If you are a shareholder of a company, you would have seen its annual reports come to you in post. Most often these reports are used as nothing but scrap paper but they hold precious answers to the financial health of the company and its future growth prospects. The abundance of numbers in these financial statements may make little sense to most shareholders, however, the key is to analyse them effectively and to read between the lines. Check out this article to learn more about financial statements and how to read them to seek valuable insights into the company’s core details and make informed investment decisions.

Financial statements are like the bones of the company that provide details of its financial activities and performance. They provide a comprehensive analysis of the company’s financial health. Every company must maintain annual financial statements, signed by all board members, before presenting them to shareholders for approval.

The key components of financial statements are,

Balance sheet

Income Statement

Cashflow Statement

If the company requires auditing under the Income Tax Act of 1961, auditors must review these statements and issue a report, which is then included with the financial statements presented to shareholders. The purpose of these statements is to provide a true and fair view of the company's financial health, revealing any fraud, errors, or misrepresentations. This transparency ensures that stakeholders such as shareholders, creditors, and investors have accurate information to make strategic decisions for the company's future.

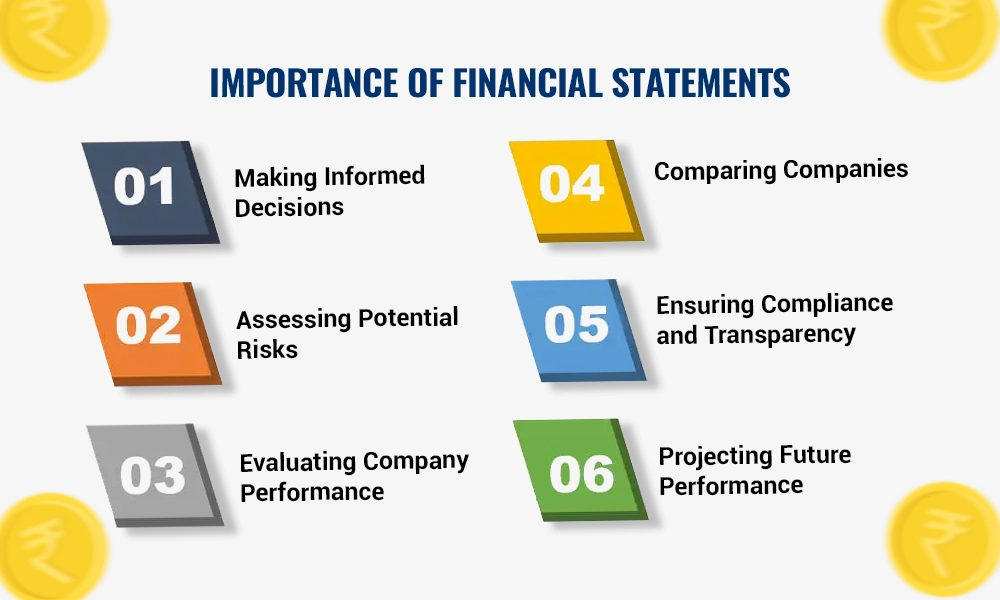

The importance of financial statements and the key insights that they can provide are mentioned hereunder.

Financial statements provide essential data that helps investors make informed investment decisions. The balance sheet offers insights into a company's financial health and stability while the income statement highlights its profitability and operational efficiency and the cashflow statement reflects its liquidity and cash management practices. Together, these documents give investors a comprehensive understanding of a company's financial status.

Investors analyse financial statements to assess potential risks associated with an investment. For example, high levels of debt can indicate financial vulnerability while consistently low profit margins may signal operational inefficiencies. Similarly, negative cash flows can suggest liquidity problems. investors can, therefore, make more prudent investment choices by identifying these risk factors.

Financial statements enable investors to evaluate a company's performance over time. Investors can track the revenue growth of the company through its ability to increase sales. Other parameters to evaluate company performance include Earnings Per Share (EPS) which measures company profitability per share and return on equity (ROE) which assesses how effectively management uses shareholders' equity. This performance evaluation helps investors understand the company's past and current abilities.

Investors can also use financial statements to compare different companies and identify the best investment opportunities. This involves examining industry benchmarks to gauge a company's performance against industry standards. Competitor analysis allows investors to assess how a company stands when compared to its competitors thereby helping investors make strategic investment decisions.

Financial statements ensure that companies adhere to regulatory standards, enhancing investor trust. Compliance with standards like GAAP or Ind-AS ensures the standardisation and reliability of financial reports while the auditor’s report provides independent verification of their accuracy. This transparency is crucial for maintaining and boosting investor confidence.

Financial statements can also provide insights into a company's future financial performance. Investors can use trend analysis to identify patterns in revenue, expenses, and profits along with financial ratios (such as price-to-earnings (P/E) and debt-to-equity) to forecast future performance. These projections are vital for making long-term investment decisions.

