The two most common components of derivative trading are options trading and futures trading. These are also among the most popular trading segments in India and have seen an increasing number of participants over the years. While we have covered various aspects of options trading in our previous blogs, let us now have a brief introduction to futures trading in this blog. Read on to learn the basics of futures trading and start your future trading journey today.

The two most common components of derivative trading are options trading and futures trading. These are also among the most popular trading segments in India and have seen an increasing number of participants over the years. While we have covered various aspects of options trading in our previous blogs, let us now have a brief introduction to futures trading in this blog. Read on to learn the basics of futures trading and start your future trading journey today.

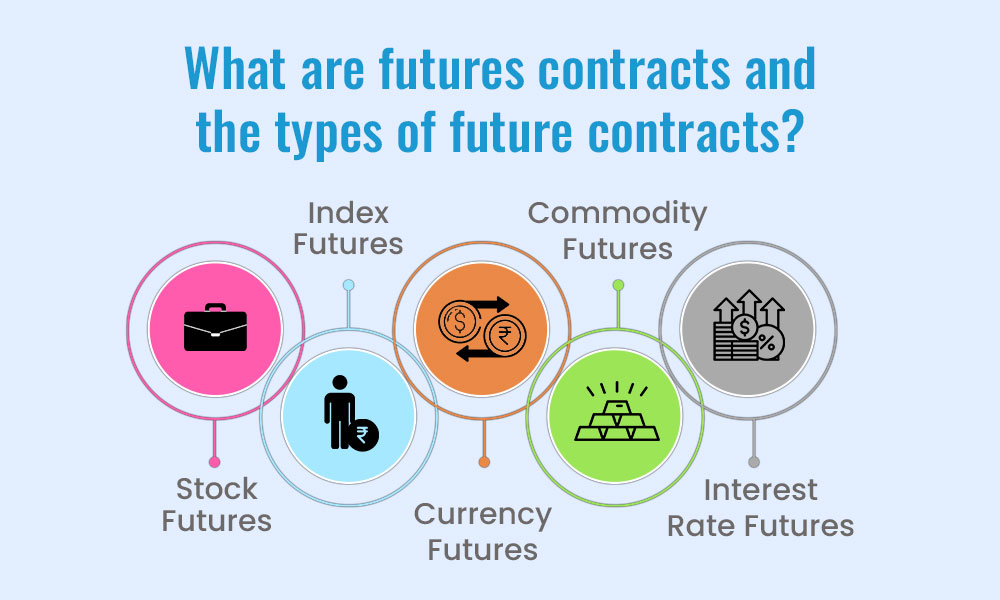

Futures are the buying or selling of financial contracts, known as futures contracts, on designated stock exchanges in the country. Under these contracts, the buyers and the sellers are obligated to buy or sell the specified quantity of the underlying asset at a predetermined rate and at a predetermined future date as per the future contract. These contracts can include commodities like gold or agricultural products, as well as financial instruments such as stock market indices or currency exchange rates. Futures trading allows traders to speculate on the future price movements of these assets, offering opportunities for profit but also carrying significant risk. Some of the common types of future contracts available for traders are mentioned below.

Futures are the buying or selling of financial contracts, known as futures contracts, on designated stock exchanges in the country. Under these contracts, the buyers and the sellers are obligated to buy or sell the specified quantity of the underlying asset at a predetermined rate and at a predetermined future date as per the future contract. These contracts can include commodities like gold or agricultural products, as well as financial instruments such as stock market indices or currency exchange rates. Futures trading allows traders to speculate on the future price movements of these assets, offering opportunities for profit but also carrying significant risk. Some of the common types of future contracts available for traders are mentioned below.

In stock futures trading, traders engage in standardised contracts that require them to buy or sell a specified number of shares of a particular company's stock at a predetermined price on a future date. These contracts, traded on exchanges, provide exposure to individual stock price movements without the need to own the actual shares. Stock futures are popular among speculators, hedgers, and arbitrageurs, allowing traders to capitalise on both rising and falling stock prices.

