Stock markets are impacted by many factors that lead to their constant ebb and surge. However, did you know Sensex and Nifty have gained approximately 10% in the past year alone? Stock markets are known to yield the maximum returns as compared to any other investment options provided investors make smart and informed choices. The first step in this direction is learning the nuances of the stock market, i.e., the fundamental and technical analysis skills. While this is a deep rabbit hole, let us take up an interesting and basic topic of fundamental analysis here, i.e., the top-down and bottom-up approaches in stock selection. Read all about these two distinct approaches and start your investment journey now!

The Top-Down Approach in fundamental analysis is a structured method where investors start by analysing the broader economic environment and gradually focus on more specific aspects, ultimately assessing individual stocks. This approach is often described as having a ‘bird's eye view’, where the analysis moves from the macro level down to the micro level. Investors typically follow the EIC framework, which involves three steps, i.e., evaluating the economy, the industry, and then the company itself.

The process of the top-down approach begins with evaluating the economic conditions within the domestic and international markets to assess whether the current economic environment is favourable for investments. After this analysis, the next step is to understand the industry to which the target company belongs. The focus is on the key factors like market demand, regulations, competition, technological advancements, etc. that impact the industry as a whole. The focus is then finally shifted to the target company and its financial performance, and the same is compared with its peers.

This approach allows investors to make informed decisions based on a comprehensive understanding of the economy, industry, and individual companies, helping them identify the best investment opportunities in India’s stock market.

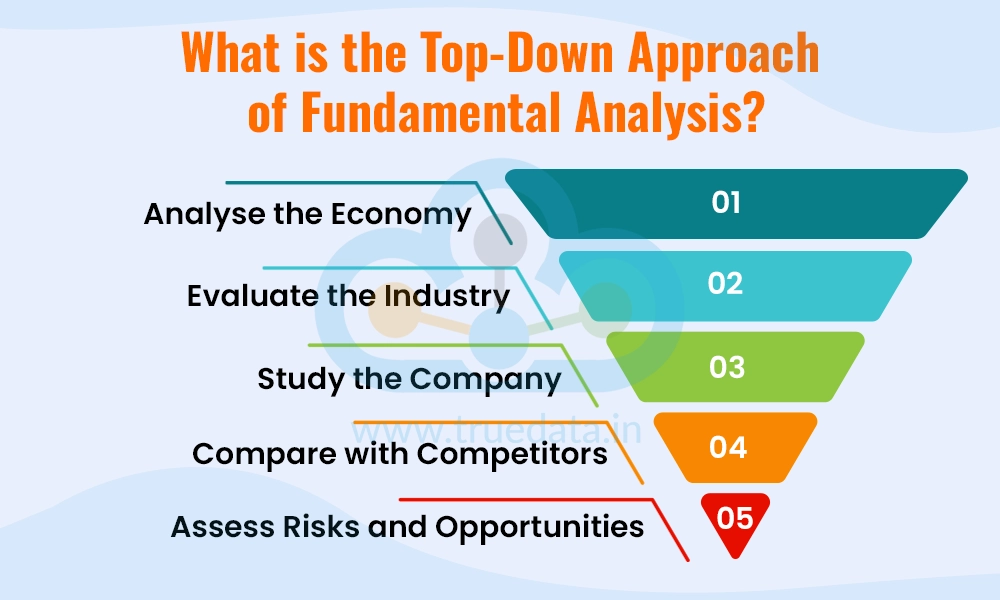

The top-down approach of stock selection starts by focusing on the macro aspects moving towards the micro aspects of the investment. The steps for the top-down approach are multiple and are summarised as under,

Analyse the Economy - The process begins with examining the overall economic conditions in India and globally. Key factors such as GDP growth, inflation, interest rates, and government policies are considered. A strong economic environment generally indicates better investment opportunities, while a weaker economy may signal the need for caution.

Evaluate the Industry - After assessing the broader economy, attention shifts to the specific industry where the company operates. Investors should study the industry’s growth prospects, demand-supply trends, market dynamics, regulatory environment, and potential challenges. This helps in understanding whether the industry offers attractive growth and profitability opportunities.

Study the Company - Once the economic and industry analysis is complete, the focus narrows to the individual company. Investors should evaluate the company’s financial performance, including revenue trends, profitability, and capital structure. Key financial metrics such as Return on Equity (ROE), Return on Capital Employed (ROCE), Earnings Per Share (EPS), and Price-to-Earnings (PE) ratio should be analysed to assess its performance.

Compare with Competitors - Comparing the company’s financial and operational metrics with its competitors within the same industry is essential. This provides a clear understanding of the company’s competitive position, relative strength, and long-term growth potential.

Assess Risks and Opportunities - Throughout the analysis, risks and opportunities at the economic, industry, and company levels should be carefully evaluated. This ensures a balanced approach, factoring in both potential challenges and rewards before making investment decisions.

