When discussing mutual funds, an average investor always focuses on the type of fund, the returns it generates, the risk involved, etc. While all these factors are important, the AMC is one important factor that influences all these concerns and more or less impacts each decision to invest in mutual funds. Although AMC is one of the fundamental concepts and terms associated with mutual funds, many investors are woefully unaware of its meaning and functions. Here is all you need to know about a mutual fund AMC and its importance for investors.

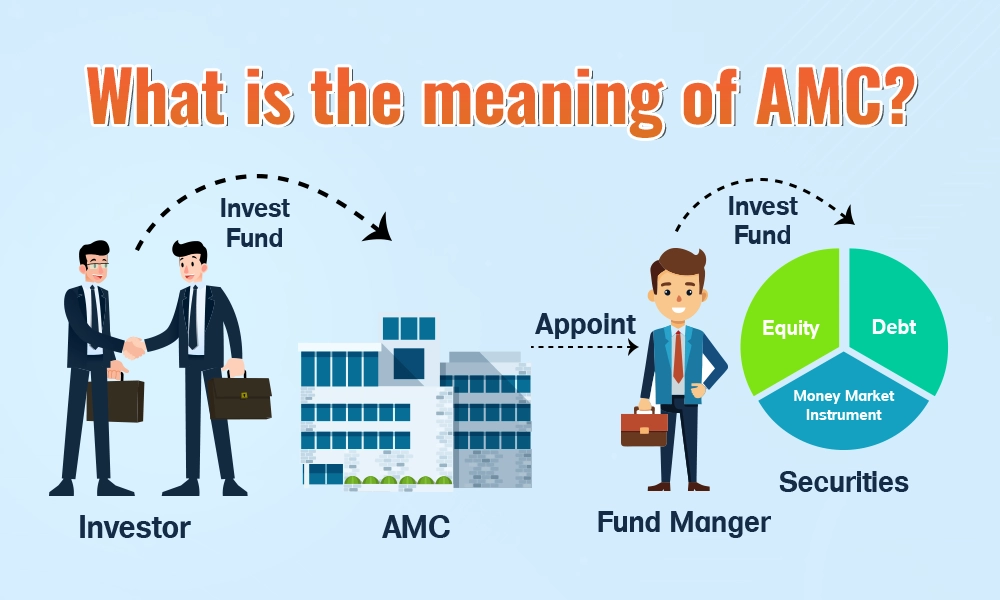

An Asset Management Company (AMC) in mutual funds is a company that manages investments on behalf of its investors. Simply put, when you invest in a mutual fund, you are essentially pooling your money with other investors. The AMC then invests this pooled money in various financial assets like stocks, bonds, or other securities, depending on the type of mutual fund you choose.

AMCs are regulated by SEBI (Securities and Exchange Board of India), ensuring they follow strict guidelines to protect investor interests. The primary job of the AMC is to manage these investments professionally, to maximise returns while minimising risks. AMCs have a team of financial experts who analyse the market and make informed decisions about where to invest the funds. The AMC charges a small fee for this service, usually referred to as an ‘expense ratio,’ which covers management costs.

The list of AMCs in India includes,

360 One Mutual Funds

Aditya Birla Capital Mutual Funds

Axis Mutual Fund

Bandhan Mutual Fund

Bank of India Mutual Fund

Baroda BNP Paribas Mutual Fund

Canara Robeco Mutual Fund

DSP Mutual Fund

Edelweiss Mutual Fund

Franklin Templeton Investments India

Groww Mutual Fund

HDFC Mutual Fund

Helios Mutual Fund

HSBC Mutual Fund

ICICI Prudential Mutual Fund

IL&FS Mutual Fund

Invesco Mutual Fund

ITI Mutual Fund

JM Financial Mutual Fund

Kotak Mahindra Mutual Fund

LIC Mutual Fund

Mahindra Manulife Mutual Fund

Mirae Asset Mutual Fund

Motilal Oswal Mutual Fund

Navi Mutual Fund

Nippon India Mutual Fund

NJ Mutual Fund

Old Bridge Mutual Fund

PGIM India Mutual Fund

PPFAS Mutual Fund

Quant Mutual Fund

Quantum Mutual Fund

Samco Mutual Fund

SBI Mutual Fund

Shriram Mutual Fund

Sundaram Mutual Fund

Tata Mutual Fund

Tauras Mutua Fund

Trust Mutual Fund

Union Mutual Fund

UTI Mutual Fund

Whiteoak Capital Mutual Fund

Zerodha Fund House

The key functions of an AMC are explained here.

