The word recession has been in constant news since the year 2020. First, the Covid pandemic and then the ongoing Russia-Ukraine war have triggered recession-like situations in many global giants that were previously touted to be too big to fall. Recently, there was news that the fourth largest economy in the world and the largest in Europe has entered a recession followed by similar news from New Zealand. So what is this recession? This has also raised concerns about what recession means for common investors in India and how they can prepare for it. Read on to get answers to all these questions and more. Read More: Sensex and Nifty at an all time high-What it means for an investor?

The word recession has been in constant news since the year 2020. First, the Covid pandemic and then the ongoing Russia-Ukraine war have triggered recession-like situations in many global giants that were previously touted to be too big to fall. Recently, there was news that the fourth largest economy in the world and the largest in Europe has entered a recession followed by similar news from New Zealand. So what is this recession? This has also raised concerns about what recession means for common investors in India and how they can prepare for it. Read on to get answers to all these questions and more. Read More: Sensex and Nifty at an all time high-What it means for an investor?

A technical meaning of recession is a significant and widespread decline in economic activity within a country or region for the last two quarters. It is generally characterized by a contraction in various economic indicators, such as gross domestic product (GDP), employment rates, income levels, industrial production, and consumer spending. Several factors can contribute to the onset of a recession. One common cause is a significant drop in investments. When businesses and investors become cautious about the future, they may postpone or cancel their investment plans, leading to a decline in economic growth. Other factors include a decrease in consumer confidence, financial crises, changes in government policies, or disruptions in global trade.

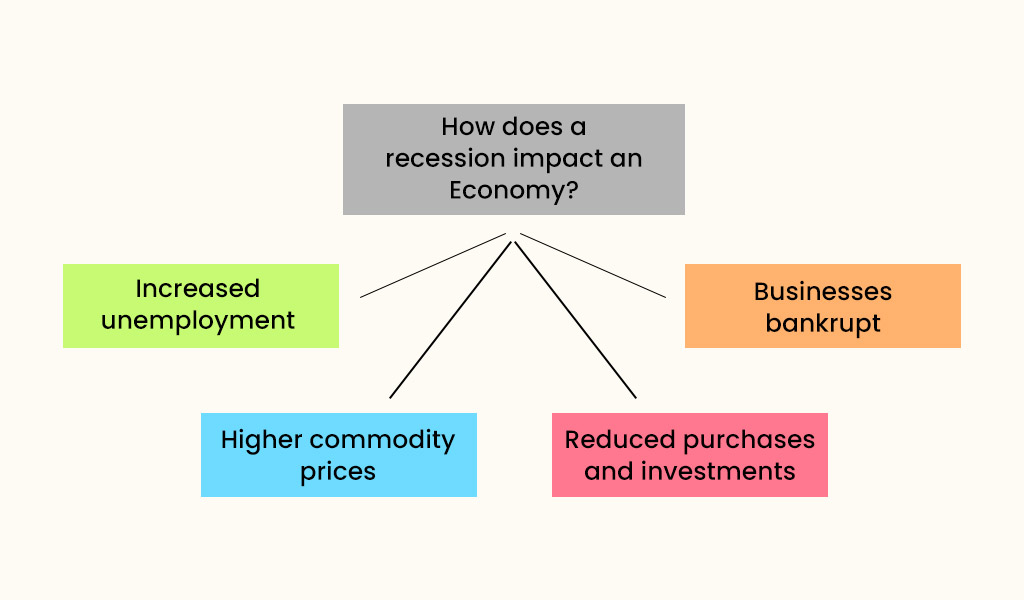

During a recession, the overall economy experiences a slowdown, and businesses may struggle to generate profits. As a result, they may cut back on production, reduce their workforce, or even close down. This can lead to higher unemployment rates as people lose their jobs or find it challenging to secure new employment. The decline in economic activity also affects consumers. When people become uncertain about the future, they tend to spend less money on goods and services. This reduction in consumer spending can further harm businesses, creating a cycle of reduced demand and economic contraction. Governments and central banks often take measures to combat a recession. They may implement fiscal policies, such as reducing taxes or increasing government spending, to stimulate economic activity. Central banks can lower interest rates or use other monetary tools to encourage borrowing and investment. These interventions aim to boost the overall demand for goods and services, restore business confidence, and eventually lead to economic recovery.

During a recession, the overall economy experiences a slowdown, and businesses may struggle to generate profits. As a result, they may cut back on production, reduce their workforce, or even close down. This can lead to higher unemployment rates as people lose their jobs or find it challenging to secure new employment. The decline in economic activity also affects consumers. When people become uncertain about the future, they tend to spend less money on goods and services. This reduction in consumer spending can further harm businesses, creating a cycle of reduced demand and economic contraction. Governments and central banks often take measures to combat a recession. They may implement fiscal policies, such as reducing taxes or increasing government spending, to stimulate economic activity. Central banks can lower interest rates or use other monetary tools to encourage borrowing and investment. These interventions aim to boost the overall demand for goods and services, restore business confidence, and eventually lead to economic recovery.

