One of the primary points of comparison while picking between two or more investments is the returns that they generate. But did you know there are many types of returns that can be considered when it comes to picking between mutual funds? Investors can focus on trailing returns, annual returns and also rolling returns. Here is a brief meaning and analysis of each type of return and its significance for investors.

Annual returns in mutual funds represent the percentage change in the value of the mutual fund investment over a one-year period. This figure indicates how much an investment has grown or shrunk in value within a year, providing investors with a snapshot of the fund’s performance. Understanding annual returns is crucial as it helps them gauge the effectiveness of their investments and compare different mutual funds. These returns consider various factors such as interest income, dividends received, and capital gains from the sale of securities within the fund. A higher annual return signifies better performance, but it is also essential to consider the consistency of these returns and the associated risks.

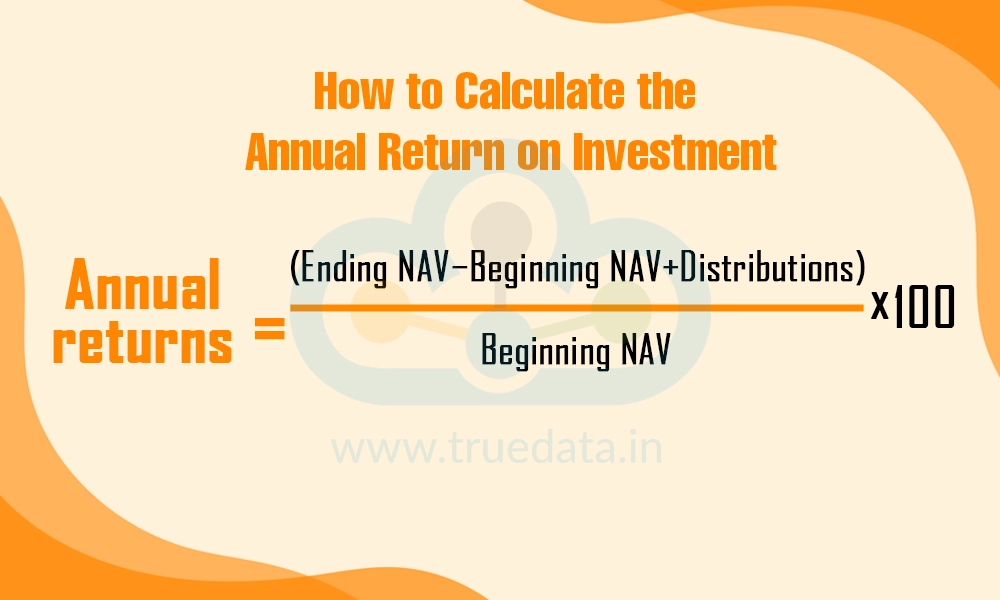

The formula for calculating annual return on investment is shown below.

Annual Returns in mutual funds = (Ending NAV−Beginning NAV+Distributions) / Beginning NAV * 100

For example,

If the Beginning NAV (Net Assets Value) of a fund is Rs. 100, the Ending NAV is Rs. 110, and there are Rs. 5 in distributions, the annual return would be,

Annual Return = (110-100+5) / 100 * 100 = 15%

Trailing returns in mutual funds measure the performance of the fund over specific past periods, such as the last 1, 3, 5, or 10 years. Trailing returns provide a historical perspective on how the mutual fund has performed over these time frames, offering insights into the fund's consistency and resilience under various market conditions. These returns are useful for evaluating the fund's long-term performance and comparing it with other funds or benchmarks. Unlike point-to-point returns, which measure performance between two specific dates, trailing returns offer a more continuous view of performance, factoring in all market fluctuations during the period.

