Just a few decades ago, the thought process and the preference when it came to investing were quite different than what it is today. The youth today has unending resources of information on various types of investment options and the goal that they are best suited for. This understanding of the key investment patterns and options that change based on the life stage that a person is in is crucial for effective financial planning, especially in today’s age where the cost of living is on a constant rise. This gave rise to the concept of life-stage investing. The concept and related details are explained hereunder. Read More: What are the differences between equity markets and debt markets?

Just a few decades ago, the thought process and the preference when it came to investing were quite different than what it is today. The youth today has unending resources of information on various types of investment options and the goal that they are best suited for. This understanding of the key investment patterns and options that change based on the life stage that a person is in is crucial for effective financial planning, especially in today’s age where the cost of living is on a constant rise. This gave rise to the concept of life-stage investing. The concept and related details are explained hereunder. Read More: What are the differences between equity markets and debt markets?

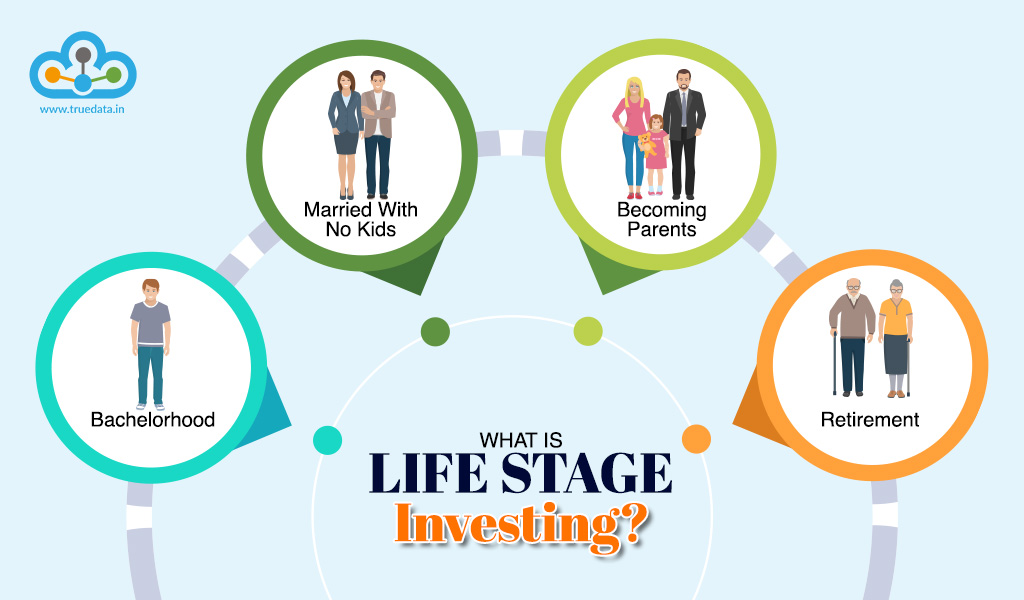

Life stage investing refers to an investment strategy that takes into consideration an individual's specific life stage or phase when making investment decisions. It recognizes that people have different financial goals, risk tolerances, and time horizons depending on their age, family situation, and career stage. The concept recognizes that investment needs and priorities change over time. For example, a young professional in their 20s or 30s may have a longer investment horizon and can afford to take on more risk to potentially earn higher returns. They may prioritize growth-oriented investments to accumulate wealth over time. However, as individual progresses in life, there is a change in their priorities and investment goals resulting in changing investment patterns. Life stage investing involves adjusting investment strategies and asset allocations to align with an individual's specific goals and circumstances. By tailoring investment decisions to a person's life stage, it aims to optimize returns while managing risk and providing for long-term financial well-being. For effective life-stage investing, many factors are taken into consideration like the age of the investor, their income levels, their family size and situation, risk appetite, financial goals, and most importantly, the time frame for investment.

The concept of life stage investing divides the life of an individual into a few key stages focusing on different goals at each stage and the risk-return perception thereby. These stages and the use of life stage investing during these stages are discussed below.

