The year 2021 and 2022 have brought a string of IPOs from companies belonging to companies from various sectors and different market capitalizations. These IPOs are a good opportunity for investors to invest in a good company with solid fundamentals. However, before making an investment in any company, one should always know its bones, which means all the core information of the IPO and the company. This is where the RHP comes into the picture. Below is the meaning of the term RHP and its significance in an IPO.

The year 2021 and 2022 have brought a string of IPOs from companies belonging to companies from various sectors and different market capitalizations. These IPOs are a good opportunity for investors to invest in a good company with solid fundamentals. However, before making an investment in any company, one should always know its bones, which means all the core information of the IPO and the company. This is where the RHP comes into the picture. Below is the meaning of the term RHP and its significance in an IPO.

RHP stands for Red Herring Prospectus which is the document that has to be submitted or filed by the company with the stock market regulator SEBI. This document contains all the information related to the IPO like the IPO size, IPO dates, eligible investors, and the reservation allotted to them in the IPO as well as key financial details of the company, its business model along with its future projections. This document gives an investor a precise idea of the company, enabling them to ascertain if the investment in such a company is a good bet.

RHP stands for Red Herring Prospectus which is the document that has to be submitted or filed by the company with the stock market regulator SEBI. This document contains all the information related to the IPO like the IPO size, IPO dates, eligible investors, and the reservation allotted to them in the IPO as well as key financial details of the company, its business model along with its future projections. This document gives an investor a precise idea of the company, enabling them to ascertain if the investment in such a company is a good bet.

The RHP is like a bible for investors looking to invest in the IPO of a company. The key details to watch out for in the RHP of an IPO are discussed hereunder.

The prime details available in the RHP are the details relating to the IPO. This will include the key dates of the IPO (opening, closing, allotment date, etc.) the RHP will also highlight the objective of the IPO, the eligible investors, and the reservation allowed for each category of such investors. Investment in a company through IPO is done by investing in lots of shares offered. Investment in individual shares is not permitted for retail investors. The details of the lot sizes and the maximum that can be invested along with the price band for investment are also mentioned in the RHP

The prime details available in the RHP are the details relating to the IPO. This will include the key dates of the IPO (opening, closing, allotment date, etc.) the RHP will also highlight the objective of the IPO, the eligible investors, and the reservation allowed for each category of such investors. Investment in a company through IPO is done by investing in lots of shares offered. Investment in individual shares is not permitted for retail investors. The details of the lot sizes and the maximum that can be invested along with the price band for investment are also mentioned in the RHP

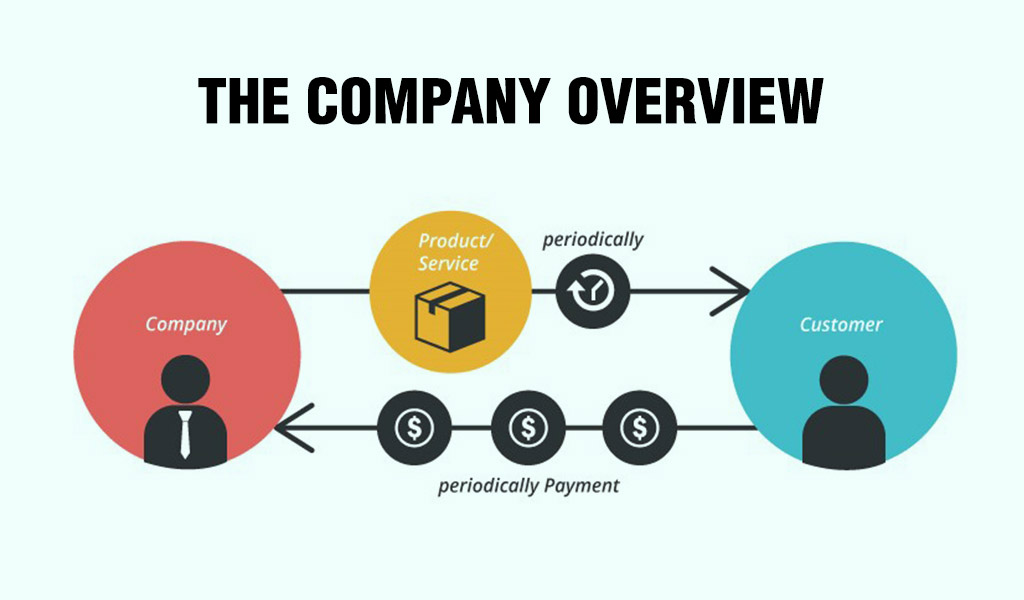

The RHP has a brief introduction of the company and relevant details like the business model of the company, the industry it belongs to, and micro and macroeconomic factor affecting the company and the industry as a whole. Other details that are provided in the RHP include the company’s key objectives, shareholding pattern, the products or services offered, the life cycle stage of such products, its growth prospects, potential markets, etc. These details give a brief idea of the company as well as the risk perception. Investors can then ascertain if investment in this company is in line with their risk-return expectation and the average investment horizon.