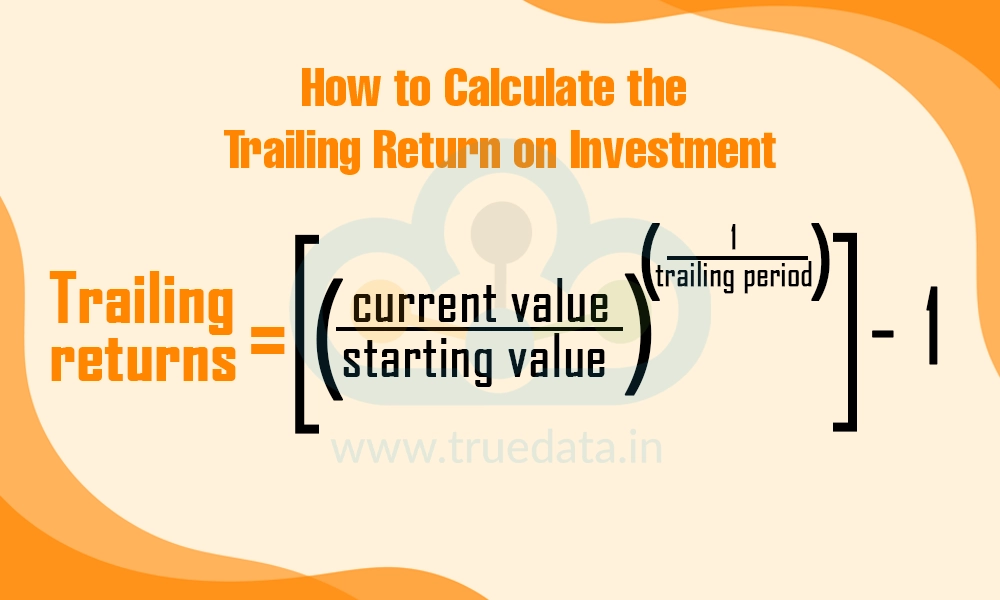

The formula involves taking the ending NAV and beginning NAV over the specified period, along with any distributions made during that time.

Trailing returns = [(Current Value / Starting Value) ^ (1/trailing period)] -1

For example,

Suppose an investor wants to calculate the trailing 3-year return of a mutual fund. Three years ago, the NAV was Rs. 30, and the current NAV is Rs. 60. The trailing return will be,

