We saw a string of layoffs in the past year and early this year. What do you do in such a case? Well, the immediate fallback option is the emergency fund you have been saving for a rainy day. But what if you do not have that, the next best thing is to use your savings or liquidate some investments to stay afloat. The only problem in this case is that you may run out of them soon and will have to start from scratch to build your investment portfolio. This is where having a passive income saves the day. Check out this blog to learn all about passive income and how to build it to reach your financial goals at a rapid pace.

Read More: Sovereign Gold Bonds vs Pure Gold

The simple meaning of passive income is having a stable and regular source of earning without any extra efforts or direct and constant involvement in income generation. Passive income can supplement the active income source and help you reach your target financial goals in a faster and more efficient manner. Passive income allows a person to diversify their income streams beyond the traditional employment or business avenues allowing them to create a robust financial portfolio.

The youth today are more aware of the need and benefits of passive income than the previous generation. Our previous generation relied on their active income to meet their needs and create a financial plan. However, what worked before cannot work now given the complex and uncertain world that we live in and the rising cost of living that the world faces today. Passive income not only provides a sense of financial security but also opens up opportunities for personal and professional growth, enabling individuals to pursue their passions, invest in education, or engage in entrepreneurial ventures without solely relying on active employment income.

With the changing world that we live in, passive income avenues can now be classified into traditional ideas and dynamic ideas. Here is a brief discussion of popular passive income ideas in each category.

The traditional passive income ideas are the age-old income sources that have been in use for decades. Our previous generation also relied on them for their retirement planning.

Rental income is a classic form of passive income where you can earn money by leasing out real estate properties. This could include residential apartments, commercial spaces, or vacation properties. You can receive rental income from these properties for perpetuity or even capital gains in case you decide to sell off your asset. The only concern is property maintenance, addressing tenant concerns, taxes on rental income, etc.

Dividend income is the share of profits that you receive from the companies for the proportion of shares held as a shareholder. An important point to remember is that declaring dividends each year is not mandatory for any company. Therefore, investors should look for dividend-paying stocks to include in their investment portfolio to earn more or less stable dividends as passive income.

Interest income is another common passive income option for investors. This interest income can be from various investments like Bank Savings Accounts, Fixed Deposits, Recurring Deposits, and Debt instruments like Bonds and Debentures. This is a low-risk option as compared to dividend income as debt instruments are less volatile than stocks. This makes it an attractive option, especially for conservative investors.

Affiliate marketing involves promoting other people's products or services and earning a commission for every sale made through your unique affiliate link. You can join affiliate programs of various companies, including e-commerce platforms and service providers. Bloggers and social media influencers can embed affiliate links in their content and when their audience purchases through those links, they receive a percentage of the sale as passive income.

Creating online content is a popular way to generate passive income. Blogging, writing eBooks, and running a YouTube channel can all contribute to income generation. You can monetize blogs and YouTube channels through advertisements, sponsorships, and affiliate marketing. Additionally, eBooks can be sold through various online platforms, providing authors with royalties for each sale.

Peer-to-peer lending involves lending money directly to individuals or small businesses through online platforms, earning interest on the loans. P2P lending platforms connect lenders with borrowers, allowing individuals to earn passive income from interest payments. However, it's essential to conduct thorough research and assess the associated risks before engaging in P2P lending.

Dropshipping is an e-commerce model where individuals sell products without holding inventory. When a customer makes a purchase, the product is shipped directly from the supplier to the customer. Entrepreneurs can set up online stores and collaborate with suppliers to handle inventory and shipping. Profits come from the difference between the product's cost and the retail price.

Angel investing involves providing capital to startup businesses in exchange for equity. You can invest in promising startups and potentially earn passive income through dividends or capital gains when the businesses succeed. This approach, however, requires a keen understanding of the business landscape and a willingness to take calculated risks.

After the initial hesitation from tourists and property owners alike, Airbnb has seen great support and huge popularity over the years. You can list their homes or spare rooms on Airbnb for short-term rentals and generate passive income. This can be a lucrative option in tourist destinations or areas with high demand for temporary accommodation. The only flip side is similar to renting out properties in the traditional manner which is maintenance of the property and tenant management.

Cashbacks are an attractive way for e-commerce websites and payment websites to attract customers. You can explore cashback programs offered by various platforms and when you purchase from such platforms, you receive a percentage of the amount spent back as cashback. This is a simple and effective way to accumulate passive income on your everyday expenses.

Creating intellectual property such as books, music, or artwork can result in royalties, providing ongoing income. Authors, musicians, and artists can receive ongoing income from book sales, music streaming, or licensing their work. This is a creative way to build a source of passive income as long as your intellectual property continues to generate revenue.

