The past week saw huge volatility in the Indian stock markets against the backdrop of major US banks crashing like dominos. This was another blow to the Indian markets after the Adani-Hindenberg fiasco early at the start of the year. The combined impact has resulted in wiping out billions from the Indian stock markets and left investors wary. These events have also triggered memories of the greatest stock market crashes in Indian stock market history. Given here are brief insights into the top stock market crashes in India over the years and how they impacted the investors at large.

The past week saw huge volatility in the Indian stock markets against the backdrop of major US banks crashing like dominos. This was another blow to the Indian markets after the Adani-Hindenberg fiasco early at the start of the year. The combined impact has resulted in wiping out billions from the Indian stock markets and left investors wary. These events have also triggered memories of the greatest stock market crashes in Indian stock market history. Given here are brief insights into the top stock market crashes in India over the years and how they impacted the investors at large.

Stock market crashes are defined as the sharp decline in the stock prices of a majority of stocks on the stock exchanges ultimately leading to a collective decline of the index as a whole. This leads to a significant loss of investor wealth. The Financial Times refers to stock market rash as a phenomenon where they fall in double digits over a period of 5 minutes. In India, the stock markets are said to have crashed in any of the following cases.

Stock market crashes are defined as the sharp decline in the stock prices of a majority of stocks on the stock exchanges ultimately leading to a collective decline of the index as a whole. This leads to a significant loss of investor wealth. The Financial Times refers to stock market rash as a phenomenon where they fall in double digits over a period of 5 minutes. In India, the stock markets are said to have crashed in any of the following cases.

The Indian stock markets have seen many cases where the stock markets crashed heavily and investors lost crores of their wealth. Given here is the list of top Stock market crashes in India and how they shaped rules and regulations in the country.

It is unbelievable but true that the earliest record of a stock market crash in India was in 1865 when there wasn't even a formal stock exchange in the country. During this time Parsi and Gujarati traders would engage in mutual trading at the junction of Rampart Row and Meadows Street. Due to the American Civil War, there was a sharp increase in the demand for Indian cotton resulting in a steep rise in the stock prices of cotton companies in India. The profits from this increased demand were invested in stock markets which resulted in increased buyers and sellers in the market as well as speculators. When the Civil War ended, speculation for cotton prices was at a peak but the demand for cotton drastically reduced resulting in a huge crash in the markets.

This was the time when Reliance Industries was growing and becoming a giant in the Indian economy. It had eventually become the target of the bears who tried their best to take control and ensure Reliance Industries shares crashed badly. The shares were trading at Rs. 131 and the bears drove the prices down to Rs. 121 by short-selling 11 lakh shares in the open market. This was an era of 14 day settlement period giving the bears ample time to short-sell and cover the delivery by buying the stock at lower prices within the settlement period thereby making profits. Mr. Dhirubhai Ambani seeing the investors losing their wealth and confidence in the name Reliance decided to put an end to this and teach the bears a good lesson. Mr. Ambani gathered brokers who were friends of Reliance Industries and asked them to buy shares of Reliance Industries and at the time of settlement ask for delivery of those shares. The bears did not have them at the time of delivery and Mr. Ambani did not allow the stock markets to open till the time these trades were settled. This led to a closure of the Indian stock markets for a period of 3 days.

The year 1992 rocked the Indian stock markets as they were hit by the first major scam also etched in history as the Harshad Mehta Scam. This stock market crash was worth approximately Rs. 5,000 crores which resulted in BSE falling by 12% approximately and a bear market that lasted for the next 2 years. The scam exposed the loopholes in the Indian financial systems which led to the redrafting of the rules and regulations and ensuring stringent provisions to protect the investors from any future frauds.

The year 1992 rocked the Indian stock markets as they were hit by the first major scam also etched in history as the Harshad Mehta Scam. This stock market crash was worth approximately Rs. 5,000 crores which resulted in BSE falling by 12% approximately and a bear market that lasted for the next 2 years. The scam exposed the loopholes in the Indian financial systems which led to the redrafting of the rules and regulations and ensuring stringent provisions to protect the investors from any future frauds.

