Every trader's morning begins with being glued to their TV or laptop and watching the stock prices in the pre-open session. The market bell rings at 9.15 am and the market opens for regular trading until 3.30 pm. Most people think it is during normal trading hours that the actual trading is done. However, the pre-open session for NSE and BSE is also equally important as it is in this session which is responsible for price discovery. The details of this pre-open market session on NSE and BSE are mentioned below.

The pre-open session was introduced in the Indian stock markets in 2010. Prior to this session, the opening price for the security was determined based on the first matched order of the day that was executed. This created huge volatility at the start of the trading sessions on account of pre-market news like company results, political changes, government policy decisions, etc. To avoid this volatility, a pre-market session of 15 minutes was introduced in the Indian stock exchanges.

The prime features of the pre-open session on NSE and BSE are highlighted below.

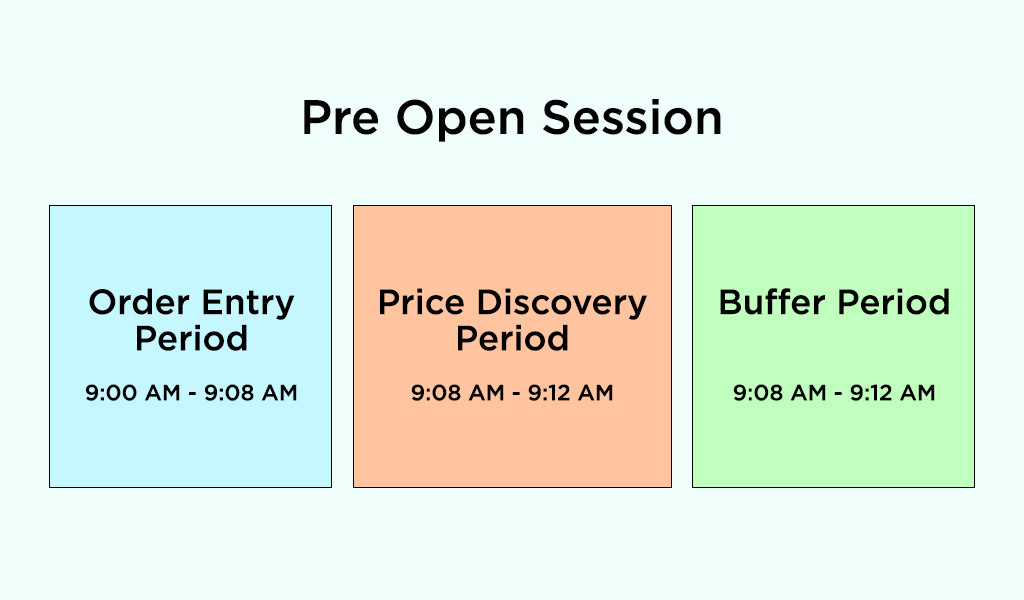

The orders in the pre-open session are collected in the initial 8 minutes of this session when traders are permitted to add, modify or delete their orders. These orders are then matched with the available prices which will lead to price discovery based on the basic demand and supply function. It is also important to note that during the pre-open session, a uniform price band of 20% will be applicable to all the eligible stocks.

Traders usually set limit orders in the pre-open session. These limit orders get priority over market orders while executing the trades. The confirmation of the same will be given to such traders on their trading platform before the normal trading session begins.

The prime purpose of introducing the pre-open session was to limit the extreme volatility due to the lack of any mechanism of price discovery. The pre-open session accounts for the price volatility due to any significant event after the closing of the previous trading session thereby allowing the price of the stocks to adjust for the same as well as traders to place their market orders at optimum prices.

The pre-open session also provides for a scenario where there are no trades matched in this session. In such cases, the orders entered during this period will be carried forward to normal or continuous trading sessions based on time priorities. The price at which the first order is executed will be the opening price in such scenarios.

The pre-market session assures higher liquidity and price determination based on fair market practices. This creates a healthy trading environment for small or retail traders as well as beginners.

As mentioned above, the pre-market session assures price discovery based on the simple demand-supply dynamics of any security. It evaluates the optimum prices at which maximum orders can be executed and such price is also known as the equilibrium price.

The orders are collected in the first 7 to 8 minutes of the pre-open session after which the order collection process is halted. The next 4 minutes are used to match all the collected orders with the optimum prices. This price can be determined based on the maximum tradable quantity or the volume of the stocks at each price level.

The final 3 minutes of the pre-open session are allocated for the smooth transition of the pre-open session to the normal trading session or the continuous market trading session. Any outstanding orders or orders to be executed at the equilibrium price (market orders) are moved to the regular trading session.

Any investor who wants to trade in the capital market segment can trade in the pre-open session provided they have the said feature in their trading account. If such a feature is not available then they can ask for the same from their broker and participate in the pre-open session. Some of the key points to remember while trading in the pre-open session of NSE and BSE are highlighted below.

The pre-open session is available in cash, margin as well as intraday trading but not for Futures and Options.

Orders in the pre-open session cannot be placed beyond the 20% margin of the previous day’s closing price.

All unexecuted orders as well as market orders will be moved to normal trading session.

Orders for Sensex and Nifty can be placed in the pre-open session.

The previous day’s closing price will be treated as the opening price for the continuous market session of the following day if no price discovery is achieved in the pre-open session.

The pre-open session although a later addition to the NSE and BSE has greatly improved the trading and investing for every participant of the market. It further allows fair market prices to be the basis of trading and avoids any situation of manipulation of stock prices.

Now that you know the basic meaning and function of the pre-market session, let us know if it helps you to understand the stock markets in a better manner. Also, do let us know if you are an active trader in the pre-open session or if you need clarity on any other market-related concepts.

Introduction In an attempt to curb speculative trading, the exchanges move stoc...

The start of the year has not brought good news for stock markets around the gl...

Mutual fund investments have simplified greatly with just a tap on your smartpho...