Net profits in the P&L statement are usually a sign of a healthy company. However, what if the company is cash-strapped and has a high cost of debt? Is it still a good investment opportunity? The answers to these questions can be found by studying the cash flow statement which can help investors understand the cash is coming from and going to from the company. We have discussed how to read financial statements as a whole and the balance sheet and P&L statements individually in our previous blogs. Let us now understand the next component of financial statements, the cash flow statement in detail.

A cash flow statement is the third and final component of the company's financial statements. It has a detailed record of all the cash inflows and outflows of the organisation for the specified period of the financial statements, usually a year or an interim period like a quarter. These details help the users understand the sources and the uses of the company cash which further helps in optimising them leading to overall efficiency in the organisation. The cash flow statement focuses solely on the actual cash transactions of the company during the specified period, unlike the profit and loss statements, which also account for notional or non-cash expenses like depreciation and amortisation.

The cash flow statement highlights the sources and uses of cash in three key areas, namely, operational activities, financial activities, and investment activities. The statement assesses whether a company has enough cash to meet its expenses, grow its business, and pay dividends. This helps in-depth analysis of the company's cash position for all stakeholders, thereby aiding in informed decision-making. A company with strong cash flows is generally considered financially healthy, while one with negative cash flow may struggle to sustain operations.

The cash flow statement analyses the cash position of the company and its key areas of cash flow. The statement is prepared in accordance with Accounting Standard 3 issued by ICAI and classifies the cash flows of the organisation into three activities for deeper insights thus leading to efficiency in cash management. The components of the cash flow statement and their significance are explained below.

This is the first section of the cash flow statement that highlights the cash flows from its core business activities. This includes the actual cash inflows from the sales of goods and services and payments for expenses required to run the business like salaries, rent, and raw materials. This component also adjusts the non-cash expenses like depreciation and interest to get the actual cash flows from operations. A company consistently generating positive operating cash flows is a sign of a healthy organisation as it implies that the company is making sufficient returns from its operations to sustain itself and eventually grow organically. On the other hand, negative cash flow from operations could indicate financial trouble indicating that the company is spending more than it earns from its main business, thus requiring resource optimisation at an organisation level.

The components and steps to calculate Cash Flow from Operating Activities as per the standard format include,

Start with Net Profit Before Tax - Take the profit earned before deducting taxes from the Profit & Loss account.

Add: Non-Cash Expenses -

Depreciation and Amortisation - Added back because they reduce profit but do not involve actual cash outflow.

Loss on Sale of Assets - Added back as it is an accounting loss, not a cash loss.

Less: Non-Cash Incomes -

Profit on Sale of Assets or Investments - Deducted because it is included in net profit but not part of operating activities.

Interest or Dividend Income - Deducted if considered part of investing activities.

Add: Finance Costs -

Interest Paid - Added back if included in financing cash flow, as it reduces net profit but is treated separately in cash flow.

Adjust for Changes in Working Capital -

Increase in Current Assets (e.g., Debtors, Inventory) - Deducted because cash is tied up in assets.

Decrease in Current Assets - Added as it means cash has been released.

Increase in Current Liabilities (e.g., Creditors, Outstanding Expenses) - Added since it means cash outflows are delayed.

Decrease in Current Liabilities - Deducted as it means cash has been paid out.

Less: Taxes Paid - Deduct the actual cash paid for income taxes during the period.

The next section of the cash flow statement refers to the cash flow related to the long-term and short-term investing activities of the business. This can include cash flow from activities like buying and selling long-term assets like land, buildings, equipment, or investments in other companies. A positive or negative cash flow from the investing activities requires deeper analysis to understand the long-term benefit and sustainability for the organisation. For example, if the company has a negative cash flow from investing activity in a financial year due to investing in new machinery can still be considered a positive sign due to its long-term benefits and indicates the growth and expansion focus of the company. However, persistent negative cash flow from investing activities indicates bad investments. Similarly, a positive cash flow from selling core business assets can also be a red flag as it will affect the long-term viability of the business.

The components and steps to calculate Cash Flow from Investing Activities as per the standard format include cash spent on or received from long-term assets and investments.

Cash Outflow from Purchase of Fixed Assets (Property, Plant, Equipment) - Cash spent on buying land, buildings, machinery, or equipment.

Cash Inflow from Sale of Fixed Assets - Cash received from selling land, buildings, or equipment.

Cash Outflow from Purchase of Investments - Cash paid to buy shares, bonds, or other long-term financial instruments.

Cash Inflow from Sale of Investments - Cash received from selling investments.

Cash Inflow from Interest Received - Cash earned from interest on loans or deposits (for non-financial enterprises, this is usually investing activity).

Cash Inflow from Dividends Received - Cash received as dividends from investments in other companies.

Cash Outflow from Loans Given to Others - Cash used for giving loans or advances to other entities.

