The realm of stock trading and investing can be quite exciting, especially in the post-2024 general elections period when Sensex and Nifty are achieving new milestones practically on a daily basis. However, this journey can also be challenging for beginners without deep market insights. The solution to this is resources like some evergreen books and knowledge material that can help traders navigate the financial markets with ease and a better understanding of the markets as a whole. We have talked about the best financial books for investment in the stock market in our previous blog and now it is time to check out the best trading books of all time. Here is a list of such books with a brief insight into the volume of knowledge they impart.

There are many timeless books that provide valuable insights into the world of trading and a better understanding of various concepts or techniques involved in mastering the art of successful trading. Some of these books and their key details are mentioned here in brief.

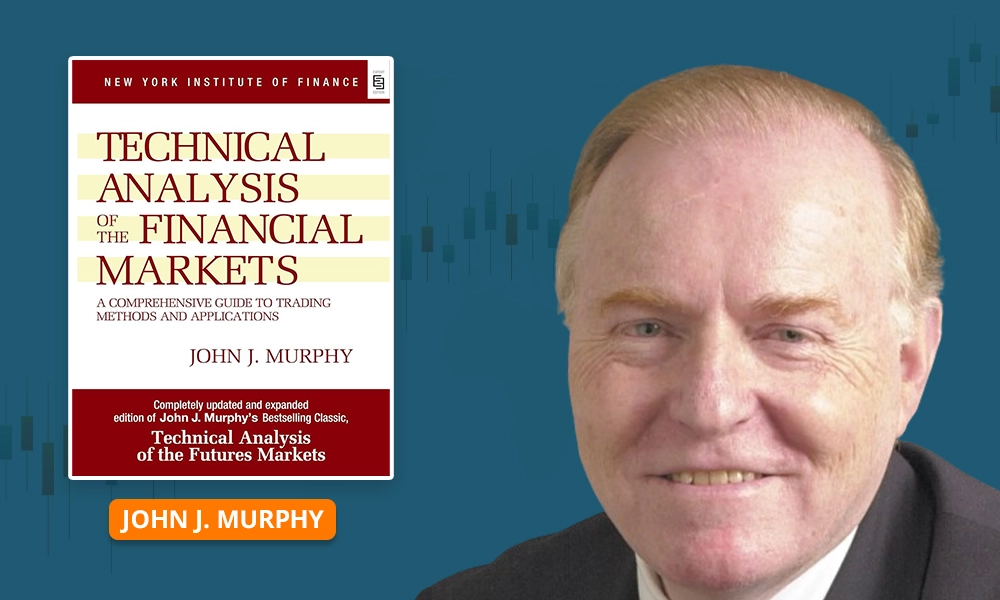

"Technical Analysis of the Financial Markets" by John J. Murphy is a fundamental guide to understanding technical analysis, a method used by traders and investors to forecast future price movements based on historical market data. Murphy covers various aspects of technical analysis, including chart patterns, indicators, and intermarket relationships. His book provides clear explanations and practical examples that help traders interpret market trends and make informed decisions. Murphy's approach emphasises the importance of studying price action and volume to gauge market sentiment and identify potential trading opportunities. "Technical Analysis of the Financial Markets" serves as an essential resource for anyone looking to deepen their understanding of market behaviour and improve their trading strategies.

