Did you know that the inflation in the education sector in India is approximately 11%? Moreover, if you plan to send your child abroad for higher education, add rupee depreciation too, and it will become beyond the reach of most Indian middle-class families pretty soon. So what can you do to keep those dreams of providing quality education to your kids alive and ensure they get the best opportunities? The answer is in smart investments and mutual funds can be a game changer! Check out this blog to learn how mutual funds can help support your child’s education and ease your burden of creating a corpus for the same.

Planning for a child's education is one of the most important financial goals for parents. With rising education costs, investing in mutual funds can be a great way to grow wealth over time. Mutual funds offer different options based on risk appetite, investment horizon, and financial goals. Here are some of the popular mutual fund options for child education plans.

Equity mutual funds invest primarily in stocks and have the potential to generate high returns over a long period. If your child's education goal is 10-15 years away, equity funds can be a great option as they help beat inflation. Equity funds are volatile in the short term but tend to perform well over 10-15 years, making them ideal for funding higher education expenses. Some of the best equity mutual funds for education planning include,

Large-Cap Funds - These funds invest in well-established companies with a history of stable growth. They provide moderate but steady returns over time.

Multi-Cap or Flexi-Cap Funds - These funds invest across companies of different sizes, providing a balanced mix of stability and growth.

Index Funds - These funds follow a stock market index (such as Nifty 50 or Sensex) and have lower expenses, making them a good long-term investment option.

Equity-linked Savings Scheme (ELSS) - ELSS funds can be a great option for combining tax benefits with wealth creation. These funds come with a 3-year lock-in period but are ideal for long-term goals.

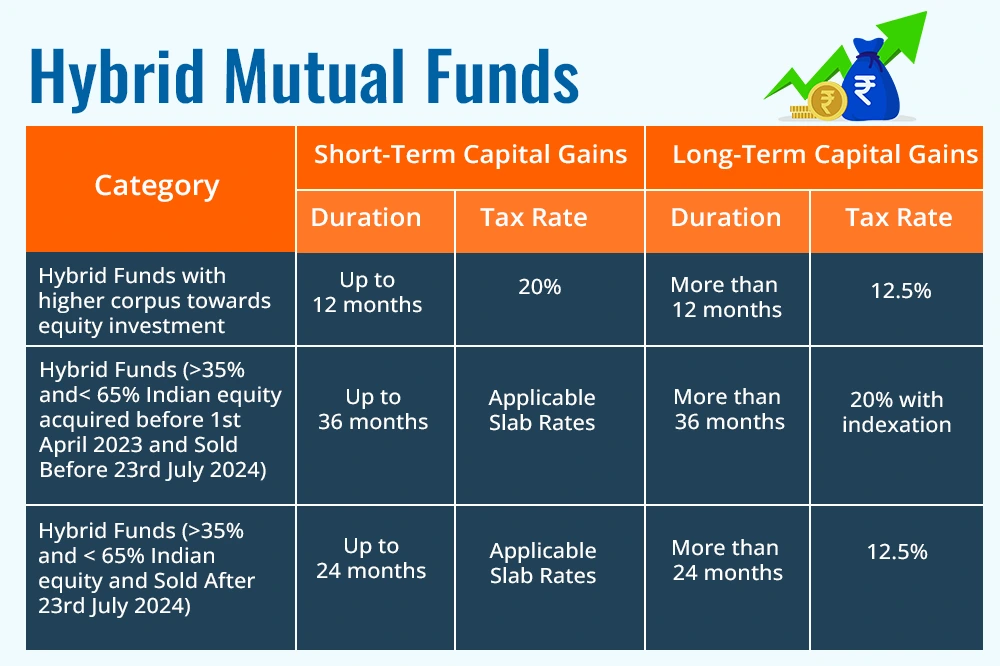

Hybrid mutual funds, also known as balanced funds, invest in both equity and debt instruments. They offer moderate risk and stable returns, making them ideal for parents who want growth but with some level of safety. Hybrid funds are a good option if your child's education is 5-10 years away, as they reduce risk while still providing growth. Some common types include,

Aggressive Hybrid Funds - These invest around 65-80% in equities and the rest in debt instruments. They provide higher returns but come with a higher degree of risk.

Conservative Hybrid Funds - These funds invest a higher portion in debt instruments (bonds, government securities) and a smaller portion in equities. They are suitable for parents who prefer a conservative or a safer approach to investing.