An AMC manages the pooled money of investors by creating a portfolio of financial assets such as stocks, bonds, or other securities. Their job is strategically allocating these funds across various investment options to maximise returns while keeping risks in check. AMCs rely on a team of experts who continuously monitor the market and adjust the portfolio as needed.

To make informed investment decisions, AMCs conduct thorough research and analysis of the financial markets, companies, and economic trends. This includes analysing the performance of different industries and companies, tracking economic changes, and identifying potential investment opportunities that align with the fund's goals.

Managing risk is a critical function of an AMC. They diversify the portfolio across different assets to reduce the impact of poor performance in any one sector or investment. AMCs carefully balance risk and reward, ensuring that the investor's money is not overly exposed to volatile or high-risk investments.

AMCs must comply with the rules set by regulators such as SEBI (Securities and Exchange Board of India) to ensure that they operate fairly and transparently. They follow strict regulations regarding how they manage funds, communicate with investors, and disclose important information about fund performance and costs.

AMCs handle all the administrative tasks related to the mutual funds they manage, including processing investor transactions (such as purchases and redemptions), maintaining accurate records, calculating the Net Asset Value (NAV), and ensuring timely communication with investors about their holdings and the fund’s performance.

AMCs offer customer support to help investors with any queries or concerns they may have. This includes providing detailed information on various mutual fund schemes, and investment guidance, and helping investors understand the risks and benefits of their investments.

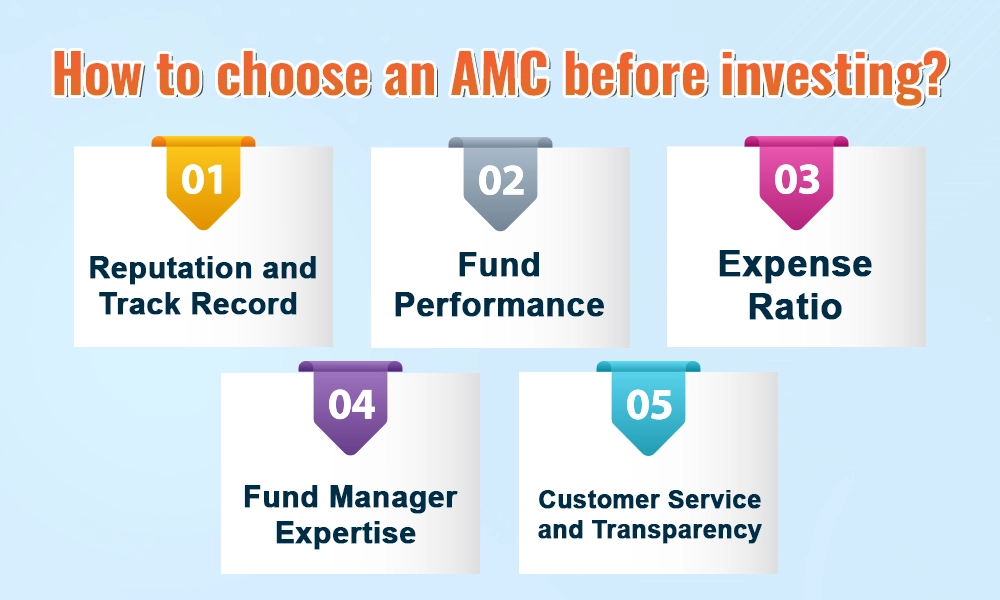

Selecting an AMC for investment is not an easy task and requires considering various factors that align with investment goals, risks and individual financial plans. Some of the top factors that can influence selecting an AMC are highlighted below.

Reputation and Track Record - Before choosing an AMC, it is important to check its reputation in the market. Investors should look for companies with a strong history of consistent performance and good management practices. An AMC with a solid track record of delivering stable returns over time is usually a safer choice for investors.

Fund Performance - Investors should also examine the performance of the mutual funds offered by the AMC. This includes comparing their past returns, especially over 3, 5, and 10-year periods. It is also essential to remember that past performance does not guarantee future results, but it can give an idea of how well AMC manages its funds in different market conditions.

Expense Ratio - The expense ratio is the fee an AMC charges for managing an investment. A lower expense ratio means more investor money stays invested, which can significantly impact the returns over time. Therefore, while choosing an AMC, investors should compare the expense ratios across different funds and choose those that offer good value for money without compromising on quality management.

