When you think of stock markets, what comes to your mind immediately? It is usually trading in stocks. But did you know trading in stock markets also includes forex trading and commodity trading? Yes, that is right. We have covered many concepts relating to stock trading and also covered the basics of forex trading in our previous blogs. Let us now cover commodity trading and its core details to help traders learn the ropes of commodity trading. Read More: What is forex trading? - All you need to know

When you think of stock markets, what comes to your mind immediately? It is usually trading in stocks. But did you know trading in stock markets also includes forex trading and commodity trading? Yes, that is right. We have covered many concepts relating to stock trading and also covered the basics of forex trading in our previous blogs. Let us now cover commodity trading and its core details to help traders learn the ropes of commodity trading. Read More: What is forex trading? - All you need to know

Commodity trading is the buying and selling of raw materials or primary products, such as metals, agricultural goods, energy resources, and more. It's a financial market where traders can speculate on the price movements of these essential goods. It is an opportunity for traders to participate in a wide range of commodities, from gold and crude oil to spices and agricultural produce. The basic idea is to profit from price fluctuations by purchasing low and selling high, or even making money when prices fall by selling high and buying back at a lower price. Commodity trading can be done in the spot market or the derivative market through the F&O segment or through forward contracts.

Commodity trading is the buying and selling of raw materials or primary products, such as metals, agricultural goods, energy resources, and more. It's a financial market where traders can speculate on the price movements of these essential goods. It is an opportunity for traders to participate in a wide range of commodities, from gold and crude oil to spices and agricultural produce. The basic idea is to profit from price fluctuations by purchasing low and selling high, or even making money when prices fall by selling high and buying back at a lower price. Commodity trading can be done in the spot market or the derivative market through the F&O segment or through forward contracts.

Commodity trading can be done through commodity exchanges, which are dedicated platforms for buying and selling various commodities. The two main commodity exchanges in India are MCX (Multi Commodity Exchange) and NCDEX (National Commodity & Derivatives Exchange). The four main exchanges for commodity trading in India and their details are mentioned below.

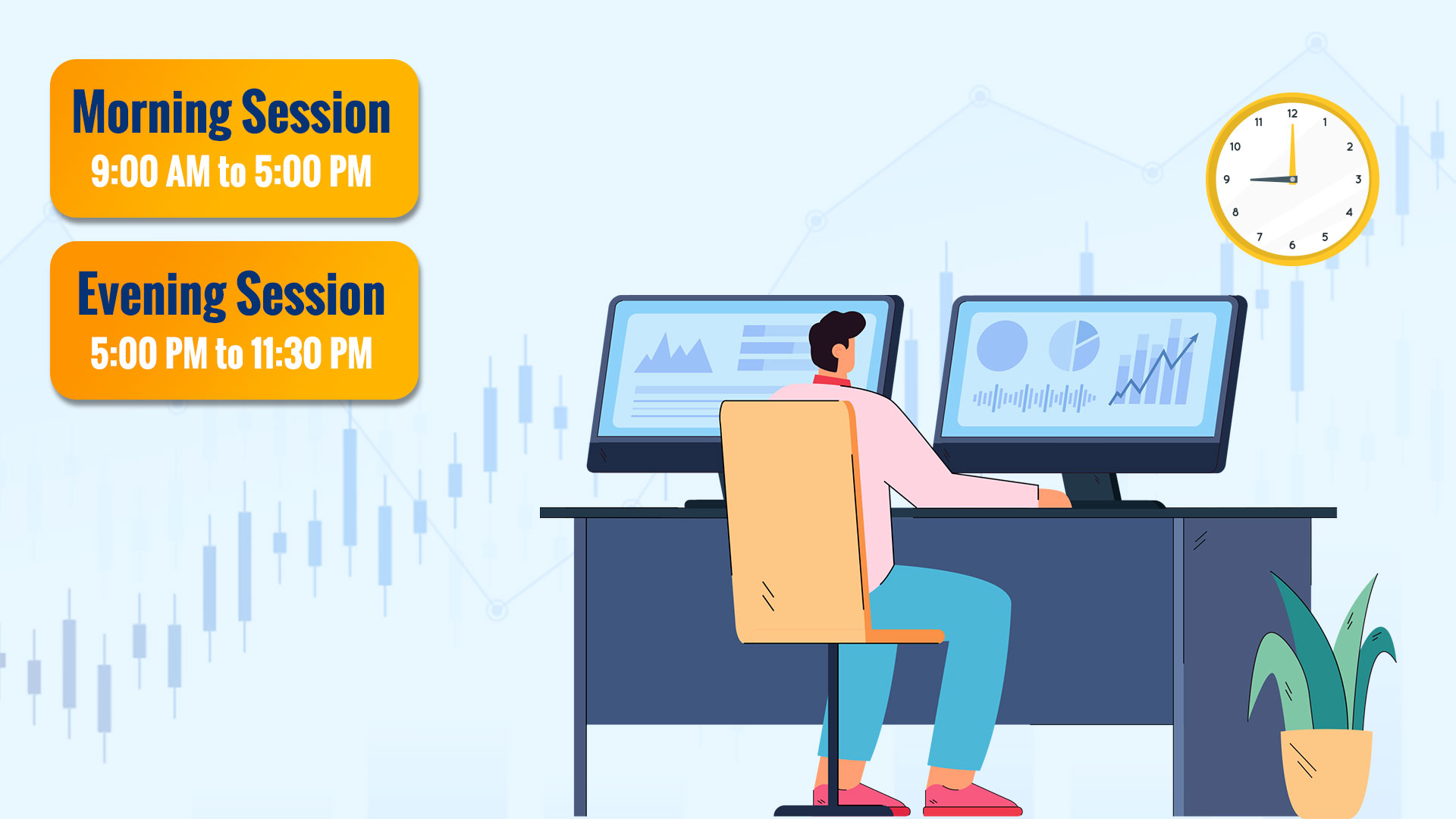

While the trading hours for each commodity exchange can vary, they typically operate in two sessions with the following timings:  Morning Session - 9:00 AM to 5:00 PM Evening Session - 5:00 PM to 11:30 PM These trading sessions provide traders with opportunities to buy and sell commodities within specific timeframes during the trading day. Traders need to understand the rules laid down by these exchanges for effective trading in commodities and the key nuances in order to create a successful trading portfolio.