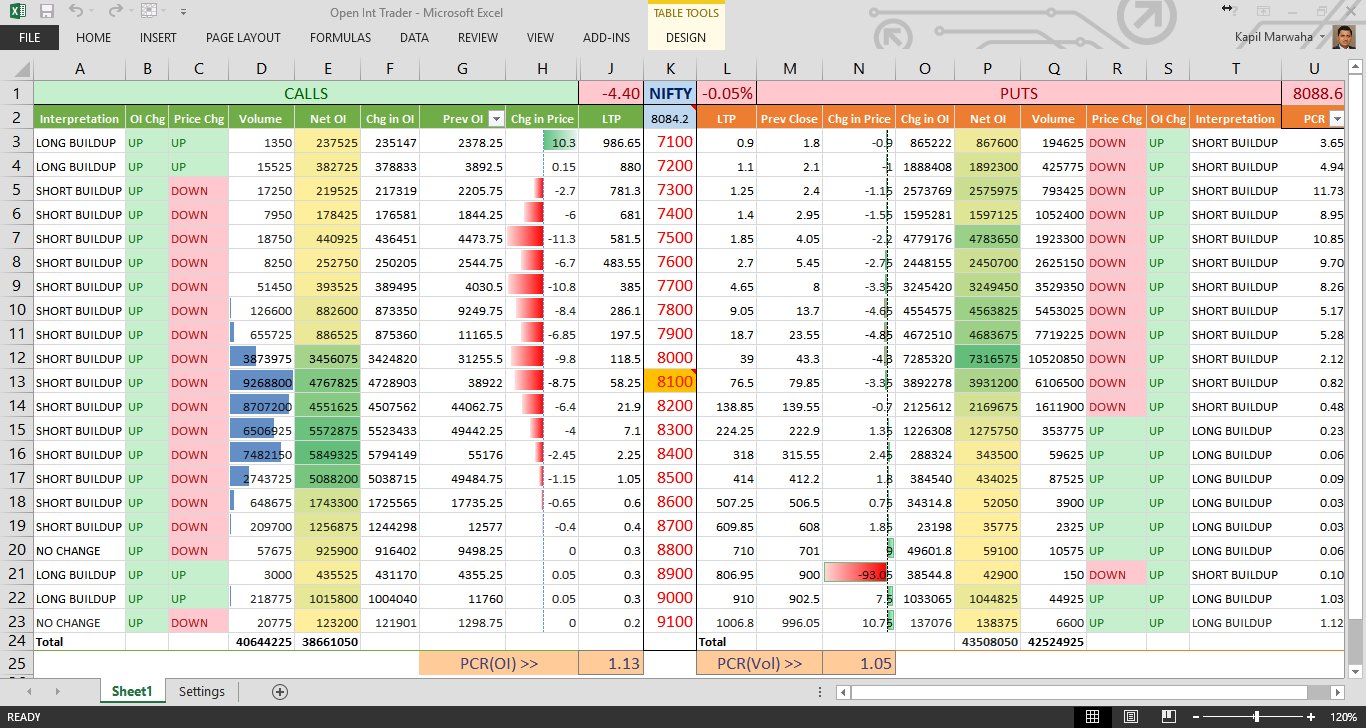

Index futures derive their value from stock market indices such as Nifty, BANKNIFTY, etc. These contracts enable traders to take positions based on the anticipated direction of the overall stock market. Index futures offer a way to diversify investment portfolios and hedge against market volatility.

Currency futures allow traders to engage in speculation or hedging related to foreign exchange rates. These contracts are linked to different currency pairs, providing exposure to the foreign exchange market. Currency futures offer opportunities for traders to capitalise on currency movements and manage currency-related risks.

Commodity futures are also a popular form of trading allowing traders to speculate on the future prices of various commodities. This includes precious metals like gold and silver, energy resources such as crude oil, and agricultural products like wheat and soybeans. Commodity futures provide a platform for traders to manage price risks and capitalise on potential fluctuations in commodity markets.

Interest rate futures are based on the future value of interest rates, often linked to government bonds or other financial instruments. Traders speculate on changes in interest rates, with the option to sell interest rate futures if they anticipate a rise in rates. Interest rate futures play a crucial role in managing risk associated with interest rate fluctuations.