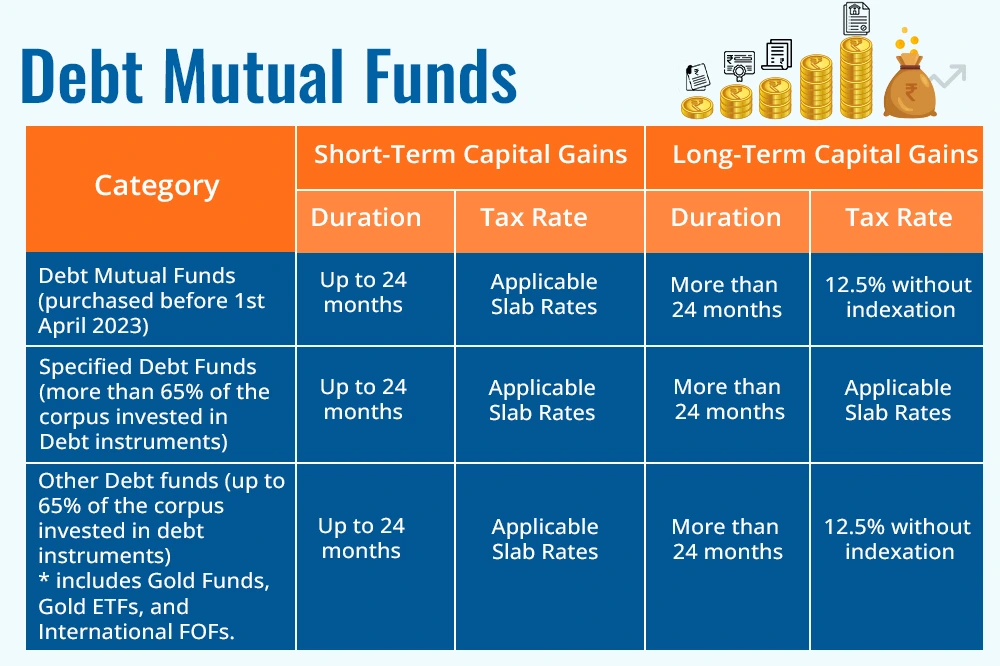

Debt mutual funds invest in government bonds, corporate bonds, treasury bills, and other fixed-income securities. These funds are known to provide steady returns and are less volatile than equity funds. Debt funds are ideal for parents who do not want to take risks and prefer stable returns over rapid capital growth.

Some types include,

Short-Duration Debt Funds - If your child’s education expenses are 3-5 years away, these funds are a safe investment option.

Gilt Funds - These funds invest in government securities and have no credit risk, making them good for those who want risk-free returns.

Fixed Maturity Plans (FMPs) - These funds invest in fixed-income securities and have a lock-in period, similar to fixed deposits but with better tax efficiency.

Mutual funds provide multiple benefits, like higher returns and flexible investment options. This makes them a very good option for funding your child's education, whether with a short-term investment horizon or for a long-term one. The reasons that make mutual funds an important part of child education planning are explained below.

Mutual funds, particularly equity mutual funds, offer higher returns compared to traditional savings methods like fixed deposits (FDs), recurring deposits (RDs), or endowment plans. While FDs typically provide 5-6% returns, equity mutual funds have historically delivered 12-15% returns over the long term. This is crucial because education costs in India rise by 8-10% annually, which implies that the traditional savings options may not grow fast enough to cover future expenses.

Inflation further reduces the value of money, making it essential to invest in assets that outpace rising costs. For instance, investing Rs. 5,000 per month in an equity mutual fund through a Systematic Investment Plan (SIP) for 15 years at a 12% return can grow to around Rs. 50,00,000, enough to meet future education needs. In contrast, keeping this money in a savings account would yield only Rs. 12,00,000-15,00,000, which may fall short. By choosing mutual funds, parents can ensure their savings grow at a faster rate, helping them provide quality education for their children without financial strain.

Many parents hesitate to invest because they believe they need a large amount of money. However, a Systematic Investment Plan (SIP) in mutual funds makes it easy to start with a small amount, like Rs. 500 or Rs. 1,000 per month. This helps parents save regularly without the burden of investing a large sum at once. SIP also benefits from rupee cost averaging, allowing investors to buy more units when prices are low and fewer units when prices are high, reducing overall risk. Additionally, the power of compounding helps the investment grow over time, leading to higher returns during the tenure of the investment. Thus, by starting early, even with small contributions, parents can build a significant fund for their child’s education without financial stress.