Recession can have both challenges and opportunities for an investor. During a recession, the stock markets may decline, leading to a decrease in the value of investments. This often leads to many investors dumping their securities in an attempt to reduce their losses. However, investors with a long-term perspective should understand that recession is a temporary phenomenon and the economy is bound to revive in the future. While it's not possible to completely have recession-proof investments, investors can take several steps to make their portfolios more resilient during economic downturns. Here are some strategies that you can consider to combat the effect of recession on your investments.

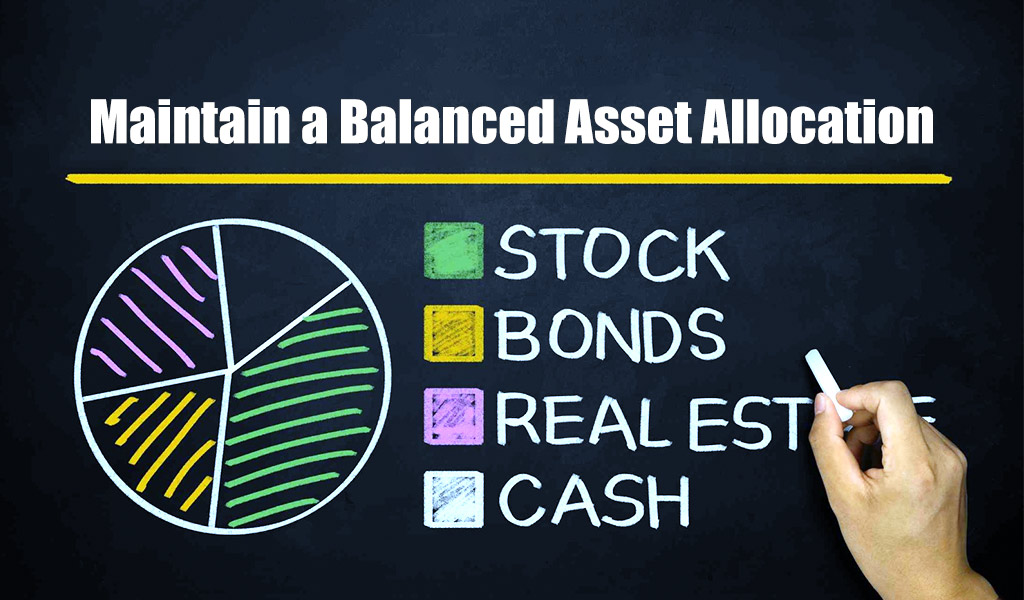

Spreading your investments across different asset classes (e.g., stocks, bonds, real estate), sectors, and geographic regions can help reduce the impact of a recession on your portfolio. Diversification allows you to have exposure to different areas that may perform differently during economic downturns.

Spreading your investments across different asset classes (e.g., stocks, bonds, real estate), sectors, and geographic regions can help reduce the impact of a recession on your portfolio. Diversification allows you to have exposure to different areas that may perform differently during economic downturns.

Invest in companies or assets with strong fundamentals, stable cash flows, and a history of weathering economic downturns. Look for businesses with competitive advantages, solid balance sheets, and sustainable growth prospects. Quality investments are more likely to withstand challenging economic conditions. Also, it is ideal to have investments in sectors like FMCG, Healthcare, Defence which are often considered to be recession-proof. These sectors do not face the drastic impact of the recession and are also a good option for long-term investment portfolios.

Invest in companies or assets with strong fundamentals, stable cash flows, and a history of weathering economic downturns. Look for businesses with competitive advantages, solid balance sheets, and sustainable growth prospects. Quality investments are more likely to withstand challenging economic conditions. Also, it is ideal to have investments in sectors like FMCG, Healthcare, Defence which are often considered to be recession-proof. These sectors do not face the drastic impact of the recession and are also a good option for long-term investment portfolios.

Determine an appropriate asset allocation strategy based on your risk tolerance and investment goals. Balancing your portfolio mix of equities, bonds, and other asset classes can help cushion the impact of market volatility during recessions.

Determine an appropriate asset allocation strategy based on your risk tolerance and investment goals. Balancing your portfolio mix of equities, bonds, and other asset classes can help cushion the impact of market volatility during recessions.

