Every investor knows that the stepping stones to a good investment in the stock market are knowing the quality of the asset and the optimum time to enter or exit the investment. This involves a thorough fundamental and technical analysis, in which the PE ratio is one of the key metrics to be considered. While the use of the PE ratio for evaluating a stock is quite common, did you know mutual funds also have PE ratios? Yes, you heard it right. PE ratios in mutual funds are also an important checkpoint that investors should consider while investing in mutual funds. Check out this blog to learn all about PE ratios in mutual funds and how they contribute to the investment decision.

The PE Ratio (Price-to-Earnings Ratio) is a financial metric that shows how much investors are willing to pay for each rupee of a company's earnings. It is calculated by dividing the current market price of a company's share by its Earnings Per Share (EPS). For example, if a company’s share is priced at Rs. 100 and its EPS is Rs. 10, the PE ratio is 10. For investors in India, this ratio helps gauge whether a stock is overvalued, undervalued, or fairly valued compared to its peers, the industry average, or the overall market (like the Nifty 50). Typically, a high PE ratio may indicate that investors expect higher growth in the future, but it could also mean the stock is expensive. On the other hand, a low PE ratio might suggest a stock is undervalued or that the company has weaker growth prospects. Investors should, therefore, consider the PE ratio along with other factors like the company’s growth potential, industry trends, and market conditions, as it varies across sectors and economic cycles.

.webp)

The formula for the calculation of PE for stock uses two elements, i.e., Market Price per Share and Earnings per Share.

PE Ratio for Stocks = Market Price per Share / Earnings per Share

However, the calculation of PE for mutual funds is not so simple as it involves calculating the PE for the basket of stocks in the fund. The formula for PE of Mutual Funds is given below.

.webp)

PE Ratio (Mutual Funds) = Weighted Average PE Ratio of Stocks in the Portfolio / Portfolio Allocation

Let us understand the above formula with a simple example.

Consider Mutual Fund XYZ with the following data.

.webp)

The PE Ratio for the Mutual Fund XYZ is calculated as below.

Step 1 - Calculating PE Ratio for Each stock

PE for Stock A = 100 / 10 = 10

PE for Stock B = 200 / 20 = 10

PE for Stock C = 150 / 15 = 10

Step 2 - Calculating the Weighted Average PE Ratio of the Fund

PE ratio of the Mutual Fund = PE of Stock A * Weight of Stock A + PE of Stock B * Weight of Stock B + PE of Stock C * Weight of Stock C

PE of Mutual Fund XYZ = (10 * 0.40) + (10 * 0.35) + (10 * 0.25)

PE of Mutual Fund XYZ = 4+3.5+2.5 = 10

PE of Mutual Fund XYZ = 10

Interpretation of PE for Mutual Funds

The mutual fund's PE ratio indicates how much investors are paying for every rupee of earnings generated by the underlying stocks in the portfolio. A high PE ratio for the fund suggests that its stocks are growth-oriented but possibly overvalued, while a low PE ratio might signal undervaluation or a focus on value stocks.

.webp)

Now that we have seen the calculation of PE in mutual funds, let us now focus on the need for this metric or its importance for mutual fund investment decisions. Here is how the PE ratio of mutual funds can help investors shape their portfolios.

The PE ratio helps investors evaluate whether a mutual fund’s portfolio is expensive or cheap relative to the earnings of its underlying stocks. If the PE ratio is high, it suggests that the fund holds stocks that are priced higher compared to their earnings, which might indicate potential growth but could also mean higher risk. On the other hand, a low PE ratio might suggest undervalued stocks with potentially lower growth but more stability.

By comparing a mutual fund’s PE ratio with that of its benchmark index (like Nifty 50 or Sensex), investors can gauge whether the fund is taking on more or less risk than the overall market. A significantly higher PE ratio may imply that the fund manager is focusing on growth-oriented, high-valuation stocks, while a lower PE might indicate a conservative approach.

The PE ratio reveals the type of stocks in a mutual fund. A high PE ratio suggests a focus on growth stocks, i.e., companies expected to grow earnings quickly. On the other hand, a low PE ratio indicates value stocks, i.e., companies considered undervalued but likely to deliver steady performance over time. This helps investors choose funds that align with their financial goals and investment style.

The PE ratio can guide investors on when to enter or exit a mutual fund. For instance, a very high PE ratio during a market boom might indicate overpriced stocks, which carry the risk of a correction. Conversely, a lower PE ratio during market downturns might suggest that the fund holds undervalued stocks with growth potential, making it a good time to invest.

Mutual funds with high PE ratios often involve higher market volatility because growth stocks are more sensitive to economic changes. In contrast, funds with low PE ratios typically have less volatile value stocks. By understanding a fund’s PE ratio, investors can assess the risk associated with the fund and choose ones that match their risk tolerance and financial goals.