The process of reading and analysing financial statements can be broken down into three components and evaluating them first on a standalone basis and then as a whole. Here is a detailed outlook on reading and analysing financial statements.

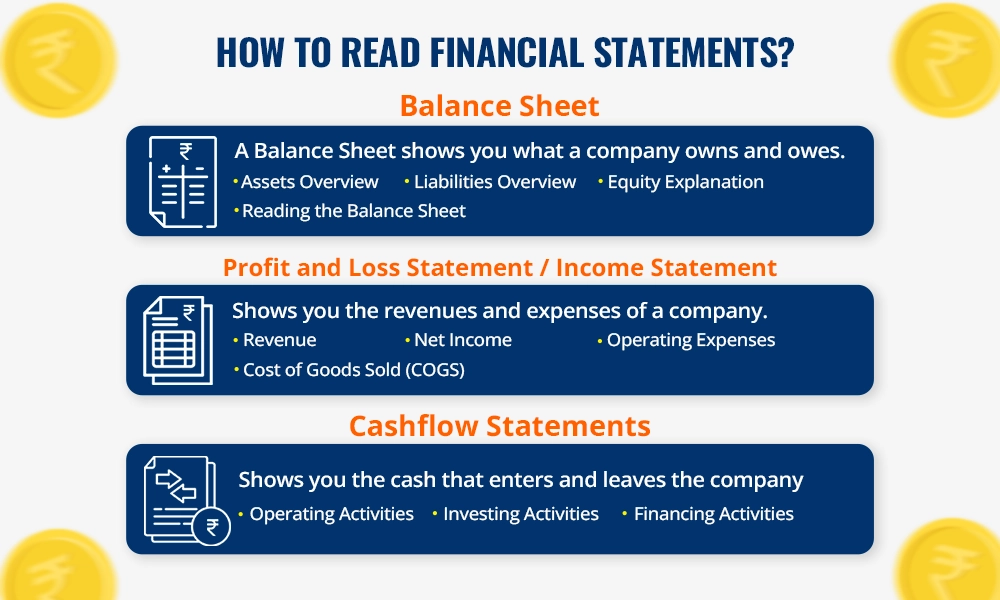

The balance sheet provides a snapshot of a company’s financial health at a specific point in time. It is divided into three main sections, namely, assets, liabilities, and equity.

Assets encompass everything a company owns, from physical items like buildings and equipment to intangible assets like patents and brand reputation. They are categorised into current assets, which can be converted to cash within a year, and non-current assets, representing long-term investments or assets which cannot be easily liquidated.

Liabilities are the obligations that a company owes. They can range from short-term debts like accounts payable to long-term obligations such as loans and lease payments. Similar to assets, liabilities are classified into current liabilities (due within a year) and non-current liabilities (due after a year).

Equity is also known as shareholder’s or owner's funds. It is the residual interest in the company's assets after deducting liabilities. Equity funds reflect the balance that would remain with the shareholders if all debts were paid off and assets were liquidated.

To analyse a balance sheet effectively, investors should start by examining the composition of assets, considering whether they are predominantly liquid or tied up in long-term investments or fixed assets. The next step is to evaluate liabilities to understand the company's debt structure and whether there is a significant amount of short-term debt or a more balanced mix of short-term and long-term liabilities. Finally, investors should assess the equity section to gauge how much of the company assets are financed through debt compared to equity.

The next component of the financial statements is the income statement. It is the detailed record of all the incomes and expenses of the company during the specified period, usually a financial year. It provides an insight into both the top line (revenue) and bottom line (net income) of the company which is essential for assessing its financial performance and making informed business decisions.

The process of understanding a profit and loss statement can be simplified by analysing its components.

The revenue section of a Profit and Loss Statement represents the total income generated by the company through sales of products or services. This is often referred to as the 'top line' as it is the first line item on the statement and indicates the primary source of income for the company.

The COGS section provides details of the direct costs incurred by the company in producing the goods or services sold. The gross profit of the company is derived by subtracting COGS from the revenue and reflects how efficiently the business is managing production costs.

The next component is operating expenses which include all other costs (such as salaries, rent, utilities, marketing expenses, and administrative costs) associated with running the business. These expenses are subtracted from the Gross Profit to arrive at the Net Income or 'bottom line'.

The Net Income represents the net profit of the business which is left over after deducting all operating expenses from the Gross Profit. It reflects the overall profitability of the business and is a crucial indicator of financial health.

The cash flow statement is a vital financial document alongside the income statement and balance sheet. It provides insights into how a business manages its cash, depicting the inflows and outflows of funds. This statement is divided into three main sections, namely, operating activities, investing activities, and financing activities. Each section offers distinct information about the financial health of the company. Here is a brief analysis of the cash flow statement.