Fund Manager Expertise - The expertise of the fund managers is critical to the success of the mutual fund. Fund managers are the driving force that can make or break a fund and, hence, investors should research the qualifications and experience of the fund managers running the schemes they are interested in. A well-experienced manager with a good track record of managing funds can make better decisions that improve the chances of earning good returns.

Customer Service and Transparency - Finally, like in any other service industry, good customer service is vital when investing with an AMC. Investors should check if the AMC provides easy access to their account information, timely updates on fund performance, and clear communication about fees and changes. Transparency in their operations, risk management and procedures or SOPs to handle investments is also an essential contributor to the decision-making process.

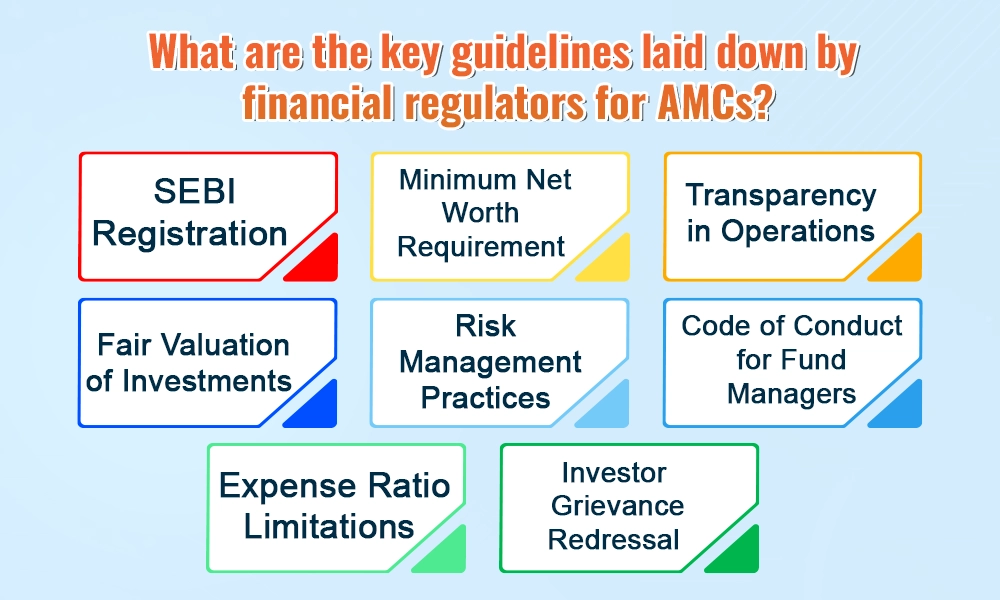

AMCs have to abide by the rules and regulations laid down by various financial regulators like SEBI, AMFI and RBI. These rules are mandated to ensure the protection of investors’ interests and adherence to fair practices by the AMCs in executing their functions and objectives. Here is a brief list of such guidelines,

SEBI Registration - Every AMC must be registered with SEBI (Securities and Exchange Board of India) and follow its regulations to ensure safe and legal operations.

Minimum Net Worth Requirement - AMCs must maintain a minimum net worth of Rs. 50 crore to ensure they have sufficient financial backing to manage investors' money.

Transparency in Operations - AMCs must provide regular updates to investors, including fund performance, portfolio holdings, and any changes in the scheme to maintain transparency.

Fair Valuation of Investments - AMCs must follow fair and accurate methods for valuing the securities in their portfolio, ensuring investors get a true picture of their fund's performance.

Risk Management Practices - AMCs must have a robust risk management system in place to handle market risks, credit risks, and other potential investment risks.

Code of Conduct for Fund Managers - SEBI mandates that fund managers must follow a professional code of conduct, ensuring they act in the best interests of investors and avoid conflicts of interest.

Expense Ratio Limitations - AMCs are required to cap their expense ratios, ensuring that the fees they charge for managing funds are reasonable and fair for investors.

Investor Grievance Redressal - AMCs must have systems to address investor complaints and resolve issues promptly, ensuring the protection of investors' rights.

AMCs are an important factor in shaping the investment portfolio and ensuring that investors make sound investment decisions while selecting a fund that aligns with their individual parameters. AMCs, being regulated by SEBI and similar financial regulators, add a level of trust and confidence among the investors towards the financial markets and ensure healthy participation of various stakeholders in the investment arena.

This article is aimed at providing key insights into AMCs and their functions. Let us know if you need details on any particular AMC or further information on this topic in general and we will take it up.

Till then Happy Reading!

Introduction For the longest time, investment in stock markets was thought to b...

One of the many features of investing inmutual funds is the ease of entering and...

One of the primary points of comparison while picking between two or more invest...