Dreaming of a flashy new phone or a sleek laptop but don’t have the funds? No worries! With easy access to loans, getting what you want is simpler than ever. In today’s economy, debt is no longer a dirty word as it is often seen as a stepping stone to new opportunities. But here’s the catch, borrowing responsibly means paying back on time. If not, you might find yourself caught in something far less glamorous, i.e., the dreaded debt trap. What exactly is a debt trap, and why should you avoid it at all costs? Let us dive in to explore how to safeguard your financial future and stay stress-free.

A debt trap happens when a person borrows money and struggles to pay it back, leading them to take on even more loans just to cover their previous debts. It is like a vicious cycle, where the person keeps borrowing to repay older loans, and the debt keeps piling up. This can be common when people use credit cards or personal loans for things like buying gadgets or covering everyday expenses, without planning how to repay them. Over time, the interest on these loans grows, making it harder to clear the debt. This can cause serious financial stress, as the person may end up paying more in interest than they originally borrowed, putting their financial future at risk.

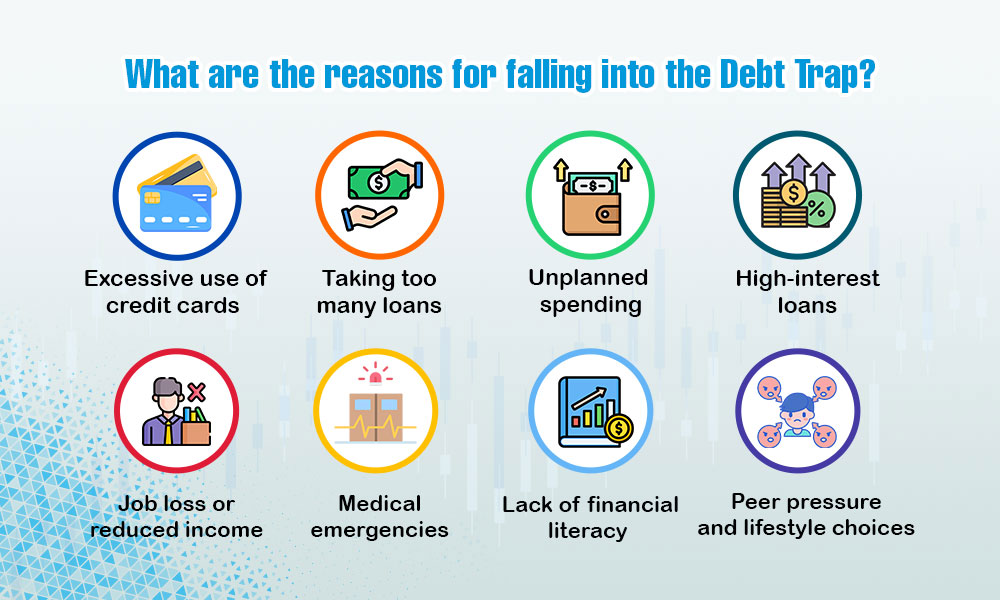

Some of the top reasons that can lead to falling into a debt trap are highlighted below,

Excessive use of credit cards - A person may rely too much on credit cards for everyday expenses, leading to high-interest payments if the balance is not paid off in time.

Taking too many loans - Borrowing multiple loans at once, such as for a home, vehicle, or personal needs, can create a heavy repayment burden leading to a debt trap.

Unplanned spending - When a person spends beyond their income without budgeting, they may need loans to cover shortfalls, increasing their debt load.

High-interest loans - Opting for loans with high interest rates, like payday loans or some personal loans, can make it harder to repay the amount borrowed.

Job loss or reduced income - Losing a job or having a lower income can make it difficult to repay existing loans, forcing a person to borrow more.

Medical emergencies - Unexpected medical expenses can push someone to take loans, which, if not managed well, can lead to a cycle of debt.

Lack of financial literacy - Not understanding how interest works or how to manage loans with a proper repayment plan can lead to poor financial decisions and eventually falling into debt.

Peer pressure and lifestyle choices - Trying to keep up with a certain lifestyle or peer group can lead to overspending, forcing someone to take loans they cannot easily repay.

