What is the fastest way to increase your wealth? Most people think it is having a great job or a business but other than ancestral wealth, the only other way to increase your wealth faster is through investing. While there are multiple investment options, equities have been known to give the maximum returns in the long term. However, investing in pure equities alone is not the only option available to investors. Equity mutual funds offer a balanced yet dynamic approach. Here is all you need to know about equity mutual funds and why you should invest in them.

Equity mutual funds are mutual funds that invest primarily in shares or stocks of companies to gain from market fluctuations and aim at generating higher returns in the long term. Like any other mutual fund, equity mutual funds also pool funds from multiple investors for investment in equities and are professionally managed by experienced and qualified fund managers who select stocks and manage stocks based on the investment strategy or the investment objective of the fund. These funds are regulated as per the guidelines of SEBI and AMFI where funds have to disclose their assets and Net Asset Value (NAV) to ensure transparency enabling investors to make informed investment decisions. Investors can invest in these funds either in lumpsum mode or through SIP (Systematic Investment Plan) to gain advantage of rupee cost averaging as well as compounding to increase the wealth in the long term.

SEBI guidelines have classified equity mutual funds into several categories based on the assets they invest in or their investment objective. These types of equity mutual funds are explained hereunder.

Large-cap funds invest primarily in shares of large and established companies, often referred to as blue-chip companies. These companies are among the top 100 by market capitalisation and are known for their stability, and strong performance records, and are often industry leaders. Large-cap funds are relatively less risky than other equity funds, making them suitable for conservative investors seeking steady growth over the long term. These funds are ideal for those who prefer consistent returns with less volatility.

Mid-cap funds focus on investing in mid-sized companies ranked between 101 and 250 by market capitalisation. These companies are in the growth phase and have the potential to become tomorrow's large-cap companies. While mid-cap funds offer higher growth potential compared to large-cap funds, they are also riskier due to market fluctuations. They are a good choice for investors with a moderate risk appetite and a long-term horizon who want to capture higher returns.

Small-cap funds invest in small-cap companies that are ranked beyond 250 in terms of market capitalisation. These companies are often in their early stages of growth, offering significant potential for high returns. However, small-cap funds carry the highest risk among equity funds because smaller companies are more vulnerable to market volatility and economic changes. These funds are suitable for investors with a high-risk tolerance and a long-term perspective.

Multi-cap funds invest across companies of all sizes, i.e., large-cap, mid-cap, and small-cap thereby offering a diversified portfolio. This diversification helps balance risk and return, as the performance of one category can offset the underperformance of another. These funds are ideal for investors seeking a mix of stability and growth, without the need to actively choose among market segments.

Flexi-cap funds also invest in companies of all sizes but they provide fund managers with the flexibility to adjust the allocation dynamically based on market conditions which may not be available in multi-cap funds. This strategy allows fund managers to capitalise on opportunities in any segment, making them adaptable to changing markets. Flexi-cap funds are suitable for investors looking for a balanced, growth-oriented approach without being restricted to a specific market segment.

Large and mid-cap funds invest in a mix of large-cap and mid-cap companies, with at least 35% of the portfolio allocated to each category. These funds combine the stability of large-cap stocks with the growth potential of mid-cap stocks, offering a balance of risk and return. They are suitable for investors who want a mix of safety and growth in their equity investments.

ELSS is a tax-saving equity mutual fund that offers deductions of up to Rs. 1,50,000 per year under Section 80C of the Income Tax Act. ELSS funds have a mandatory lock-in period of three years, making them one of the shortest lock-in options among tax-saving instruments. They primarily invest in equity and equity-related securities, making them a good choice for investors seeking tax benefits along with the potential for wealth creation over the long term.

Sectoral funds invest in specific sectors like banking, technology, or healthcare, while thematic funds focus on broader themes like infrastructure, consumption, or ESG (Environmental, Social, Governance). These funds carry higher risk as their performance depends on the growth of the targeted sector or theme. They are suitable for experienced investors who understand market trends and are confident about the prospects of the chosen sector or theme.

Focused funds invest in a limited number of stocks, usually 30 or fewer, across any market capitalisation. This concentrated approach allows fund managers to focus on their best investment ideas. However, the limited diversification also increases the risk. These funds are suitable for investors who have a high-risk appetite and want to invest in a portfolio of carefully selected stocks.

Dividend yield funds invest in companies that pay high and consistent dividends. These funds aim to provide regular income along with capital appreciation. They are less volatile compared to growth-focused equity funds and are suitable for conservative investors who value steady returns and have a medium to long-term horizon.

Contra funds follow a contrarian investment strategy, investing in stocks that are undervalued or out of favour but have the potential for long-term growth. The idea is to buy when others are selling and hold until the market recognises the stock’s true value. These funds require patience and are suitable for investors with a long-term outlook and a willingness to take calculated risks.