Absolute Return = (60-30) / 30 * 100 = 100%

Trailing Return = [(60 / 30) ^ ?] - 1 = 0.2599 = 25.99%

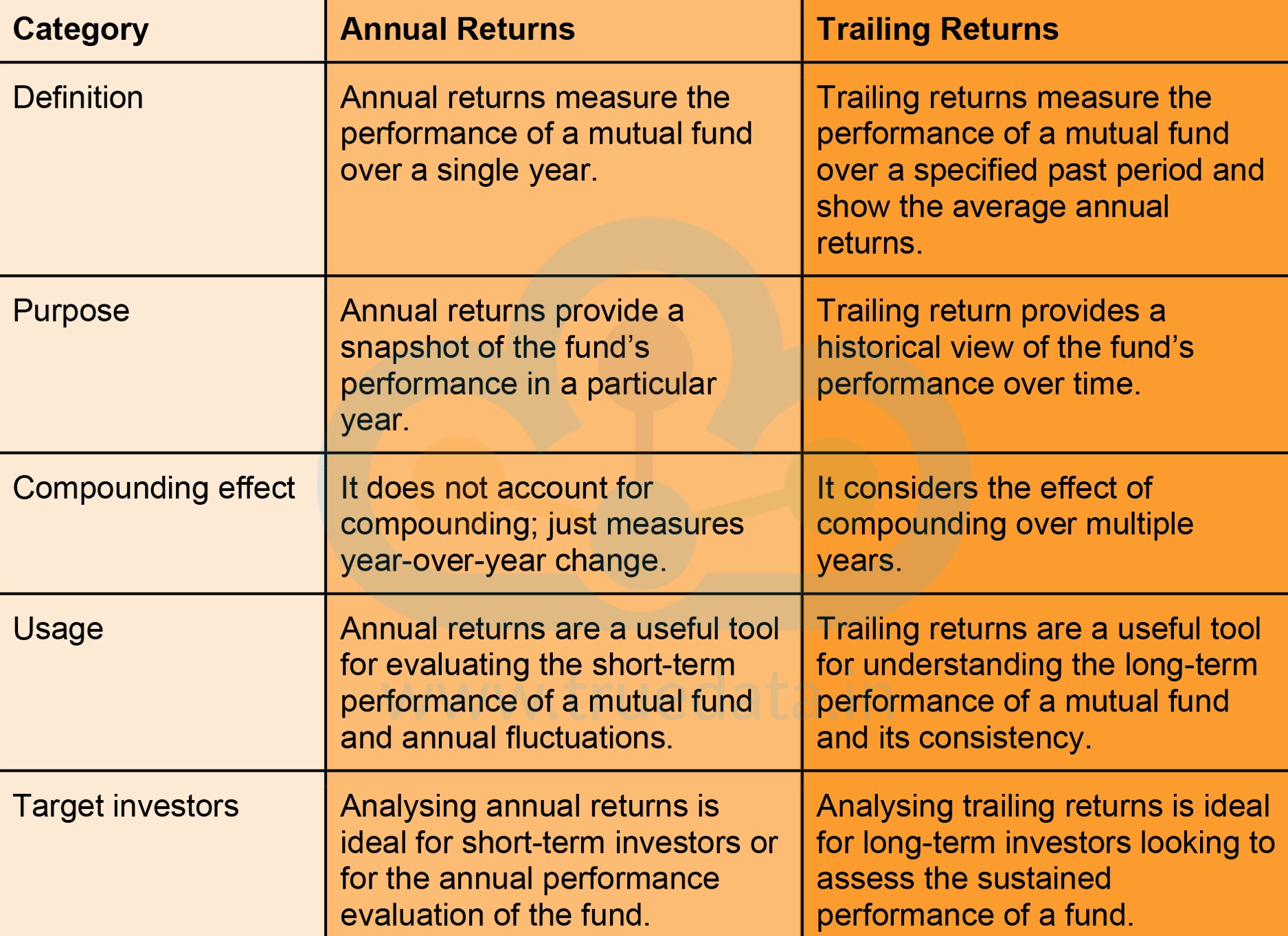

Now that we have seen the basic meaning and formula to calculate the annual and trailing returns, let us now focus on a few points of difference between the two.

Annual returns and trailing returns both provide an outlook on the performance of the mutual fund. So now the question arises which is better for investors to focus on? Here is the answer to this question.

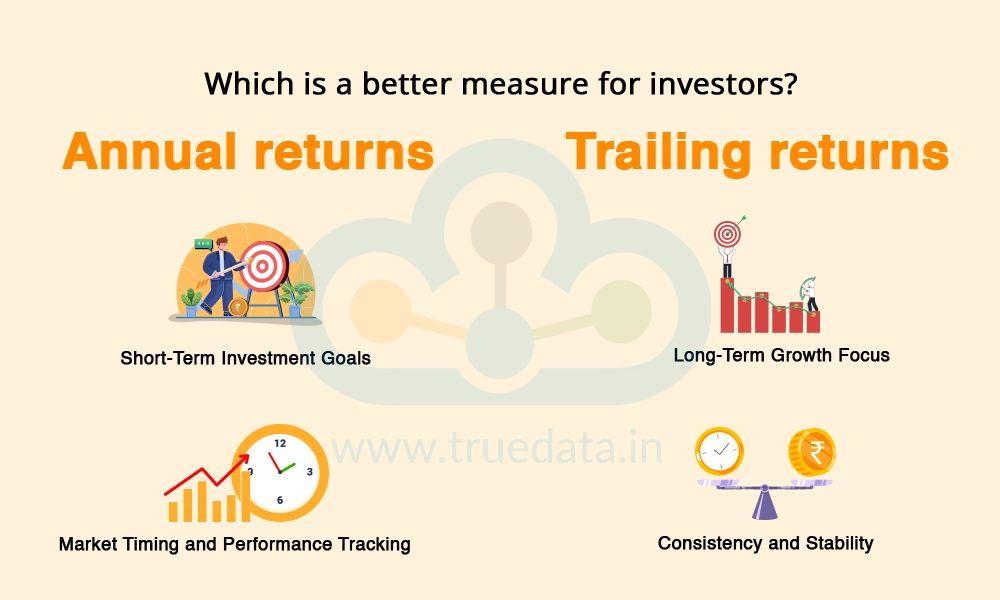

Trailing returns can be a better measure of mutual fund performance for investors due to the following reasons,

Long-Term Growth Focus - Most investors investing in mutual funds typically look at medium to long-term investment horizons. Trailing returns provide a more accurate measure of a fund’s performance over these periods while accounting for compounding and giving a better sense of the growth potential of the fund.

Consistency and Stability - Trailing returns help investors evaluate the consistency of a fund’s performance, which is crucial for making long-term investment decisions. Consistent returns over multiple years indicate a well-managed fund that can withstand market fluctuations thereby enabling investors to make informed decisions.

Annual returns, on the other hand, can be suitable in the following cases.

Short-Term Investment Goals - Annual returns provide valuable insight into how a fund performed in a specific year for investors with short-term investment horizons or those who frequently rebalance their portfolios.

Market Timing and Performance Tracking - Investors who aim to capitalise on market trends or those tracking performance relative to specific market conditions may find annual returns more relevant.

Comparing annual returns and trailing returns is like comparing apples and oranges. While annual returns focus on the short-term performance of the fund, trailing returns give a cohesive picture of the fund's performance under diverse market conditions accounting for the compounding effect on returns along the way. An analysis and comparison of annual returns and trailing returns of different funds allows investors to make sound investment decisions and choose between mutual funds that meet their investment goals and returns perception in a better manner.

This blog was a brief insight into the types of returns computed for mutual funds and how they help investors in their analysis as well as shaping their investment portfolio. Watch this space for details on more such market-related terms and their importance for investors.

Till then Happy Reading!

Read More: What is the Risk-Return Trade-Off?

Introduction For the longest time, investment in stock markets was thought to b...

It is a very well-known fact that mutual funds are considered to be among the st...

‘Mutual funds are subject to market risk’, this line is what most pe...