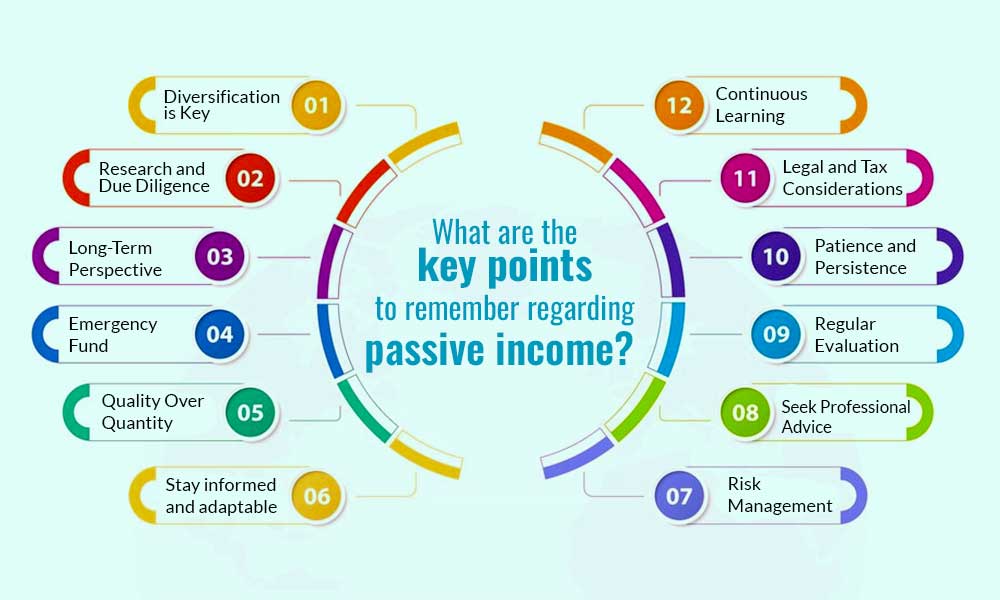

Passive income is a smoother and more efficient way to increase your overall resources to meet your needs and have a strong financial plan. However, there are a few issues that you need to look out for. Here is a list of the key points to remember regarding passive income.

Diversification is Key - Don't rely on a single source of passive income. Diversify your investments and ventures to spread risk and increase overall stability.

Research and Due Diligence - Before engaging in any passive income opportunity, thoroughly research and understand the associated risks. This applies to investments, business ventures, or any other income-generating activities.

Long-Term Perspective - Many passive income streams take time to build and become significant. Adopt a long-term perspective, as consistent efforts over time often yield better results.

Risk Management - Be aware of the risks involved in each passive income stream. Understand your risk tolerance and have a strategy in place to manage and mitigate potential downsides.

Emergency Fund - Maintain an emergency fund to cover unforeseen expenses. Having a financial safety net ensures that your passive income is not solely relied upon for immediate needs.

Quality Over Quantity - Focus on the quality of your investments or ventures rather than pursuing numerous opportunities simultaneously. Quality investments have a higher likelihood of providing sustainable returns.

Stay informed and adaptable - Regularly update yourself on market trends and economic changes, and be flexible to adapt your passive income strategies to evolving circumstances.

Continuous Learning - Industries and markets are constantly evolving so you have to stay on top of it through continuous education about new opportunities, technologies, and strategies in order to enhance your passive income streams.

Legal and Tax Considerations - Understand the legal and tax implications of your passive income activities. Comply with relevant regulations and seek professional advice to optimise your tax position.

Patience and Persistence - Building substantial passive income takes time and persistence. Be patient and stay committed to your chosen strategies, especially during challenging periods.

Regular Evaluation - Periodically review and evaluate the performance of your passive income streams. Assess whether adjustments are needed based on changing circumstances or goals.

Seek Professional Advice - When in doubt or dealing with complex financial matters, seek advice from financial professionals, such as financial planners or tax consultants, to make well-informed decisions.

Passive income is no longer considered an option in your financial planning. It is an essential component to meeting your financial goals and having a comfortable retirement plan. Therefore, it is important to start building your successful passive income streams in due time to eventually enjoy the fruits of your strategic financial planning.

This article was a brief attempt to highlight the importance of passive income and the simple yet possible solutions to generate such income for any person. Let us know if you need further information on this topic and we will address your concerns.

Till then Happy Reading!

Over the years, India’s financial sector has witnessed several high-profil...

If you are a shareholder of a company, you would have seen its annual reports co...

Thecompany’s financial statements are the starting point for evaluating it...