The world of technical analysis is filled with many tools like candlestick patterns, indicators and more. The use of these tools enables traders to make informed decisions and have a successful trading portfolio. While we have discussed many candlestick patterns earlier, this topic covers the Shooting star pattern in detail. Check out this blog to learn all about shooting star patterns and how to trade using the same.

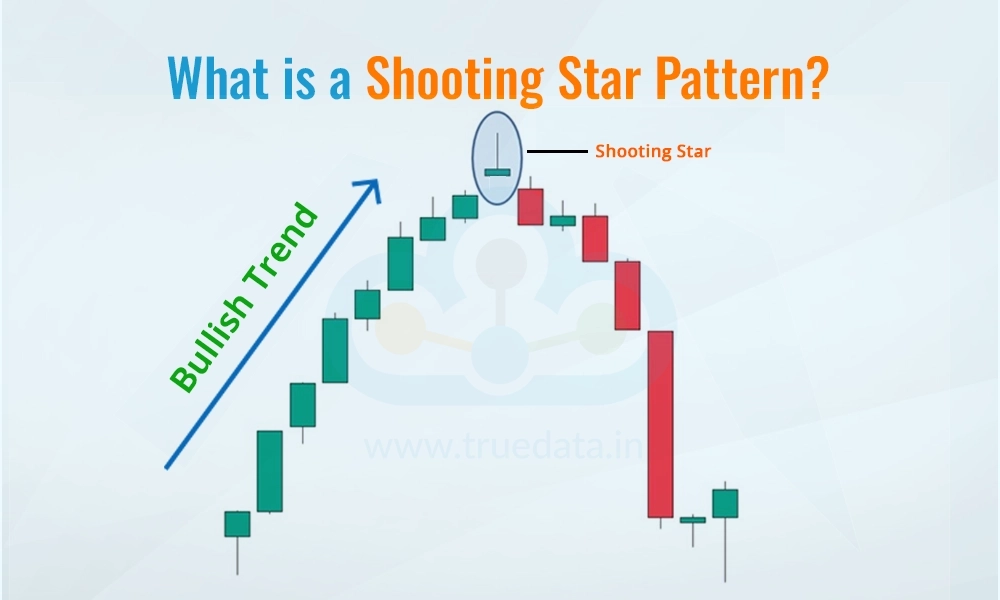

A Shooting Star pattern in technical analysis is a type of candlestick pattern that often signals a potential reversal from an uptrend to a downtrend. It usually appears after a price rally and indicates that the price attempted to rise significantly but faced selling pressure which caused it to close near the day's low. In this pattern, the candlestick has a small body, generally at the lower end, and a long upper wick or shadow, which shows that buyers pushed the price up but could not hold it there as sellers stepped in.

In simple terms, the Shooting Star pattern suggests that the market may be losing its strength, as buyers are struggling to push prices higher. Spotting a Shooting Star could be a signal for traders to consider selling or be cautious of buying, especially if it appears near a resistance level or is confirmed by other technical indicators. This pattern is most reliable on daily or longer timeframes and is best used with additional analysis, as it indicates a shift in market sentiment but does not guarantee a trend reversal.

The first step in successfully trading a pattern is to identify it accurately. Here are the details or the features to look out for to identify the Shooting Star Pattern.

Location in an Uptrend - A Shooting Star should appear after a steady price rise or uptrend. This suggests that the pattern could signal a reversal or pause in the bullish movement.

