Before you enter into any form of investment, you must first conduct a fair bit of research to develop an understanding of the market and familiarize yourself with its basic concepts. The stock market is no different, which is why you need to learn the basics of trading in stocks and all the essential terms that are sure to crop up now and then. You also need to understand why money management is important for trading. With this blog, we will discuss 10 such terms in the stock market that a trader must know before starting to invest in it. It will help you bridge the gap to becoming an expert. You may want to bookmark this page so you can return to it later as a handy reference.

Before you enter into any form of investment, you must first conduct a fair bit of research to develop an understanding of the market and familiarize yourself with its basic concepts. The stock market is no different, which is why you need to learn the basics of trading in stocks and all the essential terms that are sure to crop up now and then. You also need to understand why money management is important for trading. With this blog, we will discuss 10 such terms in the stock market that a trader must know before starting to invest in it. It will help you bridge the gap to becoming an expert. You may want to bookmark this page so you can return to it later as a handy reference.

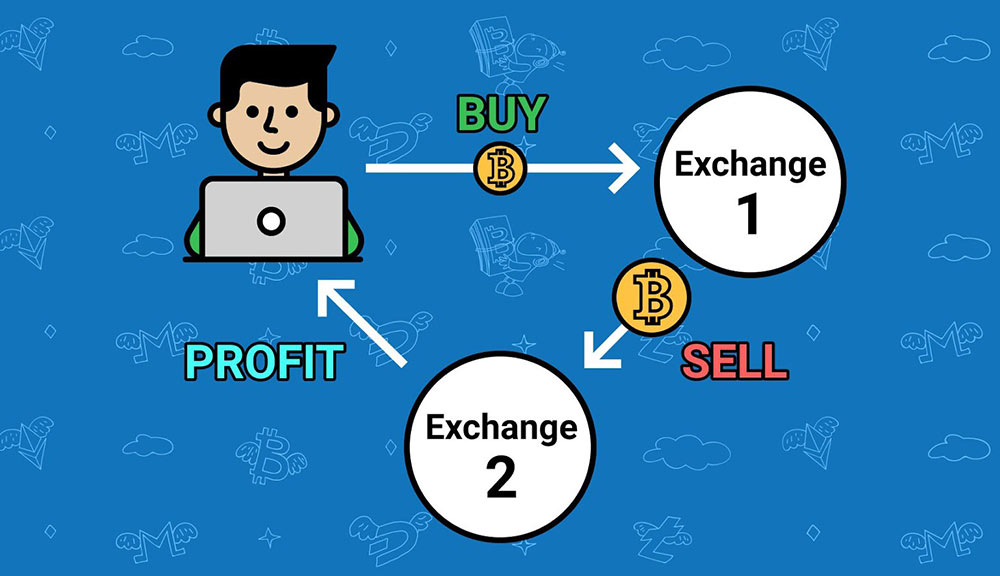

Arbitrage refers to the process of buying and selling the same security on different markets at different prices. For instance, you can sell a stock ABC for Rs. 10 on one market and Rs. 10.50 on another. Similarly, a trader can buy XYZ shares for Rs. 100 and Rs. 150 in two different markets.

Arbitrage refers to the process of buying and selling the same security on different markets at different prices. For instance, you can sell a stock ABC for Rs. 10 on one market and Rs. 10.50 on another. Similarly, a trader can buy XYZ shares for Rs. 100 and Rs. 150 in two different markets.

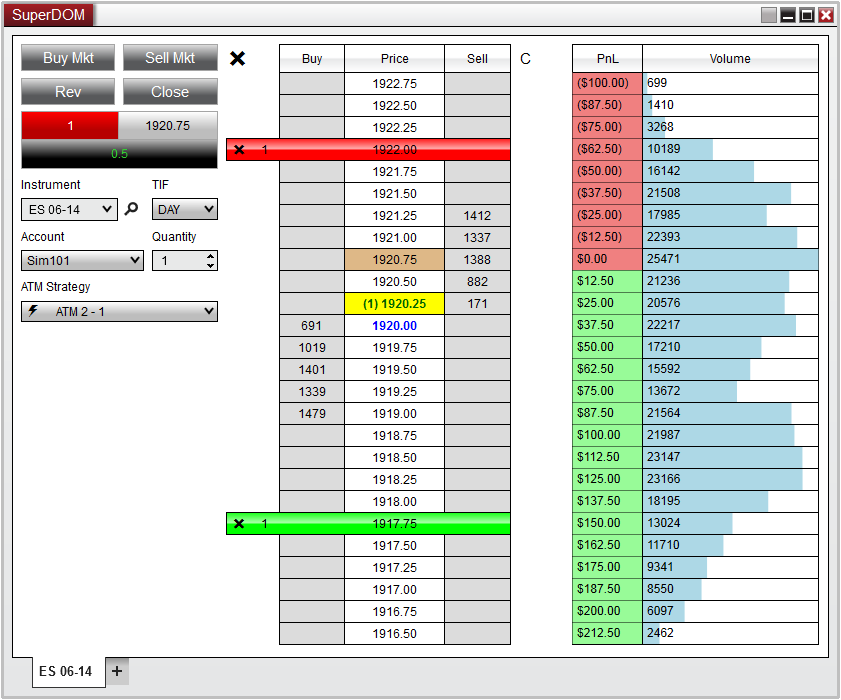

A bid refers to the highest amount of money the buyers are willing to pay to get a share of stocks. If we have more than one buyer for a stock, they all offer their bids which eventually leads to a bidding war. It ends when one buyer places the highest bid others can’t match. The bid amount is balanced against the asking price, i.e., what a seller wants per share of that same stock. We refer to the difference between these two values as the spread.