The RHP has a brief introduction of the company and relevant details like the business model of the company, the industry it belongs to, and micro and macroeconomic factor affecting the company and the industry as a whole. Other details that are provided in the RHP include the company’s key objectives, shareholding pattern, the products or services offered, the life cycle stage of such products, its growth prospects, potential markets, etc. These details give a brief idea of the company as well as the risk perception. Investors can then ascertain if investment in this company is in line with their risk-return expectation and the average investment horizon.

One of the most crucial details in an RHP is the details of the company’s financial performance. Investors can do a thorough fundamental analysis of the company using these details by calculating the relevant ratios like the PE ratio, net profit margins, debt-equity ratio, Earnings Per Share (EPS), ROCE, ROE, etc. These ratios give help in understanding if the company is on a growth trajectory or if the performance of the company has become stagnant or slipping down.

One of the most crucial details in an RHP is the details of the company’s financial performance. Investors can do a thorough fundamental analysis of the company using these details by calculating the relevant ratios like the PE ratio, net profit margins, debt-equity ratio, Earnings Per Share (EPS), ROCE, ROE, etc. These ratios give help in understanding if the company is on a growth trajectory or if the performance of the company has become stagnant or slipping down.

The promoters of the company along with its management are the key drivers of the company and are in charge of its performance. Therefore, it is important to evaluate the capabilities of the core team, their experience and expertise to manage the daily affairs as well as ensure that the colony is able to meet all its objectives. It is rightly said that a bad driver can crash even a good car. The same is the case with the promoters or the management team of a company. Hence, information regarding them is crucial in an RHP.

The promoters of the company along with its management are the key drivers of the company and are in charge of its performance. Therefore, it is important to evaluate the capabilities of the core team, their experience and expertise to manage the daily affairs as well as ensure that the colony is able to meet all its objectives. It is rightly said that a bad driver can crash even a good car. The same is the case with the promoters or the management team of a company. Hence, information regarding them is crucial in an RHP.

This portion of the RHP is crucial in understanding the USP of the company or the areas of its dominance. The strengths of the company highlight how it is different from its competition and what makes it better than them. This section, therefore, gives an idea of the company’s ability to grow and be profitable along the way.

This portion of the RHP is crucial in understanding the USP of the company or the areas of its dominance. The strengths of the company highlight how it is different from its competition and what makes it better than them. This section, therefore, gives an idea of the company’s ability to grow and be profitable along the way.

The risks of the company or the challenges faced can be in the form of industry-specific risks or risks that are specific to the company itself. This section cautions the investors and helps them in getting a true picture of expectations from the company.

The risks of the company or the challenges faced can be in the form of industry-specific risks or risks that are specific to the company itself. This section cautions the investors and helps them in getting a true picture of expectations from the company.

Every company needs to state the purpose of the IPO and the way they will be utilising the proceeds from the same. If it is an Offer for Sale (OFS) the proceeds will go to the promoters or shareholders offloading their stocks. If it is a fresh issue, they need to specify ways in which the proceeds will be utilised for purposes like the expansion of business, starting a new division, getting new machinery, acquisition of a business, etc. These details are mentioned in the RHP and have to be reviewed in detail.

Every company needs to state the purpose of the IPO and the way they will be utilising the proceeds from the same. If it is an Offer for Sale (OFS) the proceeds will go to the promoters or shareholders offloading their stocks. If it is a fresh issue, they need to specify ways in which the proceeds will be utilised for purposes like the expansion of business, starting a new division, getting new machinery, acquisition of a business, etc. These details are mentioned in the RHP and have to be reviewed in detail.

The RHP should also include any pending litigation against the company, its promoters, or management. This is a mandatory requirement as it ensures that investors are aware of all the possible or contingent liabilities that the company may have to face if the verdict goes against them.

The RHP should also include any pending litigation against the company, its promoters, or management. This is a mandatory requirement as it ensures that investors are aware of all the possible or contingent liabilities that the company may have to face if the verdict goes against them.

The RHP of the company is a public document and is available on the website of the company. The company has to file this RHP with SEBI as per the guidelines of the IPO with the timeline specified for the same. Investors can, therefore, access the RHP through the SEBI website under the filings page and by selecting public issues. The other avenues for accessing the RHP of an upcoming IPO are the websites of the stock exchanges where the IPO will be listed as well as through the websites of the merchant banks and the online portals of the brokers.

