AI is increasing its presence in every aspect of our lives, be it through social media or our office tools being integrated with AI. The introduction of AI and its advancements on a daily basis is like breaking the shackles and dramatically changing how we get our work done. With this evolving phase of technology, the stock markets are also not left untouched and the use of AI and Machine Learning in trading is seen as the next big thing. So are you too looking to take advantage of this new phase in trading? Check out this blog to learn all about AI and Machine Learning in trading along with its pitfalls that you need to watch out for.

Read More: Sector analysis-Investing in the AI sector in India

To begin understanding the use of AI and Machine Learning in reading, let us first focus on its basic meaning. Now we all know that it is advanced technology, but let us break it down in simple language for even a beginner to understand.

.jpg)

Artificial Intelligence (AI) refers to the simulation of human intelligence in machines that are programmed to think, learn, and problem-solve like humans. In India, AI is increasingly becoming a significant area of interest and investment across various sectors, from healthcare to finance, defence, agriculture, and education. AI encompasses a broad spectrum of technologies aimed at enabling machines to perform tasks that typically require human intelligence, such as understanding natural language, recognising patterns, making decisions, and even learning from experience.

Machine Learning (ML) is a subset of AI that focuses on developing algorithms and statistical models that enable computers to improve their performance on a specific task through experience, without being explicitly programmed. In India, ML is revolutionising various fields by enabling computers to learn from data, identify patterns, and make predictions or decisions with minimal human intervention. Machine learning algorithms are being applied in diverse domains such as healthcare for disease diagnosis and personalised treatment recommendations, e-commerce for product recommendations and fraud detection, agriculture for crop yield prediction and pest control, and finance for risk assessment and algorithmic trading.

Artificial Intelligence (AI) and Machine Learning (ML) have emerged as revolutionary technologies in the dynamic world of stock trading. Artificial intelligence trading offers unprecedented opportunities for traders to optimise their strategies, minimise risks, and capitalise on market trends while reshaping the landscape of stock trading by providing traders with powerful tools for data analysis, decision-making, and automation.

The impact of AI and machine learning in trading can be explained hereunder.

Machine learning algorithms have revolutionised algorithmic trading by enabling traders to automate the execution of trades based on sophisticated data analysis and predictive modelling. Through Machine Learning for algorithmic trading, traders can develop models that analyse historical market data, identify patterns, and make informed decisions in real time. By leveraging Machine Learning, traders can execute trades with precision and efficiency, reacting swiftly to market fluctuations and optimising their trading strategies for maximum returns.

AI-powered predictive analytics are invaluable for traders seeking to anticipate market trends and make informed decisions. By analysing vast amounts of historical data and identifying patterns and correlations, predictive analytics algorithms can forecast future price movements with a certain degree of accuracy. Traders can use these insights to identify potential trading opportunities, mitigate risks, and adjust their strategies accordingly, thereby staying ahead of the curve in the fast-paced world of stock trading.

AI-based risk management tools are essential for traders looking to safeguard their investments and minimise losses. These tools utilise advanced algorithms to analyse market data, assess risk factors, and implement risk mitigation strategies in real time. By monitoring portfolio diversification, setting stop-loss levels, and identifying correlations between different asset classes, AI-powered risk management solutions empower traders to make informed decisions while protecting their investments from unexpected market fluctuations.

Sentiment analysis, powered by AI, provides traders with valuable insights into market dynamics and investor sentiment. By analysing textual data from social media, news articles, and financial reports, sentiment analysis algorithms can gauge market sentiment towards specific assets or companies in real-time. Traders can use these insights to identify emerging trends, gauge market sentiment, and adjust their trading strategies accordingly, thereby gaining a competitive edge through the use of AI in stock trading.

