The year 2024 despite its despite its various ups and downs was a great year for the IPO market in India. India’s NSE saw a record 268 listings in the Mainboard and SME IPO market topping the Asian markets. The increasing interest in IPOs is also evident from the fact that a Rs.12 crore SME IPO in August 2024 got oversubscribed 419 times attracting bids of Rs. 4800 crores. With IPOs becoming so popular and new investors entering the market, it is important to know more about IPOs and their key participants to make informed decisions. Here are the key participants of the IPO process and their key details.

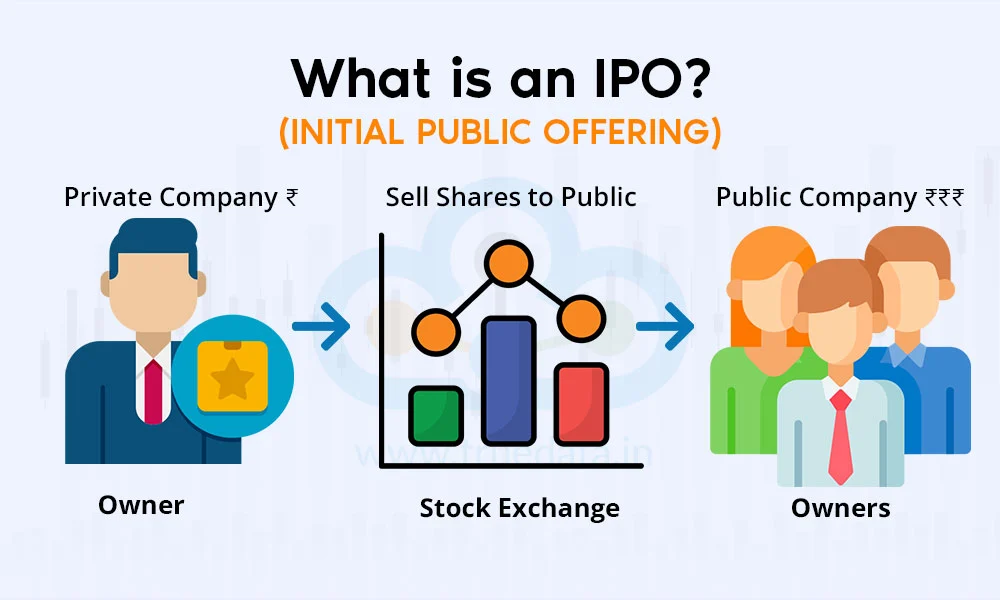

Finance is one of the primary requirements for any company to grow and progress. Companies can either use equity or debt to meet their needs and this is where IPO comes into the picture. IPO stands for Initial Public Offering and is the process through which a company goes public, i.e., invites investors to subscribe their shares and raise equity capital for the company. The business can use the funds raised to meet its financial needs like paying off debt, expanding the business, etc. By subscribing to the shares of a company, investors can become part-owners of such company and get a chance to be part of its growth story. Returns from this investment can be in the form of dividends or capital gains and the share price is based on the demand-supply forces in the market. Investing in an IPO can be a good opportunity for wealth creation but also comes with high risk in case the company fails to perform as expected in the long run.