Cash Inflow from Repayment of Loans by Others - Cash received when loans or advances given earlier are repaid.

The final section of the cash flow statement refers to the company's financial obligations and expenses. This component includes the cash flows due to financial activities like issuing or new shares, debt repayment, debt financing, payment of dividends, etc. A company having positive cash flows from financial activities due to issues of shares is a red flag for existing shareholders due to the dilution of their holdings. Similarly, a negative cash flow from financial activities due to meeting long-term debt repayment obligations can be seen as a positive sign indicating financial strength and good management.

The components and steps to calculate Cash Flow from Financing Activities as per the standard format include,

Cash Inflow from Proceeds from Issue of Shares - Cash received by the company from issuing new equity shares to investors.

Cash Inflow from Proceeds from Issue of Debentures, Bonds, or Loans - Cash received from borrowing funds or issuing debt instruments.

Cash Inflow from Proceeds from Other Borrowings - Cash raised through short-term or long-term loans from banks or financial institutions.

Cash Outflow from Repayment of Loans or Borrowings - Cash used to repay the principal amount of existing loans or debt.

Cash Outflow from Interest Paid - Cash paid as interest on loans and borrowings (may be shown under operating activity if the company chooses, but commonly placed here).

Cash Outflow from Dividend Paid to Shareholders - Cash distributed to shareholders as dividends during the period.

Cash Outflow from Payment for Buyback of Shares or Redemption of Debentures - Cash used to buy back shares or repay debentures before maturity.

We have seen the meaning of a cash flow statement and its various components. However, why is it a significant portion of the financial statements of a company and how does it help various stakeholders? The importance of a cash flow statement for different stakeholders of the company and the company as a whole is explained below.

Helps assess if the company generates enough cash to sustain and grow its business.

Indicates financial stability and the ability to pay regular dividends or reinvestment.

Shows how efficiently the company manages its cash resources.

Helps in evaluating long-term profitability beyond just paper profits.

Assists in comparing different companies in the same sector for better investment decisions.

Reveals if the company has enough cash flow to repay loans and interest on time.

Reduces lending risk by identifying financially strong or weak businesses.

Indicates whether the company is too dependent on external financing.

Helps lenders decide on loan approvals and credit terms based on cash flow stability.

Aids in managing cash efficiently for daily operations and future growth.

Helps in planning investments by analysing cash inflows and outflows.

Assists in maintaining sufficient working capital to avoid financial crises.

Provides insights into whether the company should raise funds through debt or equity.

Helps in budgeting and financial planning to ensure long-term business sustainability.

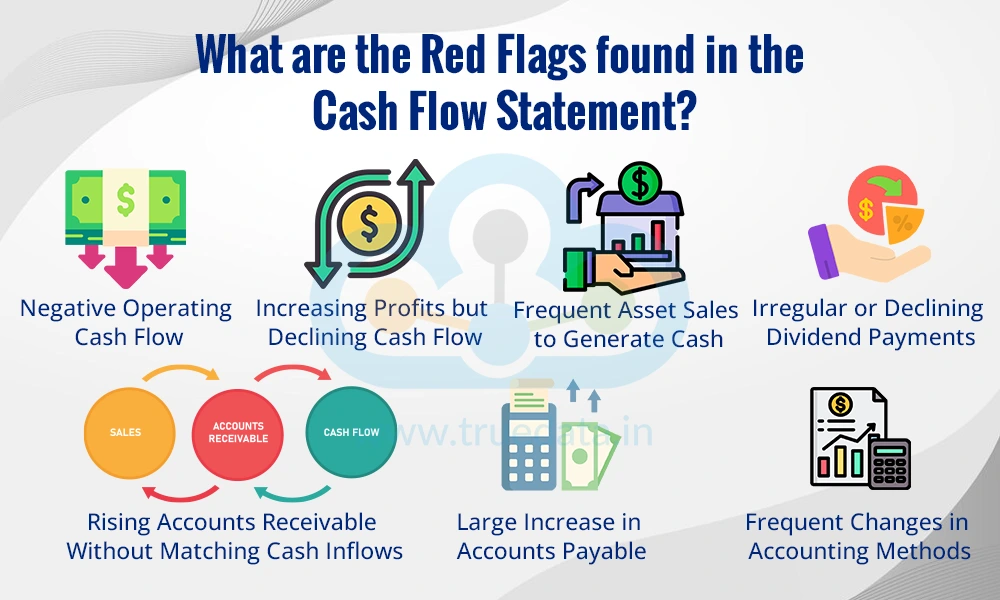

Analysing the cash flow statement is part of the fundamental analysis of stocks and highlights the true cash position of the company while the profit and loss statement shows the net profitability of the company. However, there are a few red flags in the cash flow statement that warrant a deeper analysis into other aspects of the business and the financial statements as a whole to get further insights and make informed decisions. Some examples of such red flags include,

A company with consistently negative cash flow from operating activities can be a major concern. It highlights the inability of the company to generate organic profits and convert its inventory to cash which can trigger financial instability as a company cannot survive in the long run without generating positive cash flow from its main operations. Investors should check if this is a temporary issue or a long-term problem.