.webp)

Just like there is no ideal or perfect PE ratio for stocks, the PE ratio for mutual funds also cannot be constant or perfect as it depends on market conditions, sectors, and economic cycles. However, here is a range of PE ratios for different categories of mutual funds often considered to be optimum to guide investors for informed portfolio decisions.

An ideal PE ratio for large-cap mutual funds typically ranges between 15 and 25. These funds invest in well-established companies with stable earnings, so their valuations are moderate. A PE ratio in this range suggests a balance between growth potential and reasonable pricing, making them relatively less risky for investors seeking steady returns.

Mid-cap mutual funds often have a PE ratio in the range of 20 to 30. These funds invest in medium-sized companies, which are growing faster than large caps but carry slightly higher risks. A higher PE ratio reflects the growth potential of these companies, though investors should be cautious about overvalued funds in this category.

Small-cap mutual funds generally have PE ratios ranging from 25 to 40 or more, as these funds invest in smaller companies with high growth potential. While a higher PE ratio is expected due to the speculative nature of small-cap, it also indicates greater risk. Investors should evaluate the fund's strategy and market conditions carefully.

Growth funds, which focus on companies expected to grow earnings rapidly, usually have a higher PE ratio (often 25 and above). A high PE reflects the premium investors are willing to pay for future growth, but these funds are more volatile. They are ideal for long-term investors with a higher risk appetite.

Value funds typically have a lower PE ratio, often below 15 or 20, as they invest in undervalued stocks that are trading below their intrinsic value. These funds are less risky and attract investors looking for stable returns over time, with the potential for price appreciation as the market recognises the true value of the stocks.

Balanced funds, which invest across large, mid, and small caps, tend to have a PE ratio in the range of 15 to 25. This depends on the proportion of growth versus value stocks in the portfolio. Investors can use the PE ratio to determine whether the fund leans more towards growth or value.

The above ranges of PE ratios for different categories of mutual funds are indicative of typical valuations but can vary based on several factors.

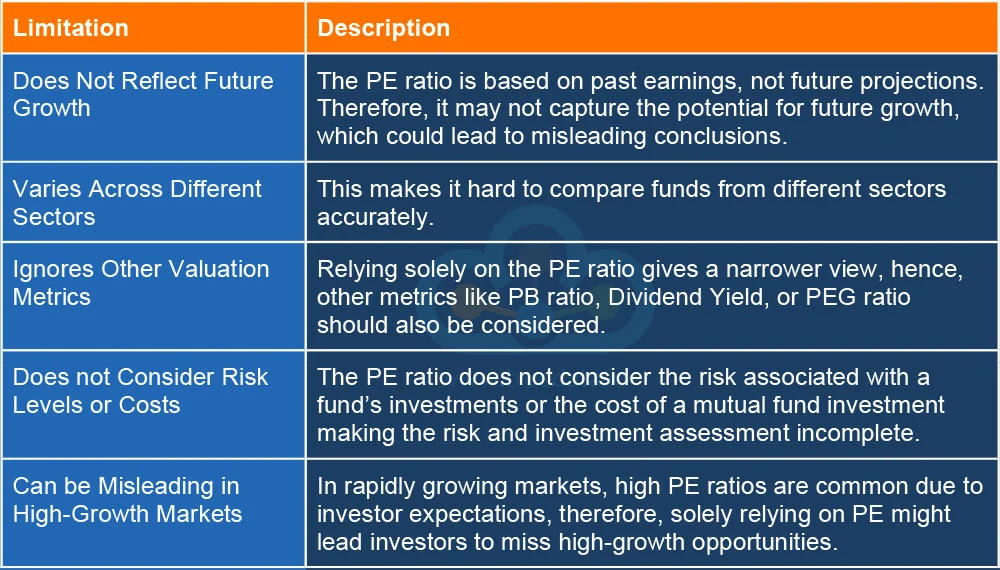

While the PE ratio can be an important aspect of fundamental analysis, it does have certain limitations. Here is a brief list of the same to caution investors while using the PE ratio for mutual funds.

The PE ratio is a useful tool for evaluating mutual funds, as it helps investors assess whether a fund’s portfolio is overvalued or undervalued based on the earnings of the underlying stocks. However, it cannot be used as a sole factor to determine investment in a fund. Investors should use the PE ratio in conjunction with other metrics like the fund’s strategy, past performance, and market conditions to make well-rounded investment decisions.

This article talks about the using PE ratio, a key fundamental analysis tool for mutual fund investments. Did you know about this metric or have been using it for your mutual fund assessment too? Let us know your thoughts or any queries you have on this topic and watch this space for analysis of similar metrics for investment decisions.

Till then Happy Reading!

Read More: What is AMC in Mutual Fund?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...