The bottom-up approach is like the flip side to the top-down approach and adopts the worm’s eye view. This approach starts by focusing on the evaluation of individual companies rather than on broader economic or industry trends. Investors start by assessing the company’s fundamentals, including its revenue, business model, market position, life cycle of its products or services as well as management quality and their role in the company’s success. This approach moves from micro-level factors (the company) to macro-level factors (industry and economy). By focusing first on the stock and then moving upwards, the Bottom-Up Approach allows investors to identify companies with strong potential, even if their sector or the broader economy is not performing in sync.

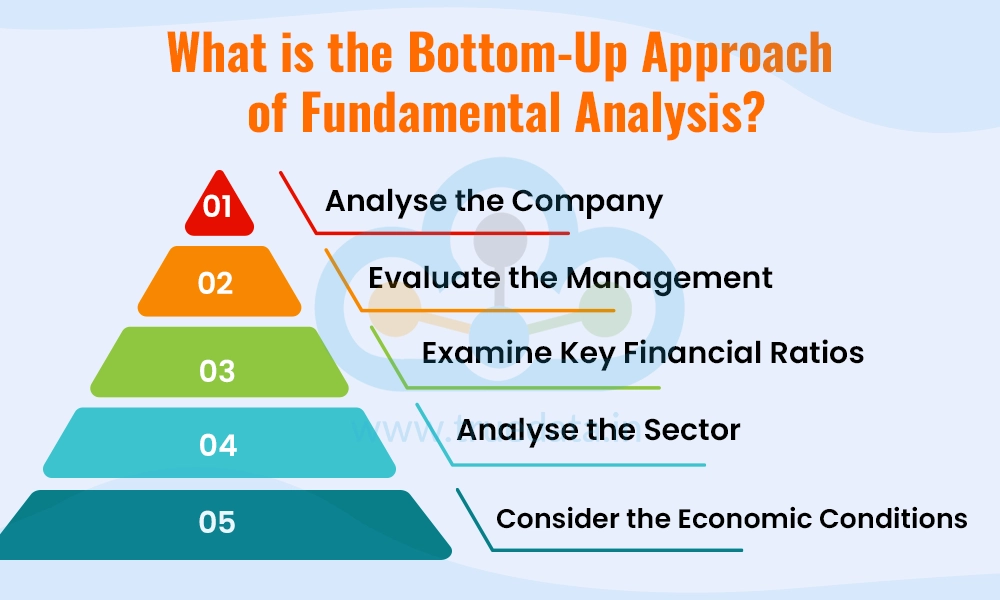

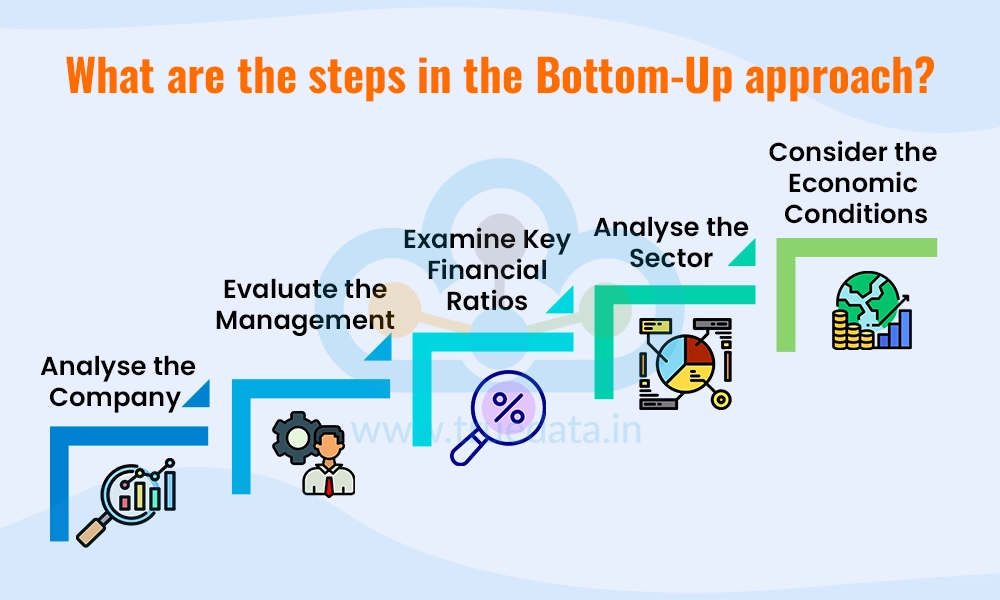

The Bottom-Up Approach in fundamental analysis involves several key steps that focus on analysing individual companies first, before considering broader industry and economic factors. The steps for the bottom-up approach are multiple and are summarised as under,

Analyse the Company - The first step is to study the company itself. Investors should focus on the company’s financial health, including revenue trends, profitability, and the business model. It is important to understand the market position of the company's products or services, and the life cycle they are in (whether they are growing, stable, or declining).

Evaluate Management - Assessing management quality is an important part of a company's fundamental analysis. Investors need to understand how effective the leadership is in running the business, making key decisions, and navigating challenges. A strong, capable management team can significantly influence the company’s future performance.

Examine Key Financial Ratios - Investors should analyse the company’s key financial ratios, such as Earnings Per Share (EPS), Price-to-Earnings (PE) ratio, Return on Equity (ROE), and Debt-to-Equity ratio. These ratios help investors understand the company’s profitability, financial health, and valuation. Comparing these ratios with competitors in the same industry can help assess how well the company is performing relative to others.

