The world of trading is constantly evolving with the use of advanced technology and state-of-the-art trading platforms. This has helped traders not only refine their trading strategies but also capitalise on changing market scenarios in minutes. However, amidst all this advancement, the crux of successful trading is having reliable market data. Without this crucial jigsaw piece, having a successful trading strategy is impossible. Dive into this blog to learn more about market data and its importance in having a successful portfolio backed by well-defined trading strategies.

Before we talk any further, let us first understand the meaning of market data and its sources. Market data refers to the real-time and historical information about financial markets that helps investors, traders, and other market participants make informed decisions. It includes details such as stock prices, traded volumes, bid-ask spreads, indices, interest rates, and more. Market data is essential for understanding market trends, analysing securities, and executing trades effectively.

There are multiple sources of this market data including,

Stock Exchanges (NSE, BSE and MCX) providing live and historical data on stocks, commodities, and derivatives.

Data shared by regulatory bodies like SEBI in the form of reports, guidelines and market trends

Market data provided by Terminals, Data Vendors, Brokerage Firms and Trading Platforms like NSE Data Feed, TrueData (Authorised Data Vendors) Zerodha and more, offering advanced analytics and market insights.

Government and Financial Institutions like RBI, the Ministry of Finance and economic surveys offering macroeconomic data, currency trends and interest rates.

Market data provides valuable financial information that helps investors, traders, and other market participants make informed decisions. There are two major types of market data: Real-time Market Data and Historical Market Data. Each type of market data serves a different purpose and is important for analysing and predicting market trends. Here is a brief explanation of the same.

Real-time market data refers to live, continuously updated information about stock prices, trading volumes, bid-ask spreads, and other market activities. This data is available instantly as market transactions happen, helping investors and traders stay updated on price changes, market movements, and trading opportunities.

Real-time market data in India is provided by stock exchanges like NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). It is also available on platforms like TrueData, Zerodha, Angel One, etc. where investors and traders can track stock prices and execute trades instantly.

Importance of Real-Time Market Data

Essential for intraday traders or derivatives trading to make quick decisions

Used by long-term investors to track stocks and make buy-sell decisions.

Used by Algo traders and in High-Frequency Trading for advanced trading strategies and algorithms

Used by market participants to understand the overall market sentiment.

Historical market data refers to past records of stock prices, trading volumes, and other market activities over different time periods—days, months, or even years. This data helps investors and analysts study long-term trends, patterns, and price movements. Historical data can be accessed from sources like NSE and BSE websites, financial research firms, brokerage platforms, and data providers.

Importance of Historical Data

Used by traders and investors in technical and fundamental analysis and predicts future price movements for long-term analysis of market trends and price movements.

Used by traders for backtesting trading strategies and refining them.

Used by economists and financial experts or researchers to understand stock market cycles, economic booms, and crashes.

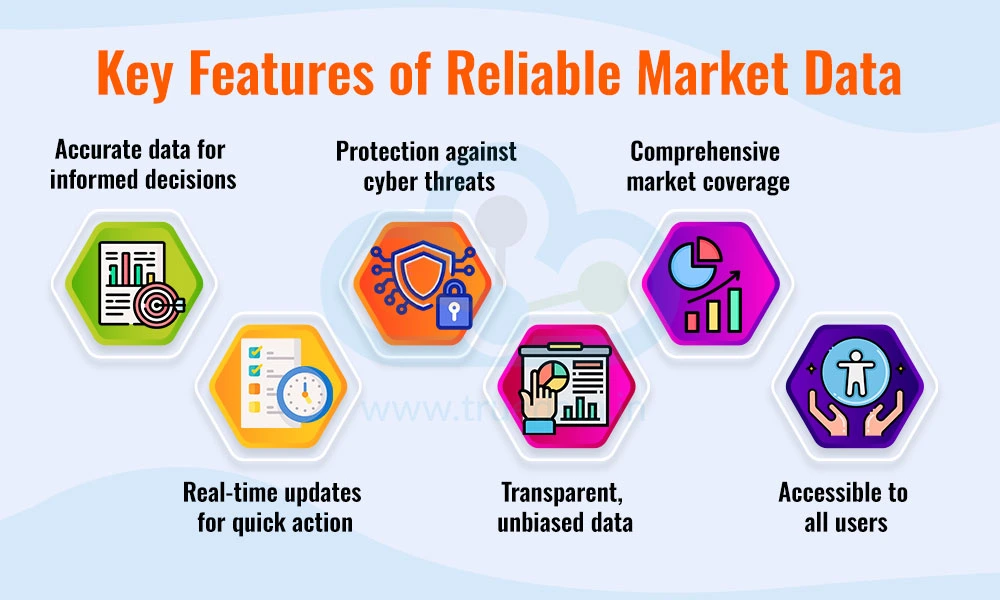

Market data is essential for making informed investment and trading decisions. However, not all market data is reliable. Good market data should be accurate, timely, comprehensive, and easily accessible to ensure that investors, traders, regulators, and businesses can make the right choices. The key features of reliable market data include,