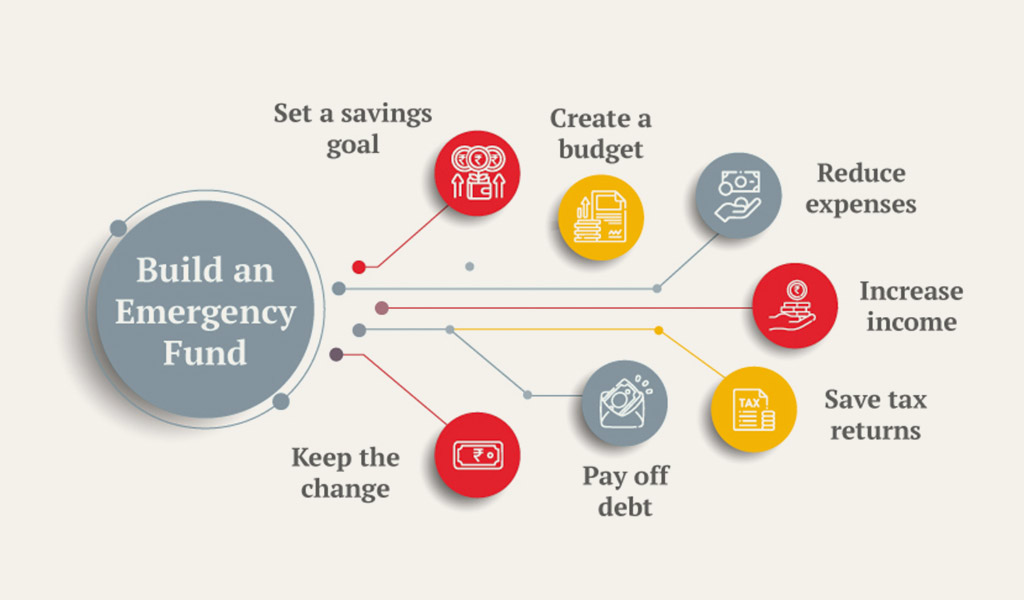

Have a separate emergency fund that covers several months' worth of living expenses. year According to most experts, a person should have funds that are approximately worth a year's expenses in their emergency fund, at the very least these funds should be sufficient to ensure survival for 6 months comfortably. This provides a financial buffer in case of unexpected job loss or income reduction during a recession. It allows you to avoid selling investments at a loss to meet short-term needs.

Have a separate emergency fund that covers several months' worth of living expenses. year According to most experts, a person should have funds that are approximately worth a year's expenses in their emergency fund, at the very least these funds should be sufficient to ensure survival for 6 months comfortably. This provides a financial buffer in case of unexpected job loss or income reduction during a recession. It allows you to avoid selling investments at a loss to meet short-term needs.

Keep yourself informed about the state of the economy, market trends, and relevant news. Stay updated on company financials, industry dynamics, and economic indicators. This information can help you make informed decisions and adjust your investment strategy as needed.

Keep yourself informed about the state of the economy, market trends, and relevant news. Stay updated on company financials, industry dynamics, and economic indicators. This information can help you make informed decisions and adjust your investment strategy as needed.

Periodically review your portfolio and rebalance it to maintain your desired asset allocation. Rebalancing involves selling or buying assets to realign your portfolio with the original allocation. During a recession, this process ensures that you're not overly exposed to riskier assets and helps you take advantage of opportunities that may arise.

Periodically review your portfolio and rebalance it to maintain your desired asset allocation. Rebalancing involves selling or buying assets to realign your portfolio with the original allocation. During a recession, this process ensures that you're not overly exposed to riskier assets and helps you take advantage of opportunities that may arise.

Avoid making hasty investment decisions based on fear or panic during a recession. Emotional reactions can lead to selling investments at the wrong time or making impulsive decisions that may harm your long-term financial goals. Stick to your investment plan and maintain a disciplined approach.

Avoid making hasty investment decisions based on fear or panic during a recession. Emotional reactions can lead to selling investments at the wrong time or making impulsive decisions that may harm your long-term financial goals. Stick to your investment plan and maintain a disciplined approach.

According to a report from Bloomberg, India has a zero probability of falling into recession while economies like The UK, Canada, and the USA have a probability of 75%,60%, and 65% respectively. This outlook for the Indian economy is also accepted by the IMF and the World Bank which hail India as the bright spot current economic situation across the globe. The stock markets in India are also hitting an all-time high which showcases the confidence of Indian as well as international investors in the economy. The GDP of the country is projected to be approximately 6.3% for FY 23-24 and is considered to be among the fastest-growing economies across the world. This positive outlook of the world towards the Indian economy is the result of cautious government policies at the time of covid and thereafter, their ability to keep inflation in check through robust monetary policies and the increased allocation towards infrastructure to build the roadmap for a developed nation in the coming years.

India is expected to experience an impact from the global economic slowdown due to its integration with the world economy. However, the magnitude of the impact is anticipated to be comparatively less severe than in Western countries. India's relatively strong domestic consumption and diversified economy can provide some resilience in the face of global headwinds. We hope this blog was able to rest your concerns regarding the news of the impending recession and provide a helping hand to safeguard your investment portfolio. Let us know what further measures you think can be adopted to keep a portfolio recession-proof and if you need any more information about the Indian economy. Till then Happy Reading!

Click Here: Leading Stock Market Data Feed Provider in India

Mutual fund investments have simplified greatly with just a tap on your smartpho...

The stock market in India has fascinated general Indian masses for long, perhap...

The mutual fund industry has millions of investors across India, with SEBI at th...