July 2023 marked a new era in the Indian stock markets with the addition of GIFT Nifty to its fold. With a lot of buzz around this significant change and GIFT City in Gujarat, GIFT Nifty is set to increase the participation of investors across the globe in the Indian markets and increase liquidity. But what does it mean for retail investors in India and can they be part of this incredible opportunity too? Know all this and more in this blog on GIFT Nifty to get answers to all your questions.

GIFT Nifty is a benchmark index that represents the performance of the Indian stock market through a trading mechanism located in the GIFT City (Gujarat International Finance Tec-City). GIFT City, an ambitious financial hub near Ahmedabad, was developed to attract global financial institutions, providing a business-friendly environment with modern infrastructure and regulations. The ‘Nifty’ part of GIFT Nifty refers to the Nifty 50, which is the primary index on the NSE and tracks the top 50 companies listed on the exchange and GIFT Nifty is the derivative contract of Nifty 50. GIFT Nifty was formerly known as SGX Nifty traded on the Singapore Stock Exchange.

GIFT Nifty was created to allow international investors to trade the Nifty 50 index futures in a time zone that aligns better with global markets, especially in the morning hours of Indian Standard Time (IST). This was made possible by the establishment of GIFT City, which offers tax breaks, less stringent regulations, and a conducive environment for trading financial instruments.

GIFT Nifty represents an opportunity for investors to trade global market futures with a focus on Indian stocks. It also helps them hedge their positions or take positions based on the Nifty 50 index in a way that is more aligned with global trading hours. Furthermore, it makes India an attractive destination for foreign investors, as they can now trade Indian stocks more easily in the global marketplace, potentially boosting liquidity and market access.

The need for GIFT Nifty arose from the growing demand for an efficient way to trade Indian stock market indices globally, especially considering the time zone differences. Before GIFT Nifty, SGX Nifty provided an opportunity for international investors to participate in the Indian stock markets. The latter was also a derivative product that allowed international investors to trade the Nifty 50 index futures on the Singapore Exchange (SGX). While SGX Nifty was popular among global investors, it posed challenges for India, as a large portion of trading activity in Nifty futures was happening outside the country. This led to concerns about a lack of control over such trades and potential market distortions. There was also news that the Singapore Exchange could add new products based on the Indian stock markets that could further drive the trading volume away from India while offering a platform that operated during the same hours as global markets leading to increased discrepancies in price movements between SGX Nifty and the Indian Nifty index.

To address these challenges, GIFT Nifty was introduced as a derivative contract that provides a more efficient and controlled way for global investors to trade Indian market indices. GIFT Nifty, traded on the GIFT City platform in India, operates in a time zone that aligns better with global markets, offering trading opportunities when Indian markets are closed. This not only allows investors to hedge positions or take positions based on the Nifty 50 index in real-time but also brings the trading of Indian stock market derivatives back onshore, under India's regulatory framework. With this transition, the SGX Nifty ceased to exist on June 30, 2023, and GIFT Nifty started to trade on GIFT CITY/ NSE IFSC on July 3rd 2023. Furthermore, all US Dollar denomination Nifty derivatives will now be exclusively traded on NSE IFSC.

The trading hours for GIFT Nifty are aligned with the global trading hours making it more accessible for global participants. Here are further details on GIFT Nifty trading hours and participants.

GIFT Nifty operates for 21 hours a day divided into two trading sessions.

The first session runs from 6:30 AM to 3:40 PM IST and the second session from 4:35 PM to 2:45 AM IST the next morning. This extended trading window enables participation during key market hours across Asia, Europe, and the U.S.

Eligible participants for GIFT Nifty include Non-Resident Indians (NRIs), Foreign Portfolio Investors (FPIs), and Eligible Foreign Investors (EFIs), who can trade through brokers that are members of the NSE International Exchange (NSE IX) in GIFT City.

However, retail investors in India are not permitted to trade in GIFT Nifty. This is on account of the regulations set by the Reserve Bank of India (RBI) where retail Indian investors are restricted from using the Liberalised Remittance Scheme (LRS) to trade in leveraged products like futures and options, including those offered by GIFT Nifty.