Value funds focus on investing in undervalued stocks that have strong fundamentals and growth potential. The fund manager identifies companies that are trading at prices lower than their intrinsic value. These funds aim for long-term capital appreciation and are suitable for investors who can wait for the market to realise the true potential of these stocks. Value funds often appeal to those who prefer a disciplined and patient approach to investing.

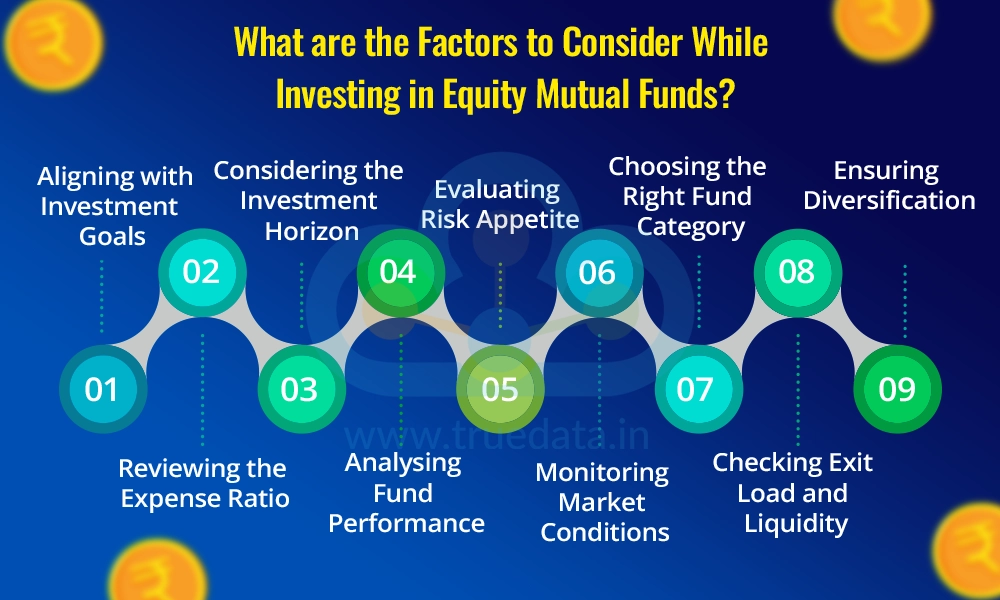

Investing in equity mutual funds is a more balanced way of investing in equities than pure equities. However, a few factors need to be considered. Here is a brief list of them.

Investors should clearly define their financial goals before choosing equity mutual funds. Whether the aim is long-term wealth creation, retirement planning, or funding a child's education, the selected fund must align with these objectives to deliver the desired results.

Equity funds are best suited for long-term investments, typically over 5 years. A longer time horizon allows investors to ride out market fluctuations and take full advantage of compounding to maximise returns.

Understanding one’s tolerance for risk is crucial as equity mutual funds are subject to market volatility. Investors must assess whether they are comfortable taking higher risks in exchange for potentially greater returns, based on their financial stability and preferences.

Equity mutual funds are available in various categories, such as large-cap, mid-cap, small-cap, or sector-specific funds. Investors should select a category that matches their risk tolerance and investment goals for optimal results.

Funds that offer broad diversification across sectors and market caps help reduce risk. Diversification ensures that poor performance in one sector or stock does not significantly impact the overall portfolio.

The expense ratio reflects the fund management costs and impacts net returns. Lower expense ratios are generally preferable, as they ensure that more of the fund's earnings benefit the investor over time.

While past performance is not a guarantee of future returns, it serves as an essential indicator. Investors should look for funds that have delivered consistent returns over 3-5 years to identify well-performing options.

Investing in equity mutual funds during market highs can be risky unless done via SIPs (Systematic Investment Plans). SIPs allow investors to mitigate the effects of market volatility by averaging the purchase cost over time.

Some funds impose an exit load if investments are redeemed within a specified period. Investors should review the exit load structure and ensure the fund offers sufficient liquidity to meet their financial needs.

