and How to Overcome It copy.webp)

The 2024 Indian General Elections have just concluded and the biggest aftermath was the impact on the Indian stock markets. Stock markets initially saw a bull run backed by the exit polls and then a deep dive once the actual results started coming in. This volatility resulted in substantial losses for many retail investors, primarily driven by stock market FOMO (Fear of Missing Out). If you are new to the stock markets, you may not have heard the term FOMO but may have likely experienced its impact on your portfolio at some point. So what is stock market FOMO and how do you overcome it? Get all your answers on FOMO here in this blog.

Read More: What is Passive Income? Why do you need it?

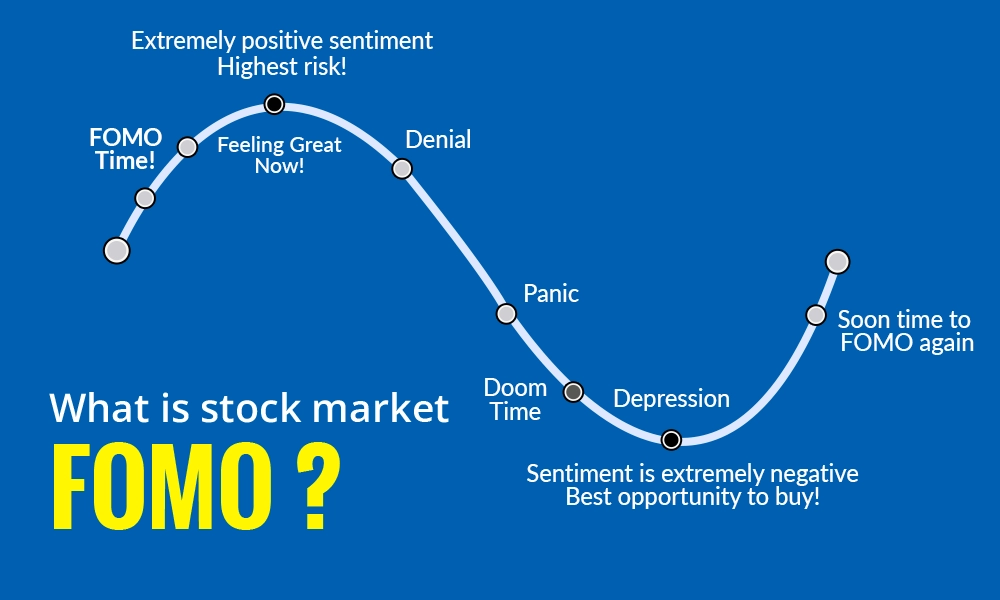

Stock market FOMO (Fear of Missing Out) refers to the anxiety and urgency investors feel when they see others profiting from rising stock prices and worry about missing out on potential gains. This emotional response can lead to impulsive and irrational investment decisions, such as buying stocks at high prices without proper analysis or selling too soon. FOMO can be particularly pronounced during events like elections or major economic announcements, where market volatility is high and the fear of missing lucrative opportunities is heightened.

Stock market FOMO is triggered by many factors that impact investor behaviour and drive stock prices. Some of the factors that trigger stock market FOMO are explained here.

Social media platforms and financial news channels can create a buzz around certain stocks, often exaggerating potential gains and triggering FOMO among investors. Any viral posts and trending news about stock market successes can prompt investors to make hasty decisions without thorough analysis, especially in the Indian market where social media usage is very high.

Hearing about the investment successes of friends, family, or colleagues can trigger FOMO. When investors see people in their network making significant profits, they may feel compelled to follow suit, fearing that they might miss out on similar gains.

Sudden and significant market movements, especially during events like elections, budget announcements, or geopolitical developments, can induce FOMO. The swift rise in stock prices can create a sense of urgency, pushing investors to buy in quickly to capitalise on the momentum.

Emerging trends and new investment opportunities, such as in technology or renewable energy sectors, can also trigger FOMO. Investors might rush to invest in these sectors, driven by the fear that they might miss out on the next big thing.

Recommendations and predictions from market experts and analysts can have a strong impact on investor behaviour. In India, many novice investors rely on expert opinions, bullish forecasts, and optimistic analysis which can fuel FOMO and lead to rushed investment decisions.

Human psychology plays a significant role in triggering FOMO. The natural desire to be part of a winning group and the fear of regret for missing profitable opportunities can drive investors to act impulsively. In a fast-paced market, these psychological factors can be particularly influential.