Thus, the platform is primarily designed for international and institutional investors, rather than individual retail traders from India.

The steps to trade GIFT Nifty are highlighted below.

Open an Account - Register with a broker who is a member of the NSE International Exchange (NSE IX) in GIFT City.

Eligibility - Ensure eligibility trade in GIFT Nifty as only eligible participants, such as NRIs, FPIs, or EFIs, can trade GIFT Nifty. Indian retail investors cannot trade in GIFT Nifty due to RBI restrictions.

Fund the Account - Transfer funds into the trading account following the broker's instructions.

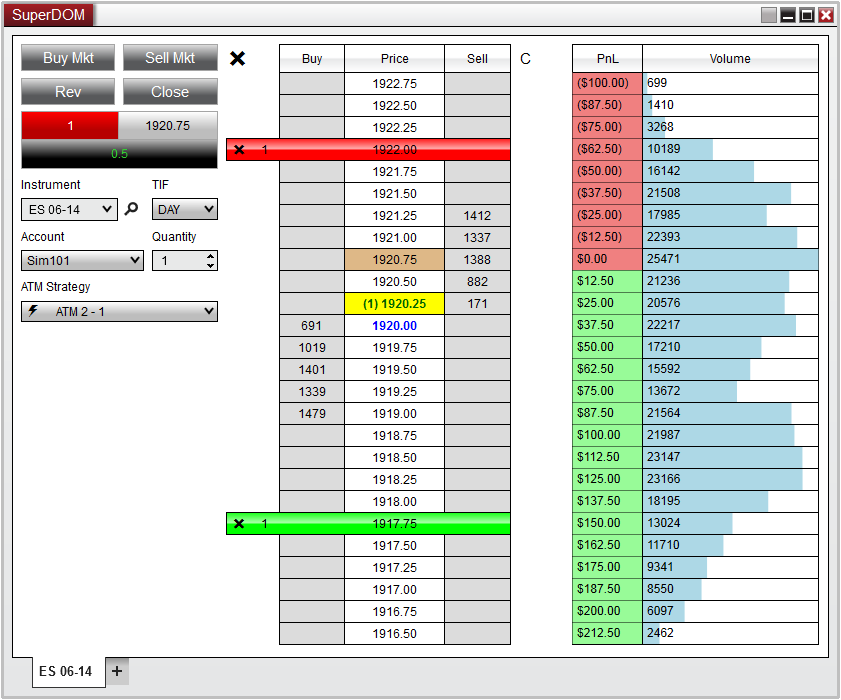

Access the Platform - Use the broker's trading platform to access GIFT Nifty contracts.

Choose the Contract - Select the target GIFT Nifty futures contract to trade based on individual investment strategy.

Place Orders - Enter buy or sell orders as per the trading plan.

Monitor and Adjust - Keep track of market movements and manage positions accordingly.

Settlement - Trades are settled in U.S. dollars, so ensure a correct understanding of the currency impact.

The benefits of direct listing on the IFSC exchange for investors and companies are highlighted below.

Access to Global Markets

Direct listing on the International Financial Services Centre (IFSC) exchange allows investors to access global opportunities. They can invest in companies with international operations or exposure, diversifying their portfolios.

Extended Trading Hours

IFSC exchanges offer extended trading hours, overlapping with major global markets. This enables investors to trade conveniently and react to global events in real-time.

Tax Efficiency

Investors benefit from a favourable tax regime, including exemptions on capital gains and lower transaction costs, enhancing overall returns.

Global Visibility

Companies gain access to international investors, enhancing their brand recognition and market reach on a global scale. This can improve their valuation and attract diverse funding sources.

Ease of Fundraising

Direct listing on IFSC exchanges allows companies to raise capital in foreign currencies, reducing dependency on domestic markets and tapping into a wider investor base.

Regulatory Flexibility

The IFSC framework offers a simplified and business-friendly regulatory environment, making it easier for companies to list and comply with global standards.

Cost Advantages

Lower listing and compliance costs compared to traditional global exchanges make IFSC an attractive option for companies seeking international exposure.