This is the first stage of the grown-up life and coming out of the comfort of home. At this stage, most of the young individuals are still living with their parents, especially as per the culture in our country. Therefore, there is ideally a very low level of responsibility on the individuals. Understandably, retirement is the last thing on the mind of such individuals at this stage, however, it is the perfect time to start investing early and build a corpus for retirement. Due to lower responsibilities, individuals can allocate a significant portion of their income (approximately 70%-75%) towards investments. Investors can also focus on growth investments that do carry a higher risk but also are excellent in wealth creation over a long-term investment horizon. The paradox at this stage is that although the responsibilities are lower and a person can choose to invest more in high-risk investments like equities, the amount available for investment is quite low. SIPs are a solution to this issue. By gradually building the corpus through SIPs, investors can also gain the maximum advantage of compounding and can opt for step-up SIPs to increase their investments as and when possible. During this phase of life, the most appropriate investment instruments include equity funds, stocks, real estate, and Initial Public Offerings (IPOs). These options offer potential for growth and capital appreciation, aligning with the longer investment horizon typically associated with this life stage.

This is the first stage of the grown-up life and coming out of the comfort of home. At this stage, most of the young individuals are still living with their parents, especially as per the culture in our country. Therefore, there is ideally a very low level of responsibility on the individuals. Understandably, retirement is the last thing on the mind of such individuals at this stage, however, it is the perfect time to start investing early and build a corpus for retirement. Due to lower responsibilities, individuals can allocate a significant portion of their income (approximately 70%-75%) towards investments. Investors can also focus on growth investments that do carry a higher risk but also are excellent in wealth creation over a long-term investment horizon. The paradox at this stage is that although the responsibilities are lower and a person can choose to invest more in high-risk investments like equities, the amount available for investment is quite low. SIPs are a solution to this issue. By gradually building the corpus through SIPs, investors can also gain the maximum advantage of compounding and can opt for step-up SIPs to increase their investments as and when possible. During this phase of life, the most appropriate investment instruments include equity funds, stocks, real estate, and Initial Public Offerings (IPOs). These options offer potential for growth and capital appreciation, aligning with the longer investment horizon typically associated with this life stage.

This is the first step into family life and an increase in the responsibilities of a person. The investment horizon at this stage is also considerably higher, approximately 25 to 30 years. Therefore, while this is the steg to enjoy life before the start of new responsibilities, it is also to be used effectively by allocating approximately 50% of the income towards investments. The investments at this stage can also focus on growth investments with relatively lower risk as compared to the prior stage, however, providing decent returns to meet the goal of long-term wealth creation. This is also the stage when most individuals purchase big assets like houses and cars. Therefore, the focus should be to invest in assets that can provide higher returns to meet the cost of buying such bigger assets while at the same time contributing to retirement planning. Some suitable choices during this stage include hybrid mutual funds, fixed deposits, national savings certificates (NSC), and unit-linked investment plans (ULIPs). These options provide a combination of capital preservation, potential growth, and consistent returns to meet the income requirements during the retirement stage.

This is the first step into family life and an increase in the responsibilities of a person. The investment horizon at this stage is also considerably higher, approximately 25 to 30 years. Therefore, while this is the steg to enjoy life before the start of new responsibilities, it is also to be used effectively by allocating approximately 50% of the income towards investments. The investments at this stage can also focus on growth investments with relatively lower risk as compared to the prior stage, however, providing decent returns to meet the goal of long-term wealth creation. This is also the stage when most individuals purchase big assets like houses and cars. Therefore, the focus should be to invest in assets that can provide higher returns to meet the cost of buying such bigger assets while at the same time contributing to retirement planning. Some suitable choices during this stage include hybrid mutual funds, fixed deposits, national savings certificates (NSC), and unit-linked investment plans (ULIPs). These options provide a combination of capital preservation, potential growth, and consistent returns to meet the income requirements during the retirement stage.

The next crucial stage is becoming parents and the financial priorities often shift towards providing for their children's future. Life-stage investing at this stage focuses on providing a greater emphasis on saving for education expenses and ensuring financial security for the family. Buying health insurance and life insurance should be crucial in the checklist at this stage if not done earlier. Furthermore, this stage often makes individuals risk-averse, and therefore, it may be prudent to invest at least 30% to 40% of the income towards investment options with lower risk and more stable income streams, such as bonds or real estate.