The RHP of the company is a public document and is available on the website of the company. The company has to file this RHP with SEBI as per the guidelines of the IPO with the timeline specified for the same. Investors can, therefore, access the RHP through the SEBI website under the filings page and by selecting public issues. The other avenues for accessing the RHP of an upcoming IPO are the websites of the stock exchanges where the IPO will be listed as well as through the websites of the merchant banks and the online portals of the brokers.

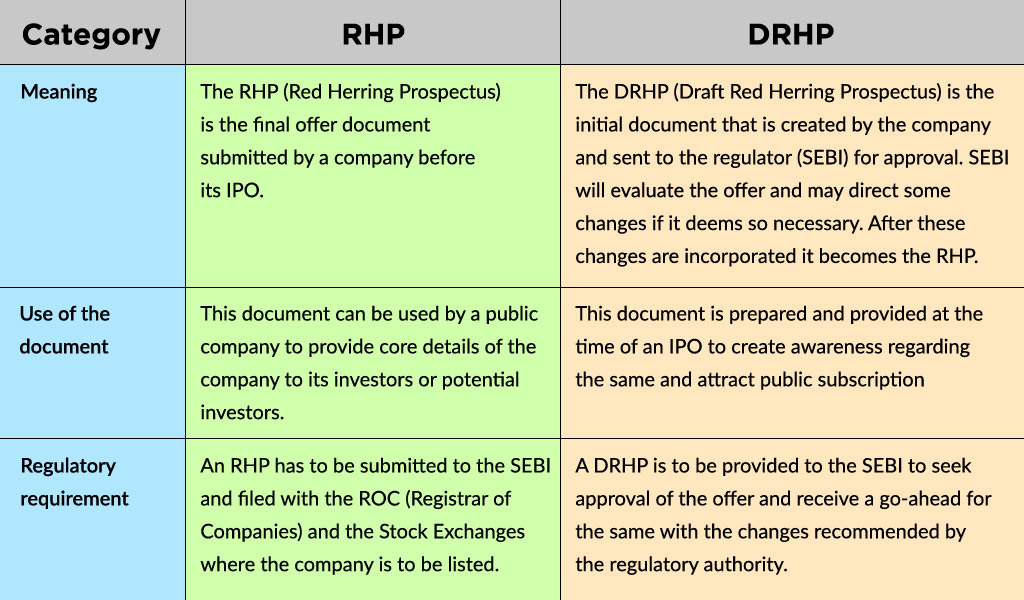

When a company is set to launch an IPO for public participation in their company, the first step towards the same is issuing the DRHP (Draft Red Herring Prospectus ). A DRHP is different from an RHP in many ways. The key differences between the two are highlighted below.

When a company is set to launch an IPO for public participation in their company, the first step towards the same is issuing the DRHP (Draft Red Herring Prospectus ). A DRHP is different from an RHP in many ways. The key differences between the two are highlighted below.

| Category | RHP | DRHP |

|---|---|---|

| Meaning | The RHP (Red Herring Prospectus) is the final offer document submitted by a company before its IPO. | The DRHP (Draft Red Herring Prospectus) is the initial document that is created by the company and sent to the regulator (SEBI) for approval. SEBI will evaluate the offer and may direct some changes if it deems so necessary. After these changes are incorporated it becomes the RHP. |

| Details provided | The RHP provides the final details of the IPO and is a precise version of the company details, its financials, etc. that are relevant to the investors before making an investment decision. | The DRHP is the initial document that a company prepares to attract the public subscription. This document contains in-depth details of the company and its offer. |

| Use of the document | This document can be used by a public company to provide core details of the company to its investors or potential investors. | This document is prepared and provided at the time of an IPO to create awareness regarding the same and attract public subscription |

| Regulatory requirement | An RHP has to be submitted to the SEBI and filed with the ROC (Registrar of Companies) and the Stock Exchanges where the company is to be listed. | A DRHP is to be provided to the SEBI to seek approval of the offer and receive a go-ahead for the same with the changes recommended by the regulatory authority. |

The RHP is rightly said to be the skeleton of a company seeking public participation for the first time. Therefore, this document should be reviewed with good insight. Novice investors can also seek the help of professionals to understand the financial jargon provided in the RHP and sift through the abundance of details to determine if they want to be part of the IPO. Hope you got a brief idea of the RHP and its importance in an IPO. Do let us know if you want to know more details relating to an IPO or other investment products related to stock markets like ETFs, Mutual funds, Index funds, etc. Till then happy reading!

Read More: Tick by Tick NSE Data for AmiBrokers

The stock market in India has fascinated general Indian masses for long, perhap...

Most Often, gold and stocks are the investment showgrounds that attracts Indian ...

There is a popular saying in stock markets that the markets are either driven by...