GIFT Nifty represents a significant step toward integrating India’s financial markets with the global economy. It provides extended trading hours, allowing international and institutional investors to trade Nifty 50 futures across Asian, European, and U.S. market hours. The shift from SGX Nifty to India’s regulatory framework provides a centralised platform for all Indian derivative products enhancing liquidity and boosting the Indian financial ecosystem thereby ensuring better price discovery. Thus although Indian retail investors are currently excluded due to regulatory restrictions, GIFT Nifty creates new opportunities for NRIs, FPIs, and EFIs, making India a more prominent player in global financial markets.

This article sheds light on a significant development in the Indian financial landscape and the possibilities of extending the scope of trading in India. Let us know your thoughts on this topic or any queries on the same and we will address them.

Till then Happy Reading!

The year 2023 began with a bummer for the Indian stock markets which saw a sign...

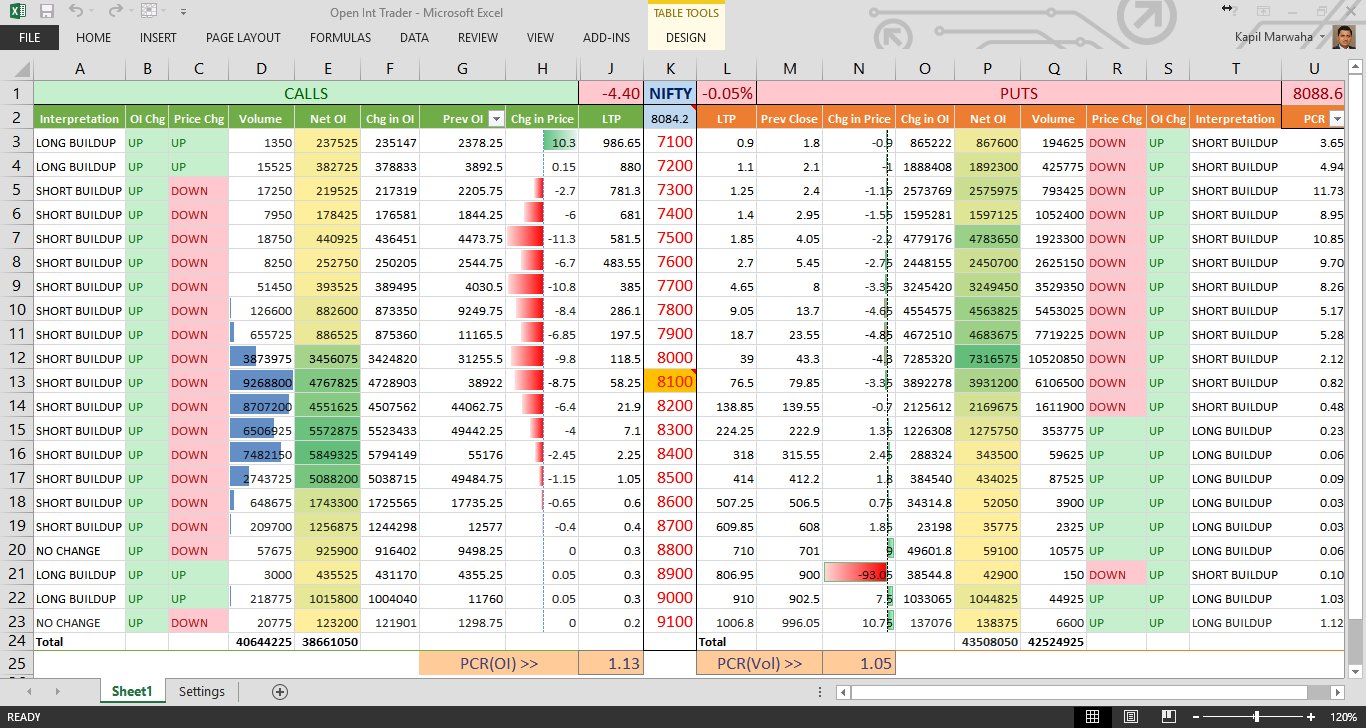

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...