Analyse the Sector - Once the company has been thoroughly analysed, the next step is to look at the industry or sector it operates in. This involves understanding the growth prospects, risks, and opportunities within the sector, and how the company is positioned relative to others in the same space.

Consider the Economic Conditions - The final step is to examine the broader economic environment, both within the domestic markets and globally. While the company itself is the main focus, understanding economic factors like inflation, interest rates, and global market trends can provide additional insights into how the company may perform in different economic conditions.

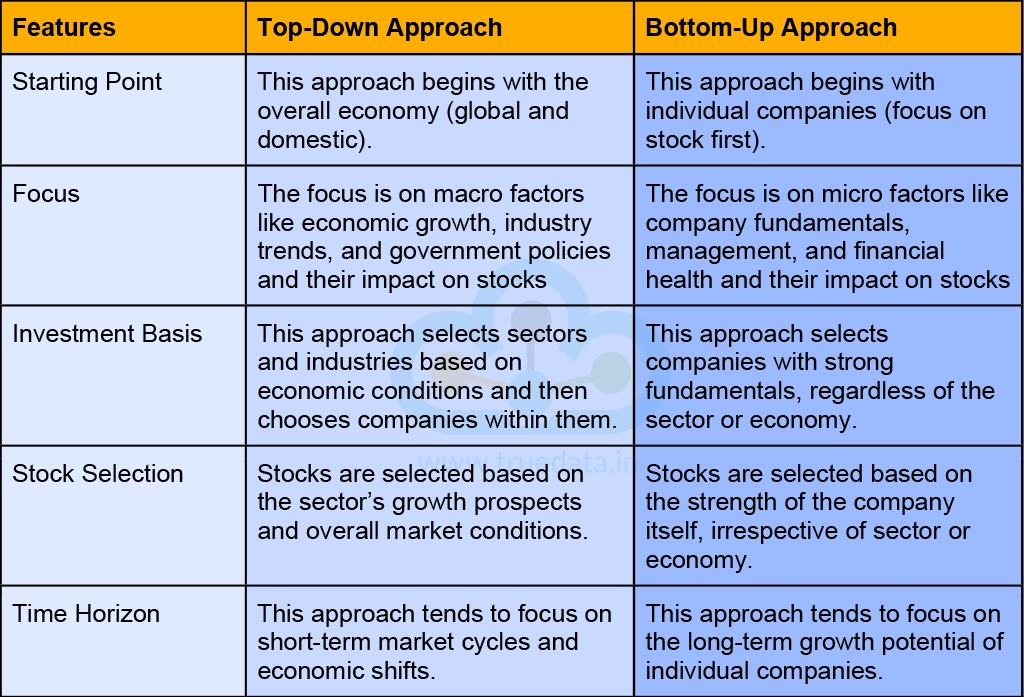

The top-down and bottom-up approaches are the diverse approaches to stock selection enabling investors to make informed decisions by choosing different paths. The key differences between these approaches help investors understand them better further aiding investors in understanding the intricacies of stock market investing.

These differences between the two approaches are highlighted hereunder.

The decision between the top-down and the bottom-up approach for stock selection boils down to the types of investors and their investment goals. The Top-Down Approach is well-suited for investors who prefer a broader view of the market and want to make decisions based on economic and market trends. For example, investors who are optimistic about the country’s economic growth might choose to invest in sectors like infrastructure, banking, or technology, which are expected to benefit from such growth. This approach is also suitable for short-term traders or active investors who want to capitalise on current market trends.

The bottom-up approach, on the other hand, is well-suited for investors with a focus on the individual companies and their strengths. For example, an investor might find a small, fast-growing tech company with a solid business model and strong earnings potential, even if the technology sector as a whole is facing challenges. This approach is ideal for long-term investors, such as those looking for value investments or growth stocks, and who are willing to research and closely monitor companies over time.

While there is no ‘one size fits all’ answer to this question, the choice between the two approaches depends on the individual investment philosophy and goals. It is a fact that the bottom-up approach tends to be more detailed and time-consuming, requiring a deep dive into company financials, management quality, and market positioning. However, it can lead to more rewarding investments, especially if the investor has the patience and skill to identify high-potential companies that are undervalued or overlooked by others.

The Top-Down and Bottom-Up Approaches to stock selection have their unique advantages and cater to different types of investors. These approaches offer distinct versions of investing by providing a structured way to identify profitable opportunities in the stock markets. Ultimately, the choice between the two is based on factors like the investor’s goals, investment style, and risk tolerance making the decision unique for every investor.

This article is part of our series on the basics of fundamental analysis of companies. Watch this space for more such topics where we take you on a journey into the different aspects of the financial analysis of companies. Let us know your thoughts on this topic or if you have any queries.

Till then Happy Reading!

Read More: Best Financial Books to Read for Beginners in Stock Market

Introduction For the longest time, investment in stock markets was thought to b...

The stock markets have seen massive volatility over the past few months. The ec...

The world today is more aware of the need for insurance than it was ever before....