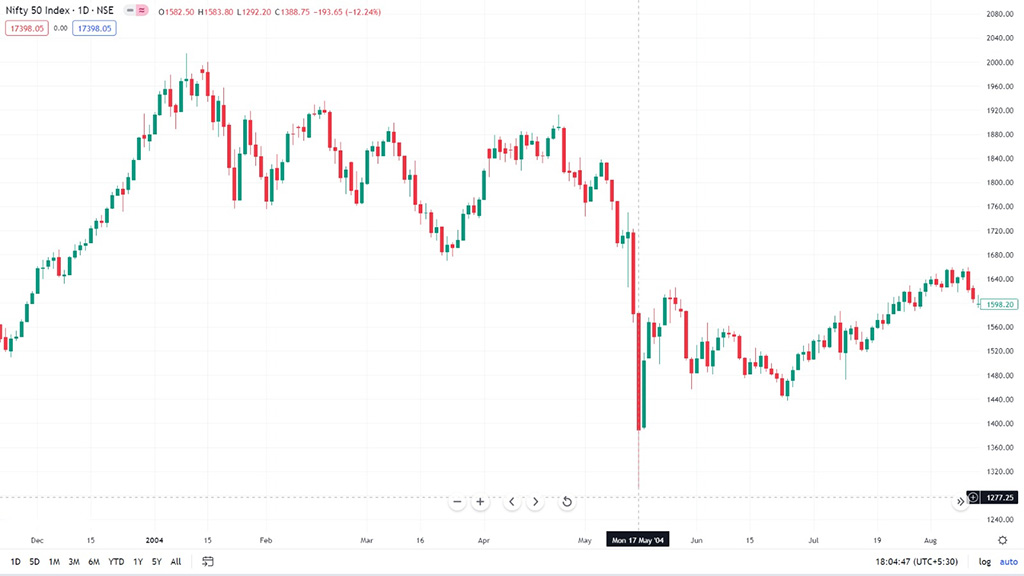

The stock market crash of 2004 was not due to any scam but rather due to the political turmoil in the country. The sudden fall of the NDA government led to a fall of 15.52% in Sensex, which was its highest fall in terms of percentage at that time. This led to massive exits by foreign institutional investors like UBS fearing political instability and the execution of committed reforms.

The stock market crash of 2004 was not due to any scam but rather due to the political turmoil in the country. The sudden fall of the NDA government led to a fall of 15.52% in Sensex, which was its highest fall in terms of percentage at that time. This led to massive exits by foreign institutional investors like UBS fearing political instability and the execution of committed reforms.

The recent bank crisis in the US reminded many of the 2008 crisis that was triggered by the US but was responsible for putting the world into recession. On January 21st, 2008, also known as Black Monday, Sensex fell by more than 1400 points resulting in massive erosion of investor wealth. The following day Sensex saw the biggest intra-day fall of 2273 points when it hit a low of 15,332 triggering the lower circuit of 10%. The reason for this massive fall is due to many reasons like the erosion of foreign investments from the Indian markets, extreme volatility in the commodity markets, and a dip in investor confidence in the national and international markets.

The recent bank crisis in the US reminded many of the 2008 crisis that was triggered by the US but was responsible for putting the world into recession. On January 21st, 2008, also known as Black Monday, Sensex fell by more than 1400 points resulting in massive erosion of investor wealth. The following day Sensex saw the biggest intra-day fall of 2273 points when it hit a low of 15,332 triggering the lower circuit of 10%. The reason for this massive fall is due to many reasons like the erosion of foreign investments from the Indian markets, extreme volatility in the commodity markets, and a dip in investor confidence in the national and international markets.

The fall of stock markets in 2015 was attributed to the devaluation of the Chinese Yuan and the slowdown of their economy. The Shanghai Stock Exchange fell by 8.85% and the ripple effect was felt in the Indian stock markets as well. Other reasons that attributed to this fall include the disappointing earnings of Indian companies and the unsatisfactory response from the top management of such companies that led to concerns about their recovery.

The fall of stock markets in 2015 was attributed to the devaluation of the Chinese Yuan and the slowdown of their economy. The Shanghai Stock Exchange fell by 8.85% and the ripple effect was felt in the Indian stock markets as well. Other reasons that attributed to this fall include the disappointing earnings of Indian companies and the unsatisfactory response from the top management of such companies that led to concerns about their recovery.

The Indian stock markets were still reeling from the stock market crash of the previous year when markets faced turmoil again in 2016. By mid-February 2016, Sensex saw a collective fall of over 26% over a period of 11 months, and markets also saw an exit of FII to the tune of Rs. 17,318 crores. This led to the further crash of Sensex by another 6% in November 2016 and Nifty fell by 541 points closing at 8000 approximately. The reason for this nosediving of Sensex was attributed to the news of demonetisation and the weakening of INR. This period also saw a fall in global indices like the S&P Index which fell by 4.45%, along with Asian markets including Hang Seng, Nikkei, and Shanghai Composite.

The Indian stock markets were still reeling from the stock market crash of the previous year when markets faced turmoil again in 2016. By mid-February 2016, Sensex saw a collective fall of over 26% over a period of 11 months, and markets also saw an exit of FII to the tune of Rs. 17,318 crores. This led to the further crash of Sensex by another 6% in November 2016 and Nifty fell by 541 points closing at 8000 approximately. The reason for this nosediving of Sensex was attributed to the news of demonetisation and the weakening of INR. This period also saw a fall in global indices like the S&P Index which fell by 4.45%, along with Asian markets including Hang Seng, Nikkei, and Shanghai Composite.