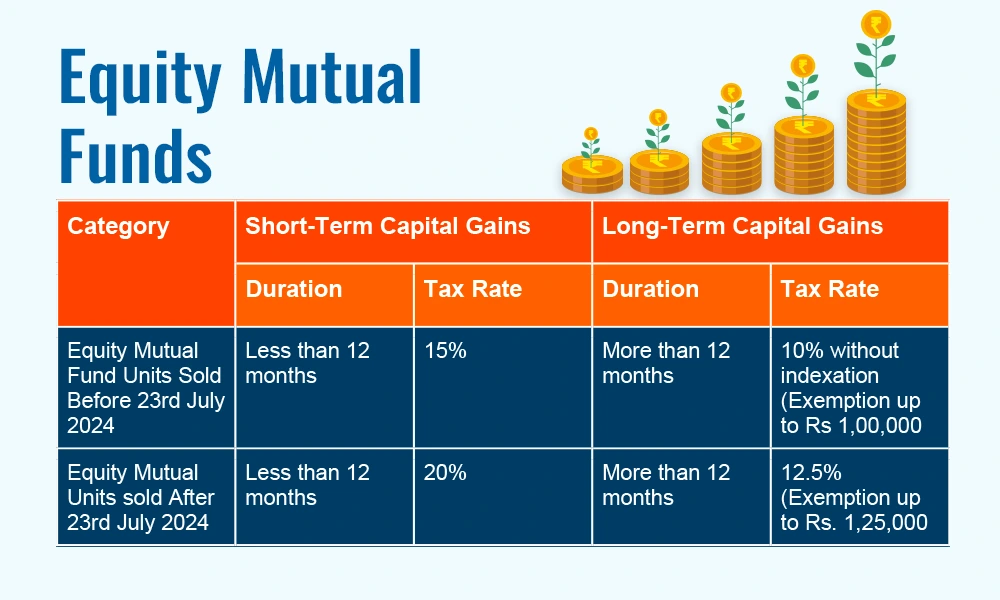

Mutual funds can help parents save on taxes while planning for their child’s education. One of the best options is the Equity-Linked Savings Scheme (ELSS), which allows tax savings under Section 80C of the Income Tax Act up to Rs. 1,50,000. This means parents can reduce their taxable income by investing in ELSS. Additionally, equity mutual funds have a lower long-term capital gains (LTCG) tax compared to traditional investment options, making them more tax-efficient. Thus, choosing the right mutual funds can help parents not only grow their education fund but also reduce their overall tax burden, making their savings more effective.

Mutual funds provide high liquidity, allowing parents to withdraw their money whenever needed without waiting for a fixed maturity period. Unlike insurance plans or fixed deposits, which may have restrictions or penalties on early withdrawals, mutual funds offer flexibility. For example, if a child needs funds for college admission, parents can easily redeem mutual fund units without hassle. In contrast, withdrawing from an insurance policy might come with penalties or delays. This easy access to funds makes mutual funds a convenient and flexible option for financing a child’s education.

Mutual funds are managed by expert fund managers who study the market and invest in the best stocks or bonds. This allows parents to benefit from professional management, even if they have little financial knowledge. Fund managers make investment decisions to help grow the money over time. Additionally, mutual funds provide regular updates and reports, showing how the investment is performing. This transparency allows parents to track their savings and make informed decisions about their child's education fund. Thus, expert management and clear reporting make mutual fund investing easier and more reliable.

We have seen how mutual funds are important in funding a child’s education and the benefits of the same. However, apart from mutual funds, other investment options can also be used to support a child’s education. Here are a few other investment options that can be used along with mutual funds to fund your children’s education.

Child ULIPs (Unit Linked Insurance Plans) combine insurance and investment, offering financial security for a child’s future. A portion of the premium provides life insurance, while the rest is invested in market-linked funds like equity or debt. If the parent passes away, the child receives a lump sum, and the insurer continues investing on their behalf. These plans offer the potential for market-based growth, tax benefits under Section 80C and 10(10D), and the flexibility to switch funds based on market conditions. ULIPs are ideal for those who want both insurance and long-term investment in one plan. However, they come with higher charges compared to mutual funds, making them less efficient for pure wealth creation.

Child Endowment Plans are a type of insurance policy that provides both life coverage and guaranteed returns, making them a safe option for securing a child’s future. These plans ensure that if something happens to the parent, the child will still receive financial support. A key feature is that they offer fixed payouts, typically in four parts, each equal to 25% of the total sum assured, along with any applicable bonuses. These payouts start when the child turns 18, helping to cover education or other important expenses. Since the returns are guaranteed, the plan carries very little risk, making it a stable and predictable option. However, because the focus is on security rather than high growth, the returns are generally lower compared to market-linked investment options like ULIPs or mutual funds.

Children’s Moneyback Insurance Plans are similar to endowment plans but offer regular payouts at set intervals, usually every 5 or 10 years. These payouts are a percentage of the total sum assured and help cover important expenses like education. The plan provides both insurance coverage and periodic financial support, ensuring that funds are available when needed. In addition to these regular payouts, the policyholder also receives a maturity amount at the end of the policy term. This makes it a good option for parents who want financial security for their child, along with periodic returns. While the plan offers stability and guaranteed benefits, the overall returns may be lower compared to market-linked investment options.

Every parent dreams of providing their children with the best education and opportunities for a financially secure future. Thus, planning for their child’s education is the topmost priority for any parent. Mutual funds prove to be an efficient tool in this process, allowing Indian families, especially the middle class, to meet the rising cost of education in India and provide their children with the resources necessary to shape their future.

This article talks about the benefits of mutual funds, specifically for creating a corpus for children’s education. Let us know your thoughts on this topic or if you need any further information on any of the investment options, and we will address them.

Till then Happy Reading!

Read more: What is financial planning?

Introduction For the longest time, investment in stock markets was thought to b...

It is a very well-known fact that mutual funds are considered to be among the st...

‘Mutual funds are subject to market risk’, this line is what most pe...