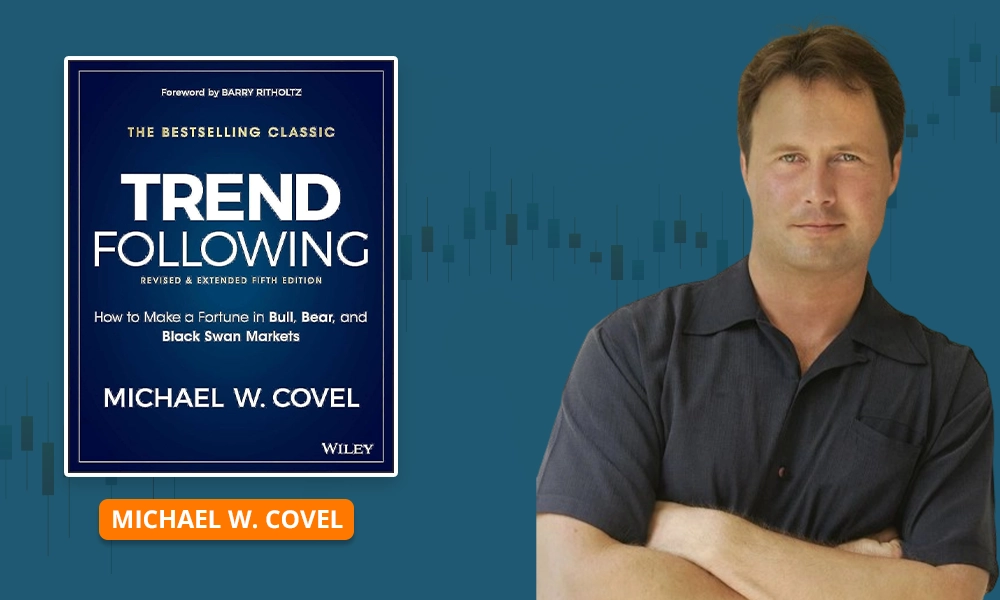

"Trend Following" by Michael Covel is a comprehensive exploration of the trend-following investment strategy which is used to capitalise on sustained market movements. Covel provides detailed insights into the principles and techniques of trend following, illustrating how traders can profit by identifying and riding market trends rather than predicting market direction. The book features interviews and case studies of successful trend followers, showcasing their methods and results. Covel further explains the importance of discipline, risk management, and a systematic approach as key to successful trading. This book serves as an essential guide for traders and investors looking to implement a robust strategy that adapts to various market conditions, aiming for consistent and sustainable returns.

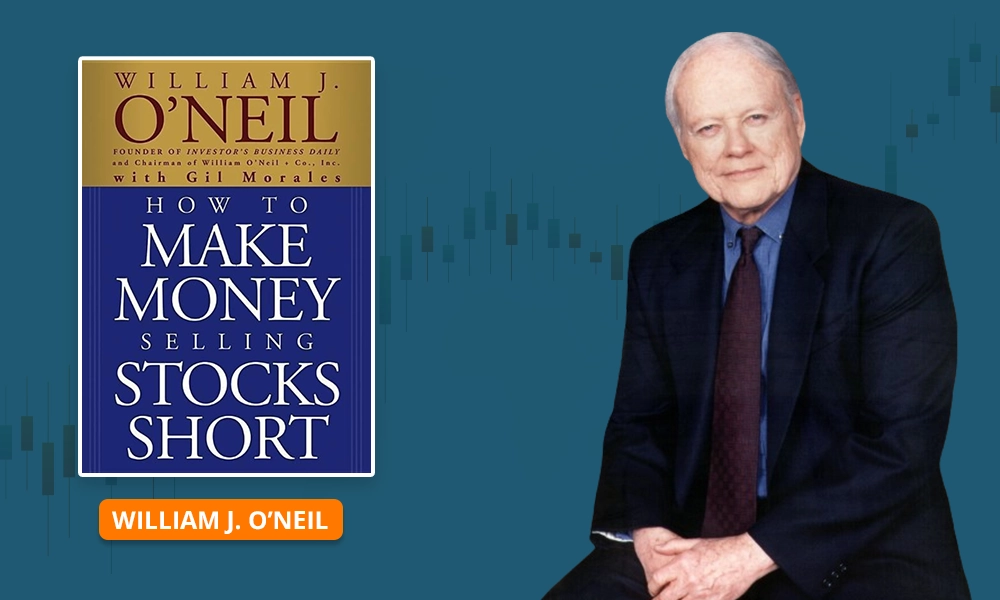

"How to Make Money in Stocks" by William J. O'Neil is a comprehensive guide to the CAN SLIM investing strategy, which highlights the importance of identifying and investing in growth stocks with strong fundamentals and technical indicators. O'Neil, founder of Investor's Business Daily, outlines a systematic approach to stock selection based on criteria such as earnings growth, sales growth, new product innovation, and institutional sponsorship. The book provides practical advice on when to buy and sell stocks, how to manage risk through proper portfolio diversification, and the importance of market timing. O'Neil's methodology combines fundamental analysis with technical chart patterns to help investors and traders navigate the complexities of the stock market effectively. His strategies have been influential in shaping the approach of many successful investors and remain relevant for those seeking to build wealth through equity investments.

"Trading in the Zone" by Mark Douglas explores the psychological aspects of trading and the mindset required for consistent success in the financial markets. Douglas, a trading psychologist, draws attention to the importance of mastering one's emotions, developing discipline, and maintaining a clear, focused state of mind while trading. He delves into common psychological pitfalls that traders face, such as fear, greed, and overtrading, offering practical strategies to overcome these challenges. Douglas's insights into the psychology of trading help traders cultivate a mindset that aligns with successful trading practices, making "Trading in the Zone" an indispensable guide for both new and experienced traders aiming to achieve long-term profitability and emotional resilience in their trading endeavours.