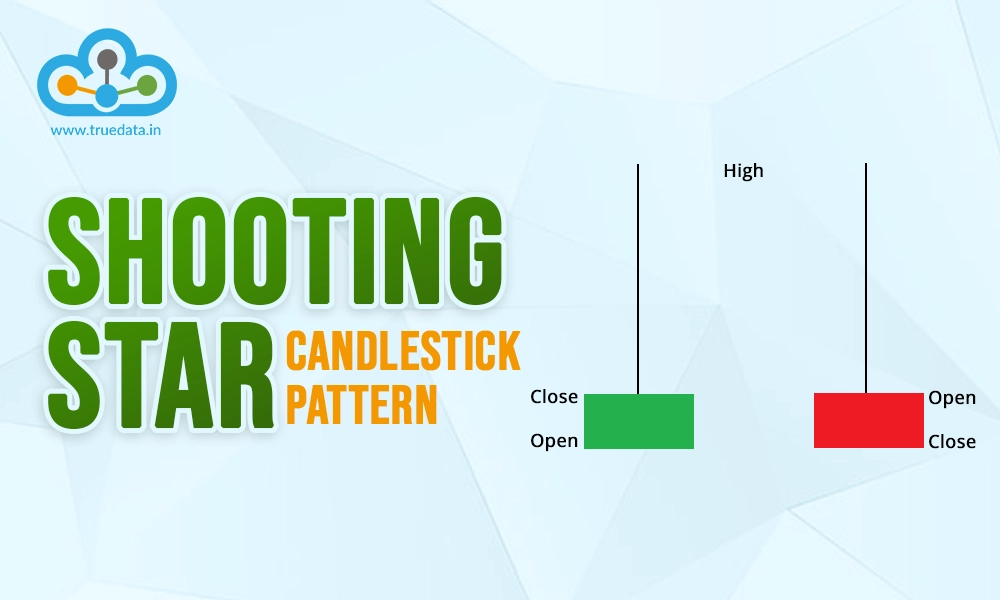

Small Real Body - The body of the candle (the filled or unfilled section) should be small and positioned near the lower part of the candle. This indicates minimal movement from the open to the close of the day.

Long Upper Wick - The upper wick or shadow (the line above the body) should be at least twice as long as the body. This shows that buyers initially pushed prices higher but lost control by the end of the session.

Little or No Lower Wick - Ideally, the candle will have a very small or nonexistent lower wick, which reinforces the strength of selling pressure at the end of the period.

Close Near the Open - The closing price should be close to the opening price, showing that sellers managed to pull the price back down near where it started.

The steps to shape a trading portfolio using the shooting star pattern are,

The first step in trading using this pattern is to confirm an uptrend as this pattern is most meaningful when it occurs after a period of rising prices. The Shooting Star signals that the bullish momentum may be weakening and a reversal might be near.

The Shooting Star pattern in itself is not enough to confirm a trend reversal. Traders should, therefore, wait for confirmation through additional indicators like a bearish candle or a drop in price. Traders can also focus on volume indicators to confirm selling pressure, as high trading volume adds strength to the pattern signals.

Once the pattern is confirmed, traders should consider entering a short position (selling the stock or asset) below the low of the Shooting Star candle. This approach helps to avoid false signals by ensuring the price is indeed starting to decline. Alternatively, traders can enter the trade at the close of the next bearish candle, which provides added confirmation of the trend shift.

The next important step is risk management. Traders should set a stop-loss above the high of the Shooting Star as this level represents a key resistance point. If the price moves above it, the reversal signal may be invalid. A stop loss helps limit potential losses if the market moves unexpectedly.

Finally, traders should set a profit target based on key support levels or recent lows, as these levels can serve as likely points where the price might reverse or pause. Many traders use the distance between the entry and stop loss as a guide to set a favourable risk-to-reward ratio for the trade.

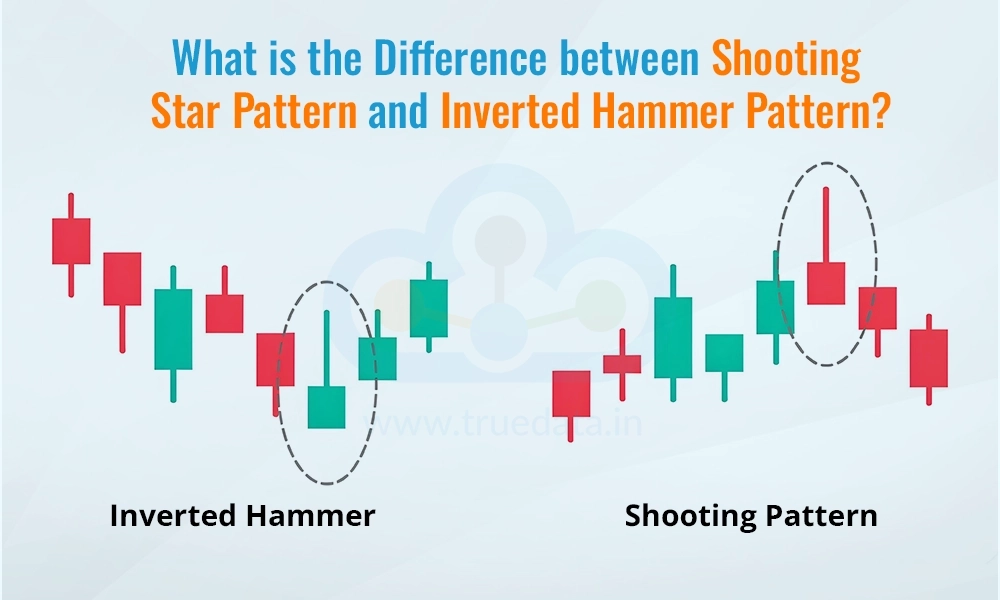

The Shooting Star pattern can appear to be similar to the Inverted Hammer Pattern and can create confusion, especially for novice traders. therefore, it is important to understand the basic identification and interpretation of these patterns accurately to make effective trading decisions. Here is a brief explanation of each pattern for traders to spot the difference between these two critical patterns.