The operating activities section of the cash flow statement delves into the cash flows arising from the core business operations. This includes cash received from customers, payments made to suppliers and employees, and other day-to-day operational expenses. A thorough analysis of this section can highlight how efficiently the company manages its day-to-day operations and generates cash from its core business activities.

This section provides investors with details about cash flows related to investments in assets such as equipment, property, or acquisitions, as well as cash received from the sale of such assets. Investors can also gain insights into how the company is investing in its future growth and development. Understanding the company's investment decisions can help investors assess its long-term prospects and strategic direction.

The financing activities section of the cash flow statement reveals cash flows from sources like loans, lines of credit, stock issuance, or dividend payments. This section sheds light on how the company finances its operations and manages its capital structure. Investors can evaluate the company's debt levels, dividend policies, and overall financial strategy by analysing this section.

Ratio analysis involves the use of financial ratios to evaluate and interpret a company's financial performance. These ratios are derived from data in the financial statements and provide insights into various aspects of a company's profitability, liquidity, and solvency. It is a crucial part of reading and understanding the financial statements as they help in comparing a company’s performance with industry peers, identify potential risks, and support informed investment decisions by providing a comprehensive understanding of the company's financial position and performance.

Ratio analysis of the financial statements can be done in the following manner.

These are financial metrics that gauge a company's income generation relative to revenue, expenses, assets, and equity over a specific period, offering insights into its financial performance.

Net Profit Margin - This shows the profit percentage from sales and is calculated by dividing net income by total sales.

Gross Profit Margin - It measures revenue exceeding the cost of goods sold (COGS) and is calculated by deducting COGS from revenue and dividing it by revenue.

Return on Assets (ROA) - This indicates profitability relative to total assets and is calculated by dividing net income by total assets.

Calculation - Begin by computing these ratios using their respective formulas.

Analysis - Compare the ratios with industry standards or past performances. Deviations may indicate underperformance or outperformance.

Actionable Insights - Take strategic actions based on the analysis. Lower ratios may prompt cost reduction or sales improvement strategies, while higher ratios may suggest maintaining or enhancing performance levels.

These are vital indicators that assess a business's ability to meet short-term obligations, serving as a financial health check and ensuring survivability.

Current Ratio - It measures the company's ability to pay short-term debts with short-term assets and is calculated as Current Assets divided by Current Liabilities.

Quick Ratio (Acid-test Ratio) - It gauges the ability to meet short-term obligations with the most liquid assets (excluding inventory) and is calculated as (Cash + Marketable Securities + Receivables) divided by Current Liabilities.

Cash Ratio - This ratio strictly considers cash and cash equivalents for meeting liabilities and is calculated as (Cash + Cash Equivalents) divided by Current Liabilities.

Calculation - Compute each ratio separately using their respective formulas.

Comparison - Compare the ratios with industry benchmarks to assess the business's standing.

Interpretation - Lower ratios than industry averages may indicate potential difficulties in meeting short-term obligations, prompting actions to manage financial resources more effectively.

These financial metrics, also known as leverage ratios, evaluate a company's capability to meet its long-term and short-term obligations, offering insights into its financial stability and health.

Debt-to-Equity Ratio - It measures debt used to finance assets relative to shareholders' equity. High ratios indicate aggressive debt financing, which may pose risks.

Equity Ratio - It gauges the proportion of total assets financed by shareholders, indicating financial stability with higher ratios.

Debt Ratio - It measures the portion of assets financed by debt, with high ratios suggesting increased bankruptcy risk during downturns.

Financial Health Monitoring - Regularly monitoring solvency ratios can help assess the company's financial stability. Significant changes in ratios can be a trigger signalling a deeper financial analysis.

Strategic Decision-making - These ratios guide decisions on debt versus equity financing. A high debt-to-equity ratio may indicate the need for equity financing to mitigate risk.

Analysis of financial statements is a very technical art that requires a deep understanding of the financial concepts and the picture presented by numbers in the financial statements. Some of the common mistakes that investors often end up making in this journey are,

Overlooking footnotes and disclosures

Focusing only on profitability rather than the entire picture

Ignoring non-financial factors

Relying solely on ratios

Lack of comparative analysis

Misinterpreting extraordinary items

Not giving importance to potential risks

Neglecting to adjust changes in accounting policies

Financial statements are the basis for forming an opinion on the company’s financial health and its future growth prospects. Therefore, they require a deep analysis and evaluation to determine the true picture of the company as a whole. Reading financial statements is a process of fine-tuning the data to understand where the company is and what it can be in the coming years.

We hope this article was above to provide you with basic details on how to analyse a company. Let us know if you need more details on this topic and we will take it up in our coming blogs.

Till then Happy Reading!

Read More: Red flags to watch out for while analysing a company’s stock

Thestock market never stands still, and prices swing constantly with every new h...

Imagine a business without any competition. What's the outcome? An unchecked mon...

Every company has a core group of people who believe in its vision from day one,...