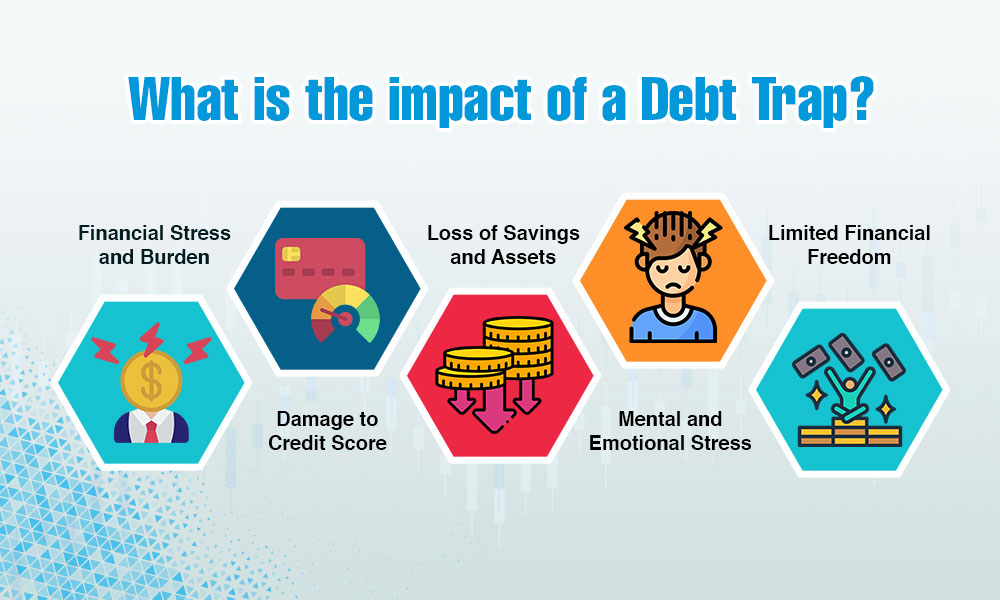

The impact of a debt trap is quite extensive and has the potential to disturb the financial future of the individual and their family as well. This impact is explained hereunder.

A debt trap puts a person under constant financial pressure, as they struggle to repay loans and manage growing interest payments. This often leads to borrowing more money to pay off old loans, increasing the debt and making it harder to escape.

Falling into a debt trap can seriously harm a person’s credit score. A low credit score makes it difficult to get future loans, as lenders view the person as a high-risk borrower. This can limit financial opportunities like buying a house or starting a business.

As debts pile up, a person may have to use their savings or sell valuable assets, like property or gold, to repay the loans. This can wipe out years of hard-earned savings and leave them with little financial security for the future.

The constant worry about repaying debts can lead to severe mental stress and anxiety. This can affect the person’s overall health, relationships, and ability to focus on work, leading to a decline in quality of life.

Being trapped in debt reduces a person’s financial freedom. They may have to cut back on spending, delay important life goals, and miss out on opportunities due to the burden of repaying loans. This can hold them back from achieving long-term financial stability.