The next crucial stage is becoming parents and the financial priorities often shift towards providing for their children's future. Life-stage investing at this stage focuses on providing a greater emphasis on saving for education expenses and ensuring financial security for the family. Buying health insurance and life insurance should be crucial in the checklist at this stage if not done earlier. Furthermore, this stage often makes individuals risk-averse, and therefore, it may be prudent to invest at least 30% to 40% of the income towards investment options with lower risk and more stable income streams, such as bonds or real estate.

This life stage typically occurs between the ages of 40 and 55 when individuals experience significant changes as their children grow older and the need for higher education expenses arises. During this period, it is recommended to reduce the exposure to equity investments and increase the allocation to debt and liquid instruments. To strike a balance between growth potential and stability, a 50/50 allocation between equity and debt instruments is advisable. This strategy enables them to benefit from potential growth in equity while prioritizing capital preservation. Investing in balanced funds, which hold a combination of equity and debt securities can be a good option at this stage. Capital preservation is also the primary concern during this stage, prompting individuals to shift a significant portion of their investments to debt instruments such as bonds, fixed deposits, or government securities. It is also important to have liquid instruments like money market funds or savings accounts for easy access to cash in case of short-term financial needs or emergencies.

This life stage typically occurs between the ages of 40 and 55 when individuals experience significant changes as their children grow older and the need for higher education expenses arises. During this period, it is recommended to reduce the exposure to equity investments and increase the allocation to debt and liquid instruments. To strike a balance between growth potential and stability, a 50/50 allocation between equity and debt instruments is advisable. This strategy enables them to benefit from potential growth in equity while prioritizing capital preservation. Investing in balanced funds, which hold a combination of equity and debt securities can be a good option at this stage. Capital preservation is also the primary concern during this stage, prompting individuals to shift a significant portion of their investments to debt instruments such as bonds, fixed deposits, or government securities. It is also important to have liquid instruments like money market funds or savings accounts for easy access to cash in case of short-term financial needs or emergencies.

The retirement phase marks the culmination of one's life journey, and investment strategies during this stage primarily revolve around generating income and safeguarding capital. Given the shorter investment horizon and the focus on stability, the exposure to equity is further reduced. During this stage, individuals typically allocate around 10%-15% of their income towards investments. The focus is on potential low-risk and high-liquidity options that can provide stability and regular income. Some suitable investment choices include overnight funds, liquid funds, post office savings schemes, and senior citizens’ savings scheme. Retirees should work closely with financial advisors to design an investment plan that aligns with their specific income requirements, risk tolerance, and desired lifestyle. Regularly reviewing and adjusting the investment portfolio becomes essential to ensure that the strategy remains well-aligned and continues to support their financial goals effectively with the evolving financial requirements and market dynamics.

The retirement phase marks the culmination of one's life journey, and investment strategies during this stage primarily revolve around generating income and safeguarding capital. Given the shorter investment horizon and the focus on stability, the exposure to equity is further reduced. During this stage, individuals typically allocate around 10%-15% of their income towards investments. The focus is on potential low-risk and high-liquidity options that can provide stability and regular income. Some suitable investment choices include overnight funds, liquid funds, post office savings schemes, and senior citizens’ savings scheme. Retirees should work closely with financial advisors to design an investment plan that aligns with their specific income requirements, risk tolerance, and desired lifestyle. Regularly reviewing and adjusting the investment portfolio becomes essential to ensure that the strategy remains well-aligned and continues to support their financial goals effectively with the evolving financial requirements and market dynamics.

Life stage investing is not a new concept and every individual in their own capacity has been following this concept for ages. However, having an effective financial plan and a safety net is crucial, especially in today’s world of increasing uncertainties. Therefore, it is prudent to identify the financial goals at each stage of life and to allocate resources toward meeting such goals in the most efficient manner. The advantage available to the youth today as mentioned above is the length of resources to understand and implement the necessary steps towards building a successful investment plan that can not only provide comfortable retirement but also wealth creation and estate planning for future generations. We hope this blog was able to provide sufficient insights into financial planning at different stages of life and help you in building your investments. Let us know if you have any queries regarding the same or any insights of your own! Till then Happy Reading!

Social media is part of our daily lives today. Be it updating any life event o...

What is the one thing that is driven in our minds right from our childhood? It ...

On July 3rd, 2023, Sensex created history by reaching the 65000 mark; barely 16...