A company with rising profits in the P&L statement but shrinking cash flow from operations is another red flag, This can happen due to aggressive accounting practices, where profits are inflated on paper but actual cash is not coming in. Investors should compare net profit with cash flow from operations to ensure profits are real and backed by cash.

Selling assets, such as property or machinery, to generate cash may be a warning sign that a company is struggling. If asset sales are not part of a planned business strategy, they could indicate that the company is facing liquidity issues and is selling assets to survive.

If a company that previously paid consistent dividends suddenly reduces or stops paying them, it may indicate cash flow problems. Investors who rely on dividends should check whether the company is still financially strong or struggling to manage its cash.

If a company’s sales are increasing but cash from operations is not, it could mean that customers are not paying on time. High accounts receivable suggest that sales are made on credit, which can lead to cash shortages and financial instability if payments are delayed for too long.

A rising accounts payable balance (money owed to suppliers) without a corresponding increase in cash flow from operations could mean that the company is delaying payments due to financial stress. While some short-term delays are normal, consistently delaying payments can harm supplier relationships and indicate liquidity problems.

A company repeatedly changing its accounting policies or reporting methods could be a red flag of potential manipulation of its financial statements. Investors should be cautious of these changes in the accounting policies, particularly if such changes lead to sudden improvements in reported cash flow without actual business growth.

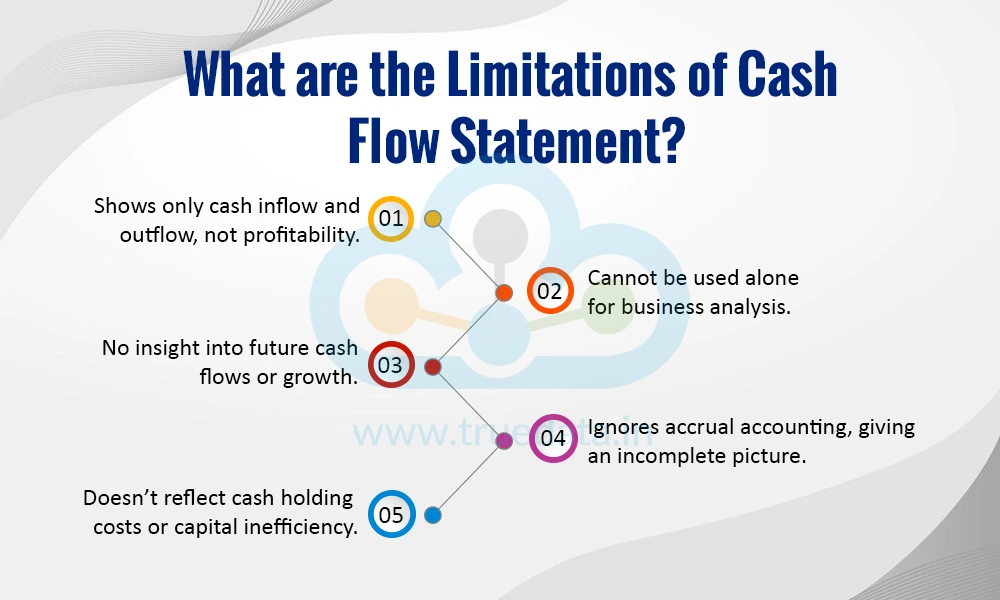

The cash flow statement like the other financial statements has an abundance of information for relevant stakeholders about the financial position of the company and its long-term survival or growth prospects. However, the statement comes with a few limitations and thus has to be read in conjunction with other financial statements to get an accurate analysis of the company. These limitations include,

Does not highlight profitability but only the cash inflow and outflow of the organisation.

Cannot be used as a standalone statement for a complete analysis of the business

No reflection of future cash flows or growth prospects

Ignores the accrual accounting method thereby reflecting an incomplete picture of financial performance.

Does not consider the cost of cash holdings or indicate inefficient capital use.

The cash flow statement is the third and final component of the company's financial statements and highlights its cash position from its various activities. While a strong and consistent cash flow is an indicator of a financially healthy and well-managed company, it should be read along with other financial statements and relevant notes for optimum understanding and having a profitable portfolio.

This article is another addition to our series on fundamental stock market analysis and how to read financial statements. Reach out to us if you find this series interesting or need further information on this topic.

Till then Happy Reading!

Read More: Solvency Ratio-What are they and what do they say?

The profits in a company'sfinancial statements assure the stakeholders of its pr...

If you are a shareholder of a company, you would have seen its annual reports co...

The stock market in India has fascinated general Indian masses for long, perhap...