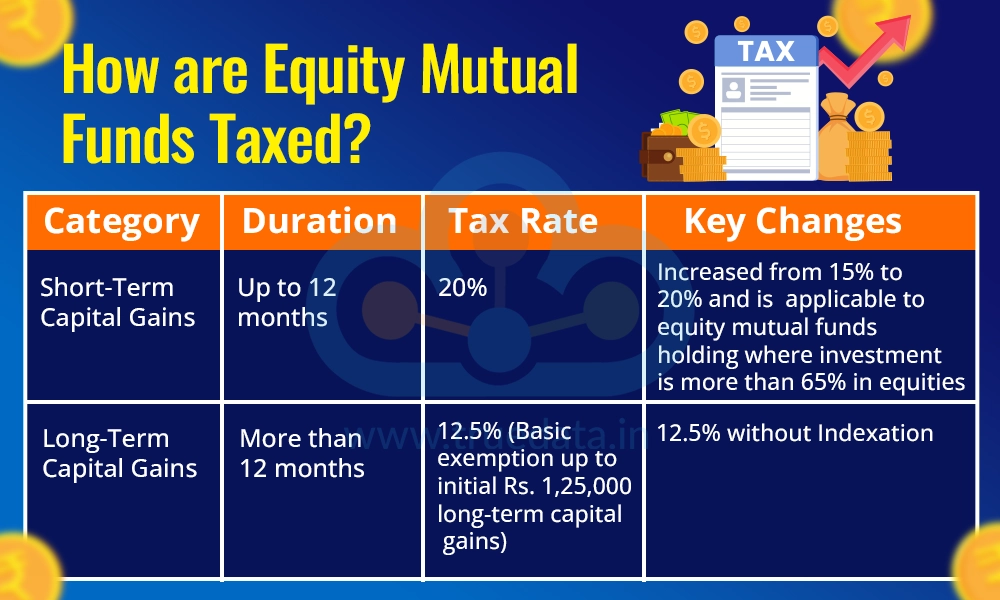

Taxation in mutual funds is a key factor in making any investment decision. With the recent overhaul of the capital gains tax, investment in equity mutual funds has to be after careful consideration of the tax impact and the net returns from investment.

Returns from equity mutual funds are in the form of dividends and capital gains. Dividends are taxable in the hands of investors as per their applicable slab rates. Capital gains on the other hand are taxed as per the holding period of the units of the fund.

The taxation of capital gains from equity mutual funds is tabled hereunder.

Equity mutual funds are ideal for individuals looking to grow their wealth over the long term and who are comfortable with the ups and downs of the stock market. These funds are suitable for investors with a time horizon of at least 5 years, as this allows them to benefit from market growth while minimising the impact of short-term volatility. They are a good choice for people with moderate to high-risk tolerance, as equity funds can offer higher returns compared to fixed-income investments, though they also carry more risk. Additionally, investors aiming for financial goals such as retirement, funding a child’s education, or purchasing a home can consider equity mutual funds to achieve inflation-beating growth. Those who are new to investing or prefer professional fund management can also benefit from equity mutual funds, as they provide access to diversified portfolios managed by experienced fund managers.

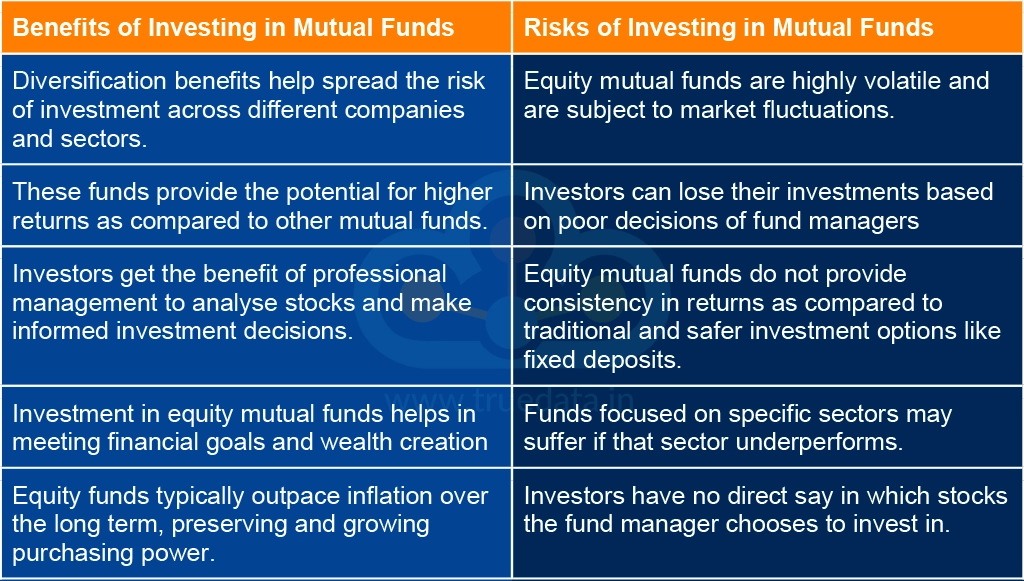

Investment in equity mutual funds can provide a fast-track option for wealth creation over time. However, investment in these funds should be after a thorough analysis of the pros and cons of investing in equity mutual funds.

Equity mutual funds are an excellent tool for wealth creation and offer the potential for high returns, particularly for long-term investors. The ease of investment through SIPs promotes financial discipline, and the ability to manage market volatility. However, they come with risks such as market fluctuations, reliance on fund managers and tax implications, which need careful evaluation before investment decisions.

This article talks about equity mutual funds in detail enabling investors to make informed investment decisions. Let us know if you invest in equity mutual funds too or have any queries on this topic and we will address them.

Till the Happy Reading!

Read More: Why Invest in Debt Mutual Funds?

Introduction For the longest time, investment in stock markets was thought to b...

One of the primary points of comparison while picking between two or more invest...

It is a very well-known fact that mutual funds are considered to be among the st...