The Shooting Star pattern is a bearish reversal candlestick pattern that typically forms after an uptrend. It has a small body near the low of the candle and a long upper wick, showing that buyers initially pushed prices higher, but sellers took control by the end of the session, bringing the price down near the opening level. This pattern suggests that buying momentum is weakening, and the market could be gearing up for a reversal. Traders interpret this as a signal to prepare for a potential downtrend, especially if the Shooting Star is confirmed by additional bearish signals in the following sessions.

The Inverted Hammer Pattern is a bullish reversal candlestick pattern that usually appears after a downtrend. Similar to the Shooting Star, it has a small body near the bottom and a long upper wick, but it indicates a potential upward reversal. Here, buyers have attempted to push the price higher during the session, but the price closed near the open due to seller pressure. This pattern shows that buying interest may be building up, potentially signalling a shift from a bearish trend to a bullish one. Traders view the Inverted Hammer as a sign to watch for a possible uptrend, especially if there is a confirmation with a bullish candle in the next session.

To summarise the essential difference between the two, while both patterns look similar, their meaning and the market context in which they appear make them quite different. The Shooting Star suggests a downtrend after an uptrend, while the Inverted Hammer indicates a possible uptrend after a downtrend.

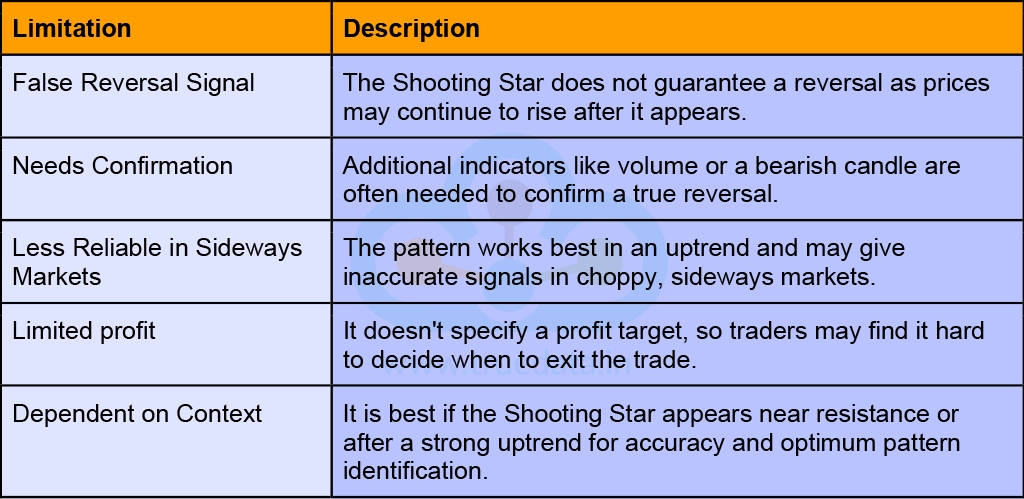

Like any other pattern, the shooting star pattern comes with a few limitations. These limitations are highlighted below.

The Shooting Star pattern is a useful candlestick signal for identifying potential trend reversals from bullish to bearish after an uptrend. It has a classic small body with a long upper wick and can be misunderstood easily for the Inverted Hammer pattern. Hence, it is important to identify the pattern correctly for its accurate interpretation and to shape a profitable trading portfolio thereafter.

This blog talks about a trend reversal pattern and how to use it for the successful technical analysis of stocks or other assets. Reach out to us if you have any queries on this topic or need information on any specific candlestick pattern and we will take it up in our coming blogs.

Till then Happy Reading!

Read More: All About Doji Candlesticks

Candlestick patterns are among the most basic and common tools traders use to cr...

Stock markets have been under a lot of pressure in the past week and investors ...

Stock investing and trading are becoming primary and secondary sources of income...