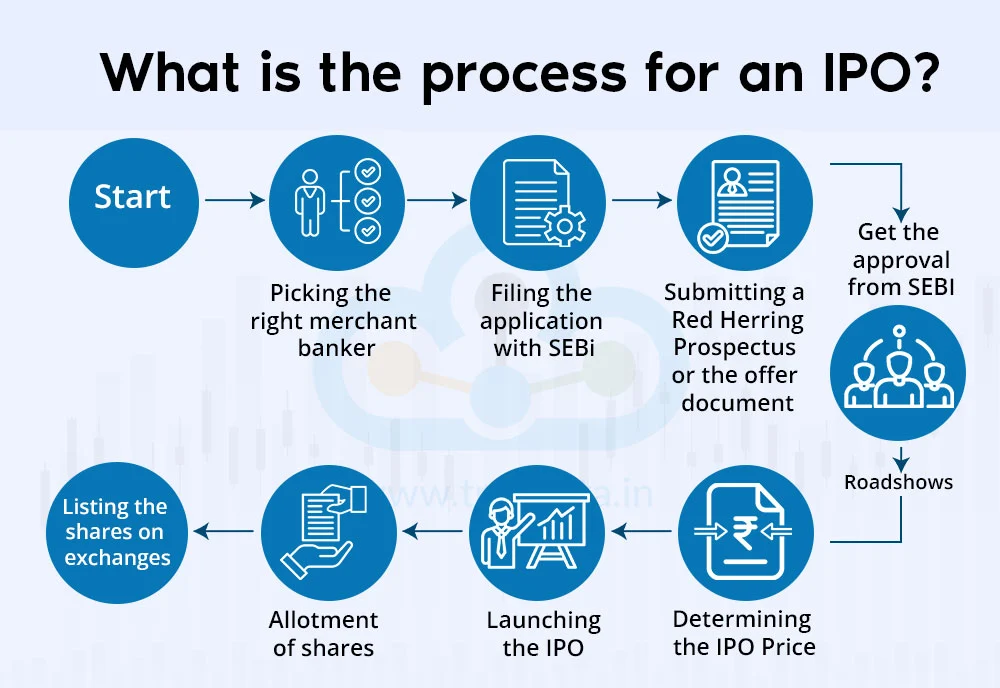

The process of IPO where a company decides to raise funds through public participation is quite lengthy. The end-to-end process beginning from the company’s decision to go public to the final listing of company shares on stock exchanges usually takes months. This IPO process is explained briefly hereunder.

The first step in the process of IPO is the company’s decision to seek public investment.

The company then hires investment banks and financial experts, called underwriters, to guide them through the IPO process and help determine the price and number of shares to sell.

As per SEBI and Companies Act, 2013 rules, the company is required to file a DRHP (Draft Red Herring Prospectus) with SEBI that highlights the details of the IPO and the company (financial statements, future plans, legal issues, etc.).

SEBI reviews the DRHP to ensure it is fair and transparent and also suggests changes if it deems necessary.

The company after incorporating the said changes file the RHP (Red Herring Prospectus) which also includes the share pricing mechanism (decided by the company along with its advisors and underwriters) and the nature of the IPO (Fixed IPO or a Book Building IPO).

The IPO is marketed or promoted by the company and its underwriters to attract public investment through various roadshows and other marketing measures as per SEBI guidelines.

The IPO is then open for public subscription for a limited period (usually 3 days) and where investors from various categories can apply for the IPO shares through different portals.

Once the subscription period is closed, the company and its underwriters allocate the shares to the investors based on the demand for shares. In case of oversubscription, the shares are allotted on proportional basis or in the manner as prescribed under the RHP.

Post allotment, shares are listed on the notified stock exchanges where the demand-supply forces of the market determine the price of the shares.

The process of an IPO is explained briefly above. This process includes various participants at various stages that have defined roles to ensure the smooth execution of the IPO and listing of shares. These participants and their details are explained below.

The company is the issuer of the shares under the IPO for the first time to the general public for subscription. The aim of the IPO is to raise funds to meet the business purposes of expansion, paying off debt, or any other business needs. The company is in charge of preparing the DRHP with its underwriters along with other necessary documents and submitting the same to SEBI ensuring required compliance.

Underwriters are investment banks who are the financial experts hired by the company to manage the IPO. These underwriters are responsible for determining the price of the shares, the number of shares sold or unsold, and ensuring the IPO is successful. If the IPO shares are not subscribed, the underwriters are charged with buying them to reduce the risk for the company.