Read More: Elevate Your Trading with Real-Time & Historical Stock Data Plugin

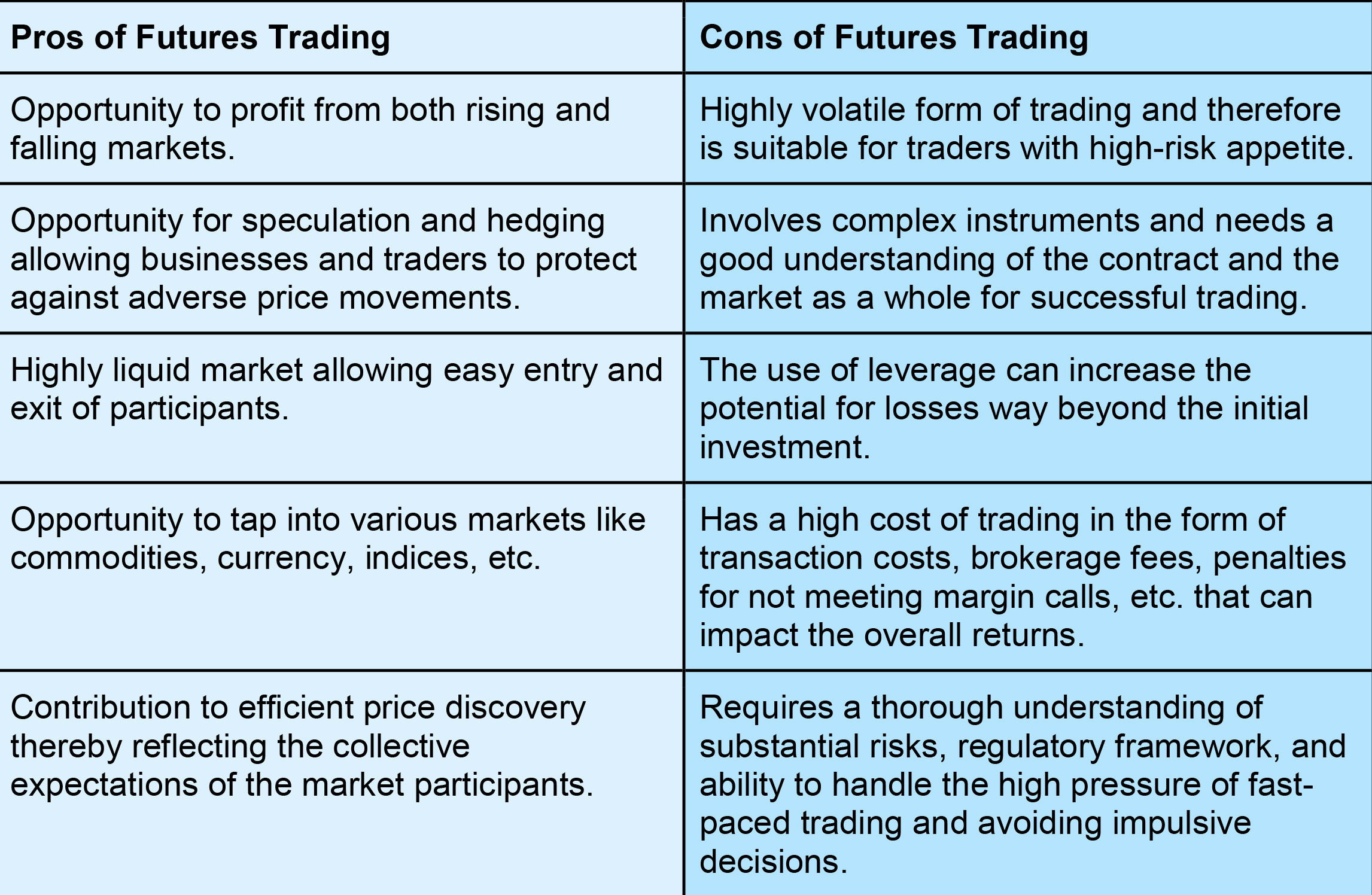

The pros and cons of futures trading are tabled hereunder.

Before taking a plunge into future trading it is important to consider a few essential factors to ensure a sound trading portfolio. Some of these factors are highlighted hereunder.

Before taking a plunge into future trading it is important to consider a few essential factors to ensure a sound trading portfolio. Some of these factors are highlighted hereunder.

