The Union Budget 2025 created a huge buzz due to its changes in the income tax slabs and the effective zero tax liability up to Rs. 12,00,000. While this news was being hailed by the taxpayers, the government also announced overhauling the existing Income Tax Act, 1961 and introducing the New Tax Bill in the coming days. The said New Tax Bill has now been introduced presenting a simplified and crisp version of the tax laws for the various classes of taxpayers in the country. Here is all you need to know about the New Tax Bill 2025 and its key changes.

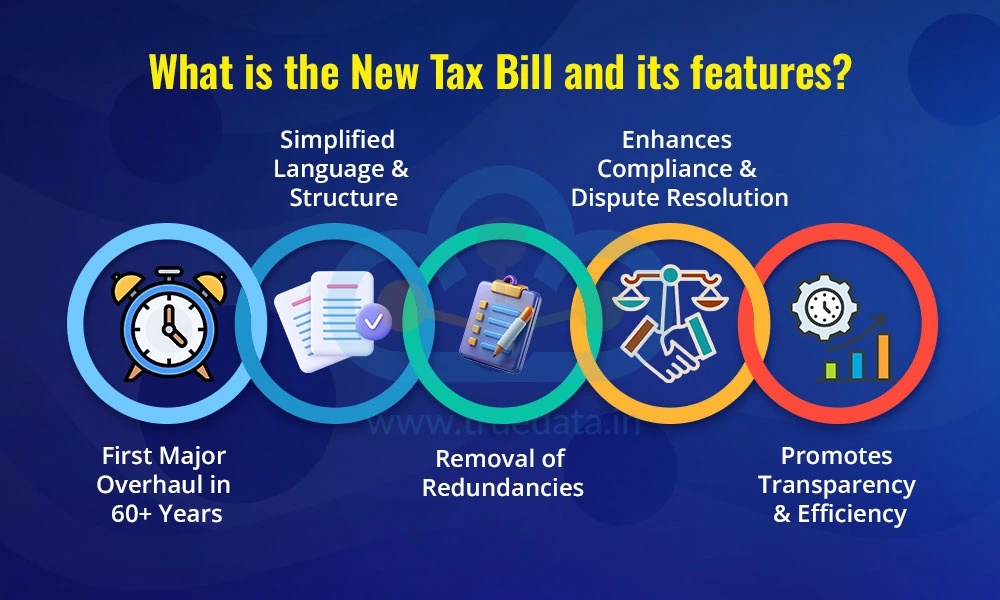

The Finance Minister Mrs Nirmala Sitharaman introduced the New Income Tax Bill on 13th February 2025 in the Lok Sabha. This updated version of the tax laws is introduced after more than 6 decades of its predecessor the Income Tax Act 1961. The New Income Tax Bill 2025 consolidates the relevant provisions of the Act under various chapters in a seamless way thereby avoiding overlapping provisions and confusion in the language of the Act. This new bill aims to simplify the language of the Act which is one of the major hindrances in its interpretation, especially for average taxpayers, thereby promoting compliance and resolution in the event of disputes.