Reliable market data must be accurate to help users make the right decisions. Even a small error in stock prices, trading volume, or financial reports can lead to poor investment choices.

Market data needs to be real-time or updated quickly (within seconds) so that investors and traders can react to price changes and market movements instantly. Delayed or outdated data can lead to losses, especially for traders who rely on quick decisions.

Reliable market data should be protected from cyber threats, hacking, and unauthorised access. Financial fraud and data leaks can cause major losses for investors and businesses.

Market data should be transparent and free from any manipulation or bias. If financial data is misleading or altered, it can create confusion and lead investors in the wrong direction.

Reliable market data should be comprehensive and cover all important aspects of financial markets, including stocks, commodities, forex (currency exchange), bonds, mutual funds, and derivatives.

Reliable market data should be easily accessible to all investors and traders, whether they are professionals or beginners.

In the world of trading, having accurate and up-to-date market data is one of the most important factors for success. Whether trading stocks, commodities, forex or cryptocurrencies, the basis of optimum decisions depends on the quality of the information received. Reliable market data helps traders understand price movements, market trends, and overall economic conditions, allowing them to make informed decisions instead of relying on guesswork. The importance of reliable market data for a successful trading strategy is explained below.

Trading is all about making the right decision at the right time. If you have access to correct and timely data, you can analyse market conditions and act accordingly. However, if the data received is outdated or incorrect, it can lead to bad decisions and portfolio losses. A trader with real-time and reliable data can exit their position quickly to avoid heavy losses.

Reliable market data helps traders identify trends in the market. Trends indicate whether prices are moving up, down, or sideways. If a trader can spot a trend early, they can take advantage of it and maximise profits. For example, if gold prices in India are steadily increasing, a trader who notices this trend early can buy gold and sell it at a higher price later. Without accurate data, it is difficult to identify such profitable opportunities and capitalise on them.

Every successful trader follows a strategy based on data analysis. A trading strategy includes identifying suitable entry and exit points and how much to invest. The use of false or inaccurate data can lead to failure in implementing trading strategies, leading to losses. Reliable market data can also help traders back-test their strategies before applying them in real trading, thereby testing their impact and effectiveness. This helps them refine their approach and avoid costly mistakes.

A smart trader always compares different investment options before making a decision. Reliable market data allows traders to analyse multiple stocks, commodities, or forex pairs and choose the best one. For example, if someone wants to invest in bank stocks, they can compare the performance of stocks in this segment like HDFC Bank, ICICI Bank, and SBI using accurate and reliable market data. This helps in selecting the best investment with the highest potential return, boosting overall portfolio returns.

The stock markets are highly volatile and a dynamic space with constantly changing market conditions. The surest way to stay ahead of the market curve is by having the latest and the most reliable market data to adapt to the changing market conditions to ensure maximum profits and minimum losses while safeguarding capital investment. Trading without the availability of good and reliable data is like driving blindly on a winding road with the maximum possibility of severe losses.

Reliable market data is the key to a successful trading strategy where traders can make informed market decisions. Without accurate and timely data, trading becomes a game of luck rather than skill. Therefore, it is essential to have reliable market data and source it from trusted sources like NSE, BSE and MCX and its authorised data vendors like Truedata. Relying on quality data helps traders improve their chances of success, minimise losses, and make smart investment choices for a profitable portfolio.

This article highlights the importance of reliable and timely market data to have successful trading strategies and a profitable portfolio. TrueData is an Authorised Data Vendor of real-time data from NSE, BSE and MCX and ensures accurate, transparent data for its users. Let us know your thoughts on this topic or if you need further information on accessing our reliable market data, and we will address it.

Till then Happy Reading!

Read More: What is short-term trading vs long-term trading strategies?

Thestock markets are always in a constant dance of ebb and surge of the market s...

Stock trading is not a simple and straightforward concept and requires a detail...

There is a popular saying in stock markets that the markets are either driven by...