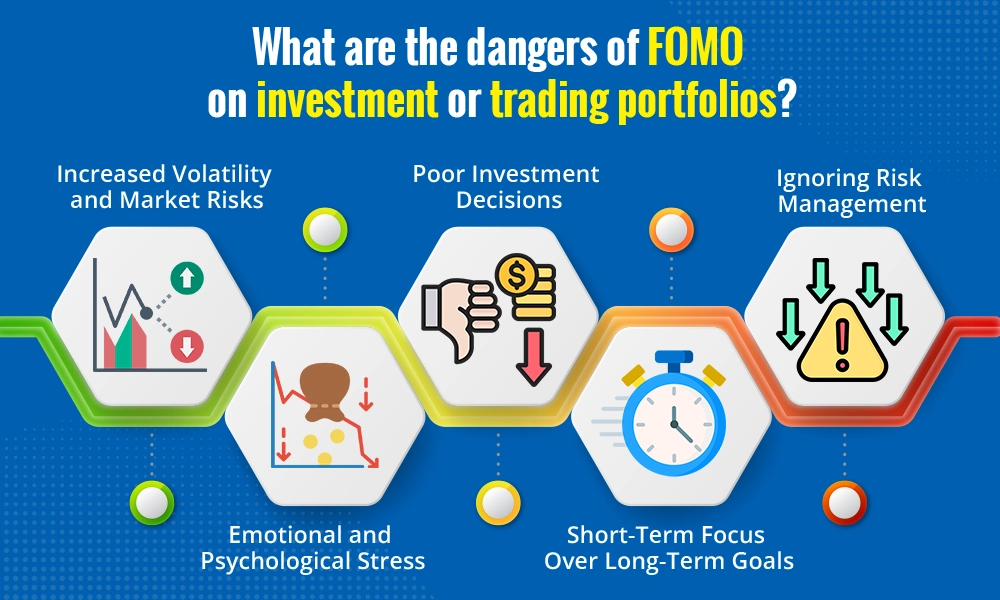

A few dangers of FOMO (Fear of Missing Out) on the investment or trading portfolio are highlighted below.

Succumbing to FOMO often means buying stocks at their peak prices, when market sentiment is overly optimistic. This exposes investors to higher volatility and the risk of substantial price corrections. The Indian market can be particularly volatile during events like elections or policy changes. Such events can trigger sharp and unexpected losses for investors and traders and impact their portfolios.

FOMO can lead to hasty and ill-informed investment choices. When investors rush to buy stocks based on market hype or peer pressure, they may overlook critical factors such as the company’s fundamentals, valuation, and market conditions. This can result in buying overvalued stocks or those that do not align with their investment strategy, potentially leading to significant losses.

The anxiety and stress associated with FOMO can negatively impact an investor's mental well-being. Constantly worrying about missing out on opportunities can lead to emotional exhaustion and burnout.

FOMO often shifts the focus from long-term financial goals to short-term gains. Investors driven by FOMO may frequently trade in and out of stocks, incurring higher transaction costs and taxes, and potentially disrupting their long-term investment plans. This short-term view can hinder the growth and stability of an investment portfolio.

In the rush to capitalise on perceived opportunities, investors may neglect essential risk management practices, such as diversification and setting stop-loss orders. This can result in a portfolio that is overly concentrated on a few high-risk assets, increasing the potential for significant financial loss.

Now that we have seen the dramatic impact that stock market FOMO can have on an investor or trader’s portfolio, it is essential to keep it in check and protect the portfolio from its adverse effects. Here are a few points to remember to achieve this.

Having a well-defined investment plan can help investors to mitigate the effects of FOMO. investors need to outline their financial goals, risk tolerance, and investment horizon, and stick to their plan regardless of market noise. This disciplined approach ensures that the investment decisions are aligned with personal long-term objectives and not influenced by short-term market movements.

Before investing, it's crucial to perform comprehensive research on potential investments. Investors should focus on understanding company fundamentals, financial health, and market conditions, going beyond headlines and social media hype to make informed decisions based on solid data.

Patience and discipline are key to overcoming FOMO. Investors should take the time to think through their investments, setting specific criteria for entering and exiting trades, and consistently adhering to these rules to avoid chasing fleeting market trends.

Recognising and managing emotional triggers that lead to FOMO is crucial. Investors should practice mindfulness and stress management techniques to remain composed during market movements, helping them control their investment decisions and avoid impulsive actions driven by fear.

Stock market FOMO is quite real and can drive a successful portfolio to shambles within minutes. Therefore, it is quite important to first understand and acknowledge it and thereafter take necessary steps to ensure they do not impact the portfolio returns. This helps investors make rational and informed decisions to build a robust portfolio even in the face of market volatility and external pressures.

We hope this article was able to address the meaning and key issues related to stock market FOMO. Let us know if you want details on similar stock market terms and phenomena and we will take them up in our coming blogs.

Till then Happy Reading!

The Japanese Yen (JPY) has long been one of the world’s major currencies, ...

Imagine a time when you could get 10gms of gold at Rs. 100 or a Reliance Industr...

The stock market in India has fascinated general Indian masses for long, perhap...