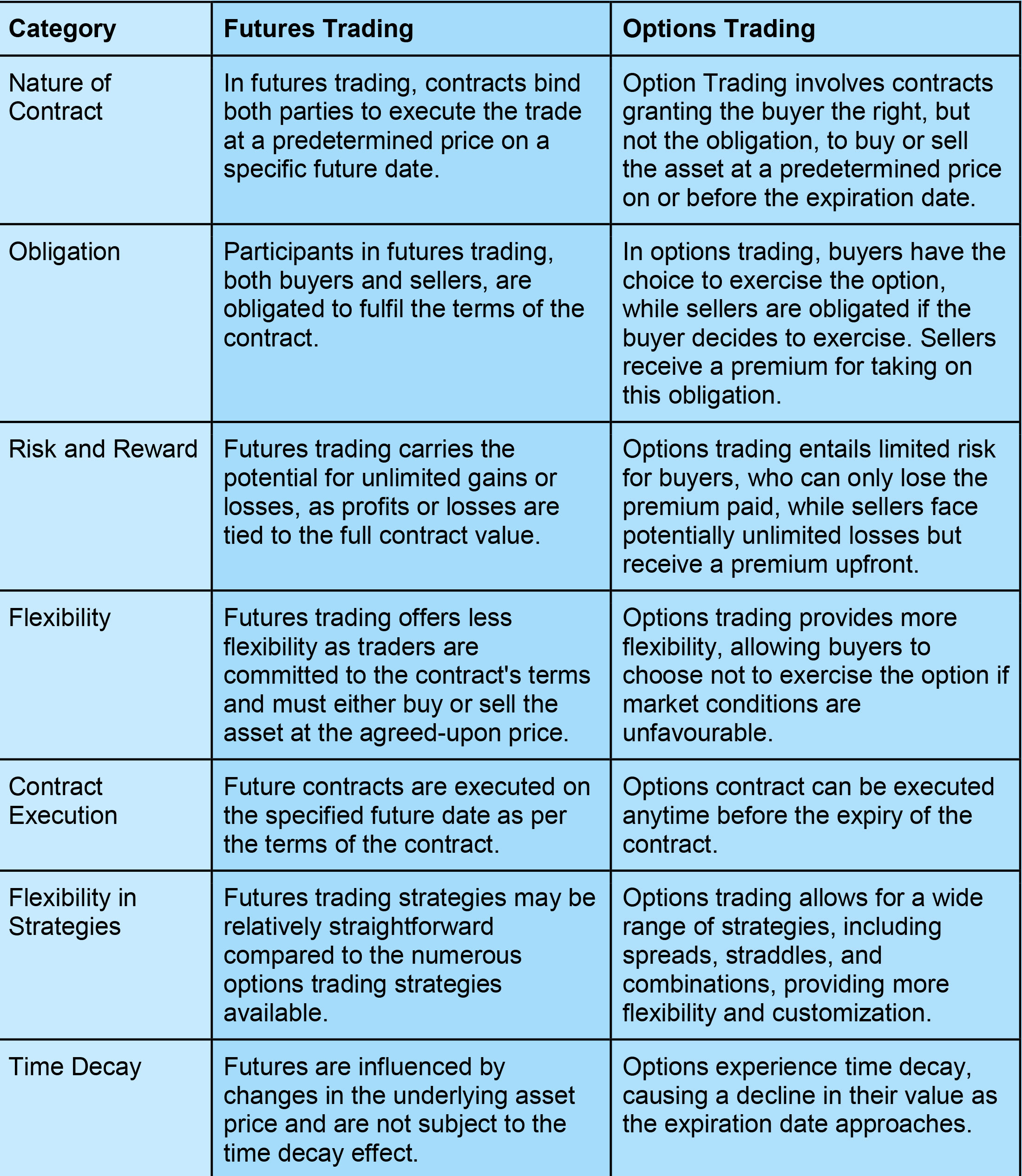

The terms futures and options are often used together to represent derivative trading, however, they are two diverse forms of trading with some fundamental differences. These differences are mentioned hereunder.

Futures and options trading has become a popular form of trading in India especially in the past few years. This increase in the number of participants, especially retail traders, can be attributed mainly to factors like the increased market awareness and tools to constantly improve and update the knowledge base as well as the improved technology and infrastructure to enable easy access to trade. However, it is important to note that futures trading like options trading is quite risky and therefore, traders need to be aware of such risks to have a successful trading portfolio. We hope this article was able to provide you with a basic knowledge of futures trading. Let us know if you have any queries relating to this topic or need any further information on futures trading and we will take it up in our coming blogs. Till then Happy Reading!

When we talk about trading in stock markets, there are multiple segments that tr...

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Indian Stock market has two leading stock exchanges - BSE (Bombay Stock Exchange...