"Pit Bull: Lessons from Wall Street's Champion Day Trader" by Martin Schwartz offers a firsthand account of Schwartz's journey from a modest beginning to becoming a successful day trader. Schwartz shares his personal experiences, strategies, and insights into the world of day trading, highlighting the importance of discipline, risk management, and adaptability in volatile markets. The book provides practical lessons on technical analysis, trading psychology, and the importance of continuous learning and adaptation to market conditions. Schwartz's narrative is engaging and offers valuable perspectives on navigating the challenges and opportunities of day trading, making "Pit Bull" a compelling read for aspiring traders looking to glean wisdom from one of Wall Street's renowned traders.

"Reminiscences of a Stock Operator" by Edwin Lefèvre is a timeless classic that recounts the life and trading experiences of Jesse Livermore, one of the most famous stock traders of all time. Written in the form of a fictionalised biography, the book offers insights into Livermore's strategies, successes, and failures in the stock market during the early 20th century. Lefèvre skillfully captures the essence of trading psychology, stressing on the importance of discipline, patience, and risk management. Livermore's journey from a novice speculator to a master trader provides valuable lessons on market dynamics, speculation, and the emotional challenges inherent in trading. "Reminiscences of a Stock Operator" remains relevant today as a compelling narrative that offers practical wisdom and timeless principles for traders seeking to understand the complexities of the financial markets.

"The Disciplined Trader" by Mark Douglas focuses on the psychological aspects of trading and the critical role that discipline plays in achieving long-term success. Douglas explores how traders' beliefs, attitudes, and emotions can influence their decision-making process and trading outcomes. He focuses on the need for traders to develop a structured approach to trading, manage risk effectively, and maintain consistency in their trading strategies. Douglas provides practical insights and techniques to help traders cultivate discipline, overcome psychological barriers, and align their behaviour with their trading goals. "The Disciplined Trader" is a valuable resource for traders looking to enhance their mental discipline, improve their trading performance, and navigate the emotional challenges inherent in the financial markets.

"Trading for a Living: Psychology, Trading Tactics, Money Management" by Alexander Elder is a comprehensive guide that integrates psychology, technical analysis, and risk management into a cohesive approach to trading. Elder signifies the psychological aspects of trading, discussing how emotions such as fear and greed can influence decision-making and trading outcomes. He covers practical trading tactics, including strategies for identifying trends, using indicators effectively, and timing trades for optimal entry and exit points. Elder also emphasises the importance of money management techniques to preserve capital and minimise risks. The book provides traders with a holistic framework for developing a disciplined trading plan and cultivating the psychological mindset necessary for long-term success in the financial markets.

"Trade Your Way to Financial Freedom" by Van K. Tharp is a comprehensive guide that focuses on the principles of trading psychology, risk management, and systematic trading strategies. Tharp highlights the importance of developing a personalised trading system that aligns with individual goals, risk tolerance, and psychological profile. The book covers essential topics such as position sizing, expectancy, and the importance of maintaining a balanced emotional state while trading. Tharp's approach integrates fundamental and technical analysis with strong attention to the psychological aspects of trading, offering practical insights and exercises to help traders refine their strategies and improve their overall trading performance. "Trade Your Way to Financial Freedom" is a valuable resource for traders looking to enhance their trading skills and achieve sustainable profitability in the financial markets.

"Japanese Candlestick Charting Techniques: A Contemporary Guide to the Ancient Investment Techniques of the Far East" by Steve Nison is a seminal work that introduces traders to the art of Japanese candlestick charting. Nison comprehensively covers the history, patterns, and practical applications of candlestick analysis, which originated in Japan centuries ago. The book details various candlestick patterns and their interpretations, highlighting how these patterns can signal potential changes in market sentiment and trend reversals. Nison also discusses the integration of candlestick charts with Western technical analysis techniques, offering insights into how traders can use candlesticks to make informed trading decisions. This book remains a definitive resource for traders seeking to enhance their understanding of charting techniques and incorporate Japanese candlesticks into their trading strategies effectively.

These are some of the best trading books of all time that help traders navigate this complex path and also try their hand at successful trading. Along with these timeless classics, traders can also use other valuable resources like YouTube videos, podcasts, trading seminars, or webinars for an in-depth understanding of the market and its nuances.

This article highlighted some of the best financial books for traders with some of the top books for beginners in stock trading along with a few that help in enhancing the trading knowledge and provide a deeper understanding of the trading world and refined use of trading strategies. Watch this space for more such resources to simplify and enrich your trading experiences.

Till then Happy Reading!

Read More: Best Financial Books to Read for Beginners in Stock Market

Did you know between 2019 and 2023, there were nearly 10 crore new demat account...

The stock market in India has fascinated general Indian masses for long, perhap...

There is a popular saying in stock markets that the markets are either driven by...