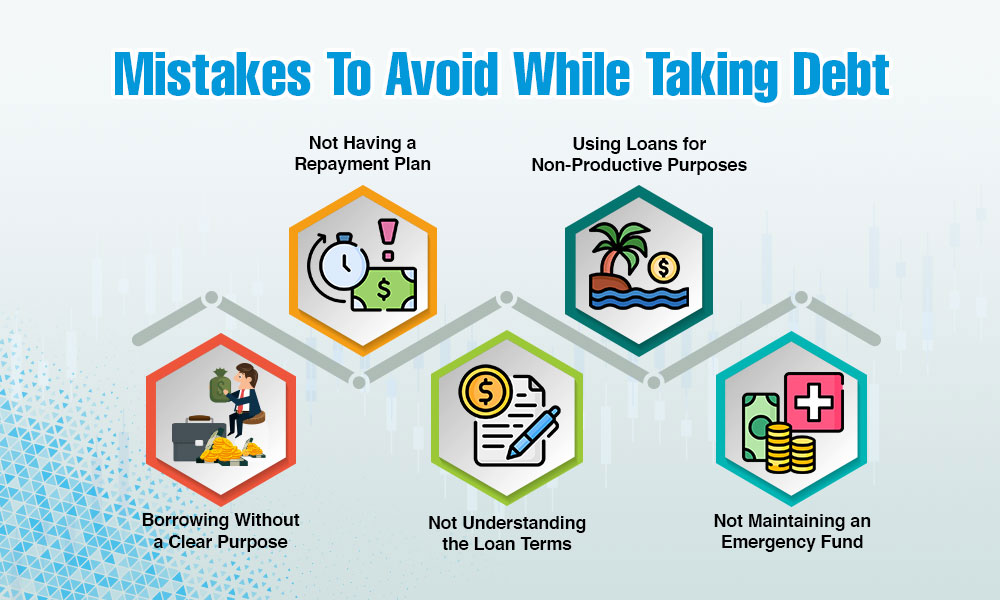

Now that we have seen the impact of falling into a debt trap, let us focus on the common mistakes to avoid in order to stay clear of one. Here is a brief list of such common mistakes that often lead to the vicious cycle of debt traps.

Before taking on debt, it is important to know the exact need for the loan. One should avoid borrowing just because money is easily available or for non-essential expenses. Many people borrow for social events like weddings or festivals, but if the debt is not for something that will improve their financial position, it can become hard to repay later.

Before taking a loan, one must make sure they have a clear plan on how to repay it. This includes knowing how much is to be paid each month and for how long. Without a proper plan, there can be missed payments, which can lead to penalties or an increase in the overall debt.

It is important to always read and understand the loan agreement before signing and know terms like the interest rate, repayment schedule, and any hidden charges. Many people borrow from informal lenders without fully understanding the terms, leading to high interest rates or unfavourable repayment conditions, which can eventually result in a debt trap.

Avoid using borrowed money for non-productive expenses, such as luxury items, vacations, or unnecessary purchases. Loans should ideally be used for purposes that will improve financial health, like education, starting a business, or buying a home. Non-productive spending makes it harder to repay and offers no long-term benefits.

Before taking on any debt, it is wise to have an emergency fund in place. Many people borrow money when unexpected expenses arise, such as medical emergencies or sudden repairs. However, by having an emergency fund, they can avoid unnecessary borrowing and reduce the financial stress of sudden events.

Falling into a debt trap, as mentioned above, is a vicious cycle that can be quite challenging to break out from. However, it is not impossible. Here are a few steps or remedies to get out of a debt trap and frame a path for a better financial future after learning from one’s mistakes.

Prioritise High-Interest Loans - Focus on paying off loans with the highest interest rates first. This will help reduce the overall amount of interest you pay, making it easier to manage your remaining debts.

Create a Budget and Stick to It - Make a monthly budget that includes all your expenses and loan payments. Sticking to this budget can help you control unnecessary spending and free up money to pay off your debts faster. Steps or techniques like 50/30/20 budgeting rules can be used for better budgeting and planning.

Consolidate Your Loans - If possible, consider combining multiple loans into a single one with a lower interest rate. This can make repayment simpler and reduce the total interest you pay over time.

Use Windfalls Wisely - If you receive any extra income, like bonuses, tax refunds, or gifts, use it to pay off your debt instead of spending it on non-essential items.

Increase Your Income - Look for ways to increase your income, such as a part-time job or freelance work. Extra income can help pay off loans faster and reduce the debt burden.

Avoid Taking New Loans - While paying off existing debts, avoid taking new loans unless absolutely necessary. Taking on more debt while trying to get out of a debt trap can worsen your financial situation.

Build an Emergency Fund - Start saving a small amount regularly for emergencies, even while repaying debt. This helps you avoid new loans when unexpected expenses arise, breaking the cycle of borrowing.

A debt trap is one of the top factors affecting the financial health of a person and when not managed efficiently, it has the potential to destroy the financial stability of the next generation too. Therefore, it is essential to take strong steps to avoid it in the first place or to get out of the debt trap at the earliest.

This article talks about the perils of the debt trap and the ways that it can affect the financial freedom of a person and their families as well. Let us know if you need more information on this topic or on concepts related to financial freedom and we will take them up in our coming blogs.

Till then Happy Reading!

Read More: What is Passive Income? Why do you need it?

The fundamental characteristic ofstock markets is the constant swing of the ebb ...

Investment in stock markets is not limited to investing in pure stocks. It has ...

After the buzz around the general elections in India had just concluded, the sta...