We are heading towards the end of 2023 and the time of festivities has begun. One of the most crucial events in the Indian stock markets is the Muhurat Trading. This is a long-standing tradition which is unique to our Indian stock markets and is considered crucial to begin the new year with the blessings of Goddess Lakshmi. This year too traders will follow the Muhurat Trading tradition on the day of Diwali on 12th November 2023. Check out this blog to know the details of Muhurat Trading and the top sectors to focus on this Muhurat Trading. Read More: List of NSE BSE and MCX Trading Holidays in 2023

We are heading towards the end of 2023 and the time of festivities has begun. One of the most crucial events in the Indian stock markets is the Muhurat Trading. This is a long-standing tradition which is unique to our Indian stock markets and is considered crucial to begin the new year with the blessings of Goddess Lakshmi. This year too traders will follow the Muhurat Trading tradition on the day of Diwali on 12th November 2023. Check out this blog to know the details of Muhurat Trading and the top sectors to focus on this Muhurat Trading. Read More: List of NSE BSE and MCX Trading Holidays in 2023

Muhurat Trading, also known as "Muhurat Trading" or "Diwali Muhurat Trading," is a special and auspicious trading session in the Indian stock market that takes place on the occasion of Diwali, the Festival of Lights. It typically occurs in the evening and lasts for about an hour. This unique tradition has been followed for decades and holds immense cultural and religious significance in India. The term "Muhurat" signifies an auspicious time in Hindu astrology, chosen to commence significant activities. During Muhurat Trading, traders and investors engage in buying and selling shares, marking the commencement of the new financial year.

Muhurat Trading is of great importance to traders in India for several reasons. Firstly, it is believed to bring good luck and prosperity in the upcoming year, making it an ideal time for investors to kickstart their financial journey. It's also a symbolic gesture of honouring the age-old traditions of celebrating Diwali and acknowledging the relationship between wealth and spirituality. Additionally, Muhurat Trading enables traders to react to any global events or news that might have transpired during the holiday break, ensuring that they are prepared for market fluctuations when regular trading resumes. Ultimately, it serves as a unique opportunity for market participants to come together, bond, and set positive intentions for the year ahead, fostering a sense of community within the trading fraternity. Given the significance of this session, it is advisable for traders to consult with financial advisors, analyze market trends, and be ready to make well-informed decisions during this brief but highly symbolic trading session.

Muhurat Trading is of great importance to traders in India for several reasons. Firstly, it is believed to bring good luck and prosperity in the upcoming year, making it an ideal time for investors to kickstart their financial journey. It's also a symbolic gesture of honouring the age-old traditions of celebrating Diwali and acknowledging the relationship between wealth and spirituality. Additionally, Muhurat Trading enables traders to react to any global events or news that might have transpired during the holiday break, ensuring that they are prepared for market fluctuations when regular trading resumes. Ultimately, it serves as a unique opportunity for market participants to come together, bond, and set positive intentions for the year ahead, fostering a sense of community within the trading fraternity. Given the significance of this session, it is advisable for traders to consult with financial advisors, analyze market trends, and be ready to make well-informed decisions during this brief but highly symbolic trading session.

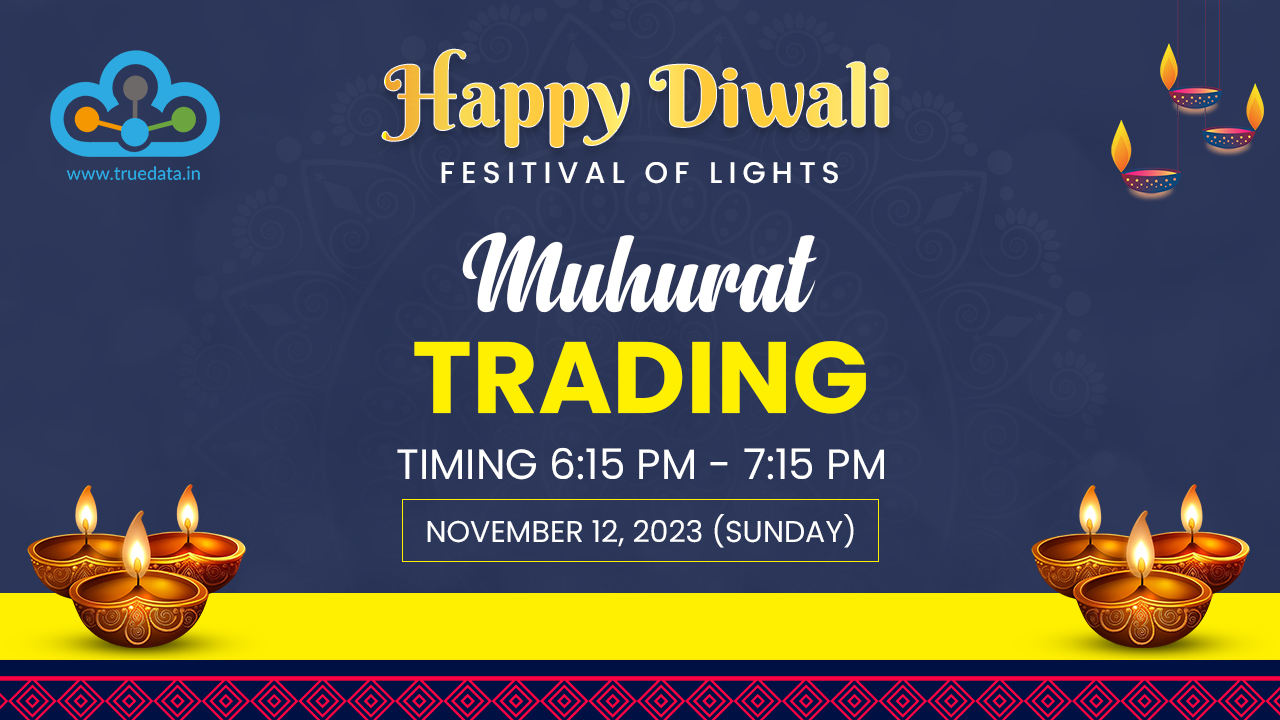

Muhurat Trading is a special trading session that takes place on the occasion of Diwali, the festival of lights. It is considered to be an auspicious time to invest in the stock market and seek good luck and prosperity for the new financial year. Here are some details about the Muhurat Trading timings for 2023.