Auditors and legal advisors are an essential part of this system as they ensure the accuracy and compliance of all the legal and accounting standards that are mandatory for the IPO to be valid and successful. Legal advisors along with the underwriters and the company draft the documents and resolve any challenges in the IPO process.

SEBI is the regulatory body with a primary role to protect the investor’s interest and is in charge of laying the regulations ensuing the same by having a fair and transparent IPO. The company has to file the DRHP and the RHP with SEBI as per the prescribed guidelines and timelines. SEBI reviews these documents to ensure the prevention of any fraud or misinformation reaching the investors.

Stock exchanges like BSE and NSE are the platforms for companies to list their shares from the IPO (Initial Public Offering) and are further traded. The company works with the stock exchanges to meet the listing requirements such as financial performance and corporate governance standards. Listing of shares on the stock exchanges is beneficial for the companies as it allows authenticity and credibility for the company and legality for the transactions.

The next part of the chain is the merchant bankers who are the financial professionals acting as intermediaries between the company and SEBI. They assist the company in preparing a prospectus, filing necessary documents, and complying with all regulatory requirements. They also participate in IPO pricing and coordinate with other participants like underwriters and stock exchanges.

Self-Certified Syndicate Banks (SCSB) are an essential part of the IPO process as they are the SEBI authorised banks that help in accepting IPO applications from investors. These banks are in charge of blocking the application amount from the investor’s bank account through a process known as ASBA (Application Supported by Blocked Amount). This process ensures that the funds remain in the investor’s account and are only debited after allotment.

The Registrar to the Issue (RTI) is also known as the IPO Registrar and helps the company during the IPO process. They manage tasks like collecting and verifying IPO applications, preparing the list of valid applicants, deciding the basis of share allotment, and handling refunds for those who do not receive shares. IPO Registrars also act as Share Transfer Agents and keep shareholder records updating information like ownership changes or contact details. Their role ensures the smooth processing of the IPO and accurate maintenance of shareholder records.

The shares invested by the investors under the IPO are credited to Demat accounts. However, they are held by depositories like the NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited) in electronic form. These depositories are responsible for crediting the said shares in the Demat account post allotment ensuring seamless transfer of ownership in a secure and paperless manner.

Brokers and sub-brokers are also intermediaries in the IPO process providing a platform with easier access for the investors to apply for the IPO. They also assist them in resolving any queries or issues in the IPO application or allotment process ensuring the role of being an effective cord between investors and the share market.

Credit rating agencies are responsible for assessing and rating the company's debt instruments (if any) or IPO structure, providing an idea of the associated risk. Although not mandatory for all IPOs, their analysis helps investors make informed decisions.

The final link of the IPO process is the investors who subscribe to the IPO shares and invest in the company. SEBI classifies investors into three crucial categories, namely, Retail investors, Non-Institutional Investors and Qualified Institutional Buyers (QIBs). Retail investors can invest in an IPO up to Rs. 2,00,000 while QIBs include entities like Banks, Mutual Funds, Venture Capitalists, etc. and are allowed a fixed percentage of allotment in the IPO. On the other hand, non-institutional investors are allowed to invest in larger amounts i.e., more than Rs. 2,00,000. It is important for investors to evaluate the risks and returns of the company along with other key details before investing in order to make informed investment decisions.

The participants of the IPO at every stage are its backbone and a disruption in any of the links in the process can break the IPO or make it unsuccessful. The defined roles and responsibilities of various participants of the IPO at various stages ensure the smooth transfer of IPO shares to the investors and help the companies meet their targets through the funds raised in the IPO.

This blog talks about the finer details of the IPO process and the key participants who work behind the scenes. Let us know if you need further details about the IPO process or its nuances and we will address them in our coming blogs.

Till then Happy Reading!

Read More: Red Flags to Watch Out for While Analysing a Company’s Stock

If you are a shareholder of a company, you would have seen its annual reports co...

Did you know more than 5000 companies are listed on theBSE and about 2000 on the...

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...