Morning Session - 9:00 AM to 5:00 PM Evening Session - 5:00 PM to 11:30 PM These trading sessions provide traders with opportunities to buy and sell commodities within specific timeframes during the trading day. Traders need to understand the rules laid down by these exchanges for effective trading in commodities and the key nuances in order to create a successful trading portfolio.

The steps to do commodity trading can be explained hereunder.

The steps to do commodity trading can be explained hereunder.

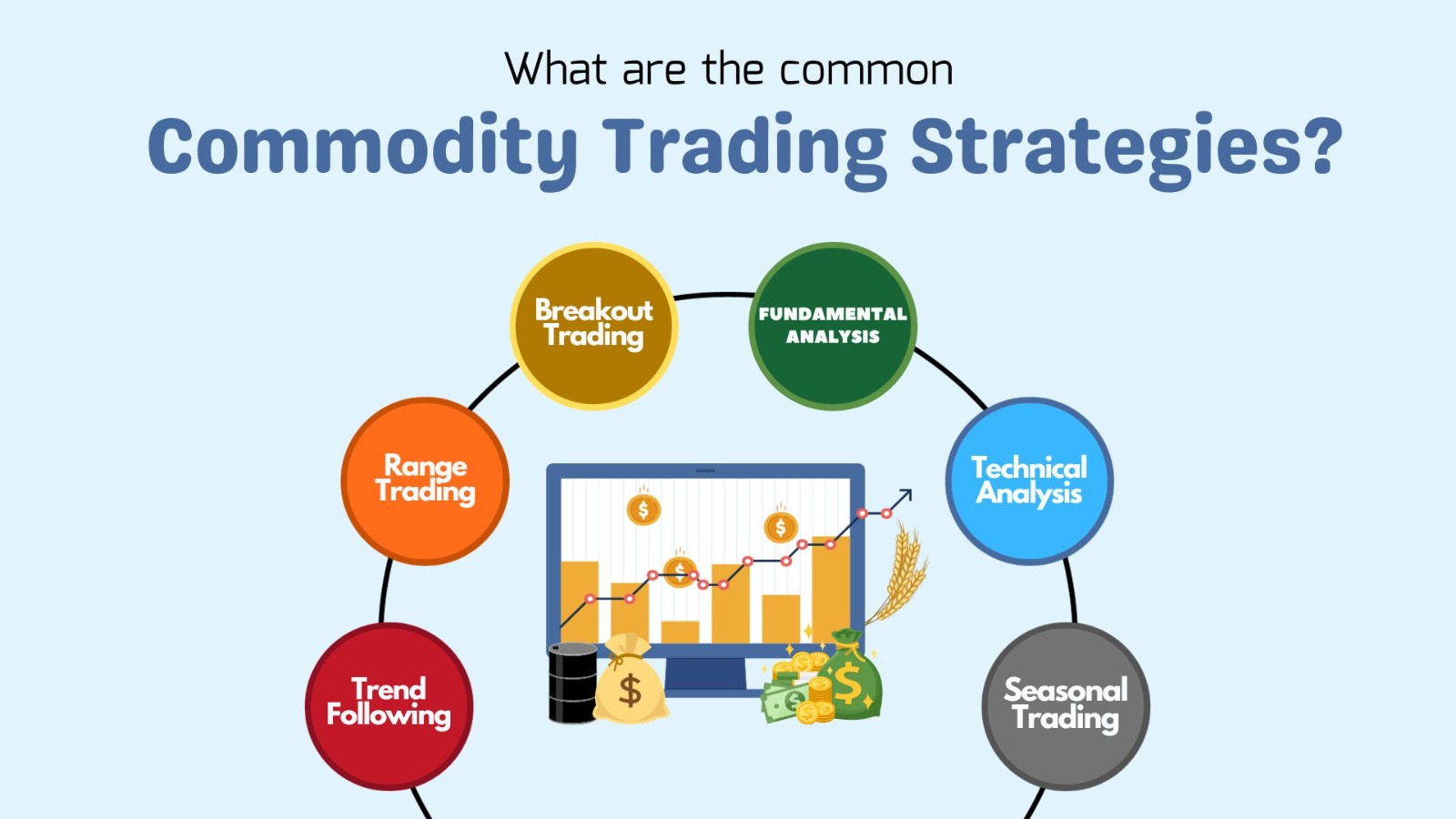

Some of the common commodity trading strategies often used by traders not only in India but also across the world are highlighted below.

Some of the common commodity trading strategies often used by traders not only in India but also across the world are highlighted below.

Commodity trading is a popular form of trading along with equity trading and currency trading. However, commodity trading is often considered riskier than equity trading due to the multitude of factors affecting the prices of commodities across the globe. Therefore, traders need to understand the nuances of commodity trading like the factors influencing the prices and the volumes of commodities being traded and the effect of macroeconomic factors on their prices. We hope this blog was able to provide you with the basics of commodity trading to help you start your trading journey and build a successful trading portfolio.

In the world of high-speed trading, success often hinges on capitalising on even...

Did you know that stock trading is fast becoming one of the most popular searche...

Did you know the number of intraday traders in India increased by over 300 from ...