Muhurat Trading is a special trading session that takes place on the occasion of Diwali, the festival of lights. It is considered to be an auspicious time to invest in the stock market and seek good luck and prosperity for the new financial year. Here are some details about the Muhurat Trading timings for 2023.

| Session | Timings |

|---|---|

| The trading session extends for one hour and 15 minutes. | 6:00 PM to 7:15 PM |

| Pre-open session for market preparation. | 6:00 PM to 6:08 PM |

| Normal market trading session. | 6:15 PM to 7:15 PM |

| Closing session for concluding trades. | 7:25 PM to 7:35 PM |

| Block deal window for specific transactions. | 5:45 PM to 6:00 PM |

| Call auction illiquid session for certain securities. | 6:20 PM to 7:05 PM |

Muhurat trading is a one-hour trading session where traders participate to bring in the new year. This session however is quite volatile and therefore, traders need to exercise caution while executing their trades. Some of the top sectors to focus on this Muhurat trading are mentioned below.

The defence sector in India has been buzzing with activity in recent years, especially in 2023 with the huge capital allocation in the Union Budget of 2023. This has allowed the companies in the defence sector to truly spread their wings and create their place in the global defence market. HAL, one of the most prominent defence sector companies has bagged many orders for its homegrown Brand ‘Tejas’ and many more such defence equipment from various countries across the globe. The recent investments in this sector by the Central government have also shown their commitment to strengthening this sector and enabled the companies to harness the power of technology and innovation. Check out more details about the defence sector and their top stocks at this link on our website.

There was a time when the NPAs in the banking sector were dangerously high. Through the implementation of various robust banking laws like the SARFAESI Act, The Insolvency and Bankruptcy Code, etc. the NPAs have been brought down radically in the past years. Furthermore, the public sector banks that were once thought to be loss-making giants are also now becoming profitable by the consistent efforts of the government to increase awareness as well as tighten the banking laws to reduce any future NPAs. Private sector banks in India today are among the top-ranking banks across the globe catering to the diverse banking needs of their customers within the country and abroad. Some of the top stocks in the banking and financial services sector to focus on include HDFC Bank, Muthoot Finance Limited, Kotak Mahindra Bank Limited, Bajaj Finance Limited, etc.

The FMCG sector is one of the strongest pillars of the Indian economy. It is considered to be a resilient or defensive sector against volatile markets. Many top stocks in this sector are considered to be blue-chip companies that are a good buying opportunity at every dip in the Indian stock markets. The factor backing the growing demand in this sector is the increasing purchasing power of people even in the remotest parts of the country as well as the changing consumer patterns. Check out more details of the FMCG sector and the top stocks in terms of market capitalisation in our previous blog on our website.

The Indian paints and coatings industry is poised for substantial growth, with Akzo Nobel India projecting an estimated increase from the current Rs 62,000 crore to Rs 1 lakh crore over the next five years. Price adjustments in essential raw materials, constituting 55-60% of input costs, have led to enhanced profit margins for the sector. This industry has become increasingly attractive, drawing the entry of new players who are investing in infrastructure, technology, and marketing to establish their presence and gain market share. Notable entrants like Grasim Industries, Pidilite, and JSW are now competing with established leaders including Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel India, collectively controlling approximately three-quarters of the market. This sector is essentially split into two broad categories namely, the architectural and industrial segments with the former being the dominant segment comprising approximately 69% of the total market. The industry has been dominated by Asian Paints Limited for the past many years which is also a blue-chip company with strong fundamentals. The increasing capital investment in the construction, infrastructure and real estate sectors is also set to increase the demand for the paints industry in the coming years.

The retail sector is another defensive sector in the Indian economy that has a mix of organised big players like DMart, Reliance Retail, etc. and unorganised players across the country. It is also a major industry in the MSME sector with huge growth potential. The growth in this sector is backed by the increasing demand across the country and the entry of new players backed by the changing consumer patterns and increasing e-commerce presence, This has translated the retail sector into a booming industry which is expected to reach approximately US$2 trillion by 2032 as per a recent report by the esteemed Boston Consulting Group (BCG).

Muhurat Trading, a time-honoured tradition in the Indian stock markets, is said to have originated with King Vikramaditya in ancient India. However, it gained official recognition when the Bombay Stock Exchange (BSE) adopted it in 1957, followed by the National Stock Exchange (NSE) in 1992. Today, most brokers enable investors to participate in this special session, held on Diwali. Notably, since 2018, the market has consistently closed in the green during Muhurat Trading, with the Sensex gaining 0.88% in 2022, 0.49% in 2021, 0.45% in 2020, and 0.49% in 2019, underscoring its auspicious and positive sentiment for the new financial year. We hope this Muhurat Trading brings the blessings of Goddess Lakshmi to your portfolio too and helps you reach your financial goals successfully. Let us know if you need more details on Muhurat Trading and we will be happy to help. Till then Happy Reading!

Introduction In an attempt to curb speculative trading, the exchanges move stoc...

The start of the year has not brought good news for stock markets around the gl...

Introduction The second half of the Indian calendar year is filled with festi...