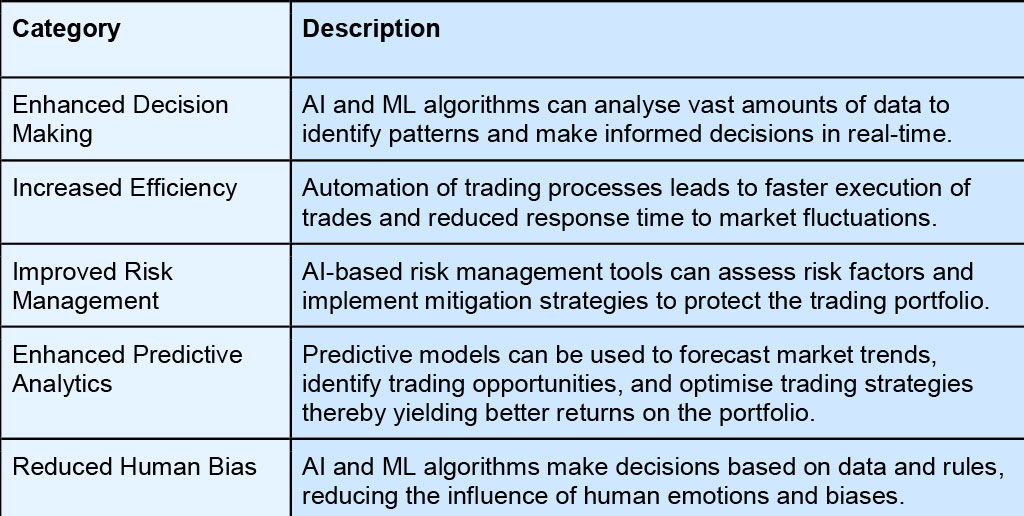

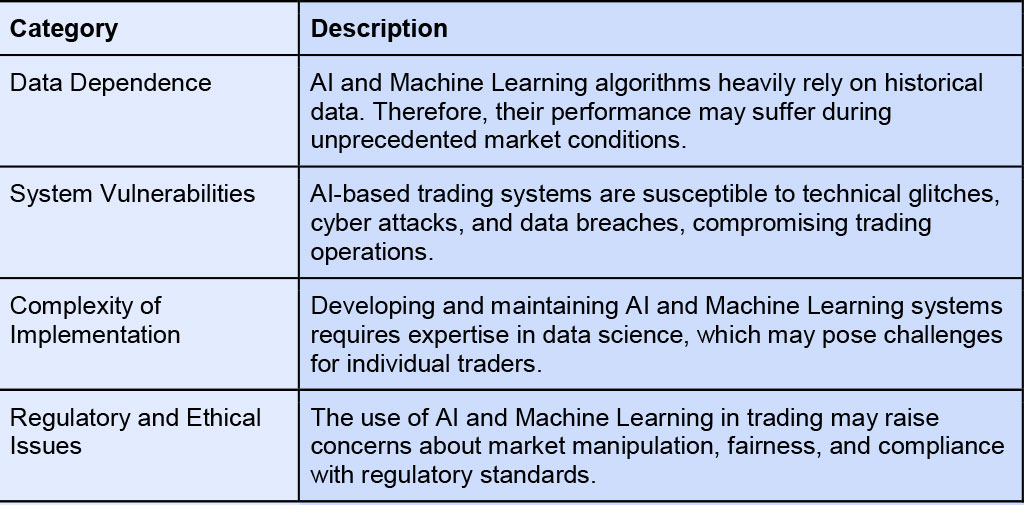

The use of AI and Machine Learning in trading is inevitable. However, before taking the plunge, it is necessary to understand the pros and cons of using these technologies for stock trading and shaping your portfolio. Here is a brief snapshot of the benefits and challenges of using AI and Machine Learning for trading to give traders a holistic view of this topic and make informed decisions.

AI and Machine Learning empower traders with data analysis, risk mitigation, and predictive insights, enhancing strategies and efficiency. With AI-driven tools like predictive analytics and sentiment analysis, Indian traders navigate markets with confidence. As AI evolves, it promises boundless opportunities, ushering in a prosperous era for Indian traders in the dynamic stock market landscape.

This blog was an overview of the use of AI and Machine Learning in the dynamic world of stock trading. Let us know if this helped you understand the concept and implement it better in your stock trading journey.

Till then Happy Reading!

SEBIs primary mission has always been to protect investors while creating a secu...

One of the primary points of comparison while picking between two or more invest...

The world of investments has been constantly evolving. Gone are the days of rely...