In 2018, the Finance Minister introduced changes in the capital gains taxes, and long-term gains on the sale of equity shares are thereafter taxed at a flat rate of 10% after an initial exemption of up to Rs. 1,00,000. This led to a fall of 600 points for two trading sessions on BSE and 400 points on Nifty 50.

In 2018, the Finance Minister introduced changes in the capital gains taxes, and long-term gains on the sale of equity shares are thereafter taxed at a flat rate of 10% after an initial exemption of up to Rs. 1,00,000. This led to a fall of 600 points for two trading sessions on BSE and 400 points on Nifty 50.

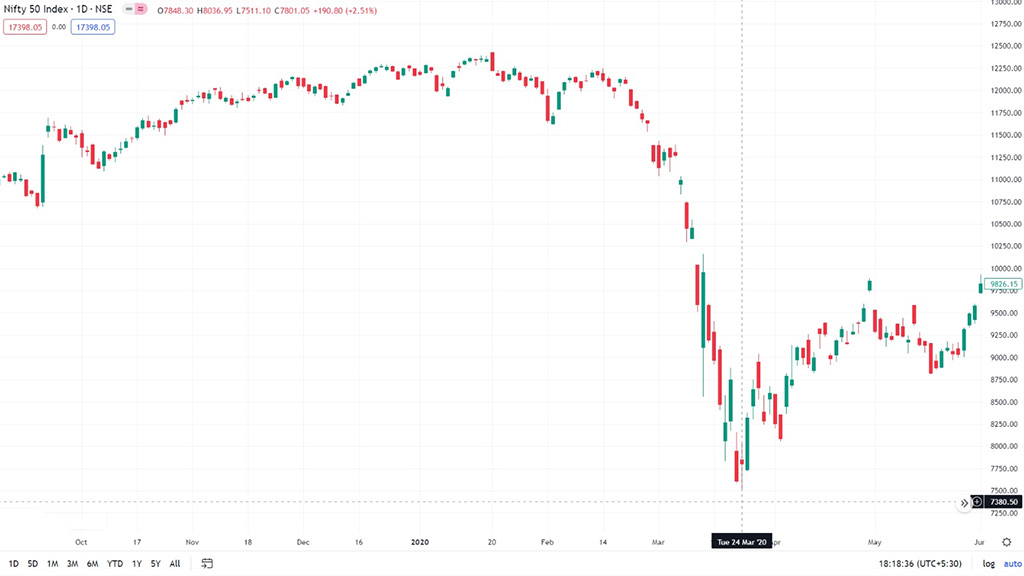

The fall of stock markets in 2020 was one of the most talked about as it was on the backdrop of Covid 19 pandemic and was part of the collective fall of stock markets across the globe. Indian Stock markets saw a slide for a continuous period of 5 days which was again the worst the country had seen since 2009. The markets further tumbled another 1000 points due to the takeover of YES Bank by RBI. by 12th March 2020, the Sensex had reached a 33-month low of 32778 approximately. The free fall further continued when the Sensex and Nifty lost another 13.15% and 12.98% respectively on 23rd March 2020. The full impact of the COVID-19 pandemic and the free fall of the Indian stock markets continued for the coming days and the lockdowns imposed by nations across the globe also led to recession-like conditions.

The fall of stock markets in 2020 was one of the most talked about as it was on the backdrop of Covid 19 pandemic and was part of the collective fall of stock markets across the globe. Indian Stock markets saw a slide for a continuous period of 5 days which was again the worst the country had seen since 2009. The markets further tumbled another 1000 points due to the takeover of YES Bank by RBI. by 12th March 2020, the Sensex had reached a 33-month low of 32778 approximately. The free fall further continued when the Sensex and Nifty lost another 13.15% and 12.98% respectively on 23rd March 2020. The full impact of the COVID-19 pandemic and the free fall of the Indian stock markets continued for the coming days and the lockdowns imposed by nations across the globe also led to recession-like conditions.

The stock market crashes are a result of any stimuli or news within the country or across any part of the globe that is material enough to impact other nations. The world again saw such impact with the Russia-Ukraine war and the breakdown of global supply chains, a rise in the crude oil prices, and the latest being an increase in Fed rates eventually leading to the fall of major banks in the US. These incidents mentioned above shaped the Indian regulatory framework for the stock markets and related institutions like the banks where measures were duly taken to safeguard the interest of the investors at large as well as the financial fabric of the nation. Hope this article was able to provide enough information about the major stock market crashes that rocked India and the reasons behind them. There are various measures that investors can adopt to safeguard their assets from this uncertainty and volatility during a stock market crash or measures to prepare their portfolio to be bulletproof against such extreme cases. Let us know if you would like to know more about such measures. Till then Happy Reading!

The stock market in India has fascinated general Indian masses for long, perhap...

Options trading is a dynamic and complex arena, filled with intricacies like opt...

Terminology of Stock Market What Is a Stock Market? A stock market is a place w...