A bid refers to the highest amount of money the buyers are willing to pay to get a share of stocks. If we have more than one buyer for a stock, they all offer their bids which eventually leads to a bidding war. It ends when one buyer places the highest bid others can’t match. The bid amount is balanced against the asking price, i.e., what a seller wants per share of that same stock. We refer to the difference between these two values as the spread.

The easiest way to find news related to the stock market is to search the terms — bear market and bull market. These two terms indicate the current trend experienced by the stock market at a given time. They differ a lot from each other and are poles apart.

The easiest way to find news related to the stock market is to search the terms — bear market and bull market. These two terms indicate the current trend experienced by the stock market at a given time. They differ a lot from each other and are poles apart.

Blue-chip stocks are the stocks behind large, industry-leading companies since they offer a stable record of significant dividend payments. Blue-chip records also have a reputation for sound fiscal management. The name comes from blue gambling chips, i.e., the highest denomination of chips used in casinos.

Blue-chip stocks are the stocks behind large, industry-leading companies since they offer a stable record of significant dividend payments. Blue-chip records also have a reputation for sound fiscal management. The name comes from blue gambling chips, i.e., the highest denomination of chips used in casinos.

Day trading refers to the practice where you buy and sell within the same trading day. It must be done before the market closes on that day. Traders who participate in day trading are known as “day traders” or “active traders.”

Day trading refers to the practice where you buy and sell within the same trading day. It must be done before the market closes on that day. Traders who participate in day trading are known as “day traders” or “active traders.”

The dividend is the portion of a company’s earnings paid to shareholders or people who own that company’s stock. It is done on a quarterly or annual basis. Note that all companies don’t pay dividends. For instance, you’re likely not after dividends if you trade penny stocks.

The dividend is the portion of a company’s earnings paid to shareholders or people who own that company’s stock. It is done on a quarterly or annual basis. Note that all companies don’t pay dividends. For instance, you’re likely not after dividends if you trade penny stocks.

This term may sound common or familiar, but it is one of the most essential terms in stock trading. Equity in the stock market represents the number of shares owned by a company. When you start investing and buy the shares of a company, it comes with an equivalent degree of ownership in that organization. The stock market is where the investors buy or sell these shares of companies (equities). In some cases, the words “stock” and “equity” can be used interchangeably.

This term may sound common or familiar, but it is one of the most essential terms in stock trading. Equity in the stock market represents the number of shares owned by a company. When you start investing and buy the shares of a company, it comes with an equivalent degree of ownership in that organization. The stock market is where the investors buy or sell these shares of companies (equities). In some cases, the words “stock” and “equity” can be used interchangeably.

A very fine, thin spread between the bid and ask prices of a given stock is known as a haircut. A haircut can also be used to refer to a situation in which a stock price gets reduced by some percentage for reasons like margin trades.

An index is a benchmark that we use as a reference marker for trading entities and portfolio managers. A 10% return may sound good, but if the market index returns more (let’s say 12%), it means that you didn’t do very well. You could have just made an investment in an index fund and saved a lot of time by not trading frequently.

An index is a benchmark that we use as a reference marker for trading entities and portfolio managers. A 10% return may sound good, but if the market index returns more (let’s say 12%), it means that you didn’t do very well. You could have just made an investment in an index fund and saved a lot of time by not trading frequently.

An Initial Public Offering (IPO) is the first sale or offering of a stock that a company makes to the public. IPO usually happens when an organization decides to go public instead of staying solely owned by private or inside investors. Before issuing an IPO, companies need to follow the strict rules set by the Securities Exchange Commission (SEC).

An Initial Public Offering (IPO) is the first sale or offering of a stock that a company makes to the public. IPO usually happens when an organization decides to go public instead of staying solely owned by private or inside investors. Before issuing an IPO, companies need to follow the strict rules set by the Securities Exchange Commission (SEC).

There are many other terms in the stock market, such as leverage, low, margin, moving average, open, order, portfolio, quote, rally, etc. The list is never-ending. Moreover, new terms are introduced with time, further adding to the list. The best way to know them all is to keep a sharp eye on the stock market trends. These 10 terms will help you lay a strong foundation for investing in the stock market.

If you are a new trader in the stock market, you will encounter multiple trading...

Terminology of Stock Market What Is a Stock Market? A stock market is a place w...

Introduction Real Time Data from NSE, BSE & MCX is distributed to various d...