it has made trading more reliable and simplified especially for intraday traders. Let us know your thoughts on this topic or if you need further information on the same and we will address it.

Till then Happy Reading!

Read More: Index Trading vs Stock Trading

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...