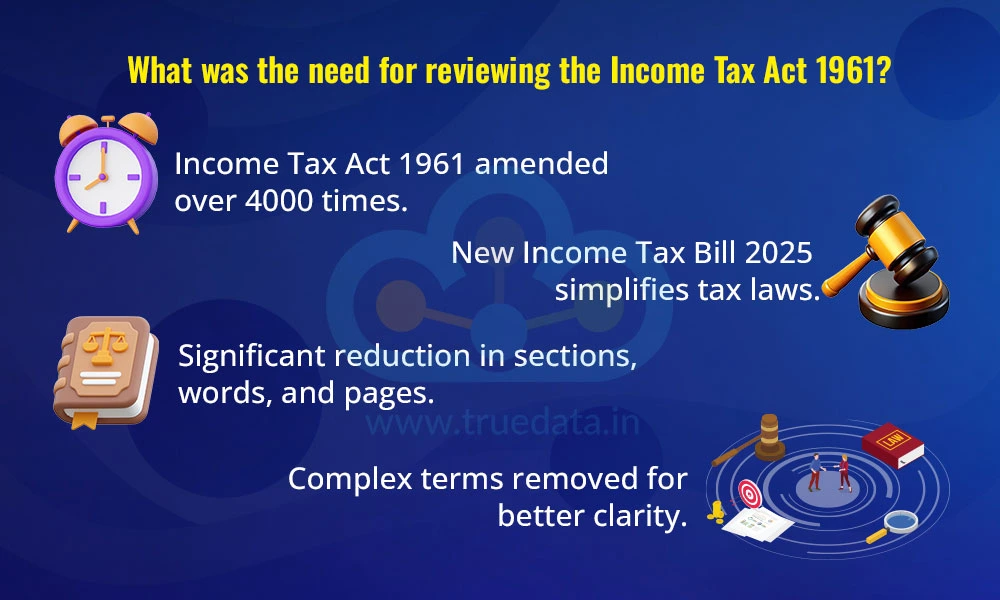

The original Income Tax Act 1961 was enacted in 1961 and came into force in the year 1962. This Act has subsequently been amended approximately 65 times with more than 4000 amendments over the years. This has essentially resulted in the Income Tax Act, 1961 far away from its original draft in order to meet the evolving tax needs and modifications needed in the Act to meet taxation policies from time to time.

This has resulted in the Income Tax Act 1961 becoming more voluminous and complex to understand and interpret not only for the taxpayers but also for the Department leading to an increase in disputes and hindrances in required compliances. The New Income Tax Bill 2025 has 622 pages, 2.6 lakh words, 23 chapters, 536 sections, 57 tables and zero provisions and explanations. This is a stark difference from the Income Tax Act 1961 which has 823 pages, 5.12 lakh words, 47 chapters, 819 sections effectively (on account of subsections and alphanumeric sections), 18 tables and several provisions and explanations supporting a section. The changes brought about by the New Income Tax Bill effectively removed about 1200 provisos and 900 explanations to make it more streamlined and direct in its intention and interpretation. The New Tax Bill removes words like ‘notwithstanding’ as well as complex sentences to make them more simplified and shorter to provide a clearer understanding and approach to the intended tax law.

The New Income Tax Bill 2025 aims to simplify the country’s tax framework by eliminating outdated or redundant provisions, providing a refined version of the latest tax laws, and introducing structural reforms in the Act to make it more simplified, transparent and direct as well as plug any loopholes that can lead to tax evasion or loss of revenue for the government. The significant changes brought under the New Tax Bill 2025 are discussed hereunder.

The New Income Tax Bill, 2025 replaces the terms 'previous year' and 'assessment year' with a single 'tax year.' This amendment is introduced to align with international practices and simplify tax filing. This change is also intended to reduce confusion, making it easier for taxpayers to understand the period pertaining to their income and when tax liability is due.

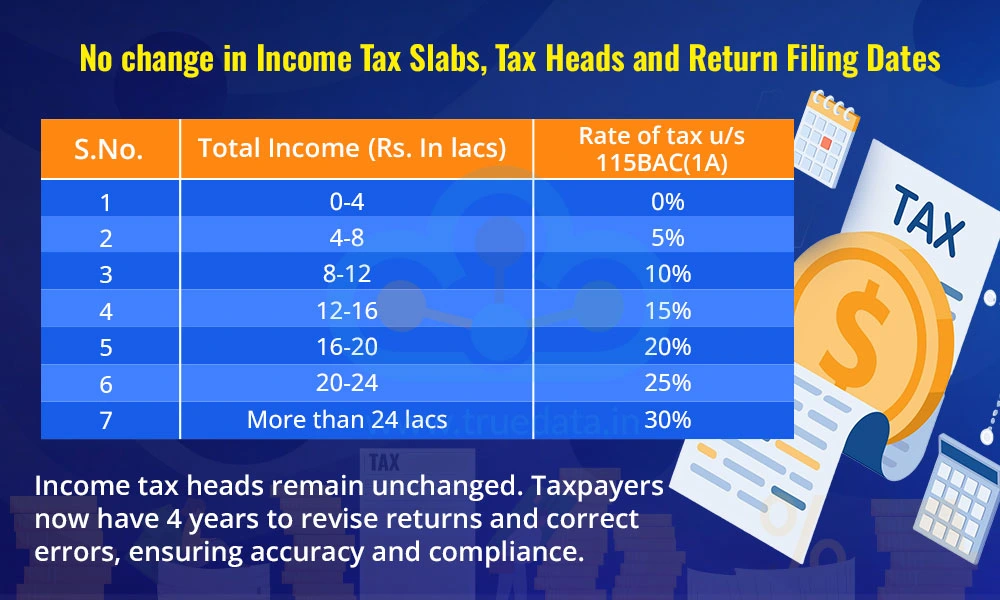

The new tax regime was introduced in the Financial year 2020-21 under section 115BAC and eventually became the default tax regime in the Financial year 2023-24. The Union Budget 2025 provided revised tax slabs under the new tax regime enhancing the basic tax exemption limit to Rs. 4,00,000 and effectively zero tax liability up to Rs. 12,00,000. The New Tax Bill 2025 changes the section for the new tax regime from 115BAC to section 202 while keeping the tax slabs the same as introduced in Union Budget 2025.

Furthermore, there will be no change in the income tax heads under which various types of income earned during the tax year will be taxed. Taxpayers now also have 4 years instead of the earlier 2 years to revise their tax returns and file a revised return to correct any omissions and errors.

The Income Tax Bill 2025 officially classifies Virtual Digital Assets (VDAs), including cryptocurrencies and NFTs, as taxable assets alongside property, shares, and jewellery. This legal recognition provides regulatory clarity and subjects VDAs to capital gains tax rather than regular income tax. The move reinforces the government's stance on regulating digital assets like physical investments, potentially increasing compliance requirements and oversight for individuals and businesses dealing in VDAs.

The new legislation proposes granting tax authorities broader access to taxpayers' electronic records, including emails, social media accounts, and online banking information during investigations. This measure aims to improve tax compliance and deter cases of tax evasion. However, it has also raised concerns about potential privacy infringements. Thus, experts have emphasised the need for clear safeguards to balance effective tax enforcement while ensuring the protection of individual rights.

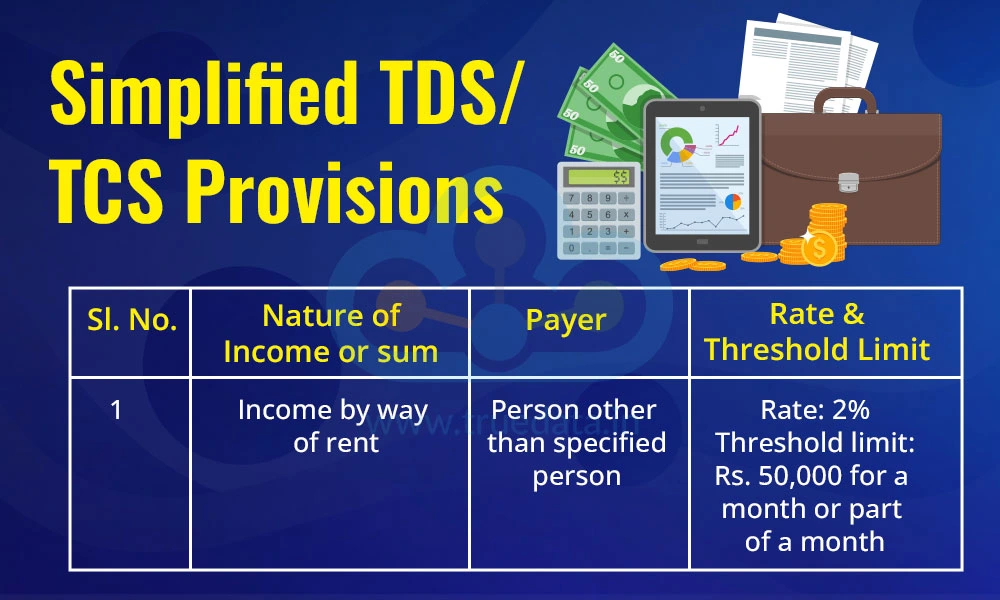

The proposed Income Tax Bill 2025 consolidates 43 TDS-related sections into a single Section 393. This will help taxpayers as TDS provisions are organised into three tables for Residents, Non-residents, and any person while detailing income type, thresholds, payers as well as applicable rates. The new bill will group similar income types and a separate table is provided that lists applicable exemptions. TCS provisions are similarly merged into Section 394, which outlines the applicable transactions for TCS, applicable thresholds, eligible collectors, and exemptions available, if any. Furthermore, related provisions on lower deduction certificates, compliance, penalties, and statement processing have been restructured into independent sections for streamlined administration.

The Income Tax Bill 2025 simplifies the Profits and Gains of Business and Profession chapter by improving section flow, merging similar provisions, and organising related topics for easier understanding. Certain complex concepts like Written-down Value are now explained using formulas, and multiple scenarios, such as Actual Cost determination, are presented in tables. Ambiguous explanations have been converted into clear sub-sections, while outdated and rarely used provisions have been removed or moved to separate Schedules or Rules to reduce complexity. These changes have cut the word count by more than half and reduced the number of sections from 65 to 41. Similarly, salary provisions have been consolidated into one section, making tax filing easier. Deductions like gratuity, leave encashment, and pension commutation, previously under Section 10, are now part of the salary chapter, while allowances like HRA are listed in Schedule II for better clarity. The use of tables and formulas enhances readability and simplifies tax calculations.

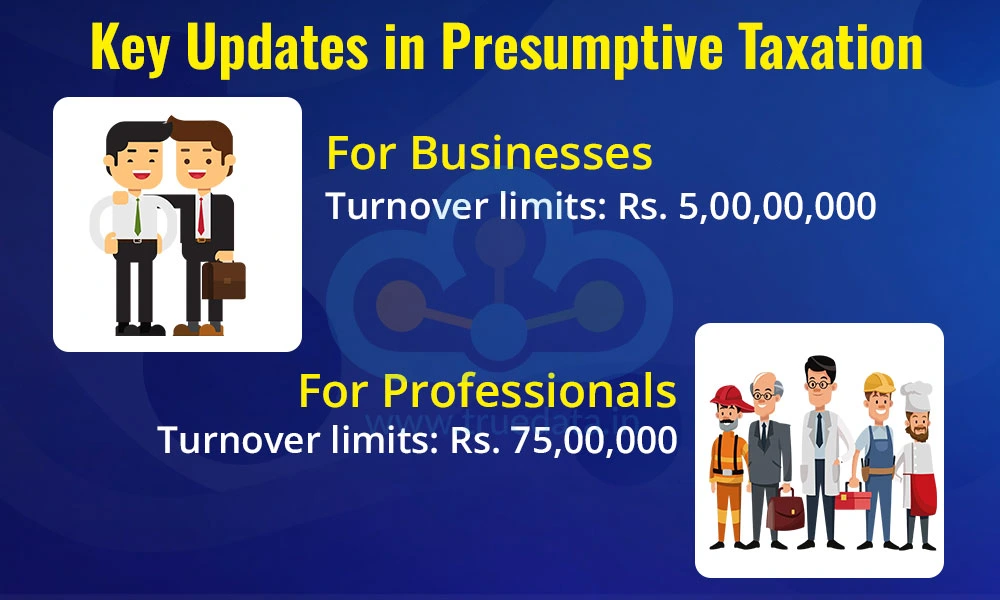

The Income Tax Bill 2025 simplifies the presumptive taxation system by increasing turnover limits to Rs. 5,00,00,000 for businesses and Rs. 75,00,000 for professionals. It merges similar taxation schemes for residents and non-residents into single sections using clear tables and simpler language, making the rules easier to understand. Common eligibility conditions are listed below the tables for quick reference. The bill also introduces a new presumptive taxation scheme for non-residents providing services to domestic electronic goods manufacturing. These changes improve readability and reduce complexity without altering tax policies.

The New Income Tax Bill, 2025, is scheduled to take effect from April 1, 2026. This timeline provides taxpayers and businesses with ample time to familiarize themselves with the new provisions and make necessary adjustments to ensure compliance.

The Income Tax Bill 2025 is a much-anticipated change in the Indian income tax laws to reduce the complexity of understanding the Act and intended tax laws. It is a major step in the Indian tax system with the aim to make it more transparent, simple and easier to understand for taxpayers and the department alike. The changes proposed in the New Income Tax Bill 2025 will be further reviewed by a JPC (Joint Parliamentary Committee) and the recommendations given by the same will be duly submitted and evaluated in the Lok Sabha. The New Income Tax Bill 2025 will come into effect in 2026 and may have additional recommendations from the JPC if approved.

This blog highlights the significant update in the Indian Tax structure and the key changes introduced under the New Income Tax Bill 2025. What do you think of the New Tax Bill and its reduction in complexity? Let us know your thoughts or if you need clarification on any aspect of the New Tax Bill, and we will address them.

Till then Happy Reading!

Read More: Gift Nifty - All you need to know

After the buzz around the general elections in India had just concluded, the sta...

The year 2023 is about to end in a month and it is almost time to set your new ...

The Budget